- German industry orders increase sharply in December…

- …but that is mainly due to incidental factors

- The production of German industry is not yet going very smoothly

- Our industry recorded a significant increase in production in December

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 09 February 2024.

This is a short commentary. Today I have other busy activities, but I still wanted to provide a glimpse of the industry in our eastern neighbors.

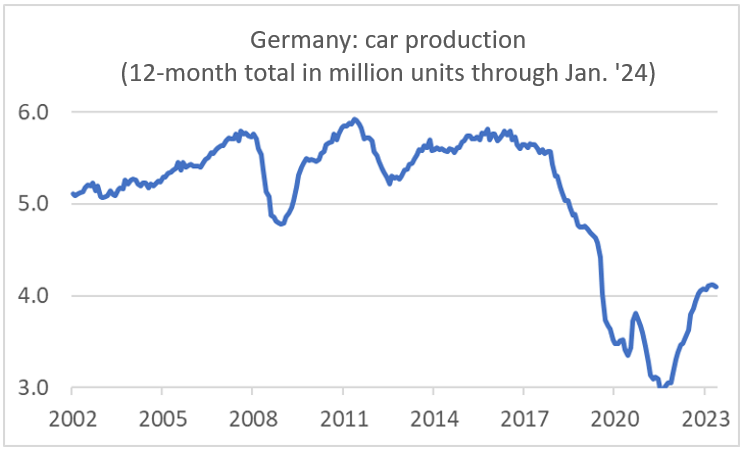

Germany is an economy with a relatively heavy weight in industry. The German industry has not been doing well for some time. That probably has to do with a few different factors. The general cost level is one of them. German energy costs are especially high. The weakness of the Chinese economy is also a problem for Germany, because the country is an important exporter to China, especially of capital goods. Finally, the German automotive sector has also been under pressure for several years, although it has been cautiously recovering since 2022.

Orders booked by German industrial companies in December were no less than 8.9% higher in volume than in December. As a result, the year-on-year comparison once again increased.

.png?width=731&height=439&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Germany%20-%20Industry%20orders%20(volume%2c%20%25).png) Source: Macrobond

Source: Macrobond

Yet that is not the whole story. The good figure was mainly due to 'large-scale items'. Orders for aircraft, ships, and trains provided a major boost and such orders are not booked evenly throughout the year. Orders may show a sharp decline again in January. Excluding these 'large-scale items', order volume fell by 2.2% compared to November. Domestic orders increased by 9.4%, and orders from other euro countries even increased by 34.5%, but the volume of orders from the rest of the world was 7.5% lower than in November.

Unfortunately, the production itself was another sad event in December. Total production fell by 1.6% month-on-month and 3.1% year-on-year in December. The energy-intensive sectors in particular contributed negatively. There, production fell by 6.3% compared to November and by 4.3% compared to December 2022. Compared to February 2020, just before the pandemic, the production level in the five most energy-intensive sectors is 23.1 % (!!!) lower. The ongoing loss of production is very disappointing because energy prices have now fallen significantly compared to the second part of 2022. You would then expect a recovery in production in those energy-intensive sectors. Not so...but the December figure was so bad that it may have been flattering.

.png?width=720&height=435&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Germany%20-%20Industrial%20production%20(indices).png) Source: Macrobond

Source: Macrobond

As indicated above, the automotive sector is of great importance to German industry. After several years in which production fell sharply, a recovery started in 2022. Unfortunately, that recovery came to an end in January. Car production fluctuates from month to month. That's why I prefer to look at figures over twelve months. In January of this year, 4.3% fewer cars were manufactured than in January 2023. Perhaps this is due to unfavorable weather and the upward trend will soon resume. Fingers crossed.

Our industry fared a lot better in December. Although production volume was 3.3% lower than a year earlier, that was the least bad figure since February 2023. The low point was reached in October with a production decline of 12.0% year-on-year. According to Statistics Netherlands, 6.8% more was produced in December than in November. Last week, NEVI figures on producer confidence showed that it had become a lot less negative in January. The picture of improvement seems consistent.

Closing

Our economy shrank in the first three quarters of 2023. On Wednesday, CBS will present the first estimate for growth in the fourth quarter and the fourth quarter may also show a small negative. I am hopeful that we will soon put the period of moderate contraction behind us. Lower inflation helps purchasing power and lower energy prices are also positive for businesses. Of course, a revival in Germany would be very welcome. Judging from the recent figures for the German industry, we should perhaps not expect too much from this.