- Dutch industry in decline…

- …while the German seems to be recovering

- Chinese reopening is not going that fast yet

- Powell put to the test

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 13 March 2023.

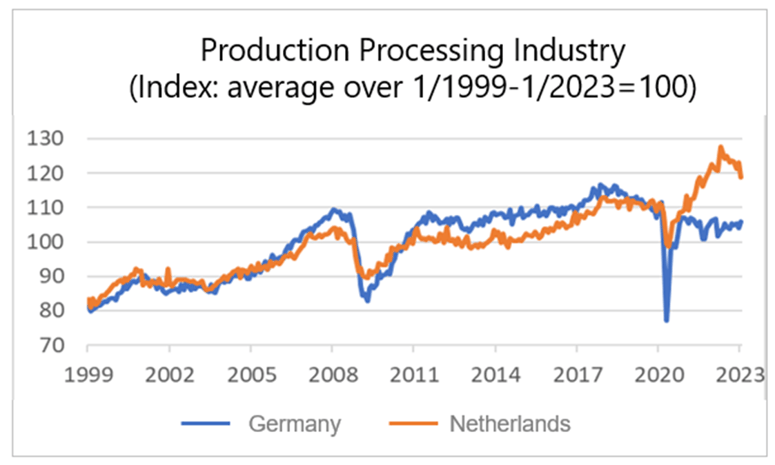

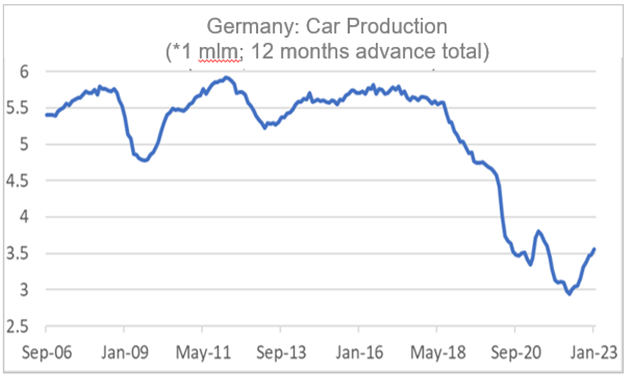

The Dutch industry has done much better than the German industry in recent years. This is remarkable because the industry in both countries is traditionally in step with each other. There are at least two main reasons. The automotive sector, which weighs much more heavily in Germany than here, has been plagued by (partly self-inflicted) problems in recent years. First came Dieselgate. After that, the German car manufacturers proved slow to develop electric models. During the pandemic, production problems arose due to the global chip shortage, and when war broke out in Ukraine last year, it caused production problems because a lot of cabling was sourced from that country.

The Dutch industry has also been doing better than the German industry in recent years because our machine building sector has performed much better. That is also remarkable because our eastern neighbors are known as producers of very high-quality machines that are always in demand all over the world. I think we have outrun the Germans because German machine building is more dependent on China, but mainly because we are much stronger in the chip sector with companies such as ASML, ASMI, BESI and NXP. In fact, Germany does not offer much in return with Infineon alone.

Source: Macrobond

However, the chart above shows that the odds seem to be turning. There is still not much growth in German production, but with us it has fallen by almost 7% since the peak in April last year. Now that the automotive sector seems to be putting the problems behind it, the Germans may be able to catch up.

Source: Macrobond

The figures for January speak volumes and give cause for some concern. In Germany production grew by 3.5% month-on-month, our production decreased by 3.3%. Compared to a year earlier, the counter in Germany is now at -1.6% and with us at -2.9%.

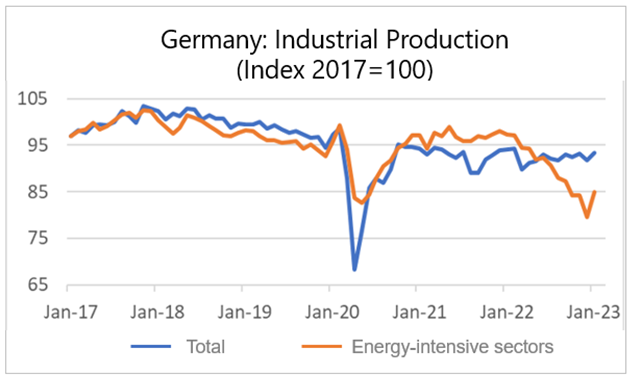

The European gas price, which exploded last year and fell again after August, has a major impact on the development of production. Destatis, the German CBS, has recently published figures on the aggregated production level of five sectors that they call the 'energy-intensive sectors'. Chemistry is the greatest of these. These five account for 76% of total energy consumption by industry, or more than a fifth of total German energy consumption.

Source: Destatis

As the graph above shows, production in the energy-intensive sectors has fallen sharply in the course of 2022. In December, production was almost 20% lower than in December 2021. But it can also be seen that production rebounded strongly in January (+6.8% month-on-month), although the year-on-year decline is still is always approx. 13%. That recovery in January is undoubtedly related to the sharp drop in gas prices. If the gas price does not rise again, a further recovery in production is on the horizon.

Unfortunately, our picture is different. Perhaps a single month is not enough for a far-reaching assessment, but in our country production in the energy-intensive sectors fell further in January: the chemical industry (-5.5% month-on-month), the rubber and plastics industry (- 1.9%) and metal processing (-2.3%). Hopefully production recovery will also follow soon for us.

Energy-intensive sectors provide high-quality employment

There is still something to be said about the importance of the energy-intensive industry. I am discussing the German situation here because Destatis conveniently provides that data. The energy-intensive sectors represent 21% of production in German industry and employ around 935,000 people, or 15% of industrial employment. (In Germany there are a total of about 40 million jobs.) This means that productivity in the energy-intensive sectors is no less than 40% higher than in the rest of industry. These are therefore high-quality, well-paid jobs that are really important for Germany's prosperity. If this activity moves to other countries due to high European energy prices, this will be a serious blow to the German economy, while CO₂ emissions in the world will not be less.

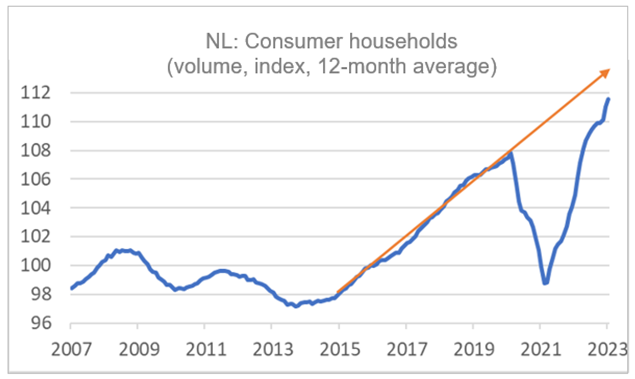

Consumption by Dutch households continues to increase

Household consumption in the Netherlands was 6.2% higher in volume in January than in January 2022. However, there were lockdowns in many sectors at that time, especially the hospitality industry, etc. The picture below shows that consumers have recovered well from the pandemic come. Spending levels have been above pre-pandemic levels for some time and are even approaching the trend that might have followed without the pandemic.

Source: Macrobond

Reopening China is not going that fast yet

The reopening of Chinese society this year will give a major boost to business in that country and thus to the business of the world as a whole. I follow the Chinese figures with interest. Business confidence indicators have skyrocketed in recent months, but the hard data suggests that the Chinese economy is far from getting off to a flying start. Unfortunately, the view of the Chinese economy in the first months of the year is always somewhat cloudy due to the changing dates of the Chinese New Year. The export value for January/February was 6.8% lower than last year. That was better than the -9.9% in December, but the figures were not very impressive. Import figures were even worse: -10.2% in January/February against -7.5% in December.

You can always check the Chinese trade figures against what other countries report on them. If the Chinese reopening in the country itself has already boosted activity, trading partners are not benefiting for the time being. For example, the value of exports from Taiwan to China in February was no less than 30.2% lower than in February 2022.

Source: Macrobond

There is no doubt that the Chinese impetus will come. Apparently we have to be patient a little longer. Meanwhile, the mood among Chinese consumers remains very depressed for the time being, although there was a slight improvement in January.

Source: Macrobond

This week, Fed Chairman Powell appeared in Congress for the semi-annual presentation of his Monetary Policy Report. He was put to the test and Congressmen used the opportunity to present their own views on inflation. With the most recent inflation figure rather disappointing and other economic data pointing to continued growth, there is a growing likelihood that the Fed will tighten monetary policy more than previously assumed.

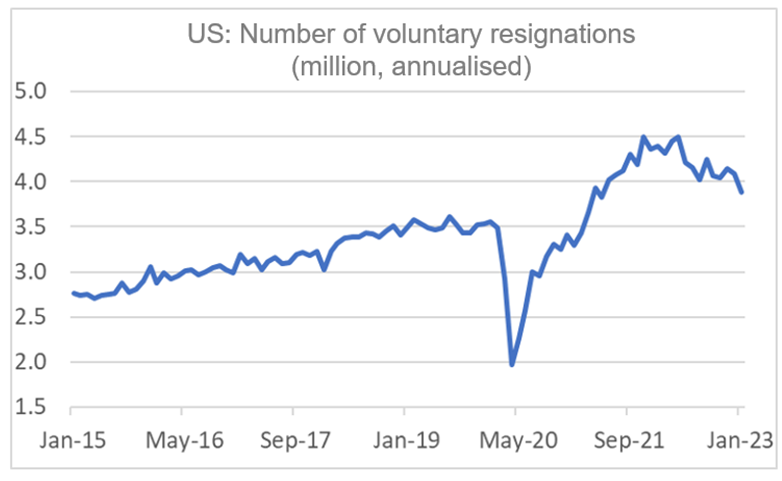

The labor market deserves the necessary attention in this context. The unusual tightness may contribute to wage increases remaining too high to drive inflation towards the 2% target. This week the so-called JOLTs report (Job Openings and Labor Turnover) was published. The number of unfilled vacancies fell in January, but less than expected and there are still almost twice as many vacancies as unemployed. Yet another series in the JOLTs report indicates that tension in the labor market is easing somewhat. The number of people resigning on their own initiative fell to less than four million in January. That was the first time since mid-2021.

Source: Macrobond

Closing

After our industry has performed remarkably better than the German one for several years, things now seem to be turning. Unlike in Germany, there are no signs yet that the fall in energy prices is boosting production in energy-intensive sectors. Hopefully that will come soon. Do not underestimate the importance of these sectors. They offer very high-quality employment and thus contribute to a country's material level of prosperity.

The reopening of Chinese society has not yet led to a spectacular recovery in economic activity. And the trading partners have certainly noticed little or nothing of economic recovery in China. It is inevitable that such a recovery will come, but it is unclear when.

Financial markets are reconsidering their view of how much interest rates must rise to bring inflation down. Next week, the ECB will undoubtedly raise the official interest rate by 0.5%. The following week, it's the Fed's turn. I bet they will do the same.