- Eurozone industry is taking a major hit

- China under great pressure

- AND does a lot better

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 19 January 2024.

I know, the title above this piece sounds dramatic. With that title, I want to draw attention to what I consider to be a very threatening development in the European economy. There is no sense of urgency. That makes it even more disturbing. The first picture makes the problem clear.

.png?width=731&height=447&name=Finance4Learning%20-%20Han%20DE%20JONG%20-%20Production%20manufacturing%20industry%20(%25%20y-o-y).png) Source: Macrobond

Source: Macrobond

The European industry is under great pressure. In our own country, industrial production was 10% lower in November than a year earlier. Now we are not a very large country and the growth rates of our industrial production can be volatile. That is a different story for the eurozone as a whole. In November, production levels in the manufacturing sector and the euro area were 6.8% lower than a year earlier. That doesn't matter. It is significantly more negative than during the euro crisis in 2012. In the US, the industry is not doing great either, but it is a lot less bad than in our country.

When interpreting these figures, caution must be exercised. The differences per country are enormous and a single country that registers a large decline due to special circumstances can strongly influence and therefore distort the figure for the eurozone as a whole. For example, production in Ireland fell by 30.4% year-on-year. However, even taking this nuance into account, the picture remains negative. Production was lower in fourteen euro countries than a year earlier and (slightly) higher in only six countries.

It is a bit of a guess as to the exact causes. Energy prices undoubtedly play a major role. But it is striking that the strong divergence compared to the US only took shape from mid-2023, while European energy prices have developed less favorably than elsewhere since mid-2021. A certain delay is logical, but it is very significant.

In any case, you can expect policymakers to have an answer to the why of this very negative development and to do something about it to the best of their ability. However, the official side remains worryingly silent. I am a supporter of the market economy and my first motto is always that governments should try not to get in the way too much. I suspect that the negative development of the industry in Europe would benefit greatly from this.

What gives?

Of course, you have to wonder how bad it is that the European industry is under so much pressure. I'm repeating myself, but it's a huge problem. Labor productivity in industry is much higher than elsewhere in the economy and our level of prosperity is determined by average labor productivity. If you lose many jobs with high labor productivity, prosperity for everyone will come under pressure. That's not nice anyway. But because we do have all kinds of ambitions (we would like more money for healthcare, education, defense, alleviating the housing shortage, not to mention the energy transition), social and social tensions will only increase.

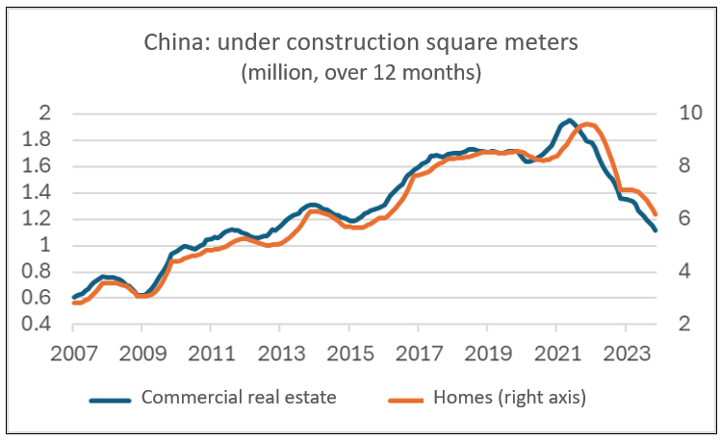

Chinese economy is under great pressure from the real estate sector

The Chinese economy grew by 5.2% in 2023 and by 1.0% in the fourth quarter compared to the third quarter. These growth rates were in line with the government's objectives. Still, the Chinese economy is struggling to benefit from the sudden end of all lockdowns at the end of 2022. In December, retail sales were 7.4% higher than a year earlier, but in November this was still 10.1%. Industrial production was 6.8% higher than in December 2022, slightly better than 6.6% in November. Those figures may sound impressive, but for China, they are not. Not at all when you consider that production was strongly depressed a year earlier due to the lockdowns in force at the time.

As is known, the Chinese economy is facing major problems in the real estate sector. The next picture shows the extent of the problem. Construction is in a strong downward trend. Compared to the peak, the number of square meters under construction (commercial real estate and residential) has fallen by approximately 35-40%. The end of this decline is not yet in sight. Keep in mind that the construction sector makes up a much larger part of the Chinese economy than in Western economies.

Source: Macrobond

Source: Macrobond

American consumers escape misery The American economy far exceeded expectations last year. We will see this year to what extent this was due to temporary factors. In any case, it seems that consumers will continue to spend. Over the last year, there was a lot of speculation among economists as to when American consumer would have emptied their piggy banks during the corona period. There was also speculation to what extent spending would be depressed by the restart of student loan repayments, which were temporarily suspended during the coronavirus period. But for now, none of this hurts consumer spending. For example, see the following graph of retail sales.

.png?width=742&height=451&name=Finance4Learning%20-%20Han%20DE%20JONG%20-%20US%20-%20Retail%20sales%20(%25%20y-o-y).png)

Source: Macrobond

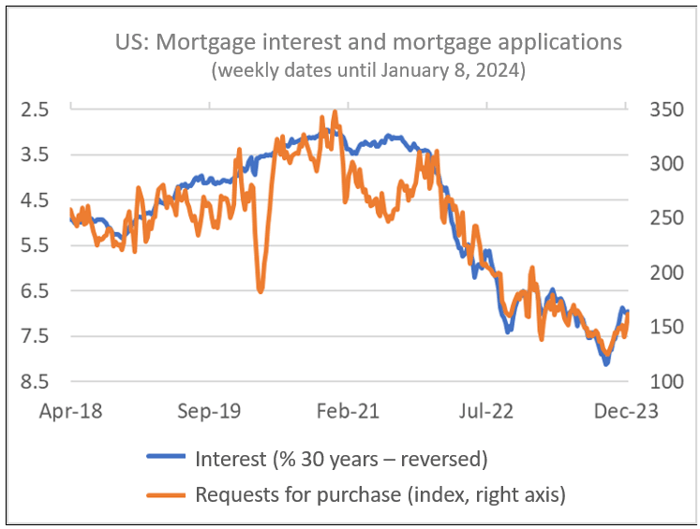

What also helps is the mortgage interest rate, which has fallen considerably in the last two months of 2023. The American housing market is very sensitive to changes in interest rates. The next picture shows that the number of mortgage applications for the purchase of a home has increased in parallel with the decline in mortgage interest rates. In this way, the lower interest rate immediately gives a boost to activity.

Source: Macrobond

You immediately see that the mood among contractors and real estate agents improves. The following image shows the National Association of Home Builders confidence index. The picture speaks for itself. It appears that the monetary easing that market participants expect from the Fed this year has already been partly realized by the market itself. Paradoxically, that reduces the need for the Fed to start cutting rates quickly.

.png?width=742&height=452&name=Finance4Learning%20-%20Han%20DE%20JONG%20-%20US%20-%20Homebuilder%20Confidence%20Index%20(NAHB%20index).png) Source: Macrobond

Source: Macrobond

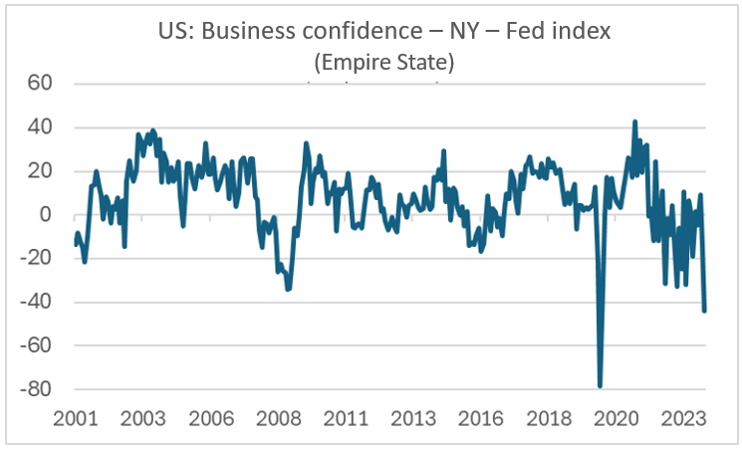

Yet it is not all cake and eggs in the US. Although the industry is developing less negatively than ours, it still seems vulnerable. The so-called 'Empire State index', which measures the confidence of industrial entrepreneurs in the New York Federal Reserve district, took a remarkable plunge in January. From -14.5 in December to -43.7. The survey on which this outcome is based was conducted between January 3 and 10. I don't know to what extent severe winter weather plays a role here, I haven't read anything about that in the comments. The absolute level of this index, excluding the pandemic, is the lowest since this series began in 2001. Moreover, it should be noted that the magnitude of the decline in January is unprecedented for the period before the pandemic. The graph also clearly shows that this series has become much more volatile since 2021. This implies that the economy has certainly not yet normalized.

Source: Macrobond

Source: Macrobond

How relevant this spectacular decline in the Empire State index is will become clear shortly. A similar measure covering the Philadelphia Federal Reserve district showed a slight improvement in January.

The US economy undoubtedly has sufficient momentum to continue growing for the time being, but downside risks will increase as the year progresses. I think growth in 2023 will be flattered by the extremely expansionary impact of federal fiscal policy. That effect has now disappeared. This growth impulse has masked the negative impact of the sharply increased interest rates. In any case, the effects of an interest rate increase will only be fully felt with some delay.

Conclusion

I can be brief. It is difficult to be very enthusiastic about the global economy. The industry in the eurozone is going through particularly tough times, but hardly anyone seems to care. The ongoing crisis in the Chinese real estate sector is having a crippling impact on the country's economy. Things are looking better in America, but it seems likely to me that the growth-depressing effects of the sharply increased interest rates on balance have not yet fully manifested themselves. IMF boss Georgieva said in Davos this week that fiscal policy in many countries is likely to be eased this year. There are quite a few elections on the agenda this year. For example in India, Indonesia and the US. Not the smallest countries! Incumbent governments may try to appease the electorate with giveaways. Perhaps this will give a new temporary boost to the global economy. Georgieva was not enthusiastic about it anyway. She actually warned against it. Considering the inflation that is not yet under control and the high national debt in some countries, this is not unwise.