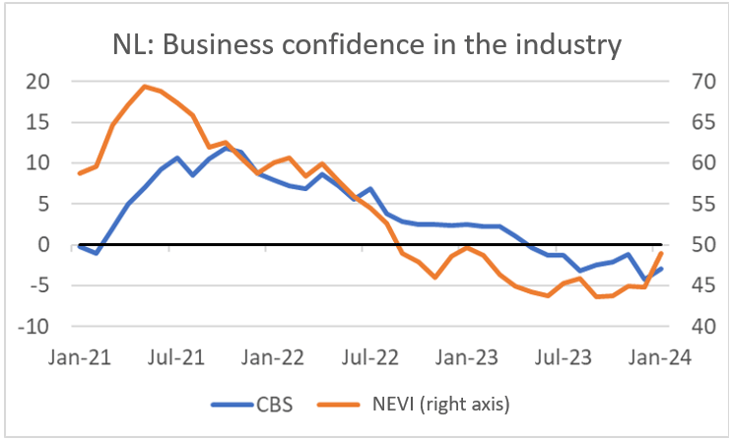

- Confidence in entrepreneurs in the industry is improving

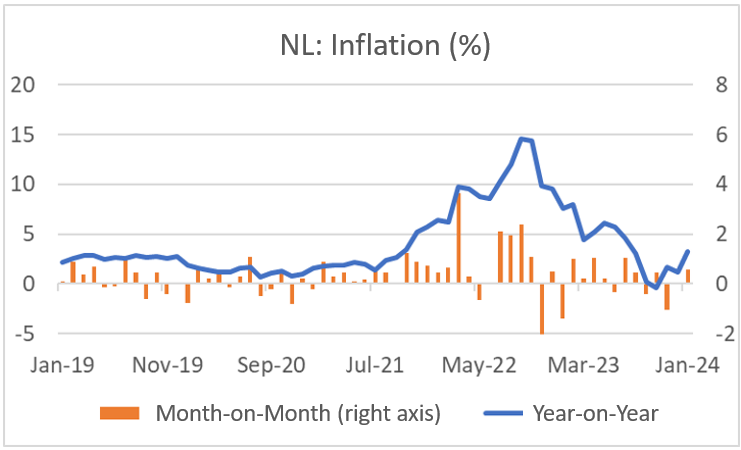

- Falling inflation supports retail sales volume

- Dutch inflation rebounds in January, but a decline is on the horizon

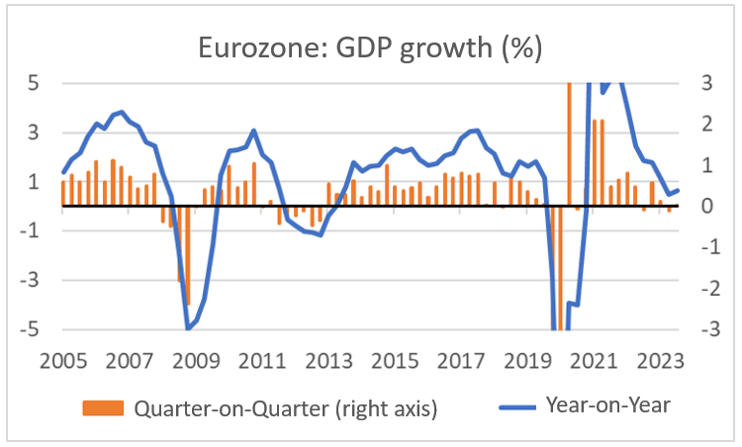

- Eurozone GDP stagnates in Q4

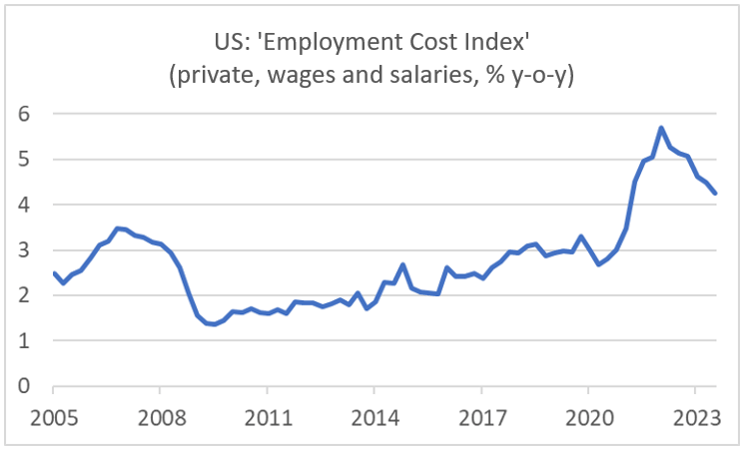

- Fed leaves interest rates unchanged, including no interest rate cuts in March

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 02 February 2024.

There is a positive development in the industry. That development is global. In our own country, both CBS and NEVI reported an improvement in business confidence in the industry this week. The NEVI purchasing managers index in particular rose sharply: from 44.8 in December to 48.9 in January. We have to go back almost three years to find a larger increase. However, the purchasing managers index is still below 50, so the survey indicates that there is still contraction. The CBS indicator is also below the long-term average. But these types of indicators don't change direction very often, so I'm hopeful that the improvement will continue.

Source: Macrobond

Source: Macrobond

The improvement in confidence is driven by lower interest rates and lower gas prices. The surveys mainly show that entrepreneurs are becoming less negative about their order position. Economists attach great importance to the assessment of orders because they are generally somewhat ahead of the economy as a whole. According to NEVI, their sub-index on production prospects for the next twelve months rose from 59.7 in December to 65.7 in January, a significant increase.

The Netherlands is not an island. On the contrary, we are only a small part of the global economy. If our industrial entrepreneurs become less pessimistic, this will be the case elsewhere. And indeed. In the US, the Institute for Supply Management (ISM) industrial confidence index rose to 49.1 in January from 47.1 in December. Just like ours, the assessment of order receipts improved. That sub-index even rose above 50 for the first time since mid-2022. In China, the confidence of industrial entrepreneurs also improved in January according to the NBS index, 50.7 compared to 50.4 in December.

%20%E2%80%93%20new%20orders.png?width=720&height=434&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20US%20-%20Purchasing%20Managers%20Index%20(ISM)%20%E2%80%93%20new%20orders.png) Source: Macrobond

Source: Macrobond

Dutch retail trade on the rise

Retail sales in our country increased by 4.2% in December compared to a year earlier. The increase in turnover has been between 3% and 7% since March. It should be borne in mind that inflation has fallen sharply over this period. The volume development is therefore a lot more favorable than the nominal turnover figures suggest. In volume, sales were 1.7% higher than a year earlier, the first clear increase in a year.

Unfortunately, our inflation rose again in January. According to the 'quick estimate', prices in January were 3.2% higher than a year earlier. In December this was still 1.2%. The base effect largely caused this sharp increase in the inflation rate. In January 2023, the price level fell by 1.4% in one month. This year, prices rose in January. Statistics Netherlands has not yet published many details, but I assume that the increase in taxes and rents mainly caused the increase in January. Given the evolution of inflation last year, a significant drop in the year-on-year inflation rate can be expected in February and April this year.

For the eurozone as a whole, an inflation rate of 2.8% for January is now on the books, after 2.9% in December. Core inflation also fell from 3.4% in December to 3.3% in January.

Eurozone economy is stagnating

Eurozone GDP is unchanged in the fourth quarter of 2023, according to Eurostat's first estimates. Compared to a year earlier, a small increase of 0.1% was achieved. As usual, there are significant differences between countries. The German economy shrank 0.3% quarter-on-quarter, while the Spanish economy grew by 0.6%.

Source: Macrobond

Source: Macrobond

Fed leaves interest rates unchanged

Like the ECB a week earlier, the Fed left the official interest rate unchanged. At the press conference after the policy meeting in December, Fed Chairman Powell made it clear that the door to interest rate cuts is open. Markets reacted happily and started pricing in a first-rate cut in March. That was too much for the Fed. This time Powell said emphatically that a rate cut in March is very unlikely. It was not very clear why an interest rate cut is so unlikely. The Fed is satisfied with the progress of inflation. Powell said that "even better data" is not needed for the Fed to decide on a rate cut. He said "more good figures" are needed to entice the policy committee to cut interest rates. However, he indicated that an unexpected deterioration in economic developments would bring an interest rate cut closer. Let's just take Powell at his word and assume that a first interest rate cut will be decided at the meeting of April 30/May 1.

During the press conference, wage developments were discussed extensively. As with us, wages are currently still rising at a rate that is higher than compatible with the Fed's inflation target. The so-called 'Employment Cost Index' is a broad indicator of the development of wage costs. In the fourth quarter, they were 4.2% higher than a year earlier. Compared to the third quarter, the increase was 0.9%. That is still higher than compatible with 2% inflation in the longer term, but it was the lowest quarterly increase since the second quarter of 2021. In other words, the increase in labour costs is moderating.

Source: Macrobond

Source: Macrobond

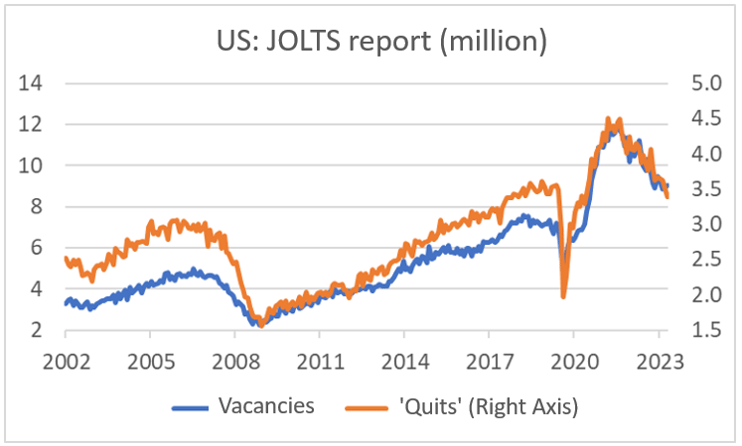

The US labour market is tight but has been relaxing for some time. That relaxation continued in December. Although the number of vacancies increased slightly in December, the trend remains downward and the number of people who resigned of their own accord fell.

Source: Macrobond

Source: Macrobond

Closing

The tone of this comment is more positive than that of previous comments. Although it is not yet very convincing, there does seem to be an improvement in the industry. I previously reported on the somewhat improving international trade in Asia. Both developments are an extension of each other. Furthermore, the decreased inflation supports purchasing power, which is favorable for the volume of consumer spending. Whether these positive developments can be sustained remains to be seen, but so far, so good. The recent past has not been great for the eurozone. The economy has been stagnating for several quarters in a row. However, it is starting to look like an improvement is in prospect during this year.