- Our GDP is growing again after three-quarters of contraction

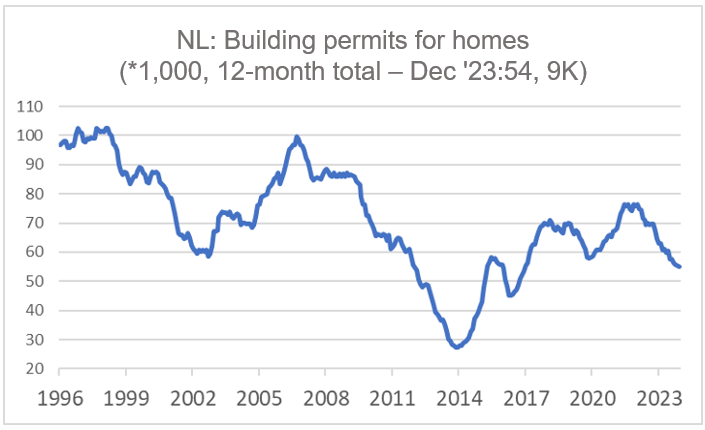

- The number of building permits granted continues to decline

- US inflation disappoints in January

- Interest rate cuts by the Fed will take some time

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 16 February 2024.

I briefly wondered whether the title of this commentary was politically correct. The de-growth movement has many followers. Then I got angry with myself. I decide what I write and I don't have to be politically correct. I am in favor of economic growth and am not ashamed of it at all.

Anyway, after three-quarters of contraction in which our GDP in volume decreased by 1.1%, our economy grew by 0.3% qoq in the fourth quarter. Private consumption in particular made a strong contribution. The first graph nicely shows what a short, mild recession looks like and how that pattern differs from previous recessions. The year-on-year comparison still shows a negative figure, but this does not compare to the recessions of 2008/09 and 2020. The contraction in the first three quarters of 2023 was also limited (-0.5%, -0.4% and -0.3%). Compare that to the -3.6% qoq of the first quarter of 2009 or the -8.3% qoq of the second quarter of 2020. The 2011-2013 recession was also quite mild but lasted about two years. Hopefully that won't happen now. The prospects are not unfavorable, although the European Commission has slightly lowered its growth estimates for 2024.

Purchasing power is increasing due to a combination of still rapidly rising wages, falling inflation, and purchasing power measures. That will keep private consumption on a growth path. The expected drop in interest rates this year will also help. Finally, I expect that a recovery in world trade will also positively contribute to our growth dynamics. Growth will not be robust this year. Construction continues to have problems and, in my view, the risks remain on the downside because energy prices could rise again if global growth picks up.

.png?width=749&height=450&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Netherlands%20-%20BBP-growth%20(%25).png) Source: Macrobond

Source: Macrobond

In fact, fourth-quarter growth figures in Britain and Japan have confirmed that the economies have entered a recession. And the German economy is also in recession. There, the volume of GDP was 0.3% qoq. The figures about the international environment are therefore not yet very encouraging.

Mood indicators are gradually improving. The Eurozone ZEW index, which meets analyst optimism, rose slightly in February. The value of this index has been confirmed in four of the last five months, although the improvement compared to January was limited. For Germany, this index has now improved for seven months in a row. It should be noted that this is about expectations. A possible series related to the assessment of the current situation fell in Germany in February and is at a historically very low level. Only in deep recessions were no negative figures recorded. Dissatisfaction with the German government may have hurt the mood.

.png?width=705&height=425&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20US%20-%20%20Confidence%20of%20SME%20entrepreneurs%20(NFIB%20index).png) Source: Macrobond

Source: Macrobond

Mood indicators elsewhere show a mixed picture. In the US, the NFIB index, which measures confidence among SMEs, fell in January after a notable rise in December. It appears that SME confidence has been trending downward since mid-2023. The graph shows that confidence among SMEs is not very high historically.

The New York Fed Empire State index and the so-called Philly Fed index both improved in February, the former even spectacularly (from -43.7 in January to -2.4 in February). The extreme cold in large parts of the US probably affected activity in January. Homebuilder confidence, as measured by the NAHB index, also improved in February, the third month in a row. I think the lower mortgage interest rates mainly play a role here. It has fallen since the end of October. The American housing market is very sensitive to changes in mortgage interest rates. This interest rate has stabilised since the turn of the year and the question is therefore whether the confidence index of house builders will continue to rise.

Dramatic, that's all I can say

The ambitions in the field of housing construction are far from being realised in our country. That depends on a series of factors. I heard the always nuanced but also accurate Peter Boelhouwer say that you cannot blame this failure on Minister Hugo de Jonge. I would say that the policy certainly did not help. Last year, 54,845 building permits for homes were granted. The graph shows that this is historically low. We wanted to build almost 100,000 homes per year over the years. That's not going to work. A further 64,536 building permits were granted in 2022 and 75,833 in 2021. Given the housing shortage, there is only one qualification: dramatic.

For me, the policy is beneficial. Due to physical discomfort, I have to say goodbye to my nice apartment in Amsterdam South. Selling won't be that difficult. I have now bought an apartment in Amstelveen that the owner had rented out. Because tax regulations have made rental less attractive and because of further restrictions arising from the proposed Affordable Rent Act, many owner-landlords are deciding to sell. I don't know whether that is also the case for the seller of my new apartment in Amstelveen. But if that is the case, then the dramatic situation on the housing market and the perhaps unintended side effects of the (proposed) policy are favorable for me in this case. I would have preferred to see it differently because I don't need this favorable development for me. This is all very unfavorable for young people.

Source: Macrobond

Disappointing inflation figures in the US

In January, US inflation was 3.1%, down from 3.4% in December. That sounds like a nice decline towards the Fed's target, but the figure was still disappointing. Core inflation remained at 3.9% and month-on-month prices excluding food and energy increased by 0.4%. The graph clearly shows that this is higher than before the pandemic and you can of course immediately understand that monthly price increases of 0.4% do not achieve 2% annual inflation. Just like us, the biggest culprit is the prices of services. Services inflation was as high as 0.7% m-o-m and 5.4% y-o-y in January. Rent increases remain an important factor. I've written about that often. Rents follow house prices with a lag. Due to the increase in interest rates from the beginning of 2022, house prices have fallen and rents should follow suit. That does happen but to a modest extent. Now I read stories that the sharp increase in illegal immigration is holding back the decline in rent increases. The decline in house prices stopped in the first half of last year. That probably also stands in the way of a lower rent increase. In any case, the inflation figures for January suggest that the battle against inflation has not yet been won.

.png?width=705&height=429&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20US%20-%20Core%20inflation%20(%25).png)

Source: Macrobond

In New Zealand, some economists predict the central bank will raise rates again at its next policy meeting. Of course, New Zealand is far away and has a small economy. Still, it's worth paying attention to what's happening there. The Reserve Bank of New Zealand (RBNZ) was the first central bank of a rich country to raise interest rates when inflation rose and was the first to stop raising rates. It's not the first time the RBNZ has led the way. A rate hike by the RBNZ means it fears inflation will rebound without such a measure.

Closing

Our GDP grew by 0.3% in the fourth quarter last year. I think growth will continue this year, but will remain modest.

Elsewhere in the world, most mood indicators are improving, although the picture is not very convincing and very strong economic growth cannot be expected.

The disappointing inflation figures in the US for January show that it is premature to claim victory over inflation. Just like us, the problem is mainly with services and that has a lot to do with wage increases, the tight labour market, and rents. The Fed really can't afford to cut rates anytime soon. New Zealand's central bank is in a similar situation and some economists predict that the central bank will soon raise interest rates again. The RBNZ started raising rates in October, nine months before the ECB did so. She also took a break earlier.