- Lagarde is counting on faster economic growth…

- …but the German Ifo index (business confidence) is falling

- Fewer bad results from the ECB Bank Lending Survey

- World trade remains weak

- The US economy is growing faster than expected

- Chinese central bank is trying to boost lending

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 26 January 2024.

During her press conference after the policy meeting, ECB President Lagarde expressed cautious optimism about the economic prospects. Inflation is still too high and it is premature to talk about interest rate cuts, but she is hopeful that the eurozone economy will pick up during the year. That hope turned out to be based on the slight improvement recorded by the purchasing managers' index for the eurozone in January. The index, now called 'HCOB Eurozone Composite PMI', rose from 47.6 in December to 47.9 in January. This means that a figure below 50 was recorded for the eighth month in a row, which indicates a contraction, but it was still the highest level since July. 'A child's hand is quickly filled.' However, I must say that purchasing manager indices do not change direction frequently. So hopefully the upward trend that has now started can be continued. Lower inflation is expected to contribute to purchasing power and thus consumer spending.

Another indicator of business confidence is the German Ifo index. This fell for the second month in a row in January and is still well below the long-term historical average. It is difficult to say to what extent German business confidence is being depressed more than elsewhere by strikes and the unpopularity of its government. The fact is that the industry in Germany also seems to be under greater pressure than elsewhere.

.png?width=731&height=453&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Germany%20-%20Business%20Confidence%20(Ifo).png) Source: Macrobond

Source: Macrobond

Lagarde's cautious optimism is also based on the results of the ECB's so-called 'Bank Lending Survey'. Every quarter, commercial banks are asked a series of questions about the lending process. The next picture shows that on balance banks still say they are tightening their credit conditions, but the extent to which this is happening has greatly reduced. The image below shows that banks still report on balance that the demand for credit from companies is shrinking. Here too, however, the degree of shrinkage is decreasing, although the picture is still quite negative. Moreover, the survey shows that companies still ask for little credit for making investments. The level of interest is stated as an important factor in why there is little demand for credit. The ECB expects lending to improve in the course of this year.

.png?width=720&height=431&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Eurozone%20-%20bank%20credit%20conditions%20(ECB%20BLS).png) Source: Macrobond

Source: Macrobond

-1.png?width=742&height=441&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Eurozone%20-%20credit%20application%20to%20banks%20(ECB%20BLS)-1.png)

Source: Macrobond

Not yet happy about world trade

Recovery of the eurozone economy cannot only come from higher consumer spending and higher business investments but improving world trade can also provide an important boost. This certainly applies to our own country. So far there has been little reason for enthusiasm in this area. Although there seemed to be some improvement in trade flows in Asia recently, the volume of world trade fell by 1.4% in November 2023 compared to October, according to CPB calculations. This instantly wiped out a modest increase in three months in a row.

The following graph shows that there is still little upward movement in the volume of world trade. The problems in the Red Sea will not help.

.png?width=742&height=450&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20World%20trade%20(index%2c%20volume).png)

And while, as mentioned, I have recently become more positive about various indicators related to international trade in Asia, the figures for Taiwanese export orders in December, which were published earlier this week, were quite a dampener, as follows picture shows. Export orders from Europe (-39% yoy), Japan (-31%), and the US (-22%) were particularly weak. But orders from China and Hong Kong were also lower than a year earlier (-4%). Orders from ASEAN countries did grow (+32%). Perhaps the decline in December turns out to be an isolated incident.

.png?width=700&height=423&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Taiwan%20-%20export%20orders%20(USD%20billion%20per%20month).png)

Source: Macrobond

US economy closes 2023 strong

The US economy exceeded growth expectations in the final quarter of last year. GDP growth was 0.8% compared to the third quarter (annualised growth was 3.3%). Compared to the fourth quarter of 2022, US GDP in volume was 3.1% higher. The composition of the growth was also excellent, as it was broad-based and not dependent on a single, incidental factor. There does not appear to be a recession in the short term. The pressure on the Fed to start cutting interest rates quickly is therefore not great.

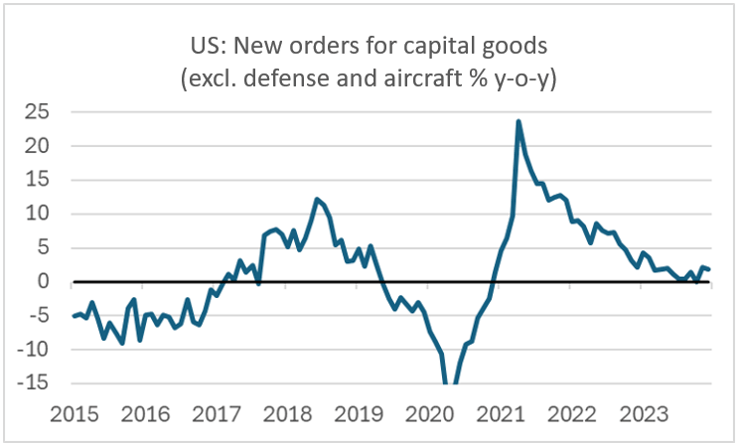

It's not all roses and moonshine in the US either. For a sustainable growth path, companies must continue to invest. Although orders for capital goods (excluding defense goods and aircraft) increased by 0.3% in December compared to November, year-on-year growth fell from 2.2% to 1.8%. If price increases are also taken into account, there will be a slight decrease in volume compared to December 2022.

Source: Macrobond

Source: Macrobond

Monetary boost in China

As is known, the Chinese real estate sector is facing significant problems and the stock market has been depressed for some time. There has been a lot of speculation lately about measures that policymakers should take to support the economy, but the central bank has excelled in inaction. There was hope that the central bank would decide to cut interest rates last Monday. That didn't happen. However, the central bank did lower reserve requirements for banks later in the week. The intention is to increase lending to the real estate sector. This action immediately led to a turnaround in the stock market, shares flew up, although the rise came to a halt on Friday. It remains to be seen whether the measure will provide much relief.

Closing

According to Lagarde, it is premature to think about interest rate cuts, but she does think that a first interest rate cut could take place in the summer. She is reasonably satisfied with the progress in the fight against inflation.

European banks are still tightening their credit conditions, but less than in recent quarters. Corporate credit demand remains weak, but less weak than in previous quarters. Together with the eurozone purchasing managers index, which became slightly less negative in January, this leads to optimism in Lagarde about the growth prospects for the eurozone economy. However, German business confidence fell again in January.

The improvement in trade figures in Asia has not yet led to a pick-up in global trade in other regions. However, the American economy grew faster than expected in the fourth quarter of last year and the Chinese central bank has reduced the banks' reserve requirements. That is an attempt to boost activity. We'll have to wait and see whether it's enough.