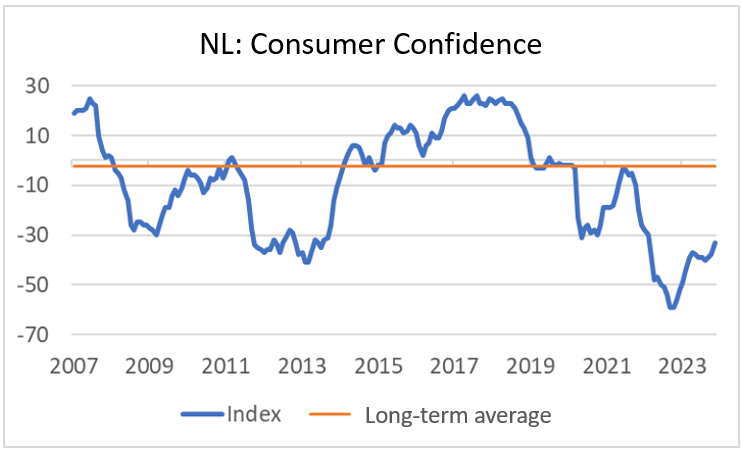

- Dutch consumer confidence is rising sharply

- Asian indicators are improving

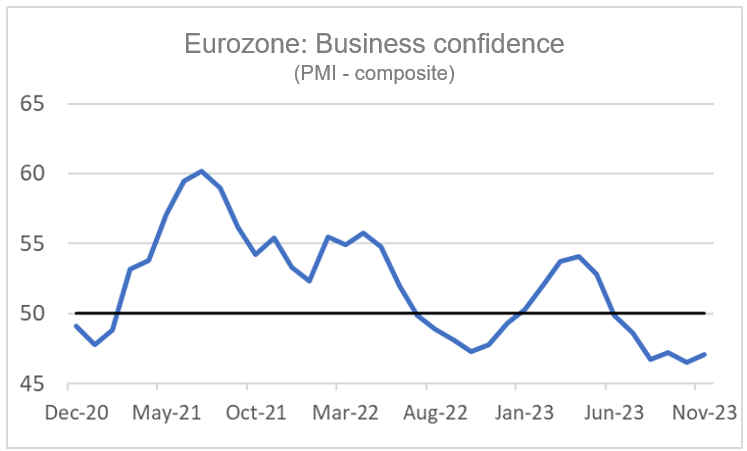

- Eurozone business confidence is bottoming out

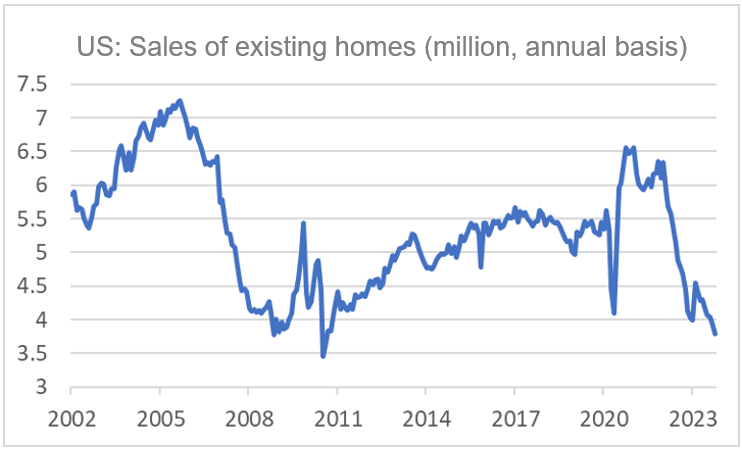

- American housing market is at a standstill

- Assessment of British industrial orders plummets

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 24 November 2023.

Dutch consumers became less gloomy in November. The CBS index rose no less than five points: from -38 in October to -33. Historically speaking, this is still a very low level, but an increase of five index points in one month is not commonplace. Consumer confidence received a huge boost when inflation unexpectedly rose from mid-2021. After inflation peaked in September-October 2022, the confidence index started to rise again. However, this stalled from March this year, despite inflation falling further. Between March and October, consumer confidence remained more or less stable at a historically very low level. But there has been a significant improvement in October. The details show that consumers across the board have become less pessimistic. Their assessment of the economy, their own financial position, and their willingness to buy improved. It is a bit of a guess as to the reason for this sudden improvement. I assume it has something to do with purchasing power. One swallow does not bring a summer, but this is a welcome development.

Source: Macrobond

Good news from Taiwan

In my opinion, anyone who wants to look at the global economy would do well to look at 'early cyclical' countries, i.e. countries that are generally at the forefront of the business cycle due to their industrial structure. That is why I follow developments in countries such as Taiwan, Korea, and Singapore. That yielded good news this week. In October, Taiwanese export orders were only 4.6% lower than a year earlier. In September this was still -15.6% and the October figure was the worst since September 2022. Export orders from Europe were still firmly in the negative: -45%, as were those from Japan (-17%). Orders from the US were only fractionally lower than a year ago (-1%) and those from Hong Kong & China were 1.3% higher. The latter is perhaps a sign that China is finally regaining some of the growth momentum, which the region is now experiencing the first effects of. Taiwan's industrial production also improved: -2.3% year-on-year in October, up from -6.9% in September and the worst figure since August last year.

Source: Macrobond

Production in Singapore's manufacturing sector was 7.4% higher in October than a year earlier. That was the best figure since May last year. Of course, it should be noted that Singapore has a relatively small economy and these figures are volatile. But still...it fits in with the improving picture in this region.

Hopefully, the European economy can also benefit from this a little. In any case, business confidence in the eurozone improved slightly in November, according to preliminary figures from S&P Global. The industrial confidence index rose from 43.1 in October to 43.8 in November. That for the services sector rose from 47.8 to 48.2 and the composite index went from 46.5 to 47.1. Values below 50 still indicate contraction, but the next picture shows that the economic downturn is in any case not deepening any further. Fingers crossed.

Source: Macrobond

These positive economic indicators are also offset by some negative ones. Although the US economy has achieved remarkable growth recently, problem areas remain, most notably the housing market. The number of existing homes sold fell by 4.1% in October compared to September. What is more important, however, is that this has reached the lowest level since 2010. The housing market is completely stuck. In the US, it is generally not possible to 'take' an existing mortgage with you to the new home. This greatly slows down the number of moves now that mortgage interest rates have risen sharply. After all, the monthly costs can then increase spectacularly and prohibitively. A stagnant housing market reduces the dynamics of an economy. Just like us, house prices are rising again in the US, albeit slowly. The imbalance between supply and demand apparently weighs more heavily on prices than the increased interest rates.

Source: Macrobond

Another negative signal came from the UK this week. Employers' organisation CBI surveys industrial entrepreneurs every month. This includes questions about the assessment of the order books. The index that measures this deteriorated from -26 in October to -35 in November. High-interest rates are often mentioned in the comments as the culprit. This British figure is of course at odds with the improving indicators in Asia. It probably shows that Europe, as usual, is lagging behind cyclically. However, we must also take into account that European economies are simply weaker than those elsewhere, probably due to relatively high energy prices.

Source: Macrobond

Conclusion

This week's economic indicators can easily be divided into two groups: hopeful and negative. Asian numerals belong to the first group. And as far as I am concerned, the improvement in Dutch consumer confidence is also positive. The stagnant US housing market and the UK's assessment of the development of orders in the industry are negative. Business confidence in the eurozone is somewhere in between.

This does offer some hope. The Asian dynamics will gradually make themselves felt elsewhere. So ultimately also with us. Furthermore, European economies will benefit from interest rate cuts as soon as inflation rates allow them. Unfortunately, that moment has not yet arrived, but that moment is getting closer every day.