- The global economy is benefiting from a strong tailwind…

- …strangely enough, the headwind is also strong

- I think the tailwind is dominating in the short term…

- …but it could well turn around later this year

- The ECB Bank Lending Survey paints a worrying picture

- Official interest rates further up

- Oil company profits are exploding…

- … why many are suddenly surprised about this is a mystery?

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 03 February 2023.

I've been writing an overview more or less every week for several decades of what I believe the most important macroeconomic indicators in the world are telling us. There is a multitude of economic figures that are poured out on us every week, but what is the common thread on the whole? Rarely have I seen so many contradictions as now. I'm just confused about it.

My conclusion is that there is currently an unusual combination of factors. On the one hand, the global economy is currently experiencing significant tailwinds. That is optimistic. At the same time, however, there is a strong headwind. The tailwind is stronger than the headwind for the time being, but that can easily change during the year.

Last year I became convinced that large parts of the global economy were heading for a recession, but I already revised that picture here last week. There are a number of powerful, positive factors.

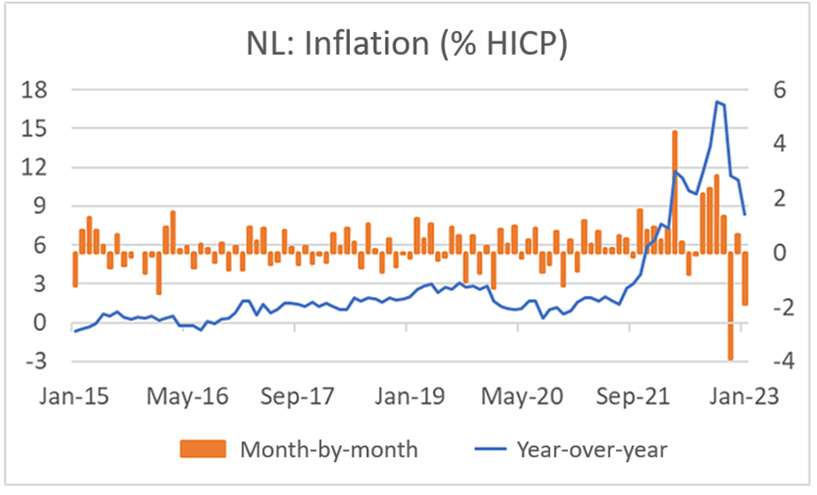

For us in Europe, the drop in energy prices is most important. Although gas in Europe is still several times more expensive than before the pandemic, a drop from around €340 MWh in August to around €55 MWh is now no less than a blessing for the economy. Inflation is falling rapidly as a result. The price cap that our government has set is suddenly hardly relevant because the current prices at the consumer level are, in my opinion, more or less in line with the price cap. Maybe they are even lower.

The knife cuts both ways. The rapidly falling gas price is pulling inflation down considerably. Incomes are developing positively this year. After all, the government has taken various measures to support purchasing power in addition to the energy price ceiling. Wage growth has also accelerated sharply in response to inflation rising earlier, and remember the increase in the minimum wage. It could just be that purchasing power will grow much more this year than the CPB calculated just a few weeks ago.

Source: Macrobond

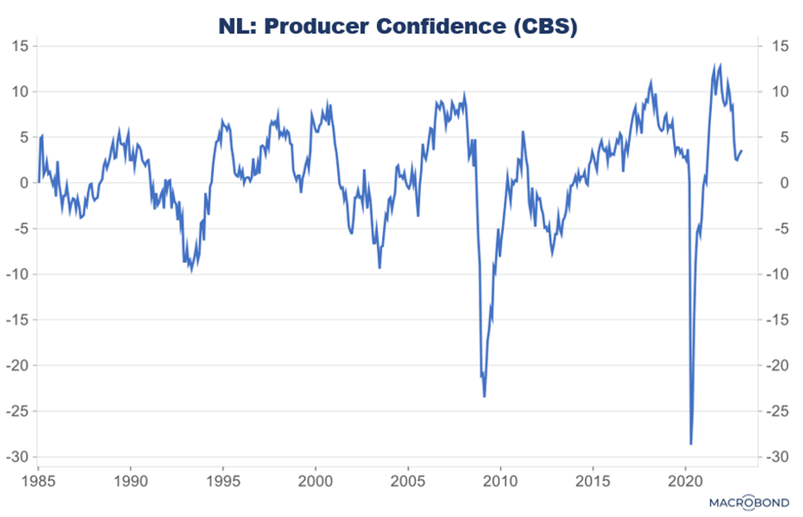

It is therefore no wonder that there is increasing optimism. Business confidence in the manufacturing industry increased from 3.3 in December to 3.6 in January, according to Statistics Netherlands' benchmark. The NEVI's PMI index rose from 48.6 in December to 49.6 in January.

Source: Macrobond

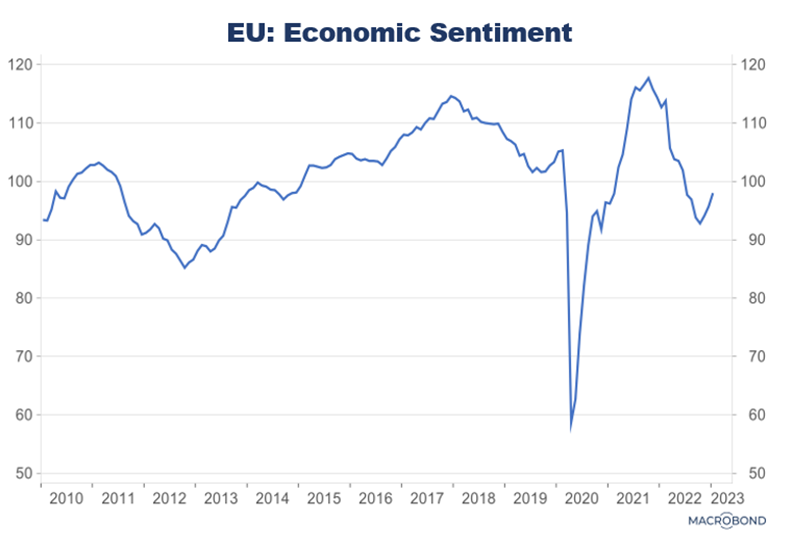

The European Commission publishes a much broader confidence index, Economic Sentiment, every month. It rose for the eurozone in January for the third month in a row: from 97.1 in December to 99.9.

Source: Macrobond

The reopening of Chinese society and thus the Chinese economy is a second crucial positive factor. China has been the growth engine of the world for decades. It fell silent in the last part of last year. You saw that not only in the Chinese figures, but also in the economic figures of the countries in the region and, for example, in the trade flow between China and the US. It is inevitable that the Chinese economy will take off now that the Chinese New Year festivities are or have come to an end. The first sign of this was evident in the January business confidence figures. According to the NBS, the index of confidence in the services sector rose from 41.6 in December to 54.4 in January. The latter figure is certainly not a record, but the increase from the previous month was the second largest in the history of this series.

Source: Macrobond

A third important factor is that problems in supply chains are currently disappearing very quickly. Since there are probably still backlogs in the production and delivery of goods, these can now be made up quickly. This will give a boost to activity in the short term. The sharp drop in international freight costs is also providing an impetus.

In contrast to that…

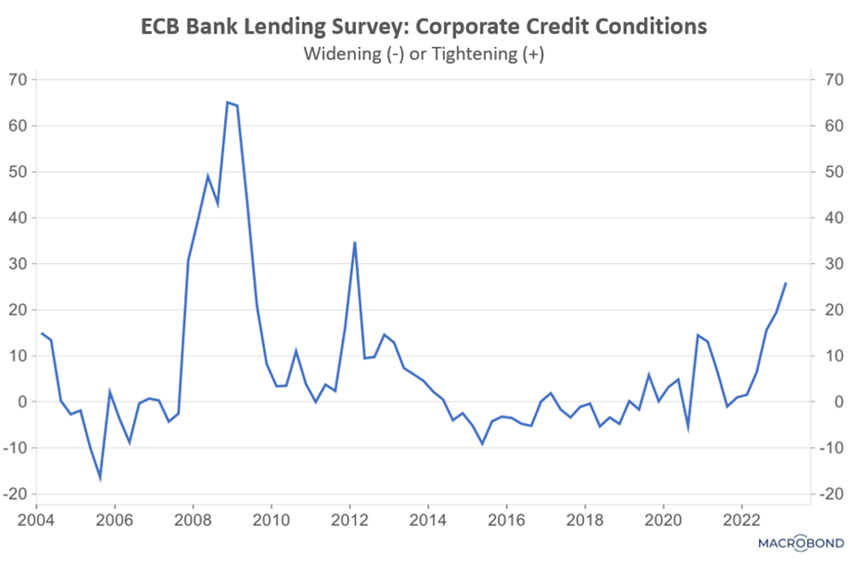

It's not all roses and moonshine. Business confidence in Europe may be improving, but the so-called Bank Lending Survey of the ECB paints a less attractive picture. The ECB surveys banks once a quarter about credit conditions, demand for credit, etc. In the most recent version of this survey, banks say that they tightened their credit conditions significantly in the latter part of 2022. The higher the line in the following chart, the more banks have on balance tightened credit conditions for companies. The level in the fourth quarter last year is of course far from what it was in 2008/2009 and it is not as bad as during the euro crisis in 2012, but still…

Source: Macrobond

In the same survey, banks also report a remarkably sharp decline in corporate credit demand. That's not really a very reassuring idea either. In particular, the demand for credit for investments is currently decreasing rapidly, while the demand for credit due to the need for working capital is still rising considerably. Not a nice combination!

Source: ECB

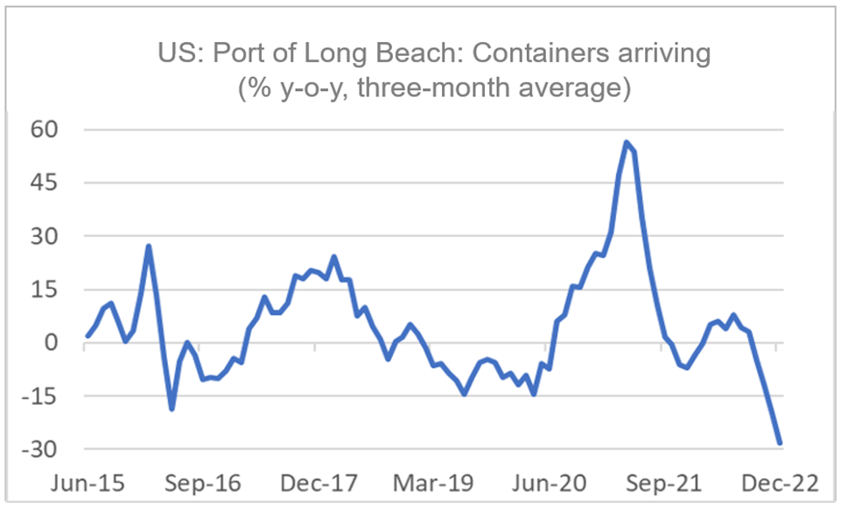

Another contradiction can be found in business confidence in various regions. While that confidence is improving in Europe and China, it is declining in the US. Well, the Americans were less affected by the higher gas prices than we were and therefore benefited less from the fall, even though the gas price in the US is currently also falling sharply. And of the reopening of China, the Americans will mainly experience the consequences of increasing imports. The next picture shows how the slowdown in the Chinese economy has cut into US imports. The decline in container arrivals at the Port of Long Beach in recent months has far outpaced the decline seen at the start of the pandemic. No wonder renting containers for the route from China to the American west coast is dirt cheap at the moment.

Source: Port of Long Beach

If imports pick up again, it will have two opposing effects. Rising imports are a "minus" in the calculation of GDP growth, so it will depress reported economic growth. On the other hand, parts may arrive that producers are waiting for and production will then receive a boost. I think the short-term net effect on growth in the US is negative rather than positive.

Some other signals are also not exactly cheerful. The US yield curve has been 'inverted' for months. The effective yield on 10-year government bonds has long been lower than the effective yield on 2-year bonds, the money market rate, or the Fed Funds rate. In the past, an inverted yield curve has been a reliable predictor of recessions.

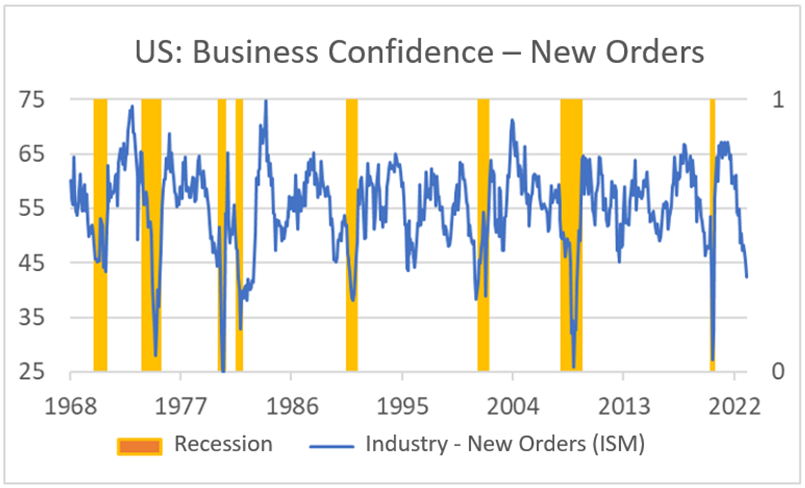

Business confidence in US manufacturing fell again in January. The important ISM index stood at 47.4 in January, up from 48.4 in December. Although there have been some ups and downs, this confidence indicator has actually been declining for well over a year. Economists like to look at the “new orders” component. In January it was 42.5. In December it was still 45.1. The following chart shows that in the past, January levels have generally, but not always, coincided with or been followed by a recession.

Source: Port of Long Beach

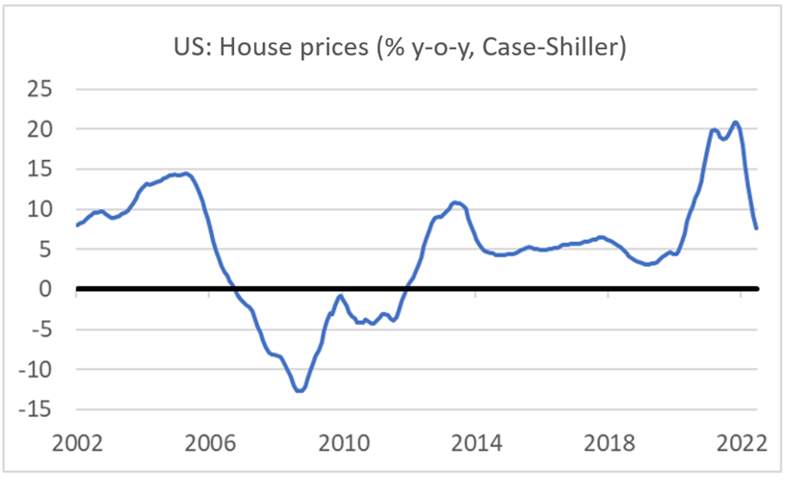

Another weak sector in the US economy is the housing market. The rise in mortgage interest rates is making itself felt. House prices have fallen every month since July last year compared to the previous month. The year-on-year increase is therefore quite decreasing.

Source: Macrobond, NBER

For example, there is quite a bit of weakness in the US economy. Yet companies continue to look for people. The number of unfilled vacancies, which had fallen slightly in recent months, rose again in December: from 10.4 million in November to 11.0 million in December. The December figure may have been distorted by the bad weather that hit large parts of the US in that month. Perhaps companies posted job openings online, but job seekers stayed by the stove.

Fed, ECB, and Bank of England raise interest rates further

As expected, official interest rates continued to rise this week. That was already announced so it was not surprising. The central bankers' message is that inflation is still too high. Fed chief Jay Powell noted that inflation is declining in some product groups, but that is not the case everywhere. Asked whether it would not be better to stop raising interest rates for the time being, he repeated his earlier message that he would rather tighten monetary policy too much than too little. After all, if it turns out that the Fed has raised interest rates too much, it can quickly lower interest rates again. He finds it more problematic when the inflation spirit, which is currently being pushed back into the bottle little by little, escapes again.

Financial markets responded positively to the various press conferences. Capital market interest rates fell remarkably sharply and share prices rebounded. You wonder if that was the intention. That is actually not possible. Falling capital market interest rates and rising share prices actually work against the tightening monetary policy. Anyway, the Fed and the ECB will raise rates again at their next policy meetings.

Finally: the profits of oil companies

I would like to close this week with a few comments on the ups and downs of oil companies. They have made huge profits in 2022. After they recently published their figures, a hurricane of indignation arose. Every self-respecting member of our parliament thought something of it and the emotion splashed. Joe Biden agreed. The outrage in itself is of course understandable, but then again it is not. Where was the emotion when these companies suffered massive profit drops in 2020 and Shell cut dividends?

What surprises me most about all this emotion is that all those outraged politicians and other people are so surprised. What do they actually think? We know approximately how much oil and gas those companies produce. In 2022, their costs will undoubtedly have increased, but perhaps no more than inflation. So when we saw that the European gas price completely exploded and the oil price was also a lot higher in 2022 than in 2021, you could count on your fingers that this would be reflected in the profits of the producers.

Moreover, the sad thing is that those high prices of oil and gas are partly due to the types who are now so outraged. Okay, the war also plays an important role. In addition, however, the exploration of oil and gas has been thwarted as much as possible for years. If that hadn't happened, prices would have been much lower now. The politicians (and others) who are so outraged now have a huge amount of butter on their heads. The sad thing is that they don't even notice it themselves. The world is going crazy fast. I'm not taking this much longer.