- Dutch consumer in a trot

- Bright spots in the global economy?

- Is the destocking process coming to an end?

- Way too early to raise the flag

- Official interest rates may be even higher and longer high

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 7 July 2023.

Consumption by Dutch households was 1.4% higher in volume in May than one year previously. That is slightly more than the growth in April: 1.2%, but it remains at a moderate pace. More was spent on services: +5.3%. Less on goods, except for cars. The latter is an international trend.

.png?width=787&height=463&name=Finance4Learning-Domestic%20Household%20Consumption%20(volume%2c%20adjusted%20for%20shopping%20days).png)

Source: CBS

Last year, consumption growth developed in line with energy prices. This means that 2022 started with strong consumption growth (in volume), but the rise in energy prices put a strong brake on consumption growth. When energy prices fell after August, consumption growth accelerated again. This year the picture is different. Energy prices have continued to fall, but consumption growth has weakened since the beginning of the year. This is remarkable because collective labour agreement wages are rising faster. Income growth currently exceeds expenditure growth. This means that buffers are growing and when consumers become more optimistic, this can easily translate into an acceleration of consumption growth, although some of that extra spending will probably be done abroad now that we are apparently ready to go on holiday en masse.

International bright spots?

The global economy has been weakening for some time. Industry in particular is under great pressure everywhere. The stock adjustment process largely causes this. During the pandemic, companies faced problems with the supply of raw materials and parts, etc. As the logistical problems eased, they built up large stocks as a precaution. Subsequently, interest rates rose, making it more expensive to maintain large inventories. After all, holding inventories consumes working capital. In addition, commodity prices began to fall. Subsequently, companies are again focusing on using their stocks.

During the process of reducing inventories, production is below the level of demand, or sales if you will. Naturally, such a process of depleting stocks will automatically come to an end when those stocks have been brought back to the desired level. The production picks up again. So you might think that there isn't much going on; just wait for the inventory cycle to bottom out and then it will go the other way, companies will have to ramp up production back to the level of demand.

But that is a bit too short-sighted. When companies cut production to use up inventories, less income is also earned. After all, all production factors involved in the production process are paid and lower production means lower incomes. Those lower incomes can in turn lead to a reduction in demand. In this way, a process of destocking can reinforce itself.

I have been less optimistic about the global economic outlook for some time now. The reopening of China does not provide a major boost for the time being. The dampening effects of higher interest rates are manifesting themselves with a slowdown in the economy, and we have not yet seen the last of that. And although inflation is falling, it remains too high. However, an economist must exercise modesty and always be on the alert for signs that things may turn out differently than he or she expects. So for a change, let me try to list signals that could indicate an improvement in the global economy, and in particular a turn in that damned inventory cycle.

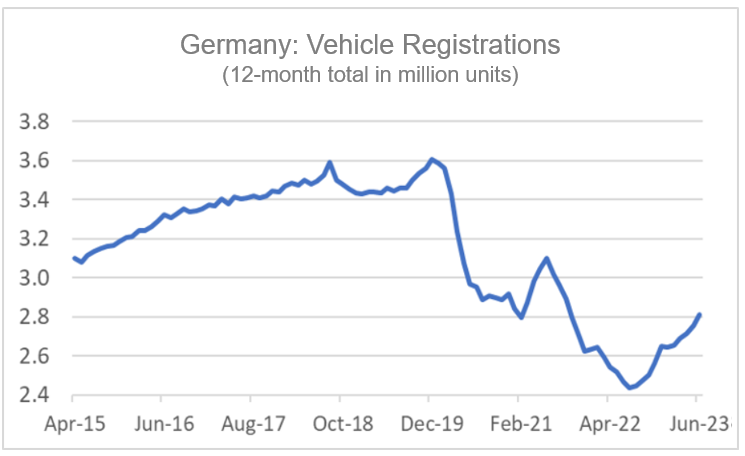

The most positive signal came from Germany this week. German manufacturing orders were 6.4% higher in May than in April. This greatly exceeded expectations. Especially orders for cars, etc. increased strongly: +8.6%. This is no coincidence because car sales are currently rising sharply in many countries. Well from a low level, but here it is mainly about the change and less about the level.

Source: Macrobond

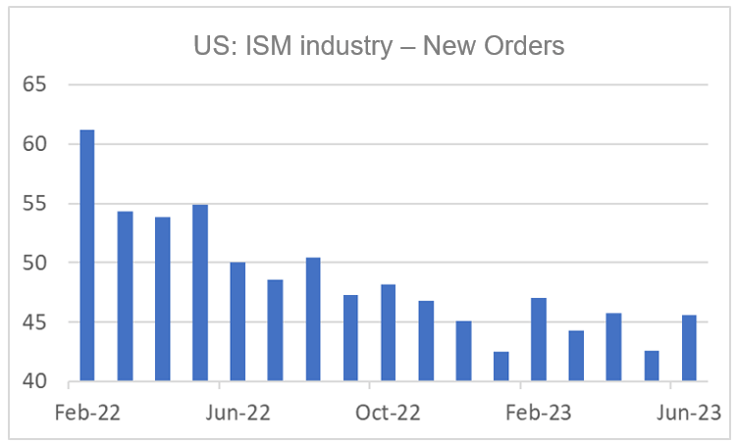

Orders also appear to be recovering in the US industry. The new industrial orders sub-index in the Institute for Supply Management's (ISM) monthly survey improved slightly in June to 45.6 from 42.6 in May. So that remains a low level, but, as I said, it's about the change here.

Source: Macrobond

According to a similar survey for the US services sector, the order position there also improved in June: 55.5 against 52.9 in May.

.png?width=747&height=456&name=Finance4Learning%20-%20US%20-%20Number%20of%20Voluntary%20Redundancies%20(million).png)

Source: Macrobond

The labour market is tight everywhere and the monthly US jobs report will show the latest developments this afternoon. According to figures from payroll processor ADP, US job growth would have been very strong in June. They recorded 497,000 new jobs, the highest number since February 2022. And according to the JOLTS report (Job Openings and Labor Turnover Survey), just over four million American workers resigned voluntarily, the highest number since December. Although these figures are volatile and a single strong figure can therefore be 'noise', the number of voluntary redundancies is seen as a sign of strength in the labour market. After all, it indicates optimism among employees that they will easily find a job elsewhere.

Not directly himmelhoch jauchzend

The tone of the foregoing may be slightly different from what I've been saying lately. Am I suddenly optimistic? It doesn't go that fast! There are more than enough less favourable economic indicators to report.

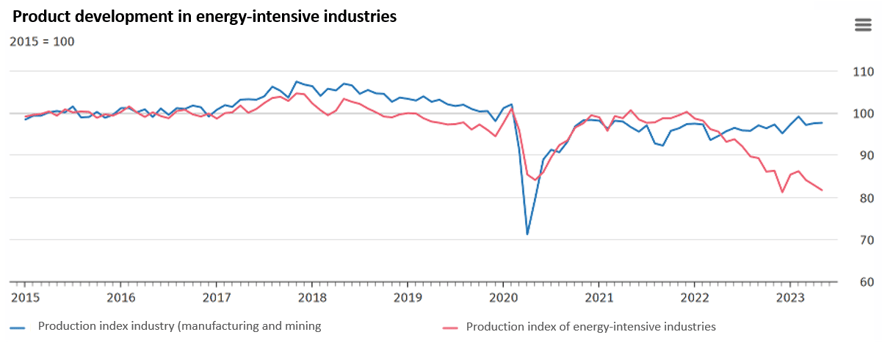

Source: Destatis

Source: Destatis

Therefore, there remains Caixin the confidence of Chinese entrepreneurs is declining, both in the industry and in the service sector. The English export machine is also available. In my the German export value decreased compared to April and also compared to my previous year, a decrease will be booked. And while the German industry booked orders in my sea, production fell. Personally, the focus is on the products in energy-intensive sectors in Germany, but there are still valleys (1.4% m-o-m in my and 12.4% y-o-y), thanks to energy prices in the three-quarters of a year valley. Finally, due to NEVI, the confidence of industrial entrepreneurs in our country increased in June. The purchasing managers' index is based on 43.8 against 44.2 in May. This means that the confidence index is well below 50 and thus indicated crime. The level in June usually comes with avenues for during recessions.

Is good never good or bad?

It is of course pleasant to see bright spots. That is good news, although for the time being they will remain no more than bright spots. But good news is not always good news for the financial markets. After all, we have a huge inflation problem and normally a weakening of the business cycle is necessary to put the inflation genie back in the bottle. The bigger the inflation problem, the more cyclical weakening is needed to bring inflation down. If economic growth does pick up again, the inflation problem may remain more stubborn than desired. This in turn may mean that central banks will have to raise interest rates even further and also have to keep them high for longer than players in the financial markets hope. For equity investors who have assumed falling interest rates, this is a setback. For example, an improvement in the economic situation can still be a 'mixed blessing'.

Closing

The Dutch consumer is in a slump. Recently, incomes have grown faster than expenditures and if consumers become more positive, many households will therefore have financial room to spend more.

I have been quite gloomy about the global economic outlook for some time now. It is precisely then that I am keen to look for signals that can prove that I am wrong, which would make me 'go over'. There are now some such signs. It could be that the destocking process in the industry is fairly well completed. Because such a process is complex and can reinforce itself, it is much too early to wave the flag. Moreover, there are still plenty of signs of weakness. Anyway, I keep a close eye on it, 'I am on the case'.

A disadvantage of accelerating growth, on the other hand, is that inflation falls insufficiently and that the central banks have to raise interest rates even further which will also keep them high for longer.