- Dutch consumers are slightly less pessimistic for the third month in a row

- Probably has everything to do with slightly declining inflation and uncertainty

- US figures are disappointing…

- …but that is probably due to the severe winter weather in December

- Chinese data is slightly better than expected; they are now going to celebrate the Chinese New Year

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 20 January 2023.

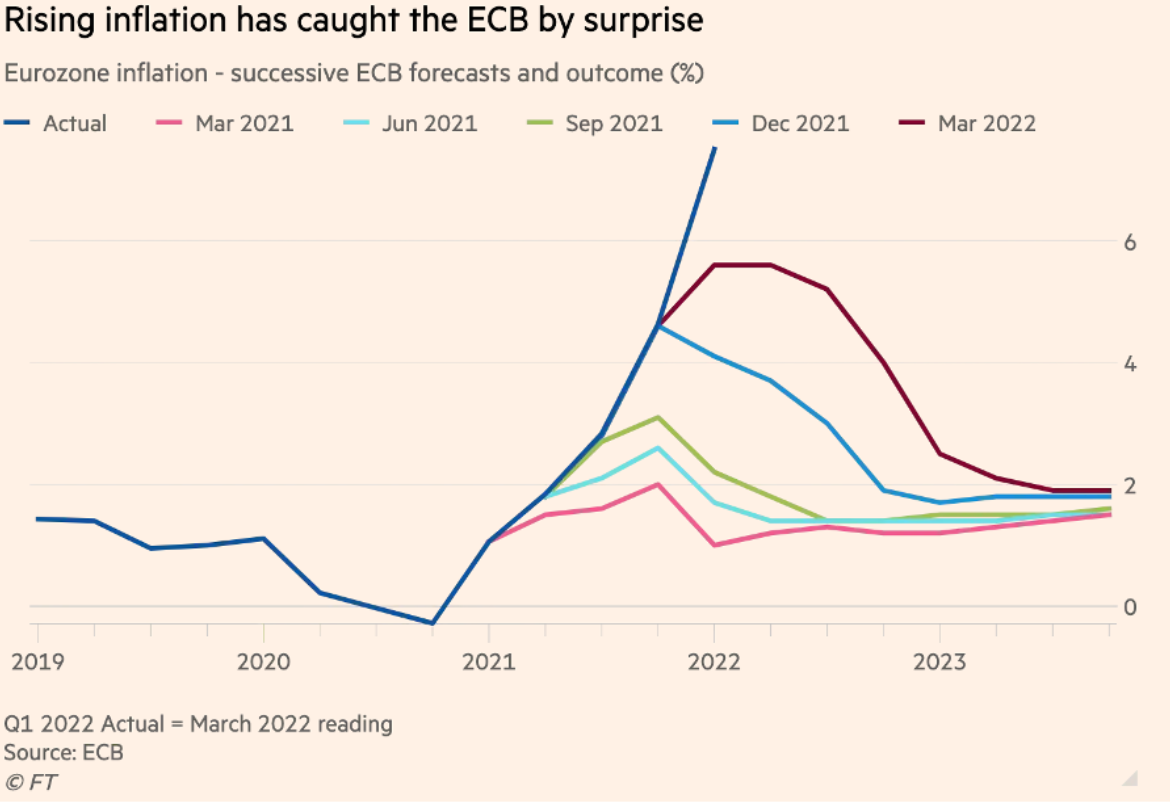

Dutch consumer confidence improved slightly again in January. It was the third month in a row that consumers were less pessimistic, although the first chart shows that confidence is still very low from a historical perspective. However, consumers are a lot less negative about the next 12 months than about the past year. The loss of purchasing power and the uncertainty caused by the sky-high and, until recently, ever-increasing inflation have taken a toll on it. The price cap for energy removes a lot of uncertainty and that will undoubtedly have helped consumer confidence in January. How all this will now affect consumption remains to be seen. So far, private consumption has developed better than might have been expected on the basis of the confidence data.

Source: Refinitv Datastream

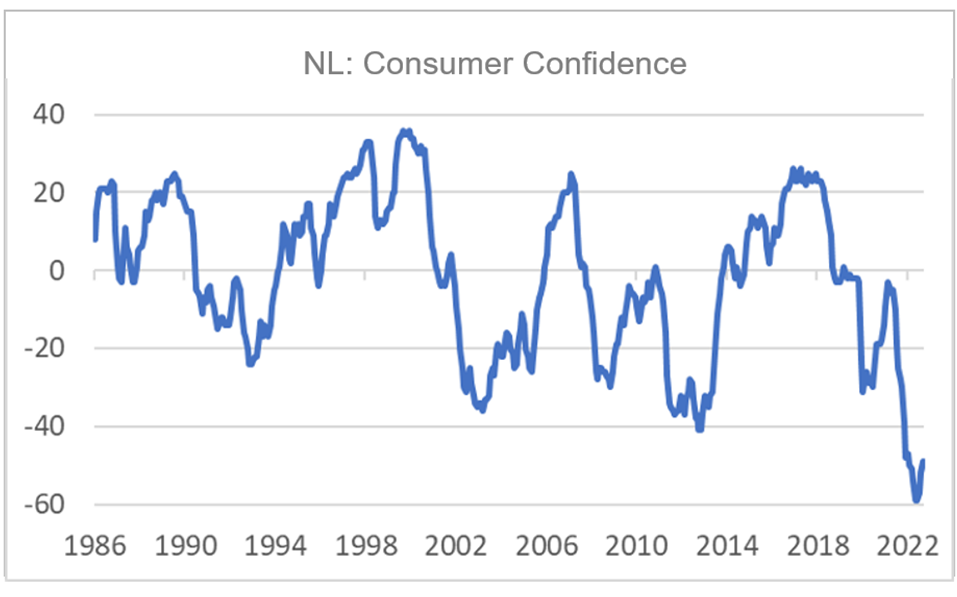

Wage growth in our country has accelerated sharply in recent months. According to the figures of the AWVN, collectively negotiated wages in the collective agreements concluded in December rose by an average of 6.1%. For 2022 as a whole, an average figure of 3.8% is now in the books. In 2021 this was still 2.1%.

Source: AWVN

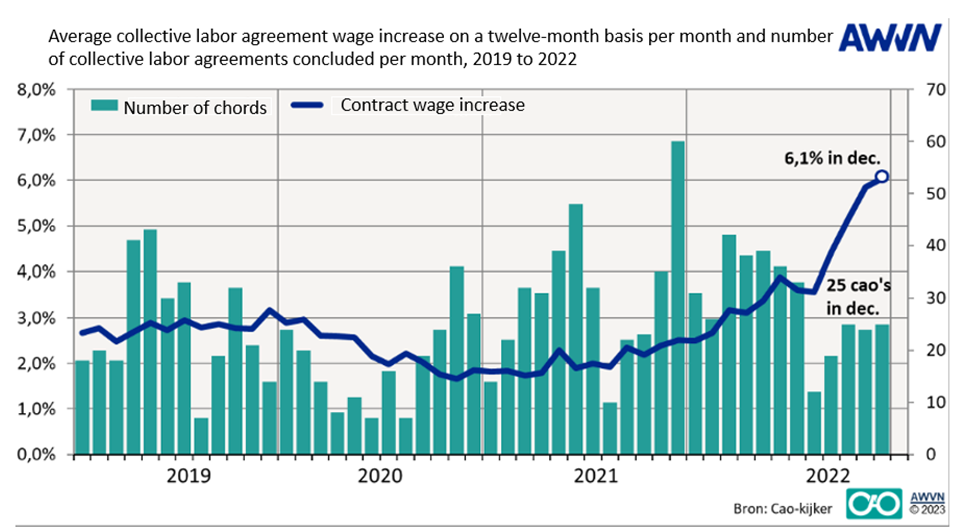

A picture comparable to the development of Dutch consumer confidence can be seen in the ZEW index in Germany. This is a survey of economists and business analysts on the state of and prospects for the German economy. The assessment of the current situation in Germany improved from -61.4 in December to -58.6 in January. Expectations for the coming period improved much more: from -23.3 in December to +16.9 in January. This increases the chance that we, our eastern neighbors, and other countries in Europe can escape a recession.

Source: Refinitv Datastream

US hit by winter weather

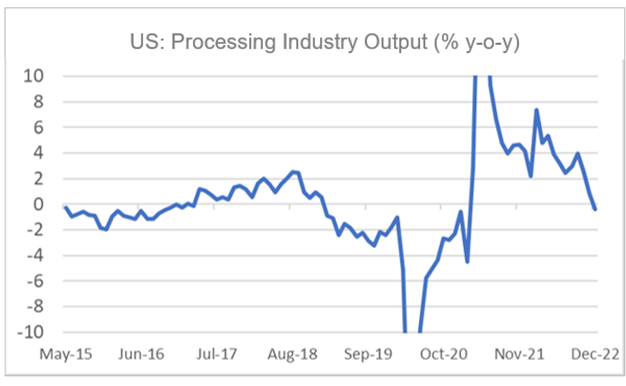

At first glance, US economic indicators for December do not paint a very rosy picture. Production in manufacturing in the manufacturing sector fell 1.3% in December compared to November. Production was 0.4% lower than a year earlier.

Source: Refinitv Datastream

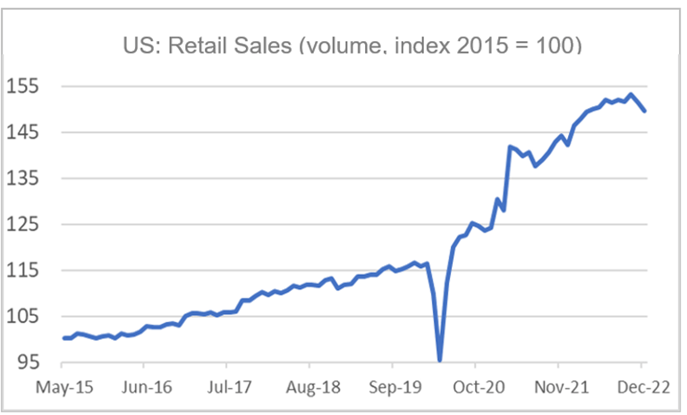

The volume of retail sales also declined: -1.2% month-on-month.

Source: Refinitv Datastream

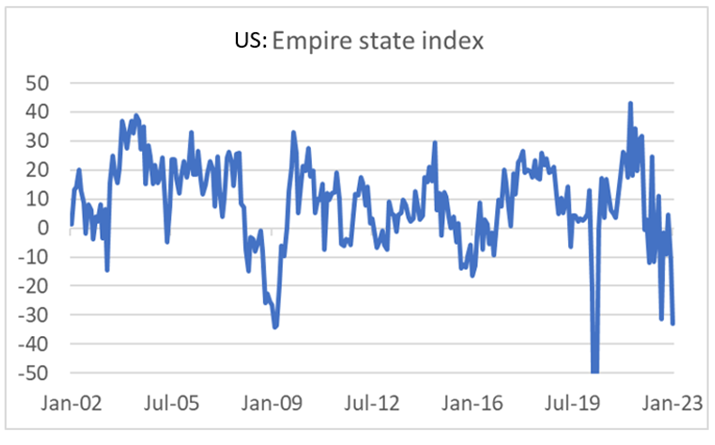

Business confidence as measured by the New York Fed in their own district fell sharply in December. The so-called Empire State index was -32.9 against -11.2 in November. The new orders sub-index even fell from -3.6 in November to -31.1. These are very low levels. The next picture shows that the Empire State index reached lower values in the last 20 years only during the financial crisis in 2009 and during the pandemic.

Source: Refinitv Datastream

Against these negative figures, the number of applications for unemployment benefits fell to 190,000 in the week of January 14. That is a very low level. The question this raises is how the strong labor market can be reconciled with the deteriorating economic indicators. It may be that the labor market is simply lagging behind. That is actually a well-known phenomenon. And certainly, in a time of labor shortages, companies may continue to hire people even if their turnover is declining. But I think that the explanation for the deteriorating economic indicators should first and foremost be found in the weather. It was very cold in large parts of the US in December. Only twice before (as long as this is recorded) did more snowfall in December than last month. Public life was disrupted. For example, large numbers of flights were canceled especially just before Christmas.

So I would still be cautious about interpreting that the economy is clearly weakening and that this weakening will force the Fed to stop rate hikes soon. We now have to assume that the Fed has entered the next phase of its tightening policy. Fed boss Powell has explained it nicely in the past. Recently, the focus has been on how quickly the Fed should raise interest rates. But now the central question is to what level interest rates should be raised. In the next phase, the central question will be how long interest rates should remain at that high level. On February 1, we will receive more text and explanations from Powell. The Fed has sharply raised the Fed Funds rate in 2022: from 0-0.25% at the beginning of the year to 4.24-4.5% now. It seems certain that this rate will be raised above 5.0% in the coming months.

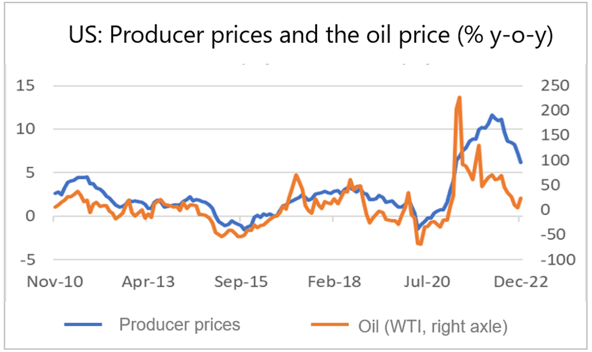

This week's release of December producer prices also sparked some 'inflation optimism'. Producer prices fell 0.5% in December and core inflation was only a modest 0.1% month-on-month. That is of course good news. It should be realized, however, that the development of producer prices is strongly influenced by the oil price, as the following picture shows.

Source: Refinitv Datastream

A little frustration

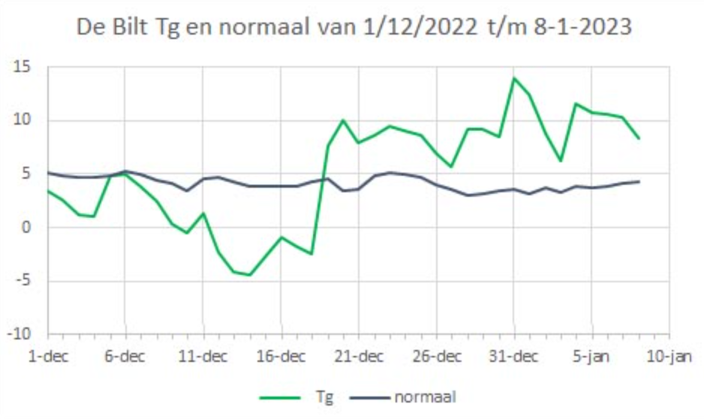

Speaking of the weather in the US above, I have to share a little frustration. This week I took part in a few meetings and briefly discussed the fall in European gas prices. The decline was generally attributed to global warming. I'm bad at that. Apparently, those people have a good overview of the whole earth from their homes. Certainly, it has been warmer than normal in the second half of December and in the first part of January, but, as mentioned, in the US - and also in Canada - it has been much colder than usual. This was also the case in North Asia and large parts of Australia. The narrative of global warming is so powerful that it is being used all the time, without people looking at the numbers. I found the following picture on the websiteklimaatgek.nl. The figures used in the picture are from the KNMI. (Tg stands for the average daytime temperature.) As you can see, it was clearly colder than normal in the first half of December in the Netherlands, but warmer in the second half. On average, it will not differ much from the average. But this aside… I had to get it out.

Source: klimaatgek.nl; KNMI

China: better than expected

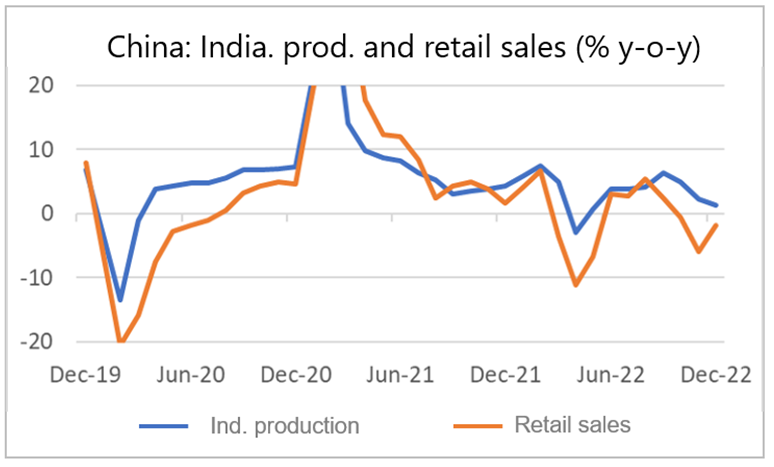

The Chinese economy was hit hard by the lockdowns last year. I suspect the abrupt ending of those lockdowns has something to do with that as well. Yet the most recent figures are less negative than expected. The volume of industrial production in December was 1.3% above that of a year earlier. That is of course still growth, but for China, it is a very low percentage. Before the pandemic, a rate of about 6% growth was normal.

Retail sales were 1.8% lower than a year earlier. That sounds quite disastrous and it is, but it is still less bad than expected. In November, retail sales were still 5.9% lower than in November 2021.

Source: Refinitv Datastream

China's GDP in the fourth quarter was unchanged from the third quarter. That was also better than expected, because shrinkage had been expected. Compared to a year earlier, growth was 2.9%. That too is very low for China.

Now that the economy is open again, an upswing can be expected. That will have to wait a while. First, the Chinese will celebrate their New Year next Sunday and then the economic activity will remain at a low ebb for two weeks when the Chinese are on holiday. It also remains to be seen how much the explosion in the number of corona infections will hinder production. In addition, China is grappling with a number of well-known problems, especially those in the real estate sector. Nevertheless, an acceleration of growth in the course of the year is reasonable.

Source: Refinitv Datastream

Closing

The view on the global economy is currently becoming somewhat clouded, especially as US economic indicators appear to have been affected by the severe winter weather in December. In the coming period, we will also lose sight of the Chinese economy a bit because the Chinese will be celebrating New Year.

The sharp drop in European gas prices is helping the European economy. Incidentally, the price of oil has also fallen. Although the gas price in Europe remains very high compared to before the pandemic, this is still good news. This reduces the risk of a nasty recession. Dutch consumers are becoming slightly less pessimistic, with the emphasis on 'something'.