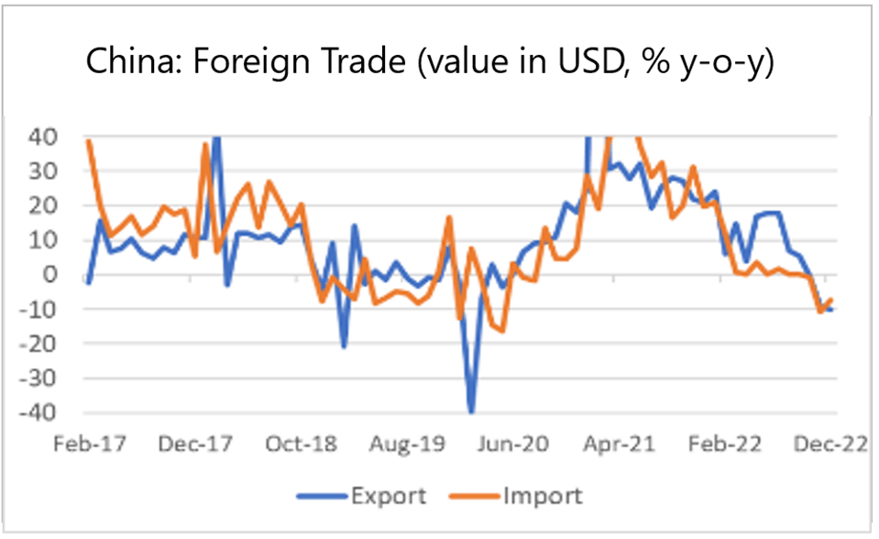

- Chinese exports are down sharply…

- …that seems to be mainly due to a weakening in foreign demand

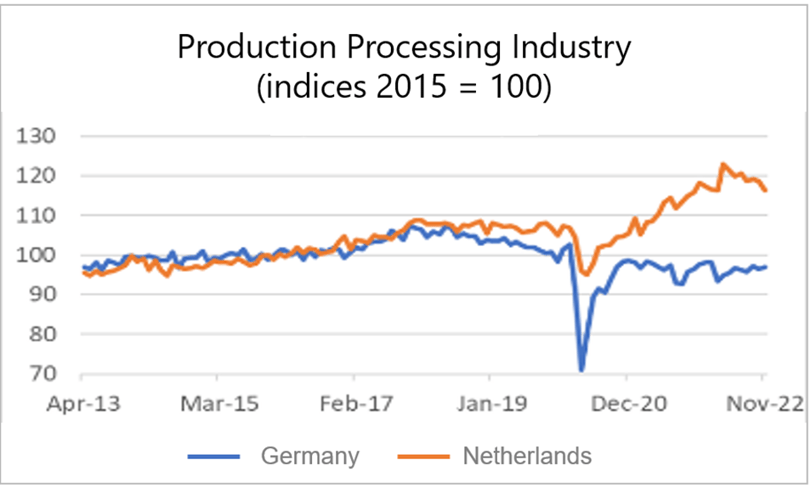

- Dutch production and processing industry is shrinking mainly, but not only, in energy-intensive sectors

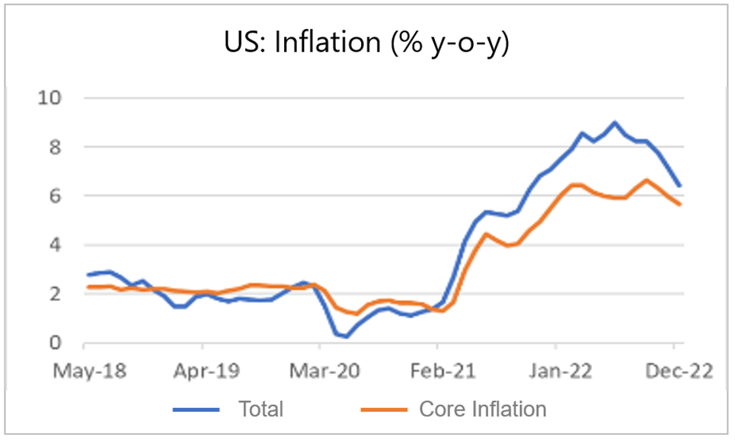

- US inflation is falling, including core inflation

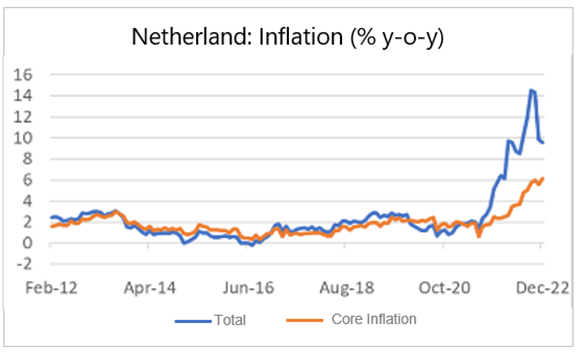

- Our headline inflation is also declining, but core inflation is still rising.

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 13 January 2023.

Trade figures from China for the month of December paint a worrying picture. The value of exports was 9.9% lower than a year ago. In November the decrease was 8.9%. In July, the value of Chinese exports was still 18.2% higher than a year earlier. So there has been a very strong reversal. Keep in mind that prices have undoubtedly increased. In volume terms, the fall in exports is therefore even greater than the -9.9%. The value of imports also fell, although the fall in December (-7.5%) was slightly less than that in November (-10.6%).

Source: Refinitv Datastream

There are three possible explanations for the sharp decline in Chinese foreign trade. Firstly, base effects play a role here, albeit a minor one. Second, foreign trade has been hampered by the lockdowns that gripped the country until December. As a result, less staff was available to take care of production and transport. A third possible explanation is that demand from abroad decreased. Since I see no reports of Western companies complaining that they are not getting supplies from China, I have to assume that foreign demand is the main culprit here. Comments from Chinese economists seem to confirm this.

The geographical picture is also interesting. Chinese exports to the US were 20% lower than a year earlier, and those to Europe were 18%. The export value to Russia, on the other hand, was on the rise: +8% year-on-year. This shows the transformation of the Russian economy. Now that Western countries have taken sanctions and their exports to Russia have fallen sharply, the Russians have to look for other suppliers. China makes good use of this.

China's weak trade data sheds an interesting [new] light on the abrupt termination of the zero-covid policy. So far we assume that this decision was made under the pressure of mass protests. But it is quite conceivable that economic considerations played a role. The lockdowns had already contributed to a significant blow to consumer spending. Policymakers may have been shocked by the weak economy, but now that exports are also falling, the opening of society is aimed at giving free rein to consumer demand in an attempt to prop up the economy as a whole.

Dutch industry is rapidly losing momentum

The fact that world trade has weakened in recent months is also reflected in the production figures of the processing industry in the Netherlands. In November it was 0.2% lower than a year earlier. In October a plus of 3.5% was recorded. That -0.2% was the first negative since February 2021. Although the figures are volatile from one month to the next, it was noticeable that production in November was 2.0% lower than in October. That was the third month in a row in which production decreased. For a large part of 2022, production was not going well. In absolute terms, a peak was reached in April, and production in November was 5.4% lower than in April.

In recent years, the Dutch industry has developed more strongly than the German industry, which is historically very unusual. In the past, the industry in both countries was quite in step with each other. My estimate is that the divergence is mainly caused by the problems experienced by German car manufacturers. This sector has a much greater weight in the total economy in Germany than in our country. However, the most recent figures suggest that car production in Germany is recovering somewhat. The next picture shows the indices for manufacturing production in both countries. There was a significant gap from 2018, but the difference is now diminishing.

Source: Refinitv Datastream

What is absolutely clear, by the way, is that the high energy prices are having a serious impact. The energy-intensive sectors will be hit hard. The volume of production in the chemical industry was 16.4% lower in November than a year earlier. The decline was 9.5% in the rubber and plastics sector. We see exactly the same in Germany and, for example, in the UK. That is of course not surprising.

The weakening is not limited to the energy-intensive sectors. Machine construction still recorded a production increase of 7.8% compared to November last year, but that percentage was much higher in the preceding months. Compared to April, the average daily production in mechanical engineering was no less than 13% lower in November.

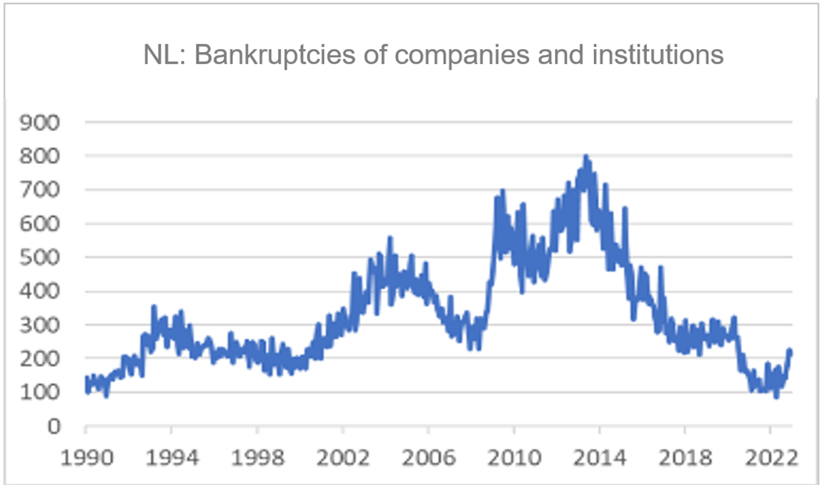

Finally, the number of bankruptcies rose again slightly in December. The next picture nicely shows the increase over the last few months, but also makes it clear that the numbers are still extremely low. The number of bankruptcies of companies and institutions (including sole traders) in 2022 after 2021 was the lowest since the beginning of this statistic in 1981. It suggests that the upward trend will undoubtedly continue. In fact, I am surprised that the increase is no longer pronounced.

Source: Refinitv Datastream

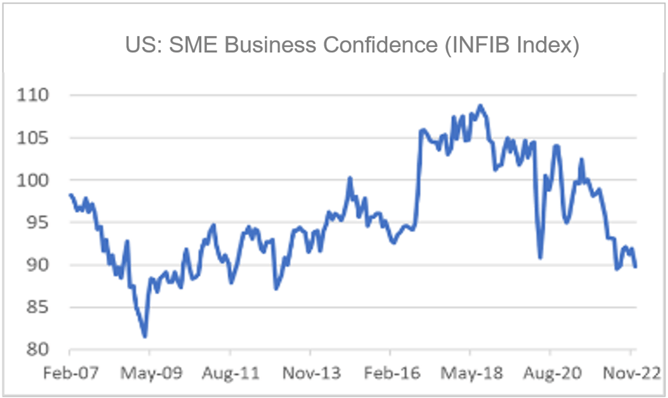

The US economy continues to send quite contradictory signals. The labor market remains tight. The number of claims for unemployment benefits fell again in the first week of the year. That actually points to a strong economic climate. On the other hand, the confidence of SMEs fell again in December, according to the measure of the National Federation of Independent Business. Confidence seemed to improve somewhat in recent months, but that trend has therefore stopped. The index is also well below its historical average.

Source: Refinitv Datastream

US inflation is moving in the right direction

US inflation was 6.5% in December. In November it was still 7.1% and in June 9.1%. So things are moving in the right direction, although there is still a long way to go. Core inflation also fell, by the way: from 6.0% in November to 5.7% in December. The fact that inflation is much higher in our country is mainly due to the fact that European energy prices have risen much faster in 2022. For example, the electricity price for American households was 14% higher in December than a year earlier, for us it was 45%. The difference was even greater with gas: 60% with us, and 19% in the US. It should be noted that these differences were even greater a few months ago.

Source: Refinitv Datastream

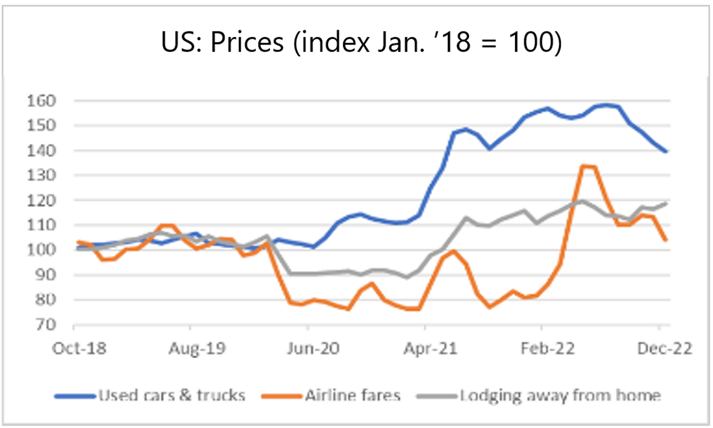

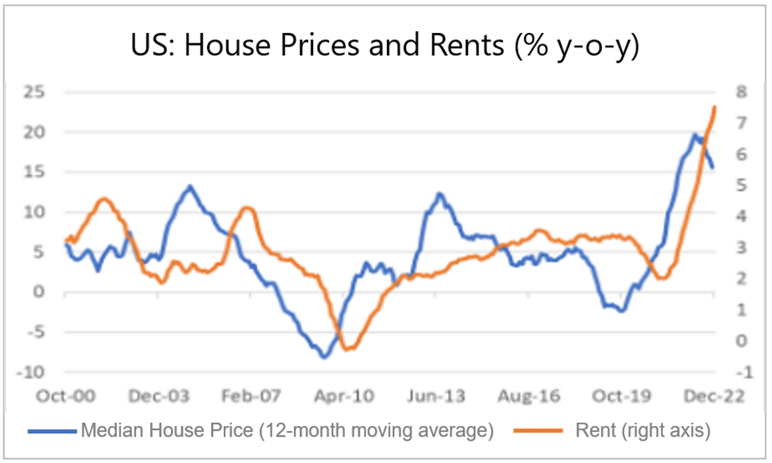

In my view, US inflation will continue to fall in the coming months. As I've written many times before, a very quick return to the Fed's 2% target is unlikely. The rate of increase in residential rents (ie actual rents and rents imputed to homeowners) is still increasing. The following graph shows that rents follow the rise in house prices with some lag. Because the increase in house prices accelerated up to and including May last year, the rate of increase in rents is still increasing. Rents make up 31% of the inflation basket. As a result, the rent increase alone is already good for 2.4 percentage points of inflation and that is not likely to decrease much any time soon.

Source: Refinitv Datastream

We already knew last week that Dutch inflation also fell slightly in December. In contrast to the US, core inflation rose further in December.

Source: Refinitv Datastream

Closing

The Chinese economy continues to trade in poor numbers. Previously, industrial production and retail sales had already been weak in October and November. This week it appeared that the contraction in exports sharpened in December. The abrupt end of the zero-covid policy may not only be related to protests against that policy but may also be a means of boosting the economy by freeing up private consumption.

In our own country, production in the processing industry is visibly weakening. The energy-intensive sectors in particular are showing signs of weakness. But other sectors are also apparently suffering from the slowdown in world trade. Fortunately, energy prices have fallen sharply in recent weeks, but I still hold my breath.

The US economy continues to give opposing signals about where it is going. SMEs are the backbone of any economy. SMB confidence in the US fell again in December after a few months of improvement.

US inflation is moving in the right direction. Core inflation also fell in September. Still, we are still well above the Fed's 2% target. The interest rate will undoubtedly be raised further by the Fed. Inflation is also falling in the Netherlands, but core inflation is still on the rise for the time being.