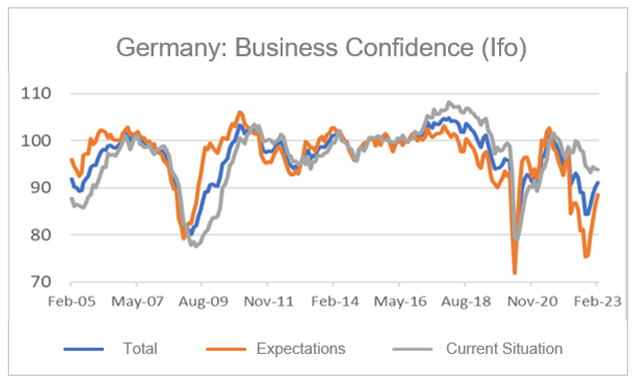

- Dutch inflation falls sharply in March…

- …and may turn negative in the course of the year

- This conceals the fact that there is indeed a wage-price spiral

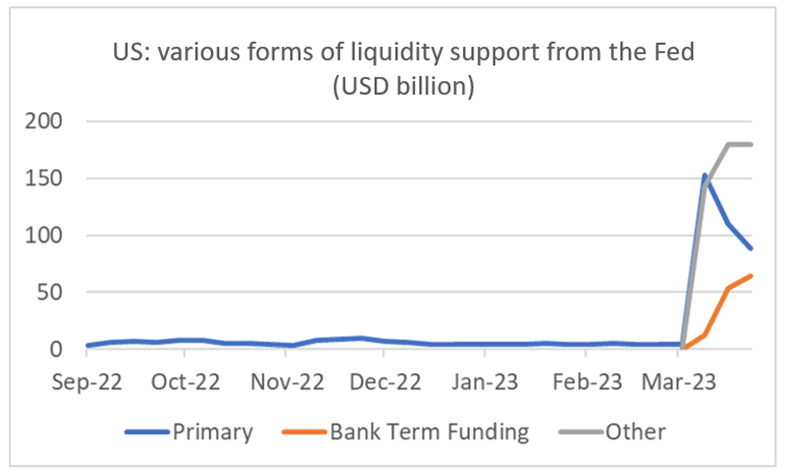

- Fed liquidity support to US banks falls

- Divergence in China

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 31 March 2023.

Inflation in our country was 4.4% in March, well below the 8.0% in February. A sharp drop was reasonable because prices in March last year rose very sharply compared to February after the outbreak of the war. Still, the figure was slightly better than I expected. The energy was the main – and in fact the only – cause of the decline. According to the provisional figures, energy prices were 28.2% lower than a year earlier. That had been -1.1% in February. The windfall was mainly in the fact that the other components that were published finally stabilized. Food was 15.0% more expensive than in March last year, but it was 15.1% in February. Up to and including February, the figure had continued to rise for months. Industrial goods excluding energy and services also stabilized. Excluding energy, the overall inflation rate was 8.1%, which of course remains high.

Source: Macrobond

Source: Macrobond

In the coming months, I suspect that the inflation rate will continue to decline only modestly. Energy prices have a somewhat delayed effect on the rest of the economy. As a result, inflation in food and other components is likely to moderate gradually in the near future. On the other hand, prices actually fell slightly in the April-June period last year. So the figure will not benefit from a “base effect” like in March.

From July onwards, the inflation rate will fall very sharply. Last year, the total average price level between July and September rose by no less than 6.6%. If the inflation rate remains around the current 4.4% in the coming months and prices rise by less than 2.2% in the July-September period, we will see a negative figure in September. That is then complete a basic effect. Much depends, of course, on energy prices.

Incidentally, Statistics Netherlands will switch to a new series for inflation in the middle of the year, in which energy prices are no longer based solely on the rates of new contracts. Instead, the actual situation with the contracts will be looked at. The old series exaggerated inflation last year, but this year the reverse is the case and the new series will be slightly higher than the old one.

If I'm correct that inflation will fall quite a bit further later in the year and will likely be below zero (by today's benchmark), that doesn't mean we're rid of the inflation problem. We are now in a phase of the inflation process in which the direct and delayed impact of energy prices dampens inflation, but there is now also a combination of a wage-price spiral and a profit-price spiral.

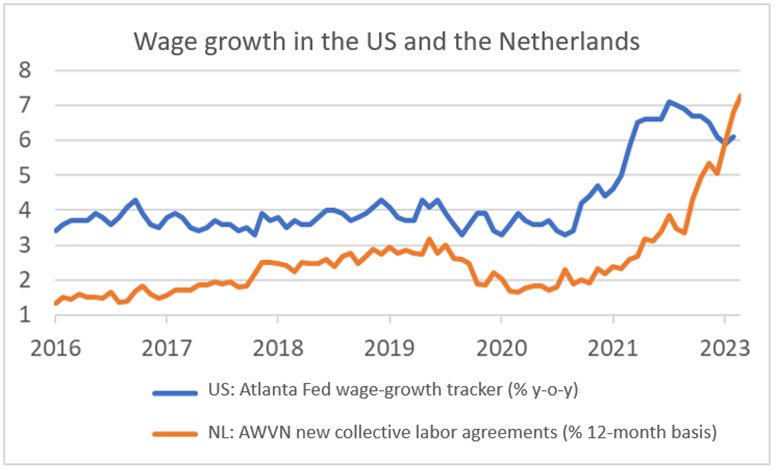

In the first quarter of this year, the average negotiated wage increase in newly concluded collective labor agreements was approximately 6.8% on a 12-month basis, according to the AWVN. That is not only well above the most recent inflation figure, but also very well above the increase in productivity. This means that the wage increase gives a strong boost to inflation. With such wage increases, 2% inflation is not feasible. Due to the development of energy prices and base effects, we may be confronted with negative inflation figures in the autumn. Don't be fooled. Those negative inflation numbers will be short-lived.

The following picture nicely illustrates that wage growth in our country, according to the AWVN series, now exceeds that in the US. For me, that is reason to think that our inflation problem, after a short-lived dip in the autumn, may eventually be more persistent than in the US.

Source: AWVN and Federal Reserve of Atlanta

Inflation in the eurozone as a whole fell from 8.5% in February to 6.9% in March. So that decrease was a lot less than with us. Core inflation even rose marginally: from 5.6% in February to 5.7% in March.

Financial sector turmoil is not over yet, but some calm is returning

The turmoil in the US financial sector is not over yet. In the recent past, I have argued several times that we cannot expect a repeat of 2008. These are incidents that do have a communal character, but will not cause major problems for the system as a whole. I stand by that, although I suspect that more incidents may arise.

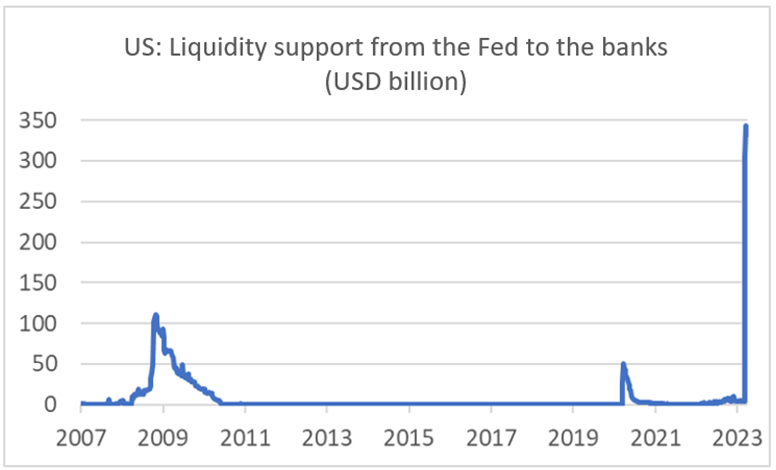

An important difference with 2008 is how quickly banks can lose their deposits. With a few mouse clicks, the money is gone. SVB reportedly lost USD 42 billion in one day, approximately 20% of its balance sheet total. This prompted account holders at other smaller banks to transfer their money to banks considered to be safer. The Fed has reacted very alertly to this. As the following chart shows, the total amount of liquidity support currently outstanding is much greater than it was in the 2008 crisis and the pandemic. Some commentators are negative about this. I wouldn't draw any firm conclusions from it. Actually, I think it's positive. The current problem is more of a liquidity problem than a solvency problem. The Fed has good tools to deal with liquidity problems.

Source: Macrobond

The following chart shows the main three different forms of liquidity support. Under the Bank Term Funding Program, banks can use qualified paper as collateral at face value, not market value. This facility was only created after the collapse of SVB. There is a strong pull because the paper that banks use as collateral has fallen in value due to the rise in interest rates. Under this new facility that is not a problem. It poses no significant risk to the Fed. Because the relevant counterparty also takes the paper back at face value or the US government redeems it at face value. 'Other' includes credits that run through the FDIC; that is also new. What is striking is that the total amount of outstanding liquidity support has decreased over the past week, but the amounts under the two new facilities have increased. I conclude from this that the problems at the banks are limited to special cases.

Source: Macrobond

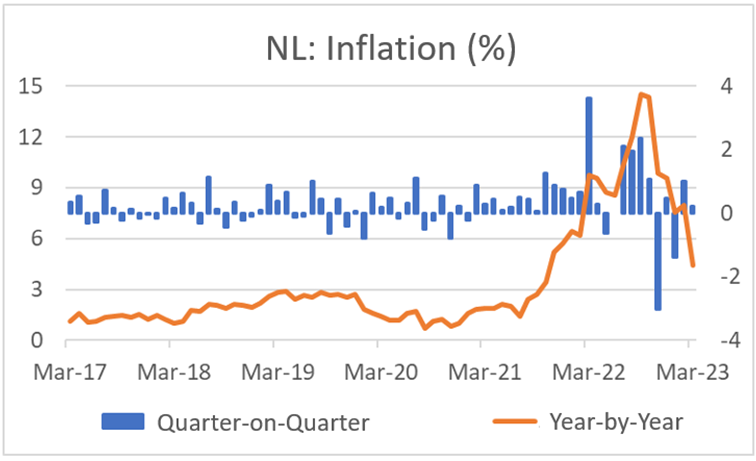

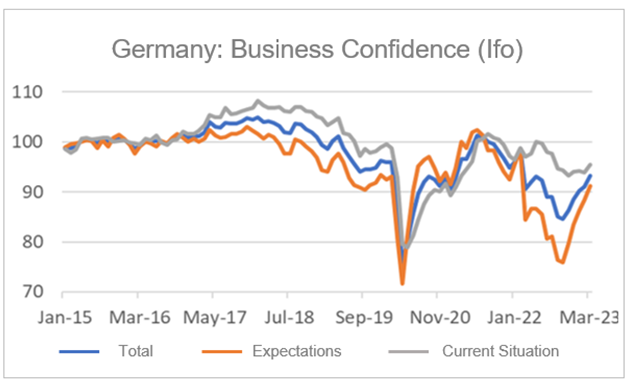

Looking at the picture, I noticed that the gap between the expectations component and the assessment of the current situation became very large last year. The following picture shows the difference between the two series. And indeed, in the last 18 years, the gap has never been larger than in September last year. It must be no coincidence that an improvement has occurred since the European gas price started to fall.

Source: Macrobond

Ifo points to increasing confidence in German entrepreneurs

German entrepreneurs have become more optimistic in March, according to the Ifo index. The expectations component in particular increased more than expected. Last week, according to the ZEW index, economists appeared to have become more pessimistic about the German economy. I think the latter was mainly due to the unrest in the financial sector and is perhaps a sign of some professional deformation. Entrepreneurs stand with their 'feet in the clay'. They see the sharp fall in energy prices and undoubtedly draw hope from this.

Source: Macrobond

Divergentie China

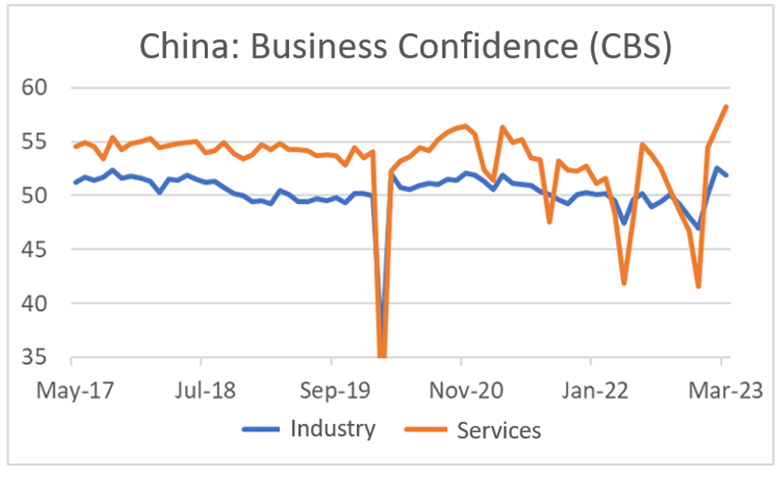

The Chinese economy currently appears to be characterized by a contradiction between industry and the services sector. After the end of the zero-covid policy in December, activity was expected to pick up sharply. This also seems to be happening in the service sector. Business confidence rose from an already high 56.3 in February to 58.2, the highest reading since 2011. Relatively warm weather and measures taken by local governments to encourage consumption are said to have had a positive impact. It is otherwise in the industry. Although the confidence index of the NBS was also above 50, which indicates growth in the sector, the index fell from 52.6 in February to 51.9 in March. It will become clear in the coming months whether these are temporary start-up problems or whether there is a more fundamental problem.

Source: Macrobond

Closing

Inflation in our country fell sharply in March. This was mainly due to energy. Encouragingly, the pace of non-energy price increases has stopped accelerating. The outlook is a bit confusing. Lower energy prices, the delayed pass-through of energy prices elsewhere in the economy, and base effects are likely to push the year-on-year inflation rate below zero in the autumn. But that will be temporary. Inflation will then bounce back because of the combination of the wage-price spiral and the profit-price spiral.

There is currently a record amount of liquidity support to the US banking system from the Federal Reserve. In the past week, the amount has dropped slightly. It doesn't wake me up.

The Chinese economy is characterized by a wonderful divergence. Entrepreneurs in the services sector are euphoric, while those in the industry are only very positive.