- Dutch inflation falls to 5.7% in June

- In the second half of the year, the inflation rate will fall sharply further due to base effects

- German business confidence takes another blow

- The European economy continues to deteriorate

- US growth is gaining momentum

- But if that prevents inflation from falling, the Fed will raise interest rates sharply.

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 30 June 2023.

Inflation in our country was 5.7% in June. That was not too bad. In May it was still 6.1%. Recall that the price level in June last year was unchanged from the previous month. The fact that year-on-year inflation has decreased therefore implies that the price level in June this year fell compared to May. Life has therefore become slightly cheaper in June in an absolute sense. That is allowed in the newspaper, although the changes from one month to the next do not say much.

Inflation is now declining across a broad front. Food prices were 12.6% higher than a year ago, compared to 12.8% in May. Services increased from 6.1% in May to 5.7% in June and industrial goods (excluding energy and fuels) were 7.3% more expensive in June than a year earlier, compared to 8.9% in May. Only energy went the other way. While a year-on-year decline of 18.5% was recorded in May, June is -16.3%.

.png?width=787&height=480&name=Finance4Learning-Netherlands%20Inflation%20(%25%20y-o-y).png)

Source: Macrobond

Statistics Netherlands introduced a new calculation method this month. Last year, actual consumer spending on energy turned out to be rising much less quickly than you might expect on the basis of the inflation figures from Statistics Netherlands. In the calculations, Statistics Netherlands always assumed that all households conclude a new energy contract every month. That is not the case, many people have a contract where the price is fixed for a longer period of time. If prices develop moderately, this does not matter much, but if prices change sharply, it does.

Statistics Netherlands has now developed a new calculation method that takes permanent contracts into account. That saves a sip on a drink. In September last year, inflation (calculated using the old method) peaked at 14.5%, but based on the new method it would have been only 7.8%. The old method thus greatly overestimated actual inflation. Energy prices are now falling and now we are seeing the opposite. In May, inflation based on the old method was 6.1%, the new method shows 9.9%.

The figures for June as published by Statistics Netherlands this morning are a mixture of both methods. The 5.7% is the difference between the value of the price index according to the new method and that of the price index of June last year according to the old method.

Statistics Netherlands opts for this approach because otherwise, the series of the official inflation figure would have had to be retroactively revised. That would lead to all kinds of problems because the inflation figure of Statistics Netherlands has a very official status and is included in all kinds of contracts, such as leases for commercial real estate. Although there may be major differences between the two calculation methods in the short term, these differences disappear in the longer term.

Incidentally, it is to be expected that our inflation will fall sharply further in the second half of the year. This is mainly due to favorable base effects.

The figures from the AWVN show that the wage increase agreed in new collective labour agreements again exceeded 8% in June. Now that inflation is falling, wage growth will also decrease, but that process is always lagging behind. It remains to be seen how much wage growth will moderate. In any case, it is clear that wage increases of approximately 8% or even more are not compatible with 2% inflation.

Inflation in the eurozone as a whole fell from 6.1% in May to 5.5% in June. Core inflation, on the other hand, rose slightly, from 5.3% in May to 5.4%. The reported inflation differences between euro countries are thereby increasing. This is because last year's rise in energy prices had a rather different effect on inflation per country. Countries also reacted differently last year to the increase in inflation in general and energy prices in particular. Many of the temporary measures taken at the time to ease the pain, which varied widely from country to country, are now expiring, leading to large base effects in a year-on-year comparison. For example, prices in Spain rose by 0.6% in June compared to May (quite a significant increase), but the year-on-year figure still fell from 3.2% in May to 1.9%. In Germany, prices rose by 'only' 0.3% month-on-month in June, but the year-on-year increase actually increased: 6.4% in June against 6.1% in May.

Divergence Europe versus the US

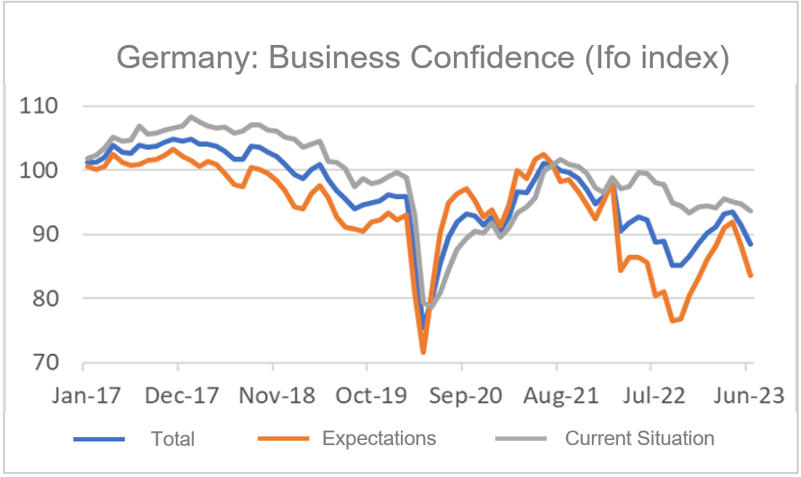

I get the impression that the economic cycle in Europe and the US is starting to diverge. Our economy appears to be weakening further, while the US economy seems to be gaining momentum. German business confidence fell sharply in June, according to the leading Ifo index. The expectations component fell from 88.3 in May to 83.6. That is quite a significant drop and the second in a row. Business confidence also fell in our country in June. The CBS series that measures business confidence in the industry showed a value of 1.0 in June. That is lower than May's 2.1; it is the lowest level since February 2021 and it is below the long-term average.

Source: Macrobond

I try to check the pulse of the economy regularly by following the figures on container throughput in ports. For the world as a whole, there has been stagnation for months now, but container throughput has fallen sharply in Northwest Europe recently.

-1.png?width=737&height=441&name=Finance4Learning%20-%20Container%20Handling%20Ports%20(RWI-ISL%20index)-1.png)

Source: RWI/ISL

Figures from the ECB show that credit growth is slowing down. In May, the outstanding volume of corporate loans was only 4.0% higher than a year earlier. In April it was still 4.6%. Money growth has been weakening for some time. In fact, the M1 money supply has been shrinking for some time. We have not seen this since the introduction of the euro in 1999.

.png?width=782&height=469&name=Finance4Learning%20Eurozone%20-%20M1%20Money%20Growth%20(%25%20y-o-y).png)

Source: Macrobond

In the US, the trend of weakening appears to be reversing. According to the Conference Board measure, consumer confidence rose considerably in June: 109.7 compared to 102.5 in May. Various regional indices of business confidence also showed a slight improvement in June.

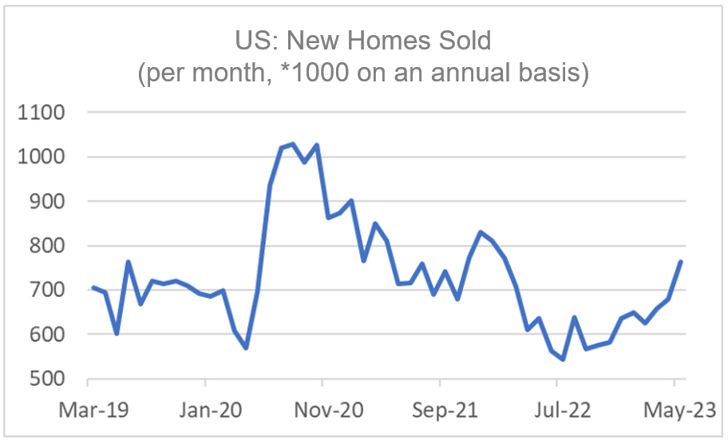

Because mortgage interest rates have been fairly stable for some time now, the housing market also appears to be improving. Mortgage applications for buying homes are gradually increasing again, the fall in house prices is slowing down and the number of new homes sold in May was the highest since February 2022.

Source: Macrobond

Source: Macrobond

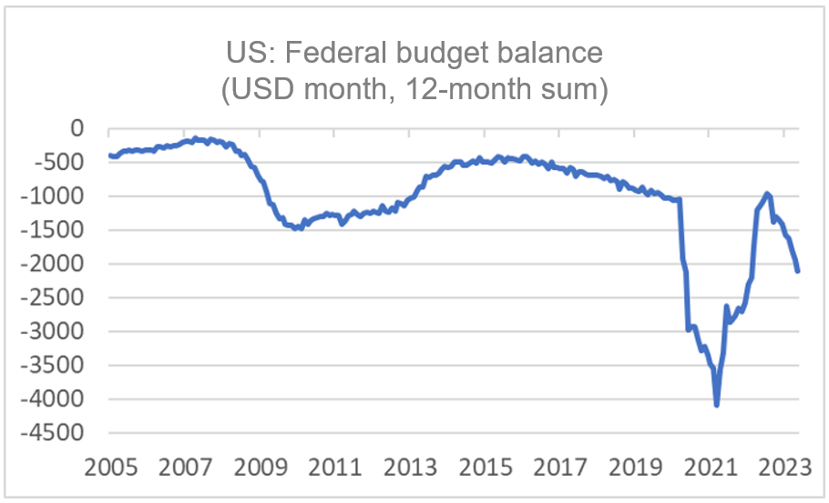

Explained the difference

This raises the question of what determines the difference between Europe and the US. It may be that our business cycle is just lagging slightly behind the US, but I think there is more to it. For example, energy costs for European companies are considerably higher than for US companies. Public finances also play a role. The federal budget in the US is currently deteriorating at a spectacular rate. In the ten months up to and including May, the cumulative deficit over twelve months increased by no less than approx. 4.4% of GDP. The deficit is therefore currently around 8% of GDP. It is inevitable that this increase in the deficit will boost the economy. Obviously, this deterioration in public finances is not sustainable in the long term. This growth impulse will soon turn into a growth-limiting factor.

Source: Macrobond

Is good news really good news?

You would think that Americans can and should be happy with the development of their economy. But the good news also has a downside. After all, the Fed is trying to slow down the economy to get inflation under control. The probability of inflation falling towards the 2% target decreases as the business cycle is stronger. It is inevitable that the Fed will have to raise interest rates significantly further if inflation remains stubborn.

This week, many central bankers gathered in Sintra, Portugal, for their annual conference, the European counterpart to the famed Jackson Hole conference in the US. All leading central bankers took the floor and their message was clear. They will do everything they can to get inflation under control. The ECB has at least one rate hike in store, but probably more.

If, for whatever reason, the US economy develops stronger than expected and inflation remains stubborn as a result, the Fed will undoubtedly raise interest rates further. How that will play out for the financial markets remains to be seen, but I can't imagine equity markets reacting wildly.

Closing

Fortunately, Dutch inflation fell again in June. The wage increase agreed upon in new collective labour agreements is still increasing, but will moderate in the long term. The extent to which wage growth will moderate will determine inflation in the longer term and will also be influenced by the tightness of the labor market.

The European economy continues to weaken. A recession remains most likely. The US economy appears to be gaining momentum. This is good news in itself, but it could stand in the way of the desired fall in inflation. In that case, the Fed has no choice and will not hesitate to raise interest rates significantly further.