- I fall off my chair in surprise

- Recent inflation estimates may be in the trash again

- Dutch inflation in March (month-on-month) was much higher than elsewhere

- Chinese lockdowns will put further pressure on logistical disruptions

- Dutch entrepreneurs are remarkably positive; for how long???

- US labour market tightens again

- The Netherlands should have US monetary policy, not the ECB…

- …or we have to compensate for the excessively loose ECB policy through restrictive fiscal policy…

- ...the chance of that happening is precisely zero

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 1 April 2022.

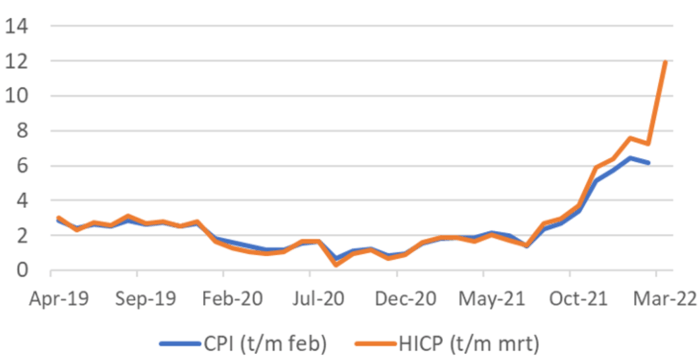

According to the European inflation measure, the Harmonized Index of Consumer Prices (HICP), Dutch inflation rose to 11.9% in March from 7.3% in February. In March, prices rose by no less than 4.7% compared to February. Those are shocking numbers. Two days earlier, German inflation had increased from 5.5% in February to 7.6% in March, and Spanish inflation rose from 7.6% to 9.8%. We could therefore already count on a significant increase, but this…..

In the eurozone, inflation rose from 5.9% in February to 7.5% in March. Lithuania leads the way with 15.6%, and the Netherlands takes the bronze. Malta has the lowest inflation rate: 4.6%, and in France, inflation is meagre: 5.1%. If you only look at March compared to February, the Netherlands takes the lead with an increase of 4.7%, followed at a respectable distance by Spain with 3.9%. I think it's because governments in other countries have intervened more quickly and decisively in energy pricing. Not that I think that's a great idea, but the differences are spectacular. According to the HICP, energy was 102.9% more expensive in March than a year earlier. In February, this was 'only' 51.7%. For the eurozone, these figures are 44.7% for March and 32.0% for February, respectively. That saves a sip on a litre of petrol. Incidentally, inflation is accelerating across a broad front. Food prices, for example, were 5.5% higher in March than a year earlier (4.6% in February).

Netherlands: inflation (%)

CPI ( until February) | HICP (until March)

Next Thursday, CBS will publish the figures according to its national benchmark, the Consumer Price Index (CPI). It has been slightly below the HICP for several months now. The main difference between the two indices is that rents imputed to homeowners are part of the CPI and not the HICP. Due to the government's tight restraint on rent increases last year, this is currently limiting the rise in the CPI (utterly contrary to what you might intuitively expect, but that's what you get when governments intervene in price formation).

Also, according to the CPI measure, our inflation will appear to rise sharply in March. If the CPI rises as strongly as the HICP, inflation according to the CPI will be 10.8% (I suspect it will be slightly lower). The absolute record dates from November 1974 with 11.0%. So we're getting close to a record.

A figure of 10.8% in March would bring the average for the first three months to 7.8%. In the CPB's base scenario, inflation will be 5.2% this year, and that scenario can go in the trash. According to an alternative scenario of the CPB, which assumes a long-term negative impact of the war, inflation will average 7.9% this year. That probably looks more like it. Finally, DNB's economists have recently raised their inflation estimate for 2022 to 6.7%. The ink of that revision is barely dry, but it now seems obsolete.

As of April 1, excise duties on petrol etc. have been reduced. Then the inflation rate could drop a bit, but for now, inflation will remain very high unless the war ends soon, energy prices fall sharply, and the logistical disturbances in the world are quickly resolved. There is little indication that such a dream scenario will unfold soon.

The staggeringly high and staggeringly rapid inflation is eroding purchasing power unprecedentedly. If consumers are not prepared to use their savings, this will lead to a sharp fall in consumer spending. Fortunately, many households have saved more than usual during the corona pandemic. So there is a buffer, but it depends on the families whether they will use that buffer. Some households have no meat on their bones at all. Inevitably, they will then need extra support.

Logistical disruptions are not decreasing for the time being: pay attention to China

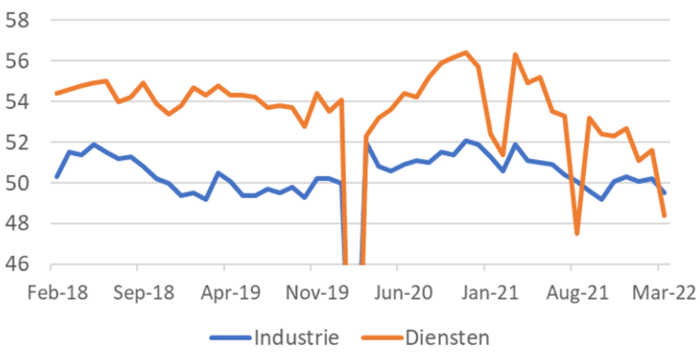

For a year and a half, the global economy has been plagued by logistical disruptions, hampering production and increasing inflation. Nearly 30% of all goods manufactured in the world come from China. It is therefore essential to closely monitor what is happening in China to gain a perspective on these logistical disruptions. There, lockdowns remain the order of the day with clear consequences for economic activity.

Business confidence fell further in March, according to central bank indices. In manufacturing, the index fell from 50.2 in February to 49.5 in March. An observation below 50 indicates contraction or, in the case of China, minimal growth. The March figure was the second-lowest monthly figure since February 2020. In the services sector, the confidence index fell from 51.6 in February to 48.4 in March, even though it was the second-lowest monthly figure since February 2020. production in China is currently stalling under the influence of the lockdowns, and it will, therefore, not get much better with the logistical disruptions in the world.

After October last year, it looked as though the logistical disruptions had eased somewhat. In surveys, producers reported that delivery times were getting shorter. I'm afraid that improvement is roughly nipped in the bud by the war in Europe and the Chinese lockdowns. That's terrible news for the short-term inflation outlook.

China: Business confidence (NBS)

Industry | Services

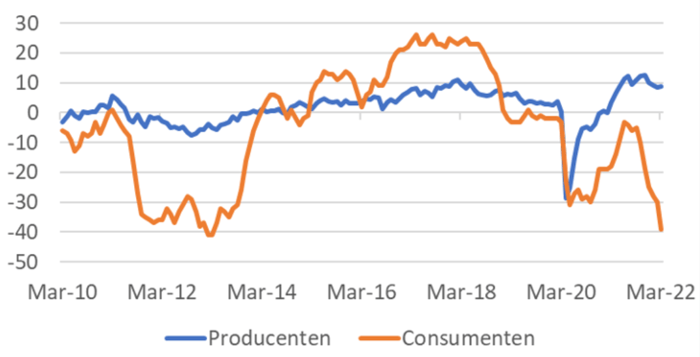

Confidence indices are (besides inflation figures) the first economic data now available for the period after the outbreak of the war in Europe. Last week I reported on the dip in consumer confidence in our country in March. Producer confidence followed this week, which turned out not to have decreased but to have improved a fraction. The following chart nicely illustrates the divergence between consumer and producer confidence.

Netherlands: confidence indices

Producers | Consumers

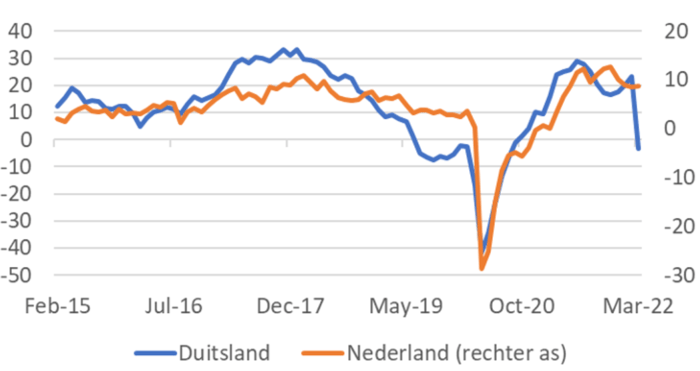

Dutch entrepreneurs are not only more optimistic than consumers, but they are also a lot more positive than their competitors elsewhere. In Germany, there is a depressed mood among entrepreneurs. The difference between the Netherlands and Germany undoubtedly has to do with the great importance of the automobile industry in Germany. That sector has been struggling with chip shortages for some time and appears to be receiving another blow because they source a lot of wiring from Ukraine. Those supplies are, of course, currently on hold.

I want to argue that the numbers show that Dutch entrepreneurs are much more innovative than elsewhere and are much more successful at dealing with challenging circumstances. I lived in Germany long ago, and the Dutch compensate for their somewhat less organisational talent with a more remarkable ability to improvise. However, I fear business confidence will also weaken in our country in the coming months.

Business confidence - industry

Germany | Netherlands (right axis)

Logistical disruptions are not decreasing for the time being: pay attention to China

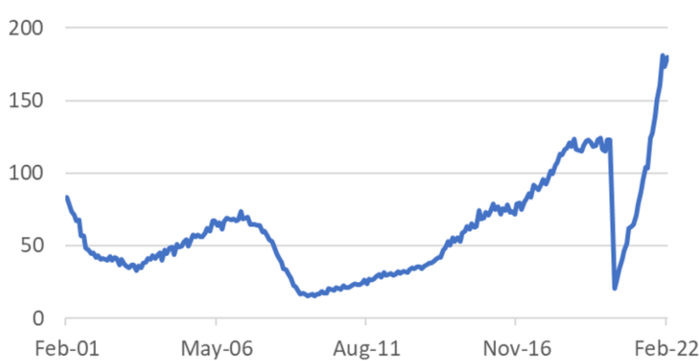

According to the so-called JOLTS (Job Openings and Labor Turnover Survey) report, the US labour market tightened again in February. Although the number of vacancies fell by 17,000, this is within the margin of error of more than 11 million. As the number of unemployed fell more rapidly, the number of vacancies per 100 unemployed rose from 173 in January to 180 in February. In December, the absolute record was set with 181.

US: vacancies per 100 unemployed

No wonder wage growth is accelerating sharply in such a tight labour market. The labour market is also tight for us. According to the CBS, we have 105 vacancies per 100 unemployed (although the CBS previously reported higher figures before revising the definition of who is unemployed). The labour market is the tightest in the province of Utrecht (130 vacancies per 100 unemployed), and Groningen is the most comprehensive (78 vacancies per 100 unemployed).

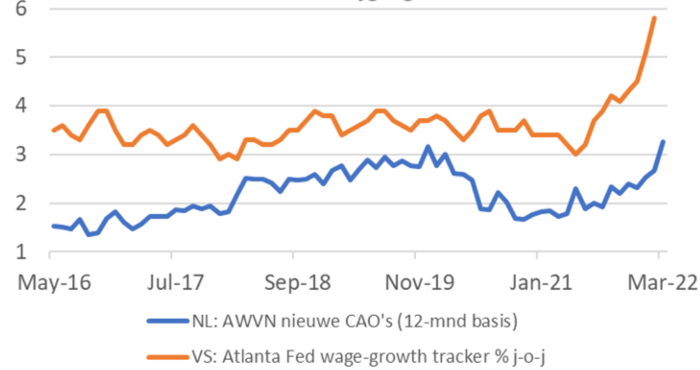

The following chart shows wage growth in the US and ours. Now, these series are probably not comparable. But at least the movement is similar. ECB President Lagarde constantly claims that the economic situation in the eurozone is so different from the US that it is justified that the ECB does not or hardly tighten monetary policy for the time being. At the same time, the Fed has already raised interest rates in the US and to raise interest rates further in the coming months. The Dutch economy may then resemble that in the US more than in the rest of the eurozone. US monetary policy would therefore be much more appropriate for our economy than ECB policy. Strictly speaking, the monetary policy of the ECB that is too loose for our economy should be compensated through fiscal policy. The probability of that happening is zero.

Wage increase

NL: AWVN new collective labor agreements (12 month basis)

US: Atlanta Fed wage-growth tracker %

Closing

This week's big story is the sharp rise in inflation in our country, more vital than elsewhere and to an unprecedented high level. The tax cut on April 1 and the VAT cut on energy on July 1 may pressure inflation figures, but the pace of price increases remains phenomenal, eroding purchasing power. Families can only absorb inflation in their spending by eating into savings, which remains to be seen.

Apart from interventions in excise duties and VAT, inflation will remain high for the foreseeable future if energy prices do not fall quickly. The lockdowns in China threaten to exacerbate logistical disruptions worldwide, which are also responsible for soaring inflation, negating the slight improvement seen in recent months. As a result, inflation may get another push-up…

With optimistic entrepreneurs, very high inflation and a very tight labour market, the Dutch economy currently resembles the American economy more than the economy in the rest of the eurozone. The Fed's monetary policy would therefore be more appropriate for us than the ECB's policy. Strictly speaking, the monetary policy that is much too loose for us should be compensated by a restrictive fiscal policy. By pointing this out, I am a voice crying in the wilderness.