- Manufacturing output growth weakens in final months of 2022

- This is mainly due to the high energy prices

- The prospects are better because…

- …energy prices have fallen…

- …China has said goodbye to lockdowns with great success…

- …and German carmakers have started their way up

- Rise in eurozone construction costs is weakening

- Inflation has more or less halved compared to September…

- …in March there will be a new sharp drop

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 10 February 2023.

Production in Dutch industry will have increased by about 6% in 2022 compared to 2021. However, growth has weakened considerably in the course of the year. In October, November and December, year-on-year growth was 3.3%, 0% and 0.5% respectively. As expected, production in energy-intensive sectors fell sharply in the latter part of the year. For example, 18.5% fewer chemical products were manufactured than in December 2021 and production in the rubber and plastics sector was more than 11% below the level of a year earlier. The growth of production in mechanical engineering is also declining. Production there was still 5.7% more than in December 2021, but that is much lower than in the spring when production growth was above 50%.

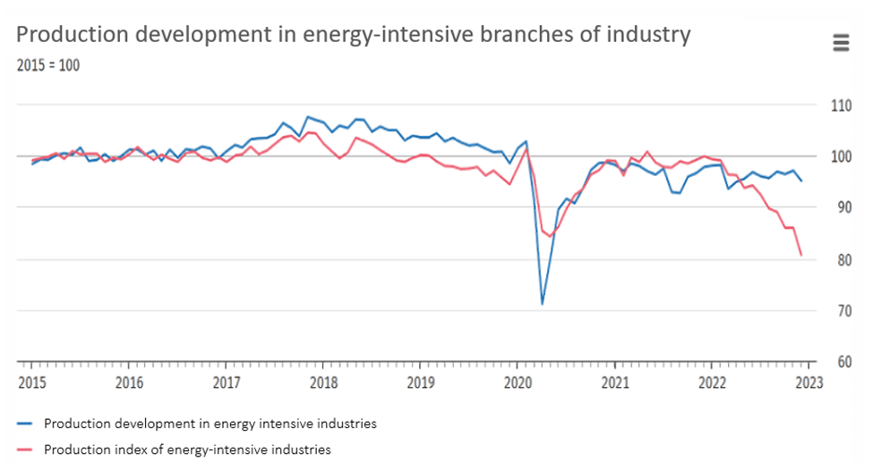

Of course, we are not the only country where the industry is suffering from the sharp rise in European gas prices. At our eastern neighbours, production in the chemical industry was even more than 30% lower in December than a year earlier. The German CBS (Destatis) has made a nice analysis of the ups and downs in the various sectors depending on the energy intensity. (For enthusiasts: Bedeutung der energieintensiven Industriezweige in Deutschland – Statistisches Bundesamt (destatis.de) )

Industry accounts for 28% of total energy consumption in Germany. The five most energy-intensive sectors use 76% of this, or about 21% of total German energy consumption. These sectors generate about 4% of Germany's GDP. The graph below clearly shows how the increased energy prices have had an impact.

Source: Destatis

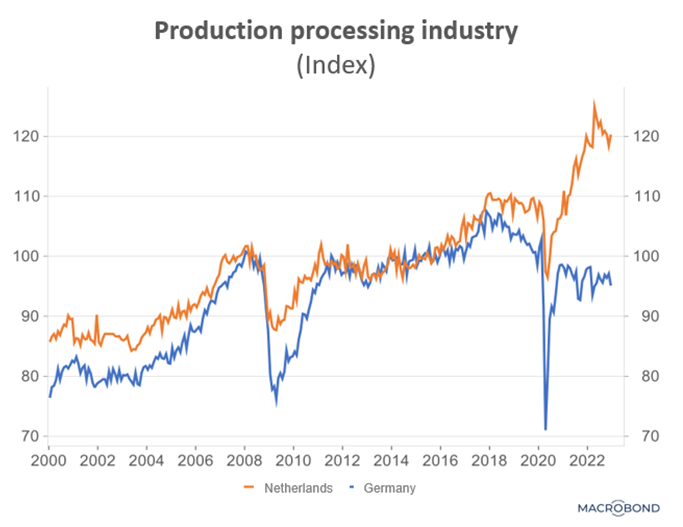

I have already pointed out the wonderful connection between Dutch and German industry. Until 2018, production in both countries was in sync. The correlation coefficient of the production indices from 2000 to 2017 is 0.95. But then things go wrong and the connection is lost. The correlation coefficient from 2018 to 2022 is only 0.14.

Source: Macrobond

No doubt this has everything to do with the problems in the prominent German automotive sector. This has led to problems in recent years. We first heard about the diesel scandal at the end of 2015. After some time, this led to much less sales of German cars. When the new emission standards were introduced, German car manufacturers were not quite ready for it. They also moved part of their production abroad. They also lagged behind in developing electric models. And finally, chip shortages have limited production for the last two years. More recently, German industry has suffered relatively much from higher energy prices because the country has a relatively large amount of energy-intensive industry.

After all this gloom about the past, we need to turn our sights to the future, which I think looks less negative for the industry. The European gas price has now fallen about 85% from its peak in August, although the current price is still three times as high as before the pandemic. Still, the current level probably does not justify a drop in production as it manifested itself in December. Whether, how quickly and how strongly production in, for example, the German chemical industry will recover, remains to be seen. It is not inconceivable that part of the production has been moved elsewhere for a longer period of time.

It is also positive that business confidence in the industry, both in Germany and in many other countries, has improved somewhat in recent months. I think that indicates that there is a good chance that the downward trend in production will reverse. Undoubtedly, this improved confidence has everything to do with the fall in energy prices.

In addition, the chip problems in the automotive sector seem more or less resolved and production by German car manufacturers is gradually picking up.

I think the most positive thing is that Chinese society is open again and the economy is benefiting from the end of the lockdowns. Germany is an important supplier of machinery to China and I expect German exports to China to pick up. We may be able to benefit from this as many Dutch companies are suppliers.

China opens with a bang

The weekly magazine The Economist calls the reopening of China one of, if not the most important economic event of 2023. Last Friday they gave a webinar about it. To be honest, the content was quite disappointing to me, but I learned a lot from it. Correspondents of The Economist who live in China and Hong Kong spoke. They reported that the reopening is going faster than expected. There were fears that the country would be hit by a tsunami of Covid infections. But according to the speakers, it actually turned out better than expected. The Chinese love to 'shop', but have been locked up for a long time. Now that they have been released, spending is rising sharply, although 80% of shoppers in Shanghai still wear face masks, according to a speaker. The production side of the economy was less affected by the lockdowns than the demand side, but will also recover strongly.

It is difficult to predict what the opening of China will mean for us. I think it will boost German exports. After all, Germany is an important supplier of machines to China. If exports indeed increase, we will also benefit. On the other hand, it is conceivable that energy prices will rise due to higher consumption in China. Actually, I am surprised that energy prices have not yet reacted to the opening of China. When energy markets anticipate an increase in demand, the price often rises before the higher demand actually manifests itself. So far that has certainly not been the case. We'll see, it's something to keep an eye on.

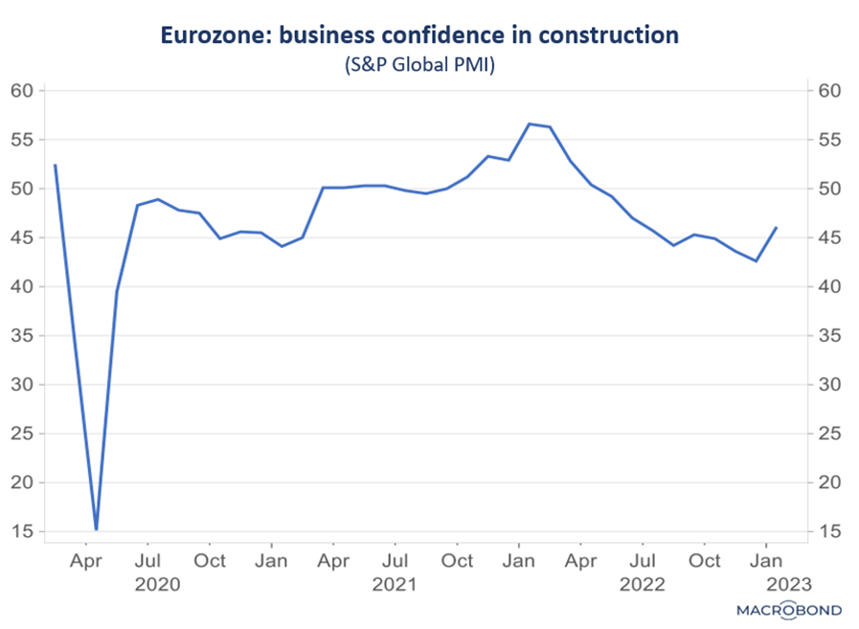

Light at the end of the construction tunnel in the Eurozone?

During the course of last year, construction in the Eurozone went downhill. Undoubtedly, the rise in interest rates played an important role in this. In January, however, the confidence index of entrepreneurs in this sector clearly improved: 46.1 against 42.6 in December. That December figure was incidentally the lowest in 31 months. A value below 50 still indicates contraction, but the contraction is decreasing considerably. According to this survey, the increase in the prices of materials was the lowest in two years. Apparently the price increases are slowing down considerably. That is good news and hopefully inflation in other sectors will also decrease further.

Dutch inflation confirmed at 7.6% in January – moving towards 4% in March

This week, Statistics Netherlands confirmed the previously reported inflation rate for January: 7.6% against 9.6% in December. The fall was mainly caused by energy prices and probably mainly by the price cap. Electricity was 22.9% cheaper than in December and 'only' 13.4% more expensive than a year earlier. The gas price was 42.0% lower than in December and 19.3% lower than in January 2022. If you dig into the details, you gradually see more categories where inflation seems to have peaked. But how quickly inflation can fall further remains to be seen. In February, that will be only mouth size. A new sharp drop will then follow in March because prices rose 3.6% in March last year. This will most likely not happen this year, as a result of which the year-on-year inflation rate will fall by about 3 percentage points. Then suddenly there is an inflation figure of about 4%. That's a whole different face. Wage demands of 10% or more are certainly excessive.

Closing

This week has yielded little macroeconomic news that would require us to change existing views. I maintain that lower energy prices and the reopening of China are the main drivers for now. There are also the necessary headwinds, such as the sharp increase in interest rates in 2022 and do not forget that the price of gas is still three times higher than before the pandemic. Also, don't forget that traditional warning signs such as the inverted yield curve in the US strongly suggest that the US economy is heading for recession.

On balance, the positive factors dominate in the short term. China's reopening is reportedly going faster and with fewer problems than feared. Production in the industry in our country clearly weakened in the last part of last year, but I think that this downward trend will soon come to an end.

Dutch inflation peaked at 14.5% (on the national benchmark) in September, but has now almost halved. In March in particular, a further sharp fall is likely to occur with a degree of certainty. I'm guessing we'll see a figure of 4-5% then. Fingers crossed