- Inflation is falling, but we are certainly not over it yet

- Industry remains under pressure, but…

- ... the inventory processing process is nearing completion

- An optimist can also find some bright spots in Asia

- Credit and money growth in the eurozone are cause for concern

- US economy sends conflicting signals

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 1 September 2023.

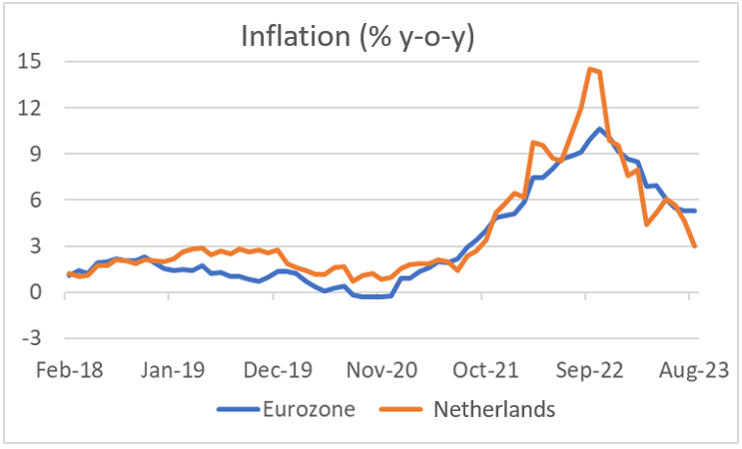

Our inflation rate was 3.0% in August, clearly lower than the 4.6% in July. However, this was mainly due to the 'base effect'. In August last year, prices rose by 2.0% in one month. Of course, that 2.0% fell out of the year-over-year inflation rate. A significant base effect occurs again in September and October because last year prices rose in those months by 2.4% and 1.1% respectively. Unless something crazy happens, our inflation rate will drop sharply over the next two months. In October we could even record a slightly negative figure.

Yet it all seems better than it is. Because in August this year, prices still rose by approximately 0.4% month-on-month. If such an increase continues for 12 months, the inflation rate will still be around 5%. We must also realise that a strong negative base effect awaits in November. In November last year, prices fell by as much as 3% month-on-month. This was of course due to the enormous fluctuation in energy prices.

In the eurozone as a whole, inflation remained unchanged in August compared to July: 5.3%. Core inflation did fall slightly: from 5.5% in July to 5.3% in August. This means that core inflation remains uncomfortably high and the ECB will undoubtedly raise interest rates some more.

Source: Macrobond

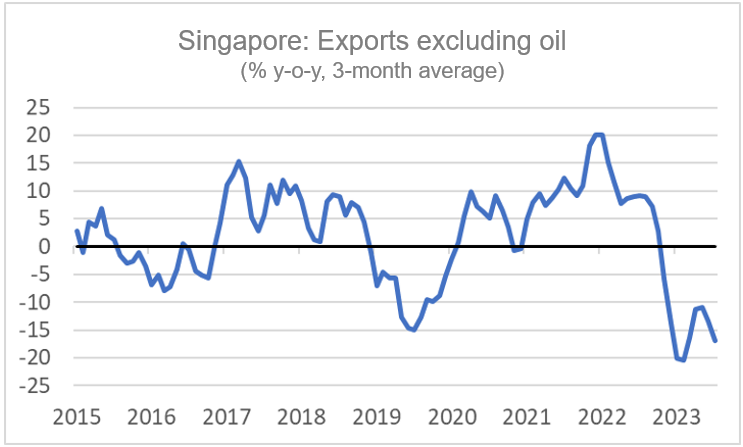

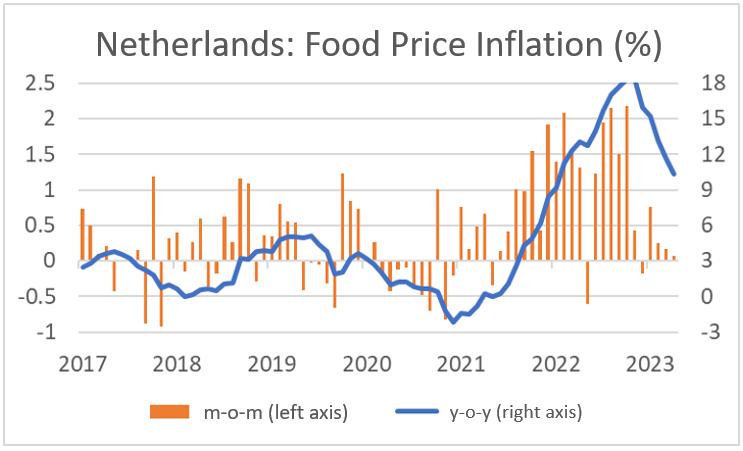

Everyone has to eat, so a lot of attention is paid to food prices. Food prices follow world market prices and energy prices, albeit with significant lags. The next picture shows that food price inflation has now fallen considerably, but that prices have risen almost every month so far. Fortunately, that monthly increase is now small and I expect that food prices will actually drop slightly in the foreseeable future. This is already happening with some products. The milk price has been falling for several months.

Source: Macrobond

Orders also appear to be recovering in the US industry. The new industrial orders sub-index in the Institute for Supply Management's (ISM) monthly survey improved slightly in June to 45.6 from 42.6 in May. So that remains a low level, but, as I said, it's about the change here.

Source: Macrobond

High-interest rates put downward pressure on spending. Naturally, some sectors are more interest-rate sensitive than others. The housing market in particular is interest-sensitive. In the US, the link between interest rates to the housing market is very fast and strong. The next picture shows confidence among homebuilders and mortgage market interest rates (on an inverted scale so that a fall in the line represents a rise in interest rates). Confidence had been on the rise since the beginning of the year as interest rates did not continue to rise, but in August the confidence index of the National Association of Home Builders fell again, no doubt because of the rise in mortgage rates. I must say that the American consumer is not yet discouraged. Consumption continues to increase steadily.

Source: Macrobond

The industry has been under pressure everywhere for some time. This has various causes. The increased interest rates and high energy prices are two of them. In addition, the recovery in China is very disappointing. Above all, the industry is struggling with inventory depletion. The pandemic caused significant logistical disruptions and caused enormous delivery problems. Entrepreneurs then decided to stockpile materials whenever they could. Because the supply problems are now over, large stocks are no longer necessary. In addition, maintaining large inventories has become expensive due to the increased interest rates. In addition, the prices of many raw materials are under pressure, so entrepreneurs with large inventories run significant price risks.

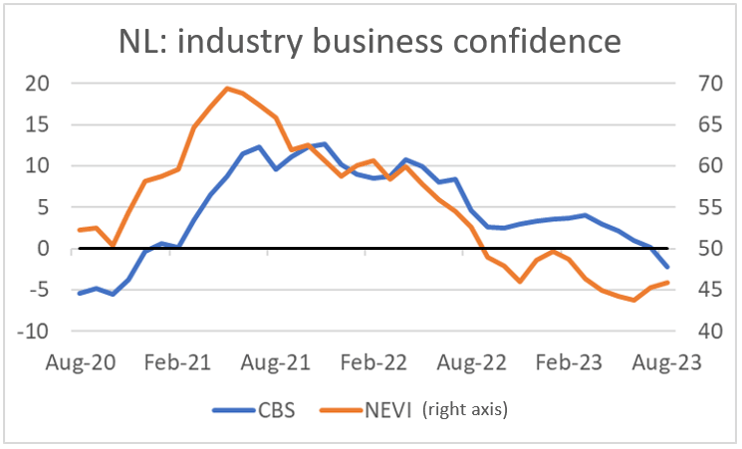

When companies draw on inventory, they produce less than they sell. If all companies do this at the same time, a downward spiral will arise. You can see this in data about business confidence and purchasing manager indices. The CBS business confidence index fell from +0.1 in July to -2.2 in August, the lowest figure since November 2020. This is in line with the figures on actual production, which show a sharp year-on-year contraction. shows. The NEVI index, which reflects the assessment of purchasing managers, was below 50 for the twelfth month in a row in August, suggesting continued contraction in the industry. A bright spot may be that the NEVI index improved slightly: from 45.3 in July to 45.9 in August. That was the second consecutive month in which the index rose slightly. The details give the impression that it will not be long until the stock decomposition process is complete.

Source: Macrobond

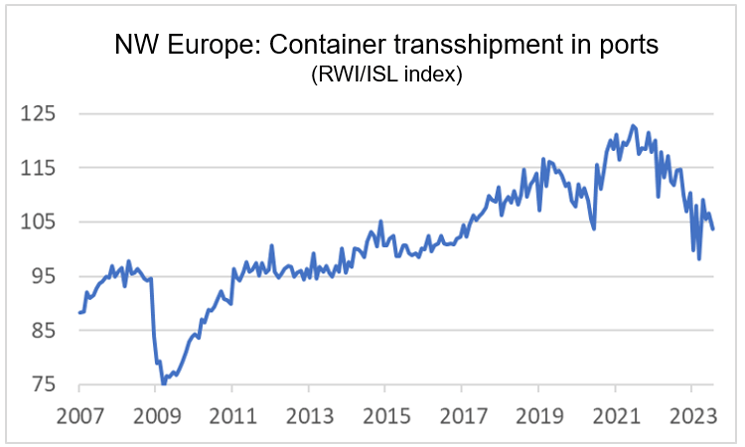

For the time being, we have not seen any positive developments in the ports. The RWI/ISL container index, which measures container throughput in the ports of Hamburg, Bremen/Bremerhaven, Rotterdam, Antwerp, Zeebrugge, and Le Havre, fell by 2.6% in July compared to June, reaching 7.2. % lower than a year earlier.

Source: Macrobond

Source: Macrobond

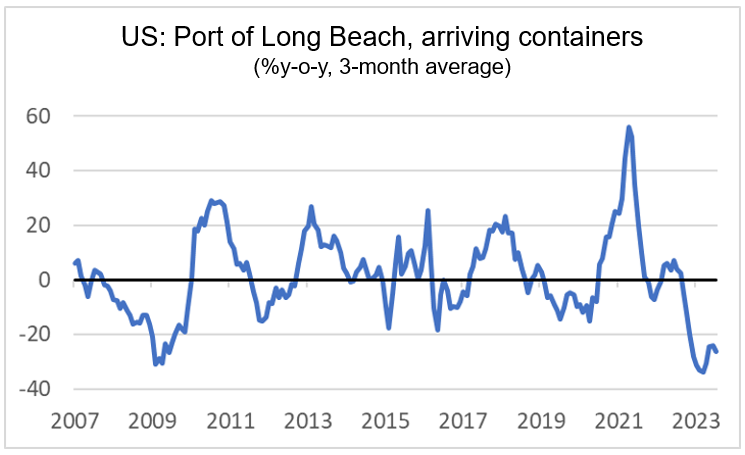

Container transport in the Pacific Ocean is also not growing. The following picture shows the development of the number of containers arriving at the port of Long Beach, on the American West Coast. That is still firmly in the negative.

Source: Port of Long Beach

Source: Port of Long Beach

Bright spots in Asia

There are also a few bright spots, although they are scarce and their light is not yet strong. China's two industrial confidence indices improved in August. The Chinese CBS benchmark improved from 49.3 in July to 49.7 in August. That of S&P Global, also called the Caixin index, even rose above 50. From 49.2 in July it went to 51.0 in August.

Another bright spot is noted in the Korean trade figures for August. Although the export value was 8.4% lower than a year earlier, that was better than expected and certainly much better than the -16.4% recorded in July. Caution is required when interpreting these figures, as they are volatile.

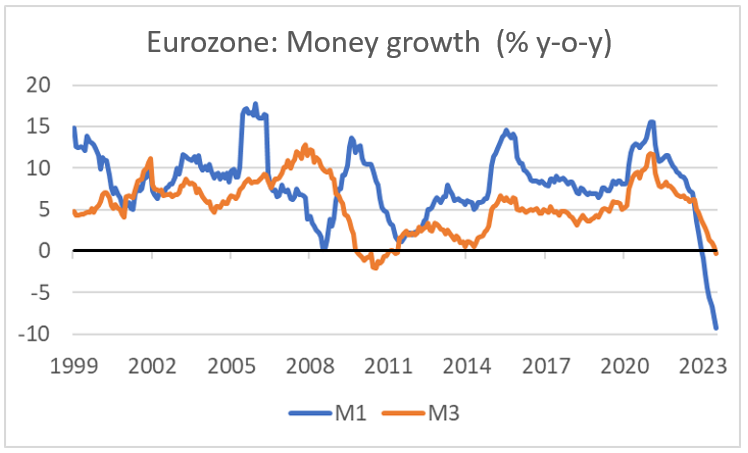

Credit and money growth in the eurozone are cause for concern

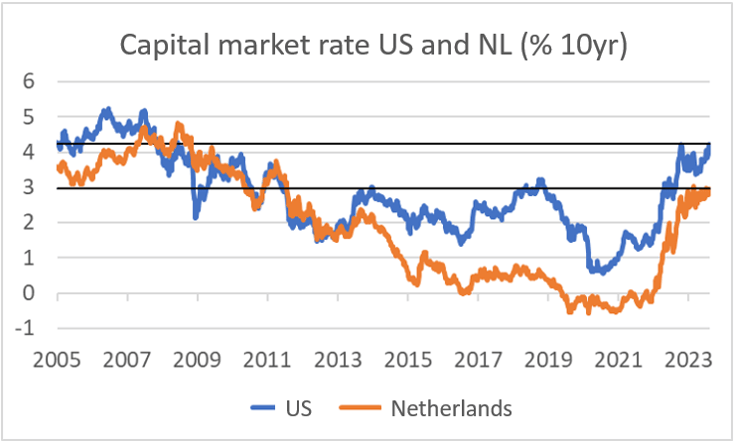

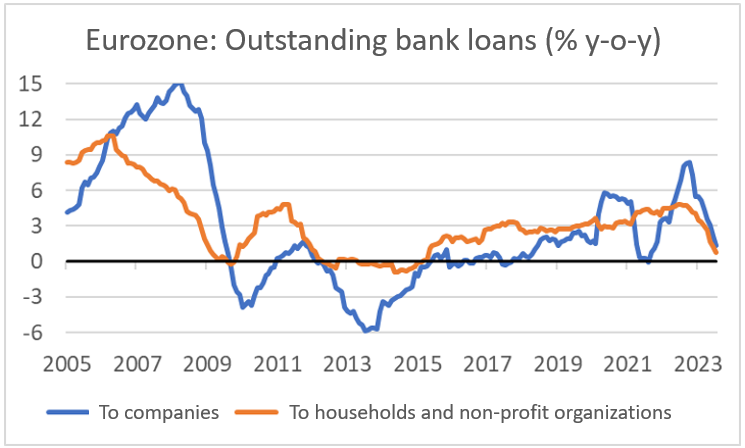

Earlier this week, the ECB published figures on lending and money growth for the month of July. That doesn't make us very happy. The next two pictures show why. The outstanding credit volume was still slightly higher than in July last year, but the growth rate has fallen sharply recently.

Money growth in the eurozone is also declining. In fact, the so-called monetary aggregate M1 has been shrinking for some time, and not very economically either. We have not seen such a contraction since the introduction of the euro. M1 includes the physical money in our wallets, but especially the money in bank balances that are immediately available. In the past, M1 growth has often proven to be a reasonably good predictor of the short-term business cycle. Hopefully this time it will be different.

Source: Macrobond

Source: Macrobond

Source: Macrobond

Source: Macrobond

The American economy is giving strikingly opposite signals. Economic growth is strong. Although the figure for the second quarter has been adjusted downwards, it is certainly decent at 2% annualised. Growth in the third quarter seems likely to largely exceed that of the second quarter.

Nevertheless, the American labour market now appears to be relaxing. The so-called JOLTS report (Job Openings and Labour Turnover Survey) shows that the number of vacancies is currently decreasing rapidly. In July, 8.8 million vacancies were counted. In June this was still 9.2 million and in December 2022 it was 11.2 million. In July there were 5.8 million unemployed. The number of people who resign themselves (the 'quits') is also decreasing. I think the figures confirm my suspicion that many companies have vacancies that they do not wish to fill unless a good candidate comes forward. You could say that the tight labour market has led to a certain 'inflation' in the number of vacancies. That will also depress wage growth and is actually exactly what the Federal Reserve wants.

.png?width=748&height=457&name=Finance4Learning%20-%20US-%20JOLTS%20report%20(million).png) Source: Macrobond

Source: Macrobond

.png?width=748&height=455&name=Finance4Learning-%20US%20-%20Change%20in%20number%20of%20vacancies%20over%20seven%20months%20(in%20million).png) Source: Macrobond

Source: Macrobond

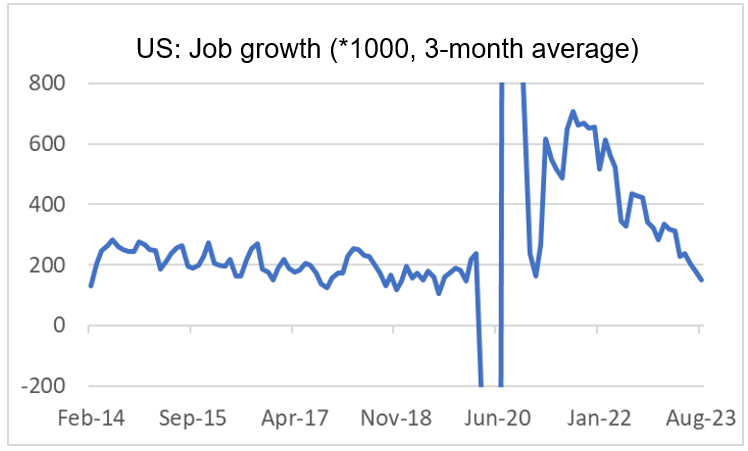

In August, the US added a net 187,000 jobs. That was slightly more than expected, but the trend is clearly downwards. The number of new jobs is now comparable to the years prior to the pandemic. Unemployment rose from 3.8% in July to 3.9% in August. In April this percentage was still 3.1%.

Source: Macrobond

Source: Macrobond

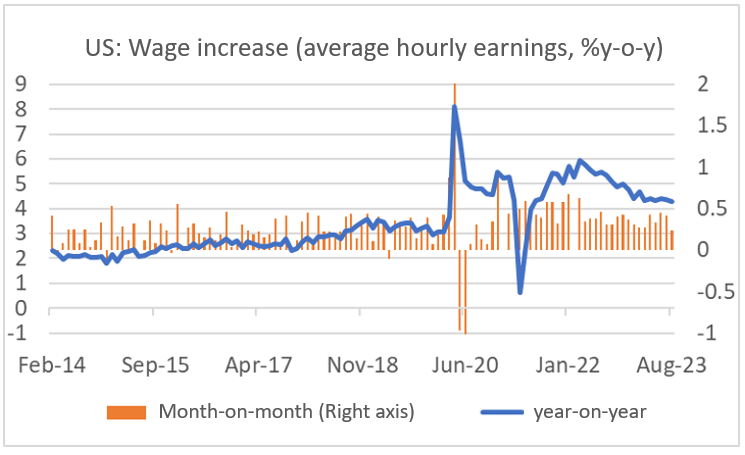

Average hourly wages were 4.3% higher in August than a year earlier. The hourly wage increase has been fluctuating around that level since March. That is clearly higher than before the pandemic.

Source: Macrobond

Source: Macrobond

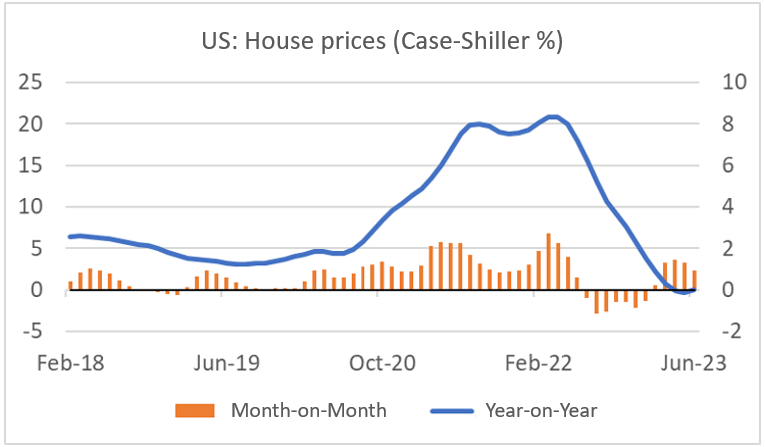

The sharp increase in interest rates, and therefore also in mortgage rates, has put pressure on the American housing market. Just like with us. House prices are now rising again from one month to the next, as the last picture shows. If the price increase continues, in my opinion, it means that interest rates are not high enough to sufficiently cool the economy. Then achieving the inflation target may also become difficult.

Source: Macrobond

Source: Macrobond

Closing

Our inflation fell sharply in August. This decline will continue in September and October. However, don't be fooled. This decrease is largely due to the base effect. In November the basic effect works very hard in the other direction. Inflation has by no means been overcome.

The industry has been struggling for some time. It appears that the stock interning process is almost complete. When the inventory cycle turns, it can boost activity in the short term. No improvements are yet visible in container transport in Europe and the Pacific, but with some good will some bright spots can be observed in China and Korea.

The growth of the outstanding bank credit volume in the eurozone has fallen considerably recently. That's not a good sign. Nor is it a good sign that the M1 money supply is shrinking quickly.

The macroeconomic figures from the US paint a confusing picture. Economic growth in the current quarter is considerably higher than in previous quarters. Yet the labour market is relaxing. House prices have been rising again in recent months. I have the disturbing idea that rising house prices imply that interest rates will have to rise even further.