- Household consumption is growing slowly

- The recession in the Netherlands is mild so far...

- …but it could take a long time

- German industry continues downward trend…

- …the comments are silent, but I think a disaster is unfolding…

- …and the German government is still in denial

- Chinese trade figures are slightly less bad

- Fed Beige Book Suggests No Rate Hike in September

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 8 September 2023.

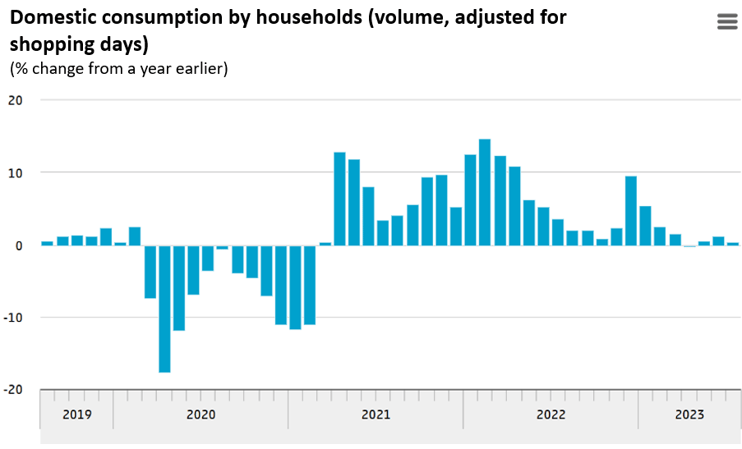

The volume of household consumption in our country was 0.4% higher in July than a year ago. We spent more on services and less on goods. Overall, however, growth has more or less stopped. Of course, we have already seen this from the GDP figures, which have shown a contraction in private consumption for two quarters. Statistics Netherlands' inflation figures suggest that inflation is currently falling rapidly. Because wage increases continue unabated at a relatively high pace, you would expect that purchasing power is currently improving sharply and that consumption could therefore grow.

Source: CBS

Rabo economists recently rightly pointed out that there is a problem with inflation figures. Last year it turned out that the energy price increase as reported by Statistics Netherlands was much higher than what families were confronted with. This was because CBS used the rates for new contracts every month in the calculation. These skyrocketed, but many families had permanent contracts. Statistics Netherlands has now adjusted the calculation method. For example, they have an old series of the price index and a new series. You would actually think that CBS would revise the figures for last year based on the new series. But that runs into problems. The official inflation rate is widely used. For example, benefits are indexed based on that figure. If Statistics Netherlands were to revise the figures, these benefits would have to be reduced again. The official inflation rate also plays an important role in all kinds of other contracts.

The new methodology results in a lower inflation rate for 2022, but a higher inflation rate for 2023. If Statistics Netherlands were to calculate for 2022 with the old methodology and for 2023 with the new one, the inflation for the two years together would be significantly exaggerated. That is why CBS has opted for an interim solution. The official inflation figure that they now publish indicates how much the price level based on the new methodology is higher or lower than the price level a year ago based on the old methodology. That's actually comparing apples and oranges, but next year we won't have to deal with this problem anymore.

According to Statistics Netherlands, inflation was 3.0% in August. The Rabo economists have pointed out that if you compare the price level of August this year based on the new method with that of last year using the same new method, inflation is much higher. When I do that calculation, I arrive at an inflation rate of 8.1%, indeed much higher than the CBS figure of 3.0%. Actually, that 8.1% is a purer benchmark if you want to say something about the development of purchasing power. So it is no wonder that consumption growth is very weak.

Be careful what you wish for

As is known, we are currently experiencing a recession in our country, which means that our GDP has been shrinking for two consecutive quarters. Many emphasise with some satisfaction that the recession is mild. And that is true. People often associate a recession with a sharp increase in unemployment. This is currently not the case, the labour market is actually tight. I would like to add another dimension to the image of the 'mild recession'. And that concerns the duration. Normally there are a few options to get out of a recession. The first is to lower interest rates. That is not an issue for the time being. A second option is expansionary fiscal policy. That is also not the case. A third option is to export yourself out of trouble. For the time being, however, world trade is extremely weak. And a fourth option is for companies to stop stockpiling and increase production again. We have been dealing with shrinking inventories at companies for some time now. That process will end at some point. This offers some hope. But I immediately contrast that with the tight labour market. Increasing production is made difficult by a lack of personnel.

My conclusion is therefore that it may be nice that this recession is mild, but the problem is that it could last a long time. I don't know what is better, a deep but short recession followed by a dynamic and strong recovery or a mild recession that lasts for a long time. Be careful what you wish for.

German industry continues to deal with negative news

A month ago I reported that orders booked by German industry in June had risen sharply compared to the previous month, after new orders in May had already been much higher than in April. This seemed to break a negative trend. I was still cautious because the June figure was helped by a number of large orders in aircraft construction. My hopes that the German industry had taken an upward path were dashed this week. In July, orders fell again by 11.7%, after an increase of 7.6% in June and 6.2% in May. The numbers are volatile. Compared to a year ago, volume was 10.5% lower and 5.3% lower compared to December last year. So all 'minus'.

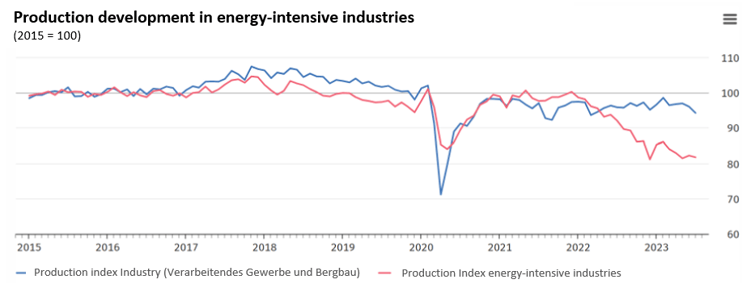

Last month I already feared that those order figures painted too positive a picture because production had not increased in July. The downward trend in industrial activity continued in July. The manufacturing industry produced 1.8% less in July than in June (in June production also fell by 0.9% m-o-m) and 1.5% less than a year earlier. (Including construction and mining, the figures were slightly less bad.) Although energy prices have fallen, production in energy-intensive sectors also fell again in July: by 0.6% compared to June and by 11.4% compared to compared to July last year. Compared to mid-2021, before the energy price increase started, production of energy-intensive German industry has fallen by almost 20%!

Source: Destatis

I'm repeating myself, but while most people accept this with resignation, I believe that a disaster is unfolding here for the German economy. The energy-intensive industry and the automotive industry are Germany's two strongholds. Although car production has picked up slightly in recent months (production has increased by 30% from its low point over a year ago, but is still around 30% lower than a few years ago), the question is how sustainable this is increase. Car sales are currently increasing worldwide, but this mainly appears to be a recovery after a very weak period. The crucial question for German automotive companies is whether they can cope with the spectacular increase in competition from China. What worries me is that the German government does not see the problems. Or perhaps they see the problems, but there is no vision of how to address them. Chancellor Scholz and his associates are still in denial. Energy policy is the 'elephant in the room'.

Slightly less bad news from China

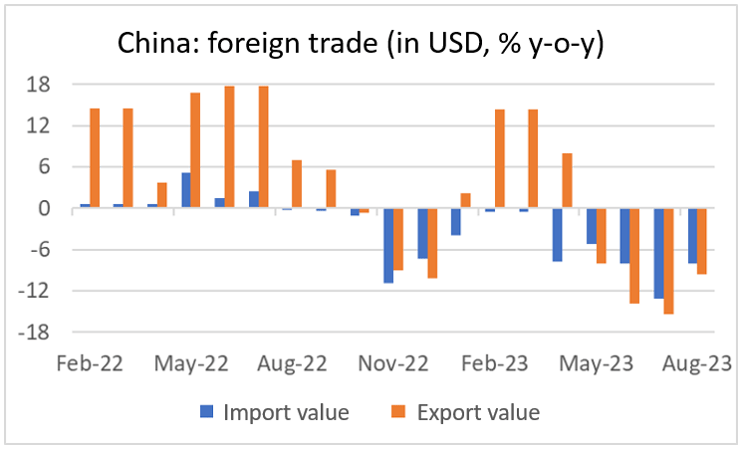

The latest figures on China's foreign trade are slightly less bad. In August, the export value (in dollars) was 8.8% lower than a year earlier. That was less bad than a month earlier. The import value was also much lower than a year earlier, but that decline was also less than in July. This may indicate that the trend has reversed and that the expected recovery of the Chinese economy is finally taking off. But let's remain careful. So far these are only smaller 'minuses' and we must remember that we are not talking about volumes, but about dollar amounts. That is why I also like to look at figures on container throughput in ports. August figures are not yet available, but no improvement is visible until July.

Source: Macrobond

The Fed's Beige Book Suggests: No Further Rate Hike in September

The hard figures for the US economy show that GDP growth in the third quarter is likely to be very strong. However, the tone of the Fed's Beige Book differs from that. The Beige Book is a summary of the conclusions drawn by the regional Federal Reserve banks about the state of the economy. To this end, they periodically hold discussions with the business community throughout the country. So it is a qualitative report, not a statistical report. It does therefore add color to the statistical data.

The most recent Beige Book talks about a weakening economy. Consumers have done their best lately, but their piggy banks are running empty. In addition, a lot is currently being spent on tourism, which the Fed suspects involves making trips that were postponed during the coronavirus period. This 'pent-up demand' is now coming to an end according to the Fed. In other words, private consumption growth will weaken in the near future.

The Fed also notes that the number of people with payment problems is increasing. Furthermore, companies expect that wage increases will weaken in the coming months and that they will no longer be able to fully pass on cost increases.

These all seem to me to be signals that developments are going as the Fed wishes. The economy is weakening, the labour market is relaxing and inflation is falling. They can let things run their course for a while and see how the economy and inflation develop in the near future. A new interest rate increase in a week and a half does not seem necessary.

It is certainly too early to claim that the inflation genie is back in the bottle, but the Fed does not want to tighten policy so much that it causes unnecessary damage to the economy. The apparent revival of activity in the services sector and rising oil prices obviously pose serious risks to the inflation outlook. After all, the services sector is currently an important source of inflation. We cannot yet rule out further interest rate increases, but I think, as mentioned, that the Fed will leave interest rates unchanged in a week and a half.

Closing

I am not yet very happy with the economic picture. Our recession may be mild, but the period of slight contraction, stagnation or very slight growth could last a long time. That doesn't sound like fun to me.

The decline in German industry continues. In the international commentary, the German economy is depicted as the 'sick man of Europe'. The German government contradicts this, but its arguments are not very convincing. Some traditional strongholds of the German economy are under pressure and the worrying thing is that the government appears to have no plan to turn the situation around. Perhaps the end of the depletion of supplies worldwide is imminent and Germany can get a boost from this. For the time being, however, that seems like hope against hope.

The recovery of the Chinese economy after the end of the many strict lockdowns has not yet taken off. That is perhaps the biggest setback for the global economy this year. The August figures for imports and exports were slightly less bad than in previous months. Maybe, just maybe, that indicates that the recovery is finally starting to take some shape. For now, however, that is little more than hope.

The Fed's policy committee meets in a week and a half. Strong economic data lately suggests the Fed will raise rates again. But the Beige Book published yesterday paints a somewhat different picture. It portrays a weaker and vulnerable economy, combined with optimism that inflation will fall further. I therefore suspect that the Fed will leave interest rates unchanged this month. This does not mean that the Fed will not raise interest rates slightly at a later stage.