- Fed and ECB hike rates again…

- …and leave all options open

- The ECB is not ready yet because of the persistence of inflation in the services sector

- The Fed is also not ready because of the stronger-than-expected economic situation

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 28 July 2023.

This week, both the Fed and the ECB raised official interest rates again. For the Fed, it was the eleventh rate increase since March last year, and for the ECB the ninth since July 2022. Both central banks are now taking a break and the policy committees will not meet again for about two months. At the respective press conferences, neither chairman of the board wanted to anticipate the decision in September. The only concrete thing Christine Lagarde wanted to say about it is that interest rates will not be cut. She kept all other options open. The ECB can decide to raise interest rates again, but can also refrain from doing so in September, which does not mean that interest rate hikes are over. At the Fed, it's all the same. Both central banks are 'data dependent'. There will be a mountain of new economic data between now and the next policy meeting.

If Powell and Lagarde don't want to commit, I'm happy to say something about it. First about the ECB. I think the ECB will raise interest rates again in September. Lagarde was clear that she and her colleagues are determined to break inflation. She didn't say it in so many words, but I think she meant to say that bringing inflation under control will take priority over avoiding a recession.

Lagarde says interesting things about the inflation process

She said about inflation, not for the first time, that it will remain too high for too long. She also said something about the inflation process. According to her, this was initially triggered by "external factors", but is now driven by wage increases and corporate profits. Very diplomatically she left in the middle which of these two currently dominates. She did say that profit margins fell somewhat in the first quarter. In other words, the inflationary effects of rising profit margins are now behind us. So the key now lies with wage growth. Given the tightness of the labor market, I think that wage growth will not be moderate enough to keep inflation close to 2%, a rate that may (temporarily) be reached in the coming months due to base effects.

Lagarde also rightly pointed out that inflation in the services sector is currently the biggest problem. This sector is labour-intensive, so that wage increases have a relatively large impact on inflation. Moreover, according to Lagarde, this sector is relatively insensitive to interest rates. In order to bring about a slowdown in growth in that sector, a relatively sharp rise in interest rates is therefore necessary. This leads me to the conclusion that the ECB is not ready yet.

European economy is weakening considerably

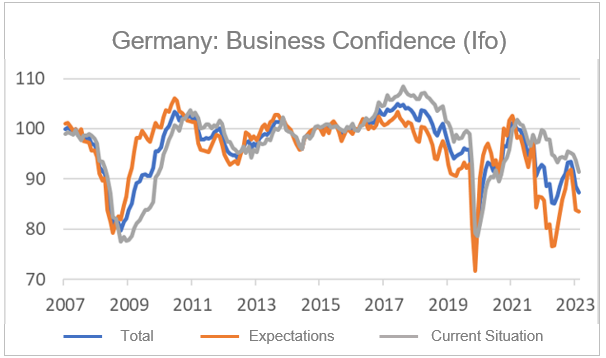

It is clear that things are now less prosperous with the European economy. We are currently seeing an unusual combination of tight labor markets and an economy that has been stagnant for two quarters. On Monday, Eurostat will publish preliminary GDP figures for the second quarter. Germany is already in recession, although according to preliminary figures, German GDP has not contracted any further in the second quarter, but has stagnated. Earlier this week, preliminary data from S&P Global showed that business confidence in the Eurozone fell again in July. The industry in particular is having a hard time. The figure for business confidence in the German industry was very bad. In July, that was 38.8, well below the 50.0, the dividing line between growth and contraction. The leading measure of German business confidence, the Ifo index, fell more than expected in July, while the level was already well below the long-term average. Those are “recession levels.” The press releases from S&P Global and Ifo give little hope that economic development will turn for the better in the near future.

Source: Macrobond

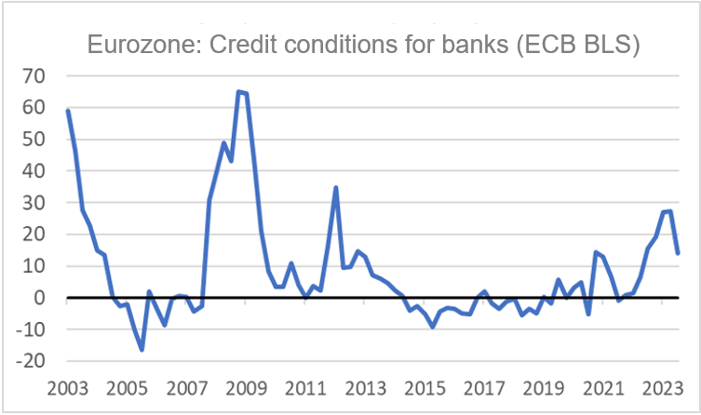

The following picture is based on the ECB's Bank Lending Survey (BLS). It conducts this survey among commercial banks every quarter. One of the questions is what banks do with the conditions for corporate loans. If a majority of the banks say they will tighten it, then the figure will be above zero. If, on balance, more banks ease credit conditions, the figure will fall below zero. In the second quarter, more banks again tightened credit conditions than relaxed them, although the balance of banks that pursue a tighter credit policy is declining somewhat. It is also clear that there is no question of a credit crunch as in 2008/09. But the continued tightening of credit conditions does not bode well for credit growth.

Source: Macrobond

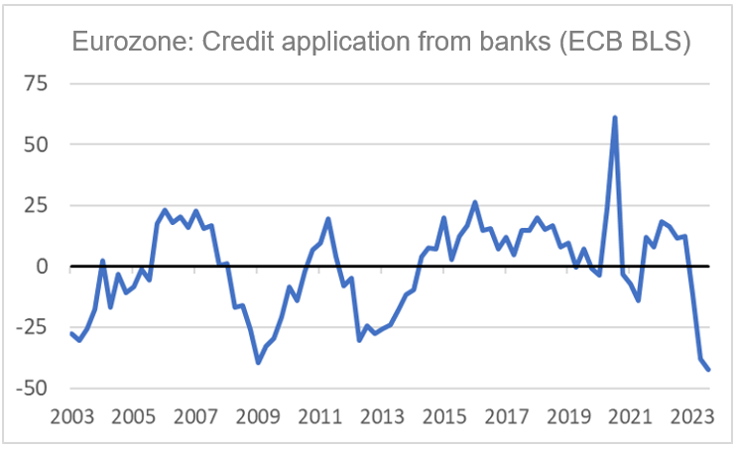

In the BLS, the ECB also asks the banks how the credit demand from companies is doing. A negative observation in the following chart is a sign that the banks are noticing that credit demand is falling. A negative record was set in the second quarter. Never before have banks reported such a drop in credit demand. The details of the survey show that this is largely due to higher interest rates and another part to companies' reduced investment propensity. We are not happy about that either.

Source: Macrobond

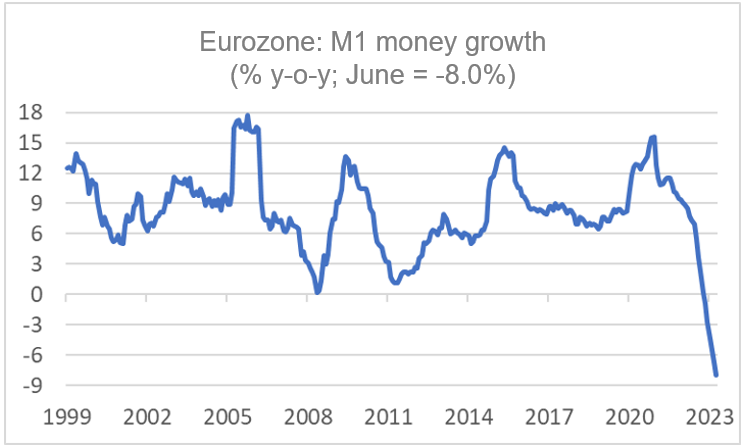

It is no wonder that money growth is falling rapidly against this backdrop. The following chart shows that the money supply M1 (consisting of means with which payments can be made immediately) has never fallen (in a year-on-year comparison) since the introduction of the euro, but has been declining for some time now. is. That is not sick either: 8.0% in June.

Source: Macrobond

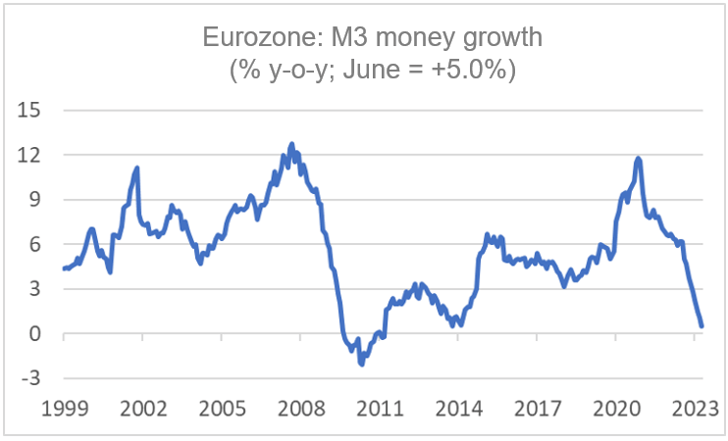

The growth of the broad money aggregate M3 (which also includes savings and time deposits) is not at a record low, but only barely positive. This indicator also points to a marked weakening of the European economy.

Source: Macrobond

Source: Macrobond

I think the conclusion that needs to be drawn is that inflation in the eurozone will remain quite persistent for the time being as the economy slides into recession. Eventually, that recession will reverse inflation, but the labor market will probably have to cool down considerably for that to happen.

Different in the US

In the US the situation is different. The economy is clearly less weak. For example, GDP grew at an annualized rate of 2.4% in the second quarter (in our terms, growth was 0.6% quarter-on-quarter). Business investment, in particular, picked up strongly. The confidence of industrial entrepreneurs in the US is also less weak than in the eurozone. The following chart shows that the difference between purchasing managers' indices across the two economies in July was the largest in the past two years.

Source: Macrobond

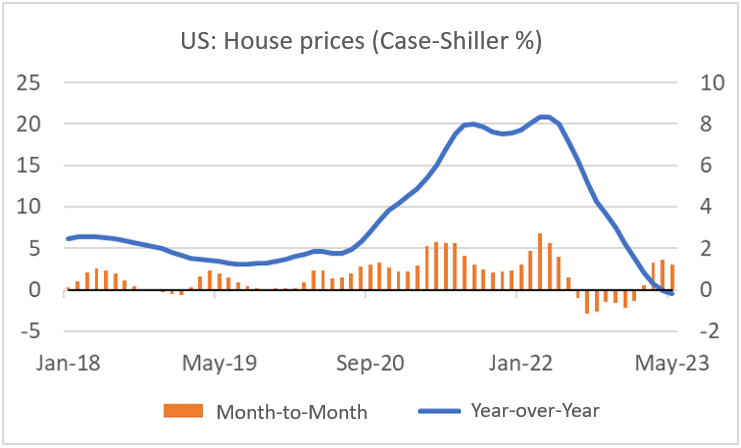

The US housing market has also started a recovery. The following graph shows that house prices (according to the Case-Shiller index) have been rising month-on-month since February. In May, prices were 4.2% higher than in January.

Source: Macrobond

The big question is whether all this is compatible with achieving the 2% inflation target. I'm afraid not and I'm inclined to say that these developments show that interest rates are not yet high enough. That is why I expect that the Fed will eventually raise interest rates even further.

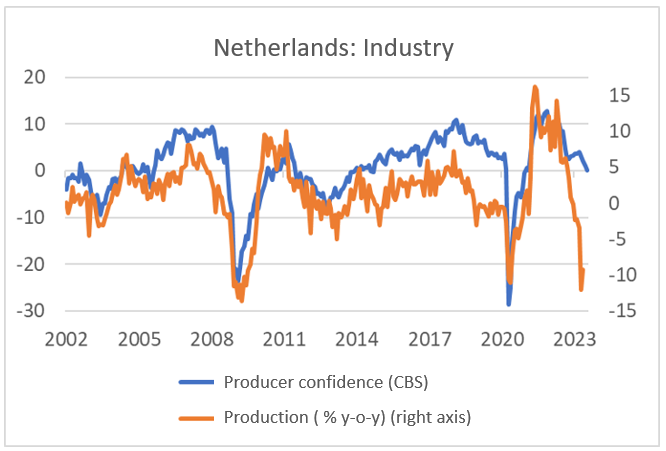

Producer confidence in Dutch industrial entrepreneurs is down again

According to the CBS index, producer confidence in the Netherlands fell further in July. From 1.0 in June to 0.1 in July. The long-term average is slightly higher: 1.4. In particular, a deterioration in the assessment of the order inflow contributed to the decline. Still, I think the level of the confidence index is still remarkably high. The following chart shows that there is a large gap between the confidence index and actual production. In May, the production level was no less than 9.2% lower than a year earlier.

Closing

This week, the Fed and the ECB raised official interest rates again. They left all options open for future decisions. I don't think either is "done," although there's a good chance the Fed will leave interest rates unchanged in September.

Due to base effects, inflation figures will fall significantly in the coming months. But that obscures some underlying issues. Inflation in the Eurozone is currently generated primarily in the services sector. Wages play a major role here. Given the tight labor market, I fear that wage growth will not moderate enough to allow an inflation rate of 2% in the medium term. That is why I think the ECB will raise interest rates even further.

Meanwhile, the economy in the eurozone is visibly weakening. So I continue to believe that a recession is inevitable.

The US economy is in better shape. That is positive but at the same time a problem. For the US, I fear that the business cycle remains too strong to achieve the 2% inflation target. That is why I think that the Fed will eventually have to raise interest rates even further.

FacebookTwitterEmailLinkedInWhatsAppShare

.png?width=752&height=455&name=Finance4Learning%20-%20Industry%20Business%20Confidence%20(PMI).png)