- The ECB raises interest rates…

- …for the last time for now

- Statistics Netherlands confirms that inflation was 3.0% in August…

- …I confirm it was actually 8.1%

- US inflation was higher than expected in August…

- …the rising oil price was the main culprit

- A further increase in oil prices would be very unpleasant

- Chinese growth seems to be picking up slightly

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 15 September 2023.

The ECB has raised official interest rates for the tenth time since mid-2022. In total, the ECB has now increased interest rates by 450 basis points (4.5 percentage points). Yesterday I watched ECB boss Christine Lagarde's press conference again with curled toes. There was a sentence in the pre-issued press release that everything revolves around: “…rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target”. Lagarde repeated that sentence three more times during the press conference. The message seems completely clear to me. After this interest rate increase, the ECB will monitor things for a while. There's a good chance this was the last increase. You wonder why they don't just write that down. Or does Lagarde think we are so stupid that we don't understand it after reading it once?

The ECB has again lowered the growth forecast for the eurozone and increased the inflation forecast. Lagarde has previously been asked about the chance of a recession. She has always rejected this quite resolutely, but now she said that we are probably dealing with a longer period of very poor growth. Another notable point in the press conference was the message that wage growth is starting to hurt profit margins, although what exactly she said about it was quite confusing. With all due respect, I didn't get the impression that she fully understood it herself.

The last question in the press conference was asked by a Dutch journalist, in this case from the NRC. That doesn't happen very often, so you pay extra attention. He asked whether the ECB is already seeing concrete signs that climate change, due to extreme weather, is pushing up food prices and thus fueling inflation. Tiring! The IPCC notes in their latest report (AR6) that the increase expected due to climate change cannot (yet) be observed for most forms of extreme weather. Apart from that, severe weather has always existed and it is therefore impossible to attribute a particular case of extreme weather to climate change with certainty, even though it does happen on a large scale. The ECB itself is a representative of climate alarmism, but the NRC journalist's question was also a bit too crazy for Lagarde. She did not address it at all in her response.

Details of our inflation

Statistics Netherlands published the detailed inflation figures for August this week. It was previously known that the official inflation rate had fallen from 4.6% in July to 3.0% in August. I also mentioned that CBS is currently comparing apples and oranges. That will last until the end of the year. It has to do with the revision of the price series for energy prices. CBS now compares its new price series with the old one. The old series significantly overestimated the actual development of the costs of living last year because many households were not immediately confronted with higher energy prices as they had fixed the rates for a longer period. Be that as it may, if you compare the just published August figure of the new price series with the August 2022 figure, you arrive at 8.1% inflation. That is lower than the 11.6% measured in January, but a lot higher than the 3.0% of Statistics Netherlands.

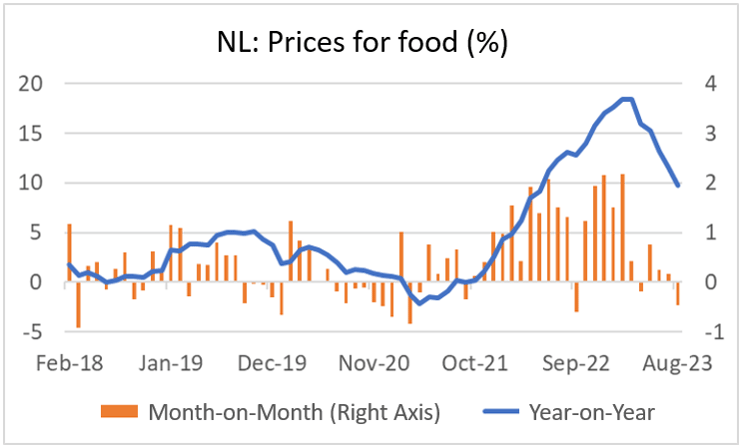

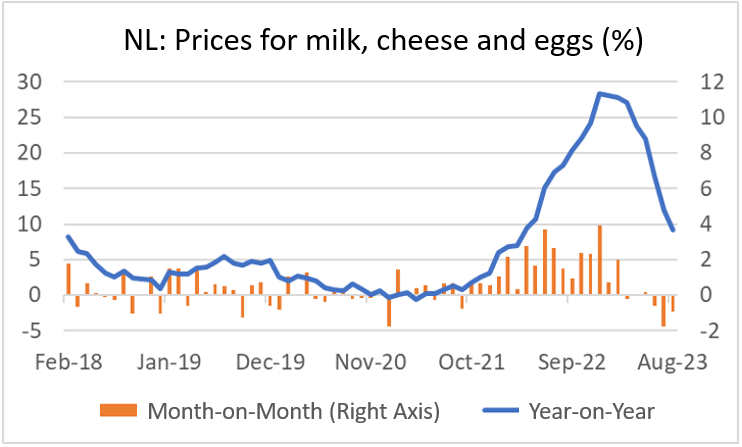

We are now seeing a decline in year-on-year price increases across a broad front. For example, food became slightly cheaper in August than in the previous month and this has been the case for milk, cheese, and eggs for a few months.

Source: Macrobond

Source: Macrobond

Disappointing inflation figures in the US

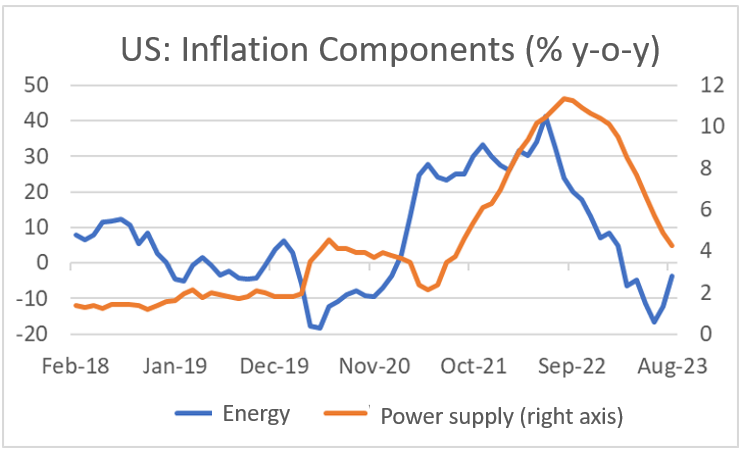

American inflation rose slightly in August: from 3.2% in July to 3.7%. Core inflation has fallen further: from 4.7% to 4.3%. On balance, these figures were slightly higher than expected. The increased oil price was the main culprit. Gasoline prices rose by more than 10% in one month. All energy prices together rose by 5.6% in August compared to July. Partly as a result, the total price increase compared to July was 0.6%. Food inflation continues to decline steadily. It now stands at 4.3% year-on-year, compared to 4.9% in July. For comparison: ours is more than 9%.

Source: Macrobond

Source: Macrobond

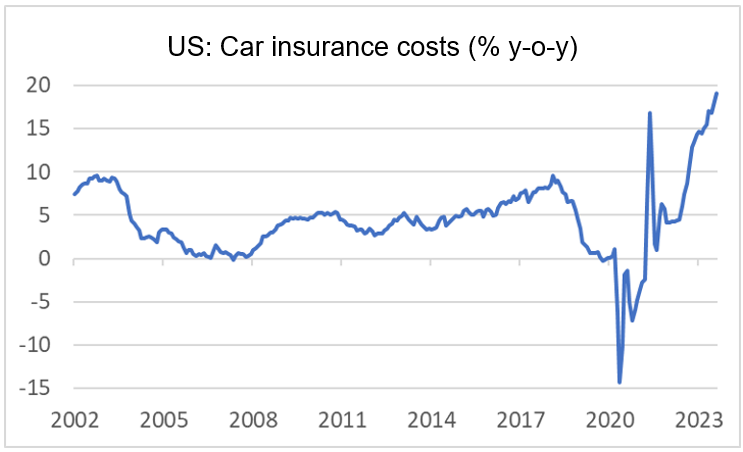

Even excluding energy and food, the core inflation, monthly inflation was slightly higher than expected at 0.3%. There are quite a few volatile developments in the details. The inflation report was therefore actually something for everyone. Economists who believe that inflation will continue to fall quickly were able to point to elements that seem to support their view. But there were also parts with very notable price increases. For example, car insurance has become significantly more expensive for months in a row. Year-on-year, premiums are now 19.1% higher.

Source: Macrobond

Source: Macrobond

The outlook for inflation is certainly not yet a done deal. Oil price developments are particularly important in the short term. The oil price has risen by about 30% since the end of June. We're going to feel that. If that increase continues and is not reversed quickly, we run the risk that higher oil prices will lead to a new broad wave of inflation. The central banks then find themselves in a difficult position. They cannot do much about the oil price, but we have experienced in recent years what happens if they let rising inflation take its course for too long. The rising oil price also affects the relative position of the European and American economies. Since we are a major importer, the higher oil price leads to national impoverishment. The Americans are self-sufficient. Although the higher oil price is also a shock to the American economy, it does not make them poorer as a whole.

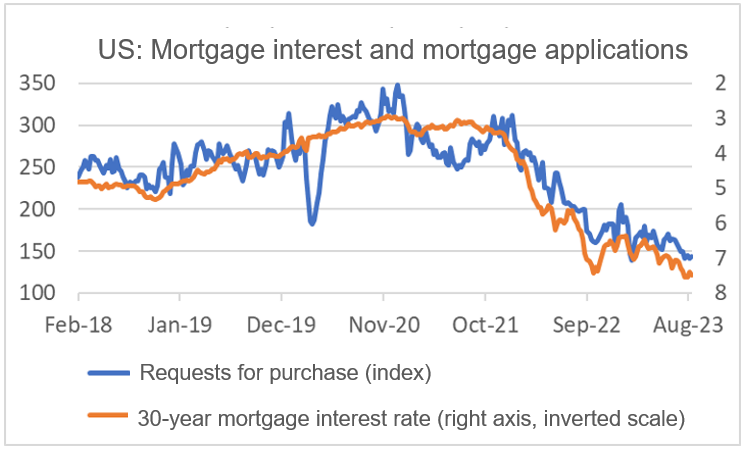

The American housing market is cooling down, but house prices are still rising again. The housing market in the US is cooling down further due to the increased interest rates. The next picture shows the mortgage interest rate (on an inverse scale) and the applications for mortgage loans for the purchase of homes. It is clear that these applications are very interest rate sensitive. They are now even below the level during the financial crisis. It is striking that house prices have risen again in recent months. This is unusual with rising interest rates and declining mortgage applications. It seems that this has to do with the tightness of the housing market.

Source: Macrobond

Source: Macrobond

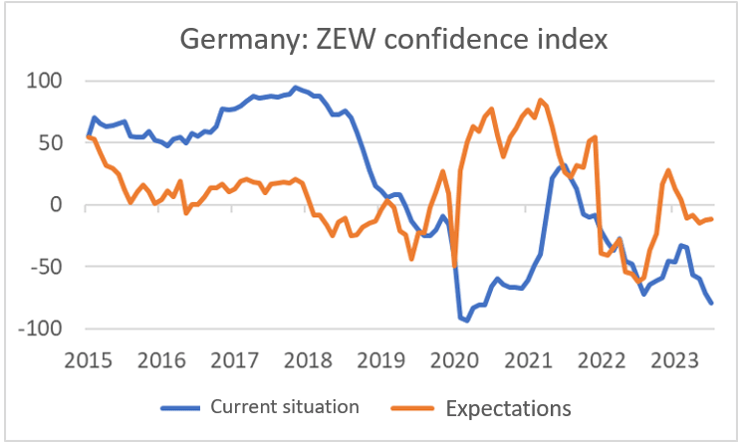

Economists and analysts are in a negative mood about the German economy

The German economy is under significant pressure. The ZEW index, which measures the mood among economists and analysts, came to -79.4 in September compared to -71.3 in August. This meant that the value in September was lower than in October last year when energy prices were much higher. That's not a good sign. Expectations did improve slightly: -11.4 in September, after -12.3 in August. For the time being, however, I will classify this as 'hope against better judgement'.

The German economy faces a significant number of persistent problems. For years, too little has been invested in infrastructure. Energy costs are sky high and industry is in danger of leaving the country. The automotive industry is increasingly facing competition from China. The integration of immigrants is also not running smoothly, and Germany is taking in large numbers of them.

Source: Macrobond

Eindelijk beter economisch nieuws uit China

In August, the Chinese economy appears to have gained some momentum. Production in the industry was 4.5% higher than a year earlier. That was better than expected and the best figure since April. Chinese consumers also spent their money with a little more enthusiasm. Retail turnover was 4.6% higher in August than a year earlier. In July it was only 2.5%. It should be noted that a growth rate close to 10% was normal before the pandemic. Still, it appears that the government's stimulus measures are starting to have success.

Closing

The ECB has raised interest rates again. That is the last increase for the time being. As I write this, I see that Brent oil is now trading above USD 94/barrel. At the end of June, this was still a tight USD 75/barrel and on September 1 it was USD 88/barrel. If this increase continues, it will halt the downward trend in our inflation. In the US this already happened in August. Then a new dilemma arises for central bankers. They have no influence on the oil price, but the oil price increase will, with a delay, affect all other prices in the economy and could thus cause a new wave of inflation. Inflation expectations could also rise. A scenario in which central banks raise interest rates even further in the course of 2024 cannot be ruled out by any means.

Given the weakness of the economy, an increase in the price of oil is very unwelcome because it implies national impoverishment for energy-importing economies such as ours. The only bright spot I see this week is that manufacturing growth and retail sales growth in China picked up slightly in August.