- The ECB has left interest rates unchanged,…

- ...the first time since July last year

- All signs point to a further weakening of the European economy

- The US economy grew strongly in the third quarter…

- ...but there are also challenges for the US

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 27 October 2023.

The ECB left the official interest rate unchanged this week after ten consecutive interest rate increases since July last year. I would be surprised if this is just a pause after which further interest rate increases will follow. I don't think the ECB will raise interest rates any further, although inflation in the eurozone is still well above target.

Monetary policy operates with significant and variable lags. Therefore, a central bank should not continue raising interest rates until the inflation target is achieved. The challenge is to find the moment when to stop raising interest rates. Going too far will cause unwanted damage to the economy.

There are several reasons to believe that we have reached the peak in official interest rates. The economic situation in the eurozone is weak. According to S&P Global's purchasing managers' indices, business confidence weakened again in October, both in manufacturing and in the services sector. In both sectors, the index again fell below 50, which indicates a contraction.

.png?width=742&height=446&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20%20Business%20confidence%20in%20the%20services%20sector%20(PMI).png) Source: Macrobond

Source: Macrobond

The difference between the level of the index of business confidence in industry in the eurozone on the one hand and the US on the other is remarkable. This may be due to the large differences in energy prices.

.png?width=720&height=435&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Business%20confidence%20industry%20(PMI).png) Source: Macrobond

Source: Macrobond

In her press conference this time, ECB President Christine Lagarde was much less optimistic about the economic prospects for the eurozone than in the recent past. Then she argued that the economy would recover smoothly and that we would be back to 'trend growth' as early as the first quarter of 2024. Now she was talking about a recovery that would manifest itself “in the coming years.” Lagarde said a few times “there is more to come”. She meant that we have not yet seen all the growth-dampening effects of the implemented interest rate increases.

It was also striking that Lagarde reported unsolicited during the press conference that the decision not to increase interest rates had been taken unanimously. Even the 'hawks' apparently think it's enough for a while. The performance of Vice President De Guindos was also remarkable. He rarely gets a question during the press conferences. This time Lagarde passed on a question to him about the consequences of the increased capital market interest rate for financial stability. De Guindos referred to the ECB's Financial Stability Report, which will be published in a few weeks, but he sounded quite concerned. Valuations of asset securities – De Guindos specifically mentioned the housing market – are high and therefore very vulnerable to rising capital market interest rates.

“There is more to come”

Lagarde is right that the ten rate increases that have been implemented have not yet had their full effect on the economy. What is already visible does not lie. This week the ECB also published the results of its quarterly survey of commercial banks. According to this Bank Lending Survey (BLS), banks again tightened the credit conditions they apply to loans to companies and households in the third quarter, although the number of banks that reported a tightening of credit conditions was slightly less than in the third quarter. second quarter. The same is visible in the demand for credits. According to the banks surveyed, this continues to decline, albeit to a slightly lesser extent than in the second quarter. If these developments do not turn for the better, a credit crunch is likely.

.png?width=742&height=445&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Eurozone%20-%20credit%20application%20to%20banks%20(ECB%20BLS).png)

Source: Macrobond

The consequences of reduced lending for the money supply are evident. Money growth has been weakening for some time now. The M1 money supply (money in the wallet plus current accounts that households and companies hold with banks) has been shrinking for months and significantly. The increased interest rates undoubtedly play a role in this. When interest rates were zero or even negative, it did not matter whether the money was in a checking account or a savings account. The increased interest rates will undoubtedly lead to money being transferred from checking accounts to savings accounts. Then it is no longer considered part of M1. The consequences for the economy are therefore probably less dramatic than the graph might suggest. At the same time, it must be said that the broader monetary aggregate M3 is also falling and that cannot bode well for economic activity shortly.

.png?width=740&height=456&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20Eurozone%20-%20Money%20growth%20(y-o-y).png)

Source: Macrobond

The eurozone is heading for a recession - or is already in one - and that is almost inevitable. Go figure. The purchasing managers' indices have been trading below 50 for several months now. Lagarde believes, rightly, that even more growth-dampening effects of the ten implemented interest rate increases will manifest themselves. Lending and the money supply are shrinking. The vice president of the ECB is understandably concerned about financial stability. That's not a pretty picture.

I am often told that I am remarkably negative for what I do. Maybe that's true, but I really can't make it any better than it is. If I try to find bright spots, I can point to the leading German Ifo index that measures business confidence in Germany. In contrast to S&P Global's purchasing managers indices, the Ifo index rose slightly in October: from 85.8 in September to 86.9. Both the assessment of the current situation and future expectations improved slightly. Perhaps this is driven by the fact that the process of stockpiling at companies is coming to an end. We will have to wait and see whether this will boost activity and whether the increase in business confidence according to the Ifo index will continue in the coming months.

The European economy can also get a boost from growing exports to the rest of the world. There we see business confidence and production gradually improving. But I doubt whether that will be enough to keep Europe out of a recession.

US economy grows fast in the third quarter

According to the first estimate, the American economy grew by no less than 4.9% in the third quarter compared to the second quarter (annualised; expressed in our way, growth is 1.2%). Year-on-year growth was 2.9%. The labour market is unprecedentedly tight. Also in the most recent week, the number of unemployment benefits applied for remained below 200,000. That's low. There is a lot of enthusiasm about the strength of the American economy.

Source: Macrobond

Source: Macrobond

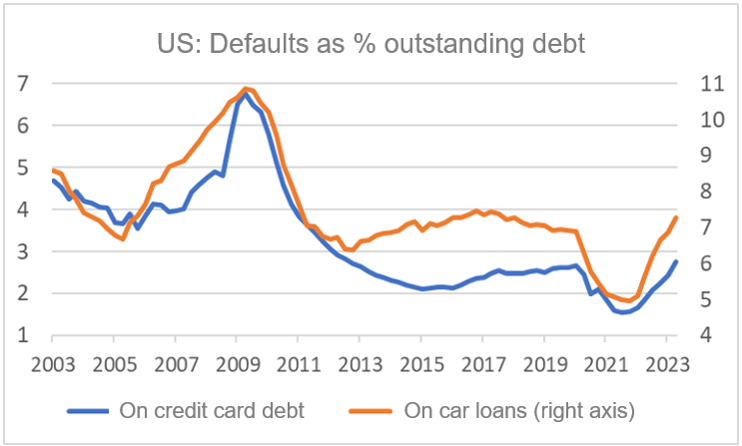

I'm certainly not sure about it. Logically, the American economy is doing much better than the European economy, given the difference in energy prices and the fact that the war in Ukraine affects the European economy much more than the American economy. But don't forget that the American economy is benefiting from the alarming increase in the federal government's budget deficit. That cannot continue. What cannot continue either is the withdrawal by households of the savings pots built up during the pandemic. There are various estimates about this. These vary, but the common thread is that the bottom of those piggy banks is in sight. Add to that the fact that people with student loans started repaying them again in October. That was shut down for three years during the pandemic. These payments limit spending power. Households are already facing an increase in payment problems. Default rates on credit card debt and auto loans are rising, although from historically very low levels.

Source: Macrobond

Source: Macrobond

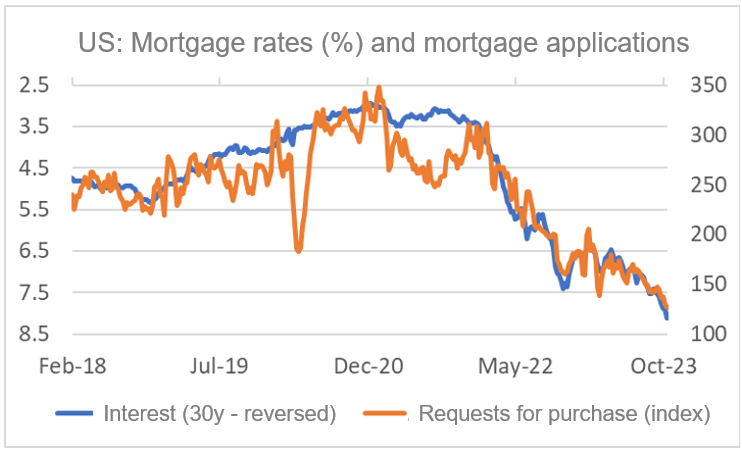

Just like in the eurozone, the American economy cannot escape the consequences of increased interest rates, which are not yet fully visible. What is visible are the consequences of one of the most interest-rate-sensitive sectors. Mortgage interest rates continue to rise. It is now a fraction above 8%. As the graph above shows, the number of mortgage applications has fallen sharply as a result of those high-interest rates. This will further put a brake on construction activity.

Conclusion

I have an eerie feeling about the economic prospects. The European economy is stagnating, if not shrinking. The ECB indicates that we have not yet seen all the growth-dampening effects of the interest rate increases, while banks are becoming less generous with credit and are noticing declining credit demand from companies. It is unclear to me how a recession can be avoided. As long as inflation is well above the ECB target, interest rate cuts are not an option. There is little or no room for stimulative fiscal policy. And even if spending could be boosted, where would the workforce come from to achieve the desired increase in production? Our hope for recovery can only rest on the corporate inventory cycle and an increase in global trade. It's all very uncertain.

The American economy has grown faster than that of Europe recently. However, I think that temporary factors play an important role in this. In my view, things are not looking rosy for the American economy over the next year and a half either.