- Dutch unemployment is rising slightly

- Chinese business data better than expected

- Trade figures from several Asian countries confirm the better picture

- American figures paint stark contrasts…

- …but I hold my breath…

- ...the sharp increase in capital market interest rates cannot remain without consequences

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 20 October 2023.

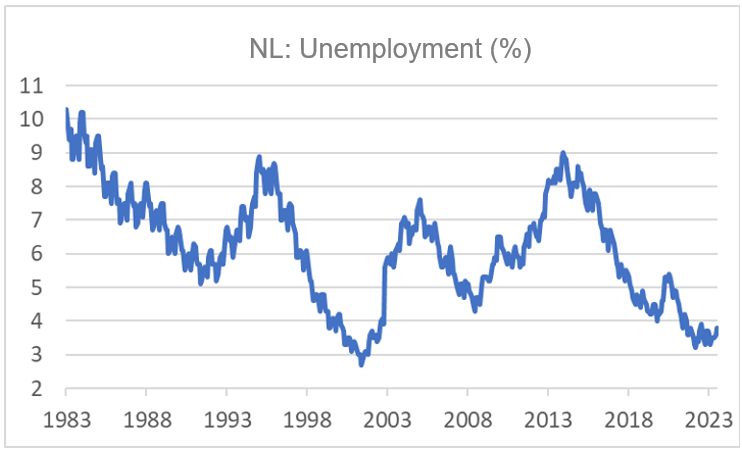

Unemployment in our country rose slightly again in September: 3.7%. In April it was still 3.4% and in April last year even 3.2%. That 3.7% is of course still a very low percentage. The labor market remains tight. Statistics Netherlands reports that an increase in the unemployment rate in recent months is consistent with the worse economic situation in our country and there is no way around that.

The number of unemployed increased by an average of 6,000 every month in the three months to September. Yet the number of people with paid work continued to increase: an average of 1,000 per month. The working population is growing, apparently somewhat faster than employment at the moment. Yet there are still 3.6 million people between the ages of 15 and 75 who are not working. In addition to the 371,000 unemployed, this concerns retirees and people who are not available for work for other reasons.

Source: Macrobond

Source: Macrobond

If you look at the graph above, you must conclude that there currently appears to be a 'wavering economy'. At the previous two turning points from falling to rising unemployment, these were considerably sharper. I suspect unemployment will gradually rise further in the coming months and quarters.

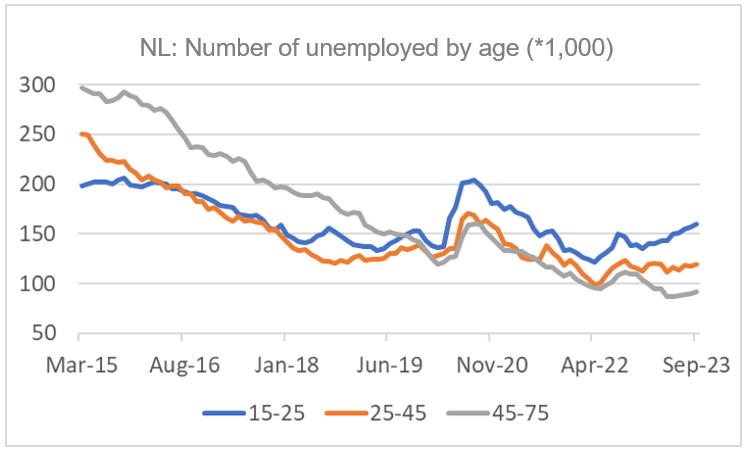

What is striking is that unemployment among young people is rising fastest. The following graph shows this. In September, unemployment among 15-25-year-olds was 8.8%. In April this was still 7.9%. There has also been some increase in other age groups, but it is much less pronounced. Unemployment among 25-45-year-olds is now 2.9%, after 2.8% a few months ago. Unemployment among 45-75-year-olds has risen from 2.1% at its lowest point to 2.2% in September. Unemployment among young people also increased most during the pandemic.

Source: Macrobond

Source: Macrobond

Komt China tot leven?

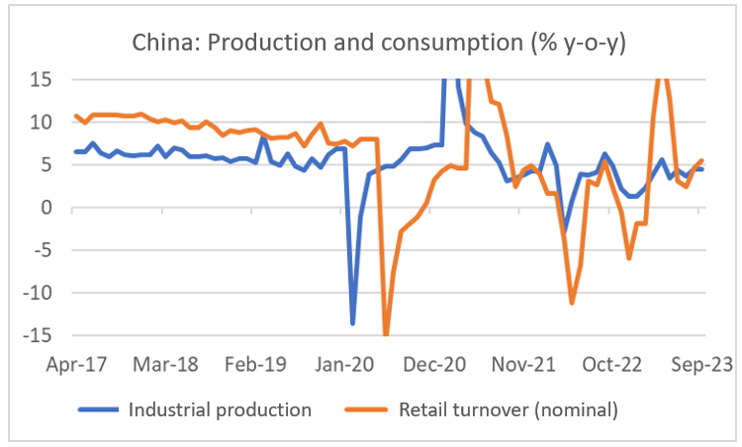

The economic development in China is a major setback this year. A sharp increase in activity was expected following the sudden end to strict lockdowns towards the end of last year. That didn't happen. But the latest figures were finally better than expected. The Chinese economy grew by 1.3% in the third quarter compared to the second quarter, when growth was limited to 0.5%. Year-on-year growth was 4.9%.

Figures on retail sales and industrial production also exceeded expectations in September. Retail turnover was 5.5% higher than a year earlier. That was still 4.6% in August. Manufacturing production exceeded the level of a year earlier by 4.5%. Although this was the same percentage as in August, it was better than expectations. Unemployment fell from 5.2% in August to 5.0% in September.

Source: Macrobond

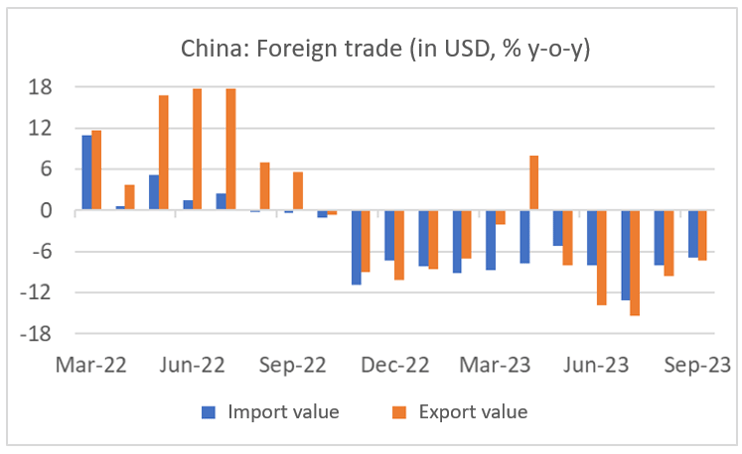

There also appears to be a cautious improvement in foreign trade. In September, export and import values were still 6.2% lower than a year earlier, but in July those percentages were still 14.3% and 12.3% respectively. The improvement in these figures is confirmed by the trade figures of some other countries in the region. Singapore's trade figures also improved. Although that country's exports in September were still more than 13% lower than in September 2022, this was still much better than the more than 22% decline in April. Remarkably, the export value to China was no less than 26.2% higher than a year earlier. Japan's trade figures also showed a clear improvement in September, although exports to China still lagged behind the level of a year earlier.

Source: Macrobond

The recent Chinese figures may be better than expected, but they are not yet very strong compared to the period before the pandemic. The Chinese economy is therefore facing some significant problems. The problems in the real estate sector are particularly significant. This week, the major project developer Country Garden was unable to pay the interest on a dollar loan, resulting in a 'default' (default). The company is probably heading towards restructuring. This will certainly have a negative impact on construction and may also cause anger among consumers who have purchased a home but have not yet received it.

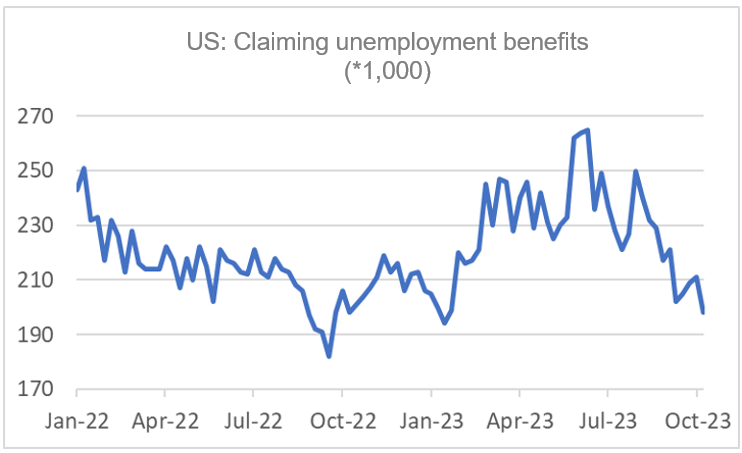

Image of extremes in the US

The economic picture in the US is currently very confusing. GDP probably grew strongly in the third quarter. According to the Atlanta Federal Reserve's GDPNow measure, that growth was 5.4% annualized compared to the second quarter. In our system, we would call it approximately 1.3% quarter-on-quarter. Retail sales exceeded expectations in September and jobless claims continue to decline. In the most recent week, the number even fell below 200,000 again.

Source: Macrobond

Source: Macrobond

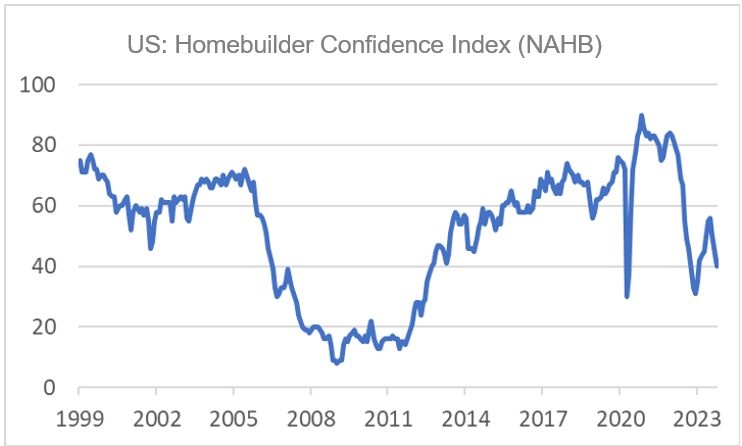

On the other hand, things are certainly not going well in the housing market. Confidence among homebuilders fell for the third month in a row in October. With a value of 40, that confidence is low from a historical perspective. There is also weakness in the number of homes sold, building permits issued, and homes under construction. All this is undoubtedly directly related to the mortgage interest rate, which has risen sharply in recent months. While the 30-year mortgage interest rate was close to 6% at the beginning of this year, it is now almost 8%. That makes quite a difference.

Source: Macrobond

Source: Macrobond

Although our economy is developing very differently from the American economy, the similarity in the housing market is remarkable. The rise in interest rates since the beginning of last year has put pressure on the market both here and in the US and initially led to a decline in house prices. Due to the increased construction costs, new construction is currently barely profitable and less is being built. Because supply falls faster than demand, an imbalance arises, causing house prices to rise again, despite the rise in interest rates. Volumes are very small.

.png?width=746&height=455&name=Finance4Learning%20-%20Han%20de%20JONG%20-%20US%20-%2030-year%20mortgage%20rate%20(%25).png) Source: Macrobond

Source: Macrobond

I keep holding on to my heart. The housing market is one of the most interest-rate-sensitive sectors of the economy. The conclusion I draw from the problems in the American housing market is that these will also occur in other sectors. In my view, it is inconceivable that the economy continues to hum along happily while capital market interest rates have risen exceptionally sharply. I therefore continue to adhere to my view that the American economy is heading for a recession.