- Food price inflation reduction has only just begun…

- …just like the reduction in “rental inflation” in the US

- Wage growth slowing down a bit…

- …but not enough to keep inflation at 2%

- Chinese recovery is delayed

- The global economy is ailing, but that's better than recessions

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 24 July 2023.

A week and a half ago, Statistics Netherlands reported their 'rapid estimate' of inflation in June. This week all the details came. Inflation is falling and will fall significantly further in the coming months. This is largely due to base effects. A year ago the gas price in Europe exploded and if it doesn't happen again, the year-on-year rate of inflation will drop rapidly. But there's more. Food prices have risen sharply, but food price inflation is clearly past its peak. Food prices are influenced, with a lag, by world market prices and energy prices. The first picture shows that our food prices are related to the food price index of the World Food Organization (FAO). With a clear slowdown, we can predict with reasonable confidence that food price inflation will continue to decline in the coming months. So far, food prices as a whole have not fallen from one month to the next, but that could well happen. Some individual items are already becoming cheaper. For example, according to the CBS figures, the price of milk has been falling for four months in a row.

.png?width=787&height=495&name=Finance4Learning%20-%20NL-CPI-Food%20and%20FAO%20price%20index%20in%20euros%20(y-o-y%2c%20Rsq%20-%200.65).png)

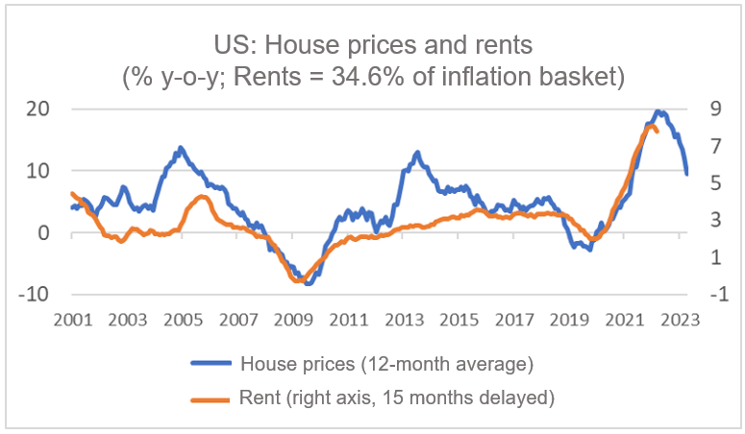

Inflation in the US has now fallen to 3.0% in June, although core inflation was still 4.8%. But that is clearly better than the 5.3% in May. Inflation will also fall further in the coming months in the US. As with us, base effects are likely to drive the figure down in the coming months. More important, however, is what happens to the rents. I write about it every month, hopefully, it won't get boring. But what happens to the rents is essential. After all, they have a weight of more than a third in the US inflation basket. The development of rents in the US is easy to predict because they follow the development of house prices with a lag. Last year's rise in mortgage interest rates hit the housing market, which is now reflected in rents. The rate of increase in rents has now fallen for two months in a row and everything indicates that this decline will continue for months to come.

The following calculation 'on the back of a cigar box' is too simplistic, but still. Rents were 7.8% higher in June than a year ago. Since the weight in the inflation basket is 34.6%, the rise in rents contributes 7.8 * 0.346 = 2.69 percentage points to inflation. In short, the inflation of 3.0% is largely caused by those rents. Okay, that is way too short-sighted, because the inflation rate is currently being held back by lower energy prices, lower prices for used cars, and lower prices for airline tickets. These prices will not continue to fall and are currently naturally offset by price increases for other goods and services.

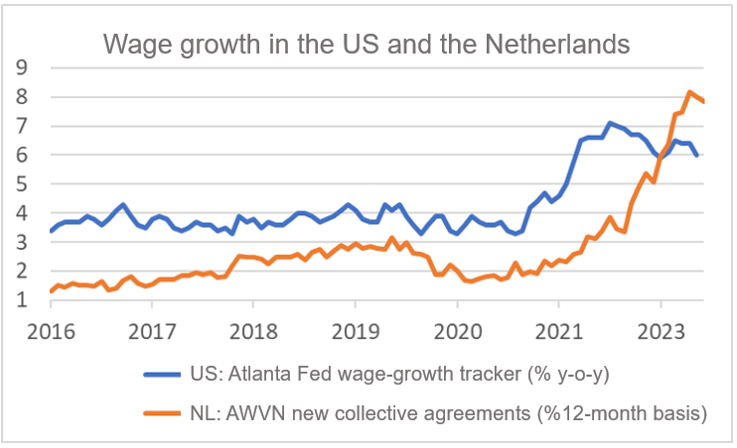

Ultimately, wage increases have a major impact on inflation. The following graph shows that we are not yet 'out of the woods' in this respect. According to the AWVN, there is already some moderation of wage increases agreed upon in new collective labor agreements. My favorite measure of US wages is the Atlanta Fed wage growth tracker. It came to 6.0% in June. Significant further moderation is needed to keep inflation at 2% over the longer term.

Dutch manufacturing production increased by 1.2% in May compared to April. Compared to May last year, a decrease of 9.2% was recorded. That is tough, but better than the -12.2% in April. Despite the lower energy prices, energy-intensive sectors are not yet showing a strong production recovery.

.png?width=672&height=410&name=Finance4Learning%20-%20Production%20manufacturing%20industry%20(indices).png)

The global economy continues to falter. At least that's better than a recession. The expected Chinese recovery has not yet materialised. The June figures on China's international trade were disappointing. The value of imports was 6.8% lower than a year earlier (May: -4.5%) and the export value was even 12.4% lower (May: -7.5%). Chinese exports to the US were especially weak (-23.7%). China does benefit from the Western boycott against Russia. Chinese exports to Russia were 91% higher in June than a year earlier, but the Russian market is not very important to China. On the import side, there were some remarkable things to note. For example, imports of copper and steel were weak (-16% and -23% respectively), but imports of oil (+45%), gas (+19%), and coal (+110%) increased. China is a very strategic buyer of oil, gas, and coal and they probably limited their purchases last year because of high prices, while they are now benefiting from the lower prices.

The US economy is happily bouncing along. The labor market remains tight. The number of applications for new unemployment benefits reached 237,000 in the most recent week. That number is not going up. Business confidence in SMEs improved in June: from 89.4 in May to 91.0. However, the graph shows that it is not over yet.

.png?width=764&height=463&name=Finance4Learning%20-%20US%20-%20Confidence%20of%20SME%20entrepreneurs%20(NFIB%20index).png)

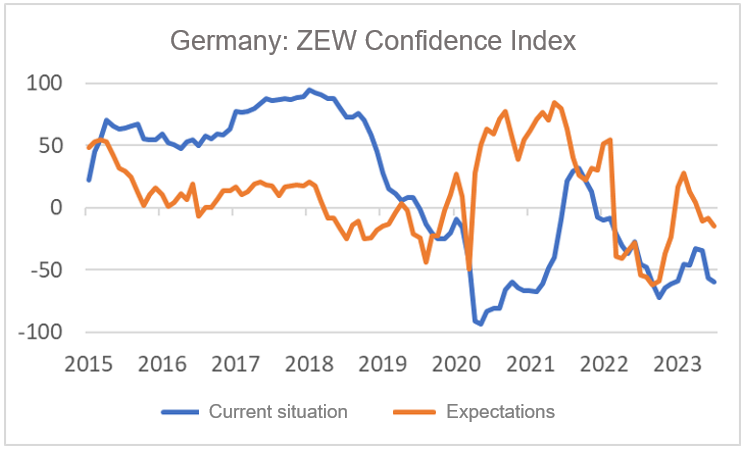

Economists and analysts whose opinion on the German economy is asked by research agency ZEW are not cheering. In July, the “expectations” component fell to -14.7 from -8.5 in June. The index for assessing the current situation deteriorated from -56.5 in June to -59.5 in July.

Summarizing

The fall in inflation that we have seen in recent months will continue in the coming period, probably firmly. Ultimately, wage growth must moderate to keep inflation at 2% over the medium term. A moderation in wage growth seems to have started in both the US and in the Netherlands, but this is still in its infancy and, given the tight labor market, it remains to be seen how quickly the moderation will continue.

The global economy has not fallen into recession, but economic growth is not high. The industry continues to struggle. Our industry is currently producing much less than a year ago. Chinese data on international trade remain remarkably weak and while the US labor market continues to be tight, SMEs remain cautious, while economists and analysts' confidence in the German economy continues to weaken.