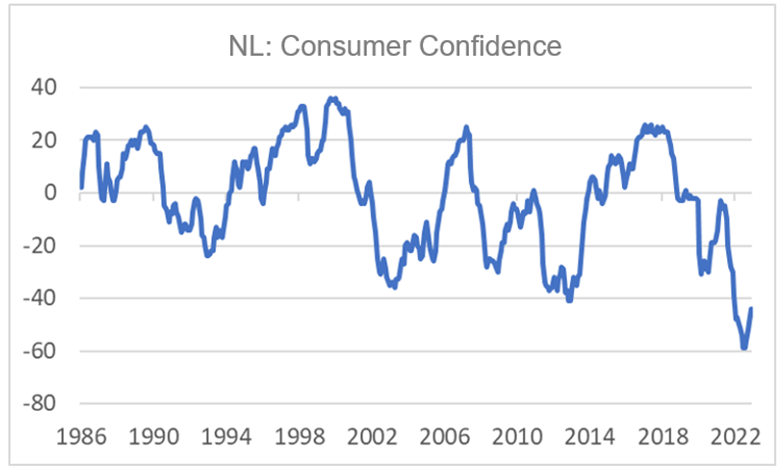

- Inflation is disappointing

- Wage-price spiral is not a danger but reality

- Wages are now rising faster here than in the US

- Confidence of industrial entrepreneurs does not continue to improve in February

- Worrying review of Italian budget deficit

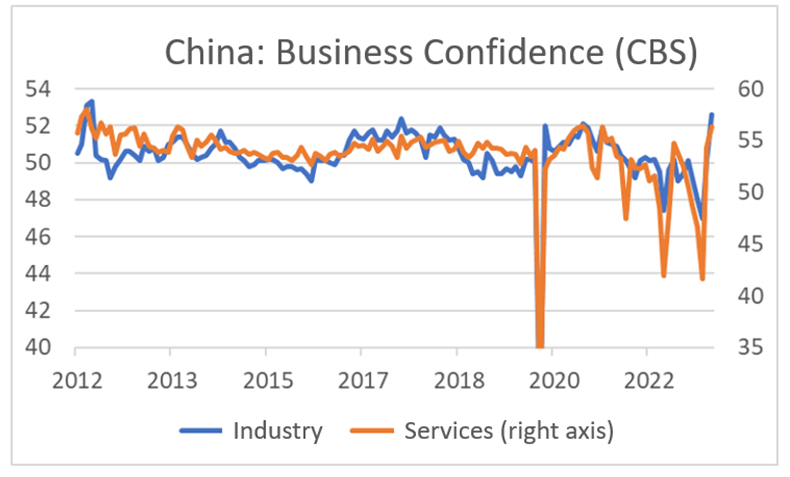

- Chinese reopening propels mood indicators

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 03 March 2023.

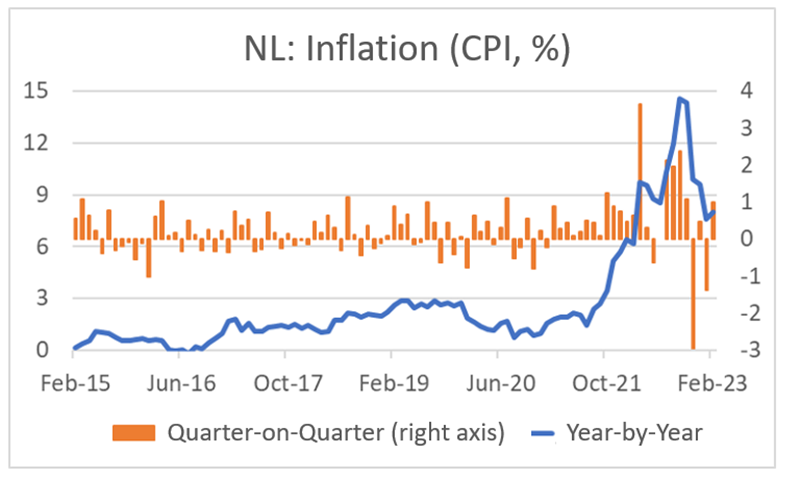

After September last year, our inflation had fallen for four months in a row. Then you actually hope that the decline will continue in February, however slight. But that didn't happen. According to the national benchmark of Statistics Netherlands, inflation was 8.0% in February, compared to 7.6% in January. On the European HICP measure, the increase was even more: 8.9% against 8.4% in January.

Before the publication of the Dutch figures, it turned out that inflation in France, Spain and Germany had risen in February, so we could already see the storm coming. Still, the actual figure was a disappointment, because our inflation rose more than elsewhere and the increase in price levels compared to January was – on the HICP measure – greater than in all other euro countries except Ireland. Incidentally, we had done slightly better than most other countries in January.

Source: Macrobond

Inflation in the eurozone as a whole fell slightly in February: 8.5% against 8.6% in January. Core inflation (ie without energy, fresh food, alcohol and tobacco), on the other hand, has risen further. It was 5.6% in February. In January it was still 5.3%. The increase in core inflation is an indication that the wave of inflation is still broadening. That is not good news. The ECB has no choice but to continue raising interest rates. On March 16, the official rates will undoubtedly be increased again by 0.5%.

The inflation rate for March will fall sharply. But that is mainly a basic effect. The graph above shows that prices in our country rose sharply in March last year compared to February: 3.7%. This was due to energy prices that rose sharply after the outbreak of the war. Such an increase will undoubtedly not be repeated in March of this year. For example, if the price increase is 0.7% month-on-month, the inflation rate (ie 8.0% in February) falls by 3 percentage points.

Economists like to look at core inflation to get a sense of how broad inflation is moving across the economy, beyond energy, fresh food, alcohol and tobacco. However, it is clear that energy prices also affect core inflation because energy is needed for everything. According to Peter Hein van Mulligen of CBS, there is often a delay of about six months. Energy prices (in the Dutch inflation basket) peaked in September/October. Of course, Van Mulligen gives no guarantees, but if he is right, core inflation should also fall within a few months. Since the oil price fell considerably from mid-June last year, inflation figures could actually fall quite quickly from June onwards. Then of course energy and other commodity prices should not rise due to the reopening of China.

Higher wage growth than in the US

Wage growth remains a source of inflationary pressure. In the field of wage formation, something miraculous has now been observed. The indicators in the chart below may not be completely comparable, but the recent divergence between wage growth in the US on the one hand and the Netherlands on the other is remarkable. According to figures from the Federal Reserve of Atlanta, wage growth in the US has already passed its peak. In our own country, we are seeing an acceleration of the wage increase agreed in collective labor agreements, although it must be said that the figures may be somewhat distorted by the collective labor agreement of municipal civil servants. An increase in civil servant salaries affects the government budget, but does not immediately lead to price increases. Nevertheless, it is remarkable that wages seem to be rising faster here than in the US. The danger of a wage-price spiral is therefore greater here than in the US.

Source: Federal Reserve of Atlanta, AWVN

Maybe I should phrase that differently. Wage growth in excess of productivity growth either detracts from profit margins or contributes to price increases. Or a combination of both. Although the picture varies greatly per sector, there is no question of a drop in profit margins on average. We should therefore not speak of 'the danger of a wage-price spiral', that spiral is simply ongoing. After the publication of the disappointing inflation figures, I again hear combative language from the trade unions.

At the same time, there are companies that use the unclear situation on the cost and price front to increase their profit margins. It may not be on a large scale, but there is also a profit-price spiral to some extent. And now that some costs are really falling in absolute terms (think of international freight prices, but also various raw material prices), the question is whether those decreases are quickly passed on to the customer - so that inflation weakens - or are used to increase margins.

If there is one thing that is clear, it is that we must get rid of this high inflation as quickly as possible. Since everyone, understandably, stands up for their own interests, it won't be that easy. Do we really need a nasty recession to get rid of inflation?

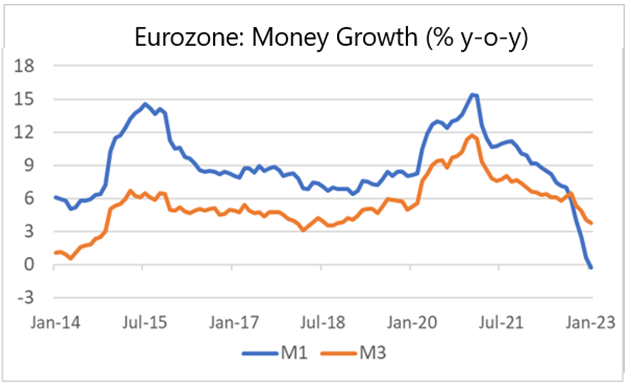

It may not be very fashionable, but a traditionally trained economist like me likes to look at the development of the money supply. There was a time when changes in money growth were seen as crucial for inflation and also the real economy. Well, money growth has been weakening for some time now. In January, M1 even turned out to be slightly smaller than a year earlier. This is exceptional, although it naturally follows very high growth figures after the outbreak of the pandemic. Such a development implies downward pressure on inflation and activity.

Source: Macrobond

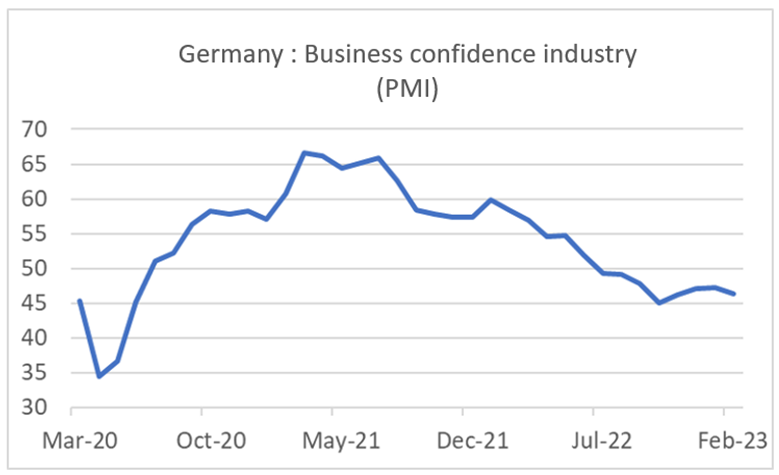

This week it was not only the inflation figures that disappointed. The data on business confidence in the eurozone countries also disappointed, more specifically: especially those in the manufacturing industry. In our own country, the purchasing managers' index of the NEVI fell from 49.6 in January to 48.7 in February, after rising for two months. In Germany, too, industrial business confidence fell after a three-month rise and, just like in our country, the PMI in our eastern neighbors was still below 50, indicating a contraction in the sector. If you do try to get something positive out of those reports, it can be reported that delivery times fell the most since 2009. This is another sign that the logistical disruptions are disappearing quickly. As a result, companies no longer have to maintain large stocks of raw materials, auxiliary materials and semi-finished products as a precaution. That may have put pressure on the order volume. So perhaps the drop in the PMI is being driven by a positive development after all and hopefully it will be temporary. Another positive message from these figures was that entrepreneurs reported a net decrease in the prices they paid for inputs. So some disinflationary pressure is developing here.

Earlier this week I spoke to an acquaintance who is on unemployment benefits. Her husband receives an ABP pension. She was pleased with her finances. Due to the increase in the minimum wage, her benefit had gone up and the ABP has significantly increased the pensions. She said they had rarely seen such an increase in their combined income (although she may be suffering from a bit of a "money illusion," i.e., she may be underestimating inflation). Another acquaintance was surprised that he will receive a lot more child benefit this year. He actually works for Goldman Sachs and wasn't really keen on the extra money! And yet another acquaintance was surprised that in November and December he had received 190 euros per month not only for the house in which he lives because of the increased energy prices, but also for his second home. He also didn't really need that money to keep his head above water. The moral of this story is that the measures to support purchasing power may be a bit too generous (or too little specific). There is no doubt that they will support consumer spending.

Source: Macrobond

Houston/Brussels, we have a problem…

Italy's government deficit figures have been revised from 2020. Three guesses in which direction… The deficit for 2020 is now on the books as 9.7% of GDP, compared to 9.5% before the revision. In 2021, the deficit appears not to have amounted to 7.2% but to 9.0% and last year the deficit amounted to 8.0%, well above the target of 5.6%. A deficit of 4.5% is targeted for the current year. I wouldn't be surprised if the actual deficit turns out to be higher...

The revision has received little media attention. This is striking, because the euro crisis started more than ten years ago when Greece revised their public finance figures, although it must be said that the revision was much larger. It should also be noted that Italy's public debt expressed as a percentage of nominal GDP actually decreased last year due to high inflation.

The fiscal rules applicable in the eurozone and laid down in the Stability and Growth Pact have been suspended in 2020 due to the pandemic. They will come into force again from next year unless otherwise decided. This remains a sensitive issue.

China off the starting blocks

Source: Macrobond

Closing

Disappointing inflation data in Europe was the main macro news of the past week. Nevertheless, it is certain that inflation will be considerably lower from March onwards and could fall quite quickly after June. Nevertheless, I remain somewhat apprehensive about the stubbornness of inflation, especially due to the acceleration in wage growth in the Netherlands. The ECB has no choice but to raise interest rates by another 0.5% on March 16 and it seems unlikely that it will stay there.

I am also concerned about Italian public finances, but I get the impression that I am the only one. So it will be me.