- US inflation slightly lower, core inflation slightly higher and opinion divided

- Brazil as a shining example

- According to the IMF, central banks are better off raising interest rates too much than too little

- I'm holding my breath, aren't you?"

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 14 October 2022.

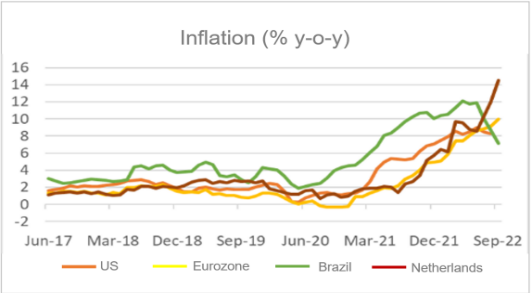

There is no topic in the economy and financial markets that is currently being discussed as much as inflation. We already knew that inflation in our country was 14.5% in September, according to Statistics Netherlands, and 10.0% in the eurozone. This week saw the addition of September inflation figures for the US and Brazil, among others.

The US figures are of great importance because of the influence they have on the financial markets. I find the Brazilian figures interesting because that country has had much more experience with high inflation in recent decades than we have and the central bank there has followed a very different strategy than ours.

Anyway, US inflation fell slightly in September: 8.2% year-on-year from 8.3% in August. Core inflation, i.e. excluding food and energy, actually rose: from 6.3% in August to 6.6% in September. Compared to August, prices rose by 0.4% in September and core inflation stood at 0.6%.

Opinions on these figures are quite divided. Higher core inflation is bad news and will undoubtedly not dissuade the Federal Reserve from thinking that interest rates need to rise further. But I also see comments that conclude that the numbers were not so bad and that inflation will fall in the near future.

House rents make up a relatively large part of the US inflation basket, almost a third. The increase in rents actually paid and in rents imputed to homeowners accelerated further in September. The good news from an inflation perspective is that house prices in the US are now falling and rents in that country are following house prices, albeit with some delay. It is therefore only a matter of time before rents will also fall. This will put significant downward pressure on inflation. I came across a comment that calculated inflation excluding food and rents was only 0.1% in September. To that you can of course say: well, if you tinker out everything that becomes more expensive, you will not be left with inflation. Yet there is something in it.

I've argued before that inflation is going to fall over the course of next year and that it may fall faster than many now expect. I stand by that opinion. Energy prices will not continue to rise, logistical disruptions in the world are easing, international freight rates are currently falling rapidly, wage growth is lagging far behind inflation and the coming recession will do the rest.

Twice as high as Brazil

In Brazil, inflation fell from 8.7% in August to 7.2% in September, after peaking at 12.1% in April this year. Unlike the ECB and the Fed, the central bank in Brazil started rate hikes as early as March 2021. In the meantime, 12 interest rate steps have been taken and the official interest rate has been increased from 2% at the beginning of last year to 13.75% now. OUCH! But with some delay, it is successful in bringing inflation down. Incidentally, the economic pain caused by these interest rate hikes appears to be not too bad. The country has not (so far) entered a nasty recession.

My point is that the central bank in that country has succeeded in bringing inflation down. I know that the situation varies from country to country, but our inflation is now more than twice that of Brazil. I never thought I'd ever experience that again. OUCH, OUCH!

Source: Refinitiv Datastream

During the various meetings of the IMF this week, inflation was also often the focus. The main message I got was the recommendation to central banks to continue to tighten monetary policy vigorously until inflation is overcome. And the recommendation to governments was not to get in the way of monetary policy and thus not allow a rise in budget deficits. Sic! There we go with our purchasing power supporting measures and the energy price ceiling of which no one can say approximately how much it will cost and for which no cover is sought in advance. Then there is now also a temporary scheme for SMEs to partially compensate for the increased energy costs. It will also cost a few cents.

The problem for central banks is that monetary policy operates with significant and uncertain delays. If they keep raising interest rates until inflation is close to their target, they are definitely going on too long and doing so will actually make a recession needlessly deep. Unfortunately, we don't know how much further interest rates need to rise to bring inflation down. That's why it was interesting and especially ominous that the IMF chief economist said it's better to raise interest rates too much than too little. In his view, the costs of high inflation in the longer term exceed the costs incurred by the central bank in the shorter term by actually inflicting unnecessary damage on the economy. I think you can build a tree over that. The extent to which the central bank raises interest rates more than necessary or less than necessary to control inflation need not be symmetrical. I think it's better to do too little than too much.

Incidentally, I do not think that our interest rates should rise as sharply as in Brazil or as we did in the 1970s and early 1980s. First, I think there is a good chance that inflation will fall in the course of next year anyway. Moreover, our economy is now much more interest-rate sensitive than it was in the 1970s and 1980s.

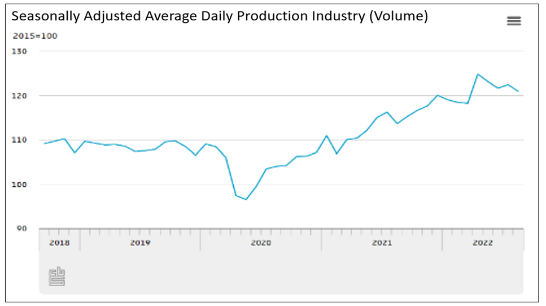

Dutch industry is doing remarkably well

Production in Dutch industry was 5.9% higher in August than twelve months previously. That is much better than in most countries around us. Machine building in particular continues to excel with a year-on-year production increase of 24.8%.

You wonder how long our industry can continue to do better than those abroad. And if you look at the figures in more detail, it is noticeable that there has been a month-on-month decline in recent months. Since the peak in April, production has fallen by about 3%. That fits more in the picture elsewhere than the year-on-year figures.

Source: CBS

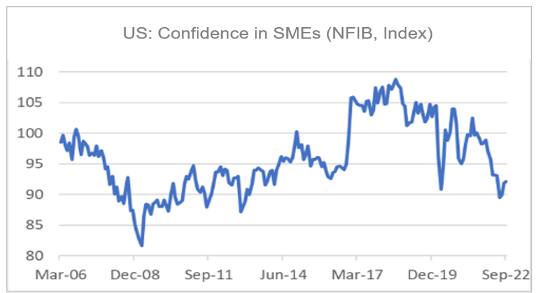

US better chance of avoiding recession

Because the price of gas in Europe has risen so sharply and that in the US much less, and also because the US is self-sufficient in energy and we are nowhere near it, the economic outlook between the two regions differs greatly. The Americans have a much better chance of avoiding a recession and if it does come it will be less deep and shorter than ours.

While our SMEs are under great pressure due to high energy costs, although there is now a regulation to reduce energy costs, American SMEs have actually become less pessimistic in the last three months. As the last picture shows, the National Federation of Independent Business (NFIB) confidence index improved from 91.8 in August to 92.1 in September.

Source: Refinitiv Datastream

Closing

As far as I'm concerned, this week was again dominated by inflation. In the US, it fell slightly in September, which is much better than ours, although core inflation rose and concerns are still high. Brazil is the shining example for me. There, the central bank raised interest rates early on, with the result that inflation has been falling for months now and is currently less than half of Dutch inflation, while the economic damage caused by that monetary tightening has (so far?) been reduced better than expected.

The IMF has declared inflation the public enemy number one, two, three and four. The fund recommends that central banks continue vigorously with rate hikes and believes that it is better to raise interest rates too much than too little. To me it sounds like a fairly blind panic and I hold my breath.