- Volume of Dutch retail sales has fallen sharply

- A new international theme: sharply falling orders

- The Fed is certainly not stopping

- US economy remarkably robust

- The Russian economy is now sinking further

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 04 November 2022.

The economy is weakening. This is clearly visible in large parts of the world and certainly also with us. Statistics Netherlands reported that retail turnover was 5.3% higher in September than a year earlier. That seems like a good figure, but it should be borne in mind that this is a nominal figure. In volume terms, retail sales were 3.5% lower than a year earlier. These figures are volatile, so it may be better to look at quarterly figures. In the third quarter, the volume of sales was 3.6% lower than a year earlier and no less than 5.2% lower than in the second quarter (corrected for shopping days). The picture below shows that there is a clear relationship between the volume of retail sales and economic growth. Quarterly figures are shown in the graph. The GDP figures for the third quarter are not yet available, which will be published by Statistics Netherlands on 15 November. It seems likely to me that there will be a significant negative, partly because the second-quarter figure (2.6% growth q-o-q) was flattered by one-off windfalls that are unlikely to be repeated in the third quarter.

Source: Refinitiv Datastream

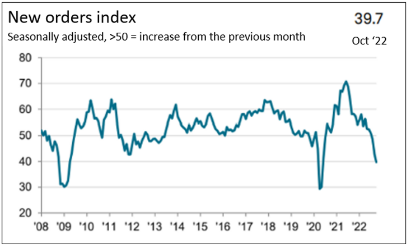

The Dutch Purchasing Managers Index (NEVI) fell from 49.0 in September to 47.9 in October. October was therefore the second month in which the index was below 50, which strictly speaking indicates contraction. In February, this confidence indicator was still slightly above 62, indicating strong growth. The decline since then has been quite significant. Export orders in particular are developing badly, the sub-index came in at 39.7. The following chart shows that export orders fell faster only during the crisis in 2008/09 and just after the outbreak of the pandemic. It seems that the international economy has weakened rapidly over the last few months.

Source: NEVI

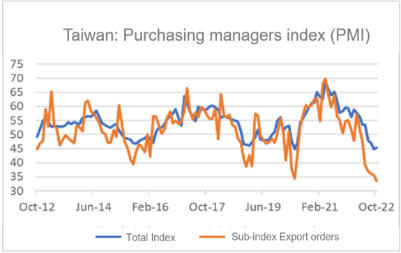

Sharply falling orders, a new international theme

This picture is also reflected in figures from Taiwan, for example. Business confidence in that country has been weak for months. Although the purchasing managers' index (the national version) rose slightly in October, it remained below 50 for the fourth month in a row. In Taiwan, too, export orders are particularly weak. The export orders sub-index fell to 33.5 in October from 35.6 in September. This means that this sub-index reached its lowest value since this series was started in 2012. The decline since March is also the sharpest decline since the start of this series over such a period.

Source: Refinitiv Datastream

The trend of sharply declining orders appears to be an international theme. Factory orders in Germany fell 4.0% mom in September, after falling 2.0% in August. Foreign orders actually fell 7.0% mom in September. Orders from other EU countries were especially weak: -8.0%.

The next two pictures illustrate this. After the strong recovery from the collapse caused by the pandemic, there is now a new and sharp decline. The absolute level of order intake at German industrial companies is now comparable to 2015!

Source: Refinitiv Datastream

In the year-on-year comparison, the counter stood at -10.7% in September, slightly less dramatic than the -11.1% in July. The following chart makes it clear that such fat minuses are not so common. In the last 20 years, only the crisis of 2008/09 and the pandemic have seen even worse figures, although they were very much worse.

Source: Refinitiv Datastream

A recession, how deep?

These are very unusual times. I think there is no doubt that a recession is imminent, especially in Europe. Unlike in all previous recessions after the early 1980s, central banks will do little or nothing to prevent, mitigate or speed up recovery. In fact, monetary policy, both at home and in the US, will certainly be further tightened. That should make this recession relatively deep.

But there is something in return. Firstly, consumer spending can be supported because many households still have buffers that they built up during the corona period. In addition, government support packages will partly compensate for the loss of purchasing power. And thirdly, many companies that get into trouble may be able to make a restart because there are many resources available from parties such as private equity funds that look for opportunities to 'put committed money to work'.

On balance, it is therefore not easy to predict how deep the recession will become.

China: the 'stop-go' economy

The Chinese economy continues to be plagued by frequent local lockdowns. In fact, the activity there shows a wonderful stop-go cycle. In October things were again quite wrong with the various confidence indicators. The central bank measures business confidence on a monthly basis, as is done elsewhere. The confidence index in the manufacturing sector fell from 50.1 in September to 49.2 in October, that in the services sector from 50.6 in September to 48.7. I haven't looked up the numbers, but it's not often that both measures score below 50. Meanwhile, the real estate crisis continues. We should therefore not expect major growth impulses for the global economy from China in the short term.

US economy remarkably robust

The US economy is much more robust than most other countries. That also makes sense. For example, energy prices, or rather gas prices, have risen much less quickly than here and the Americans are more or less self-sufficient in energy. Moreover, the war in Ukraine is, of course, much further away.

A characteristic that our country shares with the US is the tight labour market. Where according to the most recent CBS figures there were 143 vacancies per 100 unemployed, this number in the US was 200 a few months ago. There seemed to be some relaxation in recent months, but the number of vacancies rose sharply again in September: to 10.7 million from 10.3 million in August. In doing so, there were 186 vacancies per 100 unemployed in September.

Source: Refinitiv Datastream

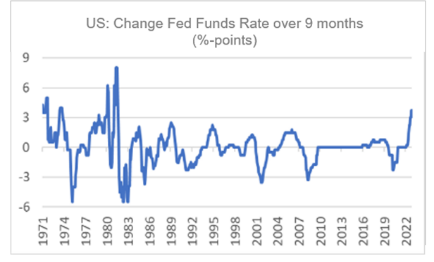

Fed won't stop just yet, surprises the stock market

The Fed raised rates again this week by 0.75%. The interest rate over the past nine months has now been increased by 3.75 percentage points in six steps. We are of course coming from an extremely low level, but since the early 1980s the Fed has not raised official interest rates that much over such a period. So this is really historic.

Source: Refinitiv Datastream

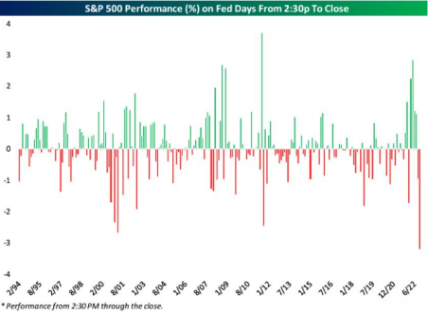

The financial markets were seriously misled on Wednesday. The usual short written explanation of the interest rate decision was interpreted as a sign that the Fed will not raise rates much further. Equity markets rebounded. In the press conference that followed, Fed Chairman Powell skilfully dashed the markets' hopes. The Fed will continue to raise rates “until the job is done,” Powell said. The Fed will moderate the pace of rate hikes, but even that may not be the case in December. Disappointed, the stock market reversed and at the end of the day the signs turned deep red. The following picture shows how violent the price movement was from the start of the press conference. Since 1994, the price loss from the moment the Fed boss started speaking until the end of the trading day has never been greater than last Wednesday.

Are the sanctions starting to bite in Russia?

After the war broke out and sanctions against Russia were imposed, growth estimates for the Russian economy were immediately sharply lowered. According to an initial estimate, GDP is expected to contract by 8% this year. The ruble went into free fall and the central bank raised interest rates sharply (from 9.5% to 20%). Restrictions on capital exports were also imposed. The measures led to a recovery of the ruble and a moderation of inflation after an initial shock. This enabled the central bank to lower interest rates again (now at 7.5%) and the Russian economy entered calmer waters. Meanwhile, the growth forecast for this year has been increased to about -3.5%, still a strong contraction, but much better than -8%.

However, the most recent indicators point to a new setback. Last week, Elvira Nabiullina, the president of the central bank, already hinted at this. Unemployment rose to 3.9% in September (from 3.8% in August) and retail sales were 9.8% lower than a year earlier. In August it was still -8.8%. Confidence indicators are also deteriorating. The manufacturing purchasing managers index fell from 52.0 in September to 50.7 in October. In the services sector, it went from 51.1 in September to 43.7, a very sharp drop that may have something to do with the partial mobilisation. Figures over one month are not yet a trend, but all figures point in the same direction.

Closing

These are uncertain times. What do we know for sure? First, that major central banks will continue to raise interest rates. They also recognise that this makes a recession likely. Actually, they don't mind that much. It is also better to become unemployed when the labour market is tight than when there is already mass unemployment. The interest rate rise is already historic.

We also see that all kinds of confidence indicators, especially in Europe, are deteriorating. It strikes me that especially the assessment of the inflow of new orders suddenly becomes very negative, also outside Europe. The hard figures on orders in Germany confirm this picture. The development of order intake is an important indicator of where the business cycle is heading in the short term.

We cannot expect anything from the Chinese economy in the short term due to the frequent lockdowns and the problems in the real estate sector.

The US economy is stronger than ours and they still have a chance of avoiding a recession, but that chance is getting smaller as the Fed feels compelled to raise rates more than previously thought.