- Inflation in the Netherlands and the US is slightly lower, but also wider.

- Rising rent rises will stand in the way of a rapid decline in US inflation for the time being.

- Chinese sitting at home do not produce goods and do not buy cars.

- Russian car sales fall sharply.

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 13 May 2022.

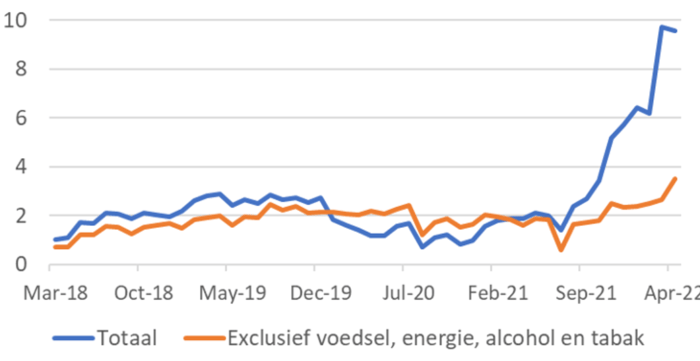

Inflation will continue to occupy people's minds for the time being. In our country, CBS published its own inflation figures for April. Inflation was 9.6%, slightly lower than 9.7% in March. The inflation figure was somewhat depressed by the reduction in excise duties on petrol and diesel as of 1 April. Unfortunately, inflation is now also broadening in our country. Core inflation, ie excluding food, energy, alcohol and tobacco, accelerated from 2.6% in March to 3.5% in April. Core inflation has been particularly strong in the last three months. In those three months alone, prices excluding food, energy, alcohol and tobacco rose by 2.7%, or 11.1% if such a price increase lasted for 12 months (annualized).

EN: Inflation (% CBS measure)

Total

Excluding food, energy, alcohol, and tobacco

The details of that inflation report raise quite a few questions for me. Take the category of glass, crockery and household items. Those prices were 9.8% more expensive in April than a year ago. Have the production and transportation costs for these goods really increased that much to justify such price increases?

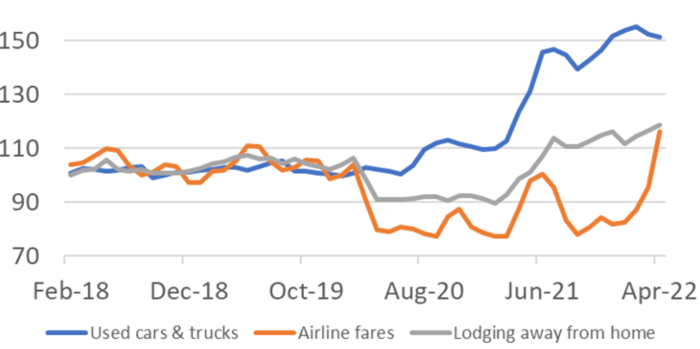

US inflation falls slightly but broadens further

US inflation also fell slightly in April, from 8.5% in March to 8.3% in April. Core inflation in the US is noticeably higher than in the US, although it fell slightly in April compared to March: 6.2% against 6.5%. The details of the US inflation report show nicely what is happening in the economy. The following picture shows the price development of used cars, airline tickets and the costs of overnight stays in hotels and B&Bs. The phenomenal price increase of used cars seems to be over. Airline tickets, on the other hand, become more expensive very quickly now that people want to fly again. Hotels and B&Bs had become cheaper during the pandemic, but that has completely changed. Since the low in February 2021, prices have risen by more than 32%.

US: Prices (index Jan. '18 = 100)

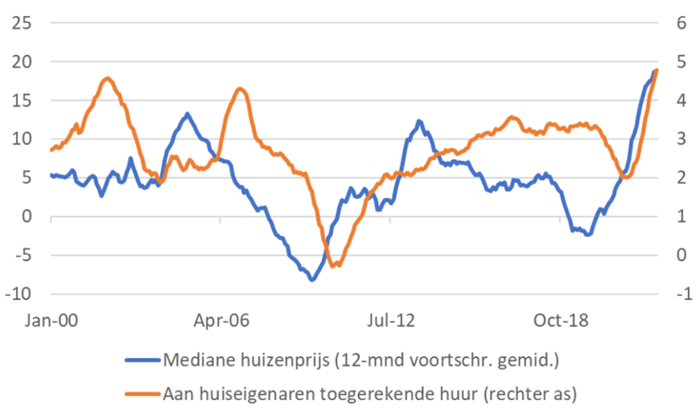

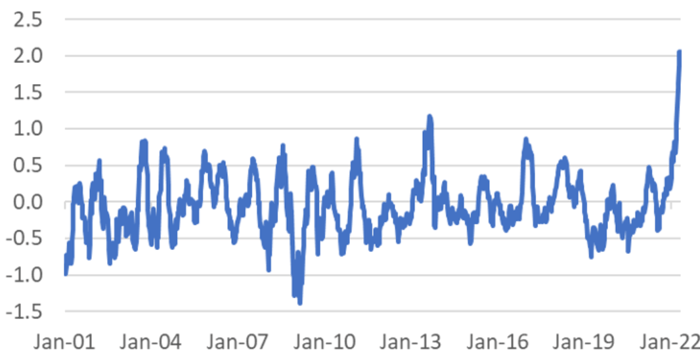

The Fed has now entered a mild panic and they seem determined to bring inflation under control by raising official interest rates quickly. A great plan, I think. Nevertheless, I don't think inflation will come close to the 2% target anytime soon. Not only is the gap still large, but the housing market is also standing in the way of a rapid decline toward 2%. Rents and imputed rents to homeowners make up more than 30% of the US inflation basket. Both forms of rent follow house prices with a considerable lag. The following picture shows that rent growth could accelerate further from the 4.8% in April in the near future.

US: house prices and rents (%)

Median house price (12 months advance average)

Rent imputed to homeowners (right axis)

The interest rate rise is now remarkably strong.

Incidentally, the US housing market has not yet contracted, despite the sharp rise in mortgage rates in recent months. The following picture shows the change in 30-year fixed-rate mortgage rates over a 5-month period. The rate that has risen in recent months is unprecedented in the last 20 years. The US housing market has shown in the past to be highly interest-rate sensitive. In my view, therefore, it cannot be long before that market takes a hit.

US: Mortgage rate (30 years; % change over 5 months)

The outlook for economic growth remains very uncertain. Germany's ZEW index, which measures economists and analysts' confidence in the country's near economic future, improved slightly in May but remains at low levels. The assessment of the current state of affairs, on the other hand, continued the decline seen in recent months.

Don't forget the Chinese lockdown

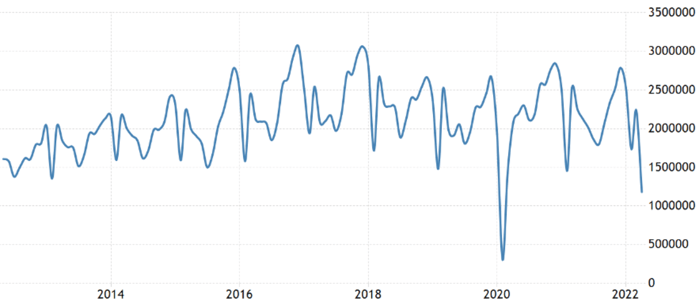

China is partially in lockdown and that is starting to be reflected in economic statistics. Production and transport are affected. In April, the value of exports was only 3.8% higher than a year earlier. In March this was still 14.7%. It is inevitable that we will soon notice this in the form of fewer deliveries of goods from China. That will not help our production. The fact that many Chinese are forced to sit at home also has an impact on spending. For example, Chinese car sales in April were more than 47% lower than a year ago.

China: car sales by month

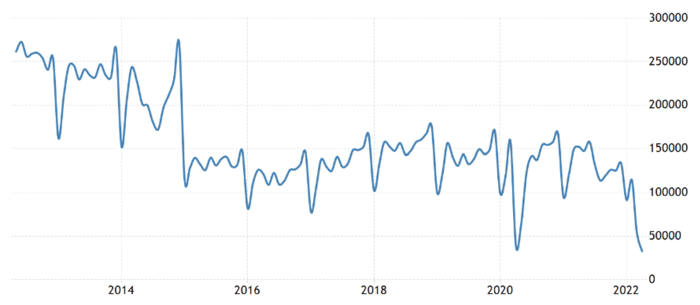

The war continues in Europe. This also has repercussions on the economy, both here and in Russia. I think that the Russian central bank is trying to cope with the situation as best as possible, but that it cannot avoid a sharp economic downturn. In Russia, car sales in April were more than 78% lower than a year earlier.

Russia: car sales by month

Closing

I find it difficult to be optimistic about the economic outlook. Inflation may fall slightly in the near future, but not very sharply. Central banks will tighten monetary policy further, potentially holding back activity. The war is leading to uncertainty and higher energy prices, which also hampers business. Finally, the Chinese lockdowns also affect the global economy.

If I am looking for something optimistic, it is that the uncertainty surrounding inflation is so high that the inflation rate could also drop sharply at some point. But on balance, you have to say that it is all just coffee grounds.