- Dutch business confidence in industry stronger than expected

- German economy records surprisingly strong growth in Q3

- Yet I continue to expect a recession

- ECB raises interest rates again and is not yet done with rate hikes,…

- …but almost. Seems to have turned around too

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 21 October 2022

We've been talking about an impending recession for some time now, but where is it now? According to ING, the recession in the Netherlands has already started. They base that conclusion on debit card transactions that their customers make. There is still an increase in the third quarter, but if you take inflation out of it, there is a minus. This means that ING thinks that the volume of consumer spending has decreased in the third quarter compared to the second quarter. And that's okay. The erosion in purchasing power is unprecedented and we had bought so much stuff during the lockdowns that it looks like a buyers strike is going on. That image is consistent with reports we hear about full warehouses.

I also note that our GDP grew extremely strongly in the second quarter, 2.6% from the previous quarter. This was partly due to incidental investments in fixed assets that probably did not repeat in the third quarter. When Statistics Netherlands publishes the first estimate of economic growth on 15 November, I think the number will be negative.

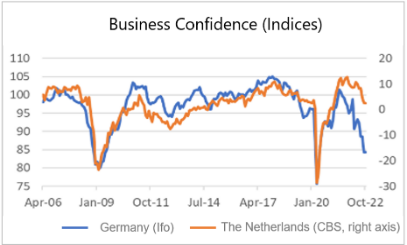

Yet the picture is certainly not negative across the board. For example, according to CBS, business confidence in the industry weakened slightly in October, from 2.5 to 2.6 in September, but this confidence index is still above the long-term average. I find that quite remarkable. The first graph shows that business confidence with us (at least on this measure) compares favourably with, for example, the confidence of German entrepreneurs. While I tend to distrust the CBS figure, I must acknowledge that the difference with Germany is consistent with the difference in manufacturing output. It is also much stronger with us than the German one. So, I shouldn't make the mistake of claiming that the figure is wrong.

Source: Refinitiv Datastream

The funny thing is that the confidence of entrepreneurs is especially strong in the electrical industry, mechanical engineering and in means of transport. Let that be precisely sectors where German companies are overrepresented. Maybe our entrepreneurs are just smarter than the German ones or there are local factors, such as bottlenecks in local transport or regionally different labour shortages that seem to give us an edge. For now, let's just stick to the supposed superior cleverness of our entrepreneurs...

Incidentally, the following picture shows that the expectations component of the German Ifo index has fallen to a very low level, clearly lower than at the time of the 'Great Financial Crisis' in 2008/09. The assessment of the 'current situation', on the other hand, is a lot more positive.

Source: Refinitiv Datastream

Where is the recession?

Contrary to expectations, the German economy did not shrink in the third quarter. According to an initial preliminary calculation, German GDP grew by 0.3% qoq in volume, where a contraction of 0.2% was expected. No details have been published yet, but the support measures may well have played an important role here.

France and the US did not shrink in the third quarter either. The French economy grew by 0.2% qoq and the US by 0.6% qoq (or, as the Americans put it, annualised 2.6%). The Chinese economy also grew strongly in the third quarter: 3.9% qoq, compared to -2.7% in the previous quarter. In China, industrial production growth also picked up in September: +6.3% yoy from +4.2% in August. It should be noted that China has become a stop-go economy due to the ongoing temporary local lockdowns. More structurally, it is important that the problems in the real estate sector in China continue. House prices have already fallen for five months compared to a year earlier, albeit relatively modest for the time being (in September -1.5%). The construction also notes minuses and very solid.

I maintain that we are entering a difficult period. This week, S&P Global released preliminary October purchasing managers' indices for a number of countries. See the table below. Except in France, the composite index (i.e. manufacturing and services combined) was below 50. Formally, that implies contraction, but for a real recession to occur, this figure should at least fall below 45. For the included countries, this is only the case in Germany. So far, this has apparently not led to a decline in GDP in volume.

| Composite PMI – Purchasing Managers Index |

||

| October 2022 | September 2022 | |

| Eurozone | 47,1 | 48,1 |

| Germany | 44,1 | 45,7 |

| France | 50,0 | 51,2 |

| US | 47,3 |

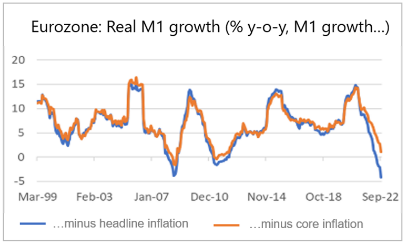

It is no longer fashionable to look at money growth these days. Because of my upbringing as an economist, I secretly do that anyway. In September, the growth of M3 in the eurozone accelerated slightly again: 6.3% after 6.1% in August. M1 growth actually slowed from 7.0% in August to 5.8%. The development of M1 is more relevant than that of M3 for the purpose of interpreting the economy in the short term. M1 growth has now fallen for 12 months in a row. Many economists look at M1 growth in real terms, (i.e. net of inflation). The next picture shows that picture where two lines are shown. In one case headline inflation has been subtracted from M1 money growth, in the other core inflation. However, the message is absolutely clear. Current real money growth is comparable to that of previous recessions.

Source: Refinitiv Datastream

ECB seems to be making a turn

The ECB raised all official interest rates by 0.75% this week. That was as expected. At the press conference, ECB President Christine Lagarde said that this move has made substantial progress in removing the stimulative influence of monetary policy. But apparently not quite. At the press conference in September, Lagarde had said two to five paces would be taken, including those in September. So now two of those five have been set. When asked how many more will follow, Lagarde was much more vague than last time. She repeated, almost ad nauseam, that the ECB is looking at the situation from meeting to meeting based on incoming data. She indicated, however, that the ECB considers three factors in particular, namely: 1. the economic situation and the resulting inflation outlook; 2. the interest rate hikes already implemented; and 3. The delays with which interest rate hikes work in the economy.

In September, Lagarde had emphasised that a recession is nothing more than a risk scenario. Now she was less adamant, reporting that a recession is increasingly likely. It all sounded less aggressive (or less hawkish if you will) than in September. The bond market reacted immediately with a drop in yields.

I continue to find the ECB story very strange. First, they created a huge amount of liquidity for years. Then they downplay inflation. They then claim that inflation is supply-side and that there is nothing the ECB can do about it. You would think that inflation is a situation where supply falls short to meet demand. Even if this is due to production problems, monetary policy can still contain demand in order to achieve a better balance. Anyhow… Then the ECB panics, accelerates interest rate hikes, indicating that the aim is to dampen aggregate demand in the economy. Is inflation now suddenly driven by too strong demand? And if Ms Lagarde is actually saying that current interest rates are still providing a stimulus to the economy, why not raise interest rates all at once to levels where they no longer are. In fact, Ms. Lagarde says the current interest rate level is still 'wrong'.

What also surprises me is that the ECB wants to further slowdown the economy while it is already on the brink of a recession, also according to the ECB. In addition, commodity prices are falling, freight prices are falling, and wages are rising, but at a slower pace than the rate of inflation.

If I were the ECB…

If I were the ECB, I would have raised interest rates much sooner and would just pause now to see how the economy and inflation develop. But hey, I'm not the ECB. My job here is not to tell them what they should do, but what they will do. Well, I think the ECB will raise interest rates one more time in December, by 0.5%. And then maybe again, at 0.25% or 0.5%. But then it's done.

The ECB Bank Lending Survey gives cause for concern

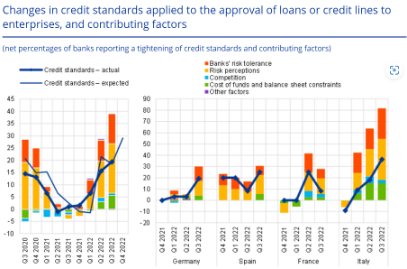

Every quarter, the ECB surveys a large group of commercial banks about credit conditions, credit demand, etc. The results of this bank lending survey were published earlier this week. I think it is an important survey because a tightening of credit conditions in the past has often foreshadowed cyclical weakness.

In that regard, this report is not very optimistic. Across the board, banks say they tightened their credit standards in the third quarter and expect to continue doing so in the fourth quarter. As can be seen in the following picture, it mainly depends on the risk perception of banks and their willingness to take risk. The situation is certainly not as bad as it was during 2008/09, but since the recession of 2011-2013, banks have not tightened their credit standards as much as they are now.

Source: ECB

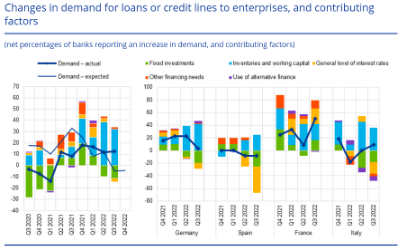

The following picture can also be found in the same report. It's about the demand for credit. The picture that emerges is not encouraging either. Companies ask for less credit to make investments in means of production and much more for working capital and to finance inventories. This indicates involuntary stock building and pressure on liquidity.

Source: ECB

Closing

The recently published figures do not provide an unambiguous picture of where the economy currently stands or is heading. Full warehouses, declining business confidence, very low consumer confidence and the ongoing erosion of purchasing power suggest that many economies are slipping into recession. On the other hand, several recent macro figures have surprised positively. For example, the German economy grew in the third quarter and Dutch business confidence in manufacturing remains above the long-term average. Still, I think the gravitational pull of the loss of purchasing power, increased operating costs and sharply higher borrowing costs will eventually take their toll and push the economy into recession.