- 17.1%

- 10.0%

- Panic in Frankfurt

- Recession inevitable

- Europe – US divergence"

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 30 September 2022

A dramatic figure, otherwise you can not call it. According to the European HICP measure, inflation in our country was 17.1% in September. In August it was still 13.7%. Obviously it was a record by this measure. And of course energy was the main culprit: +113.8% y-o-y against 'only' 88.4% in August. Yet it wasn't just energy. Non-energy industrial goods were 7.2% more expensive than a year ago, from 5.8% in August, while services price gains accelerated from 4.6% in August to 6.0% in September. The very little bit of good news was that food inflation moderated slightly: 10.5% more expensive than last year, from 10.8% in August.

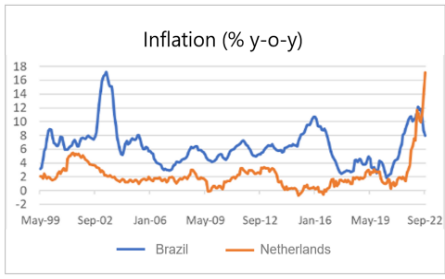

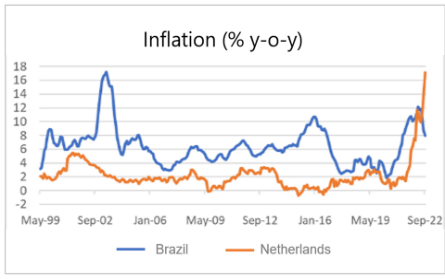

The national inflation measure that Statistics Netherlands will publish next week will come out at around 15%, compared to 12.0% in August. For 'fun', I have briefly compared Dutch inflation against that in Brazil in the following chart. That country has actually been struggling with high inflation for 40 years, but now we envy the Brazilians for their inflation. I never thought it would come to this again.

This year, our economy is still growing by 4.6%. Two-thirds of this was already realised in the first half of the year. Next year, the growth will still be 1.1%, according to the CPB.

Source: Refinitiv Datastream

Questions in parliament

Of course we are not the only European country with a phenomenal inflation problem, but we are high 'in the left row'. We only have to tolerate the three (3) Baltic countries, although we did catch up with those three (3) in September. In the eurozone as a whole, inflation stood at 10.0% in September, compared to 9.1% in August. Core inflation accelerated from 4.3% in August to 4.8% in September. It is striking that inflation in France is only 6.2%. Energy prices there were 17.8% higher in September than in September 2021. For the eurozone as a whole, this was 40.8%. That makes quite a difference with our 113.8%…. Isn't it time to ask questions in parliament about this?

The consequences of such inflation are obvious. First, it leads to an unprecedented erosion of purchasing power and it is inevitable that consumer spending will take a serious hit. In the short term, that blow may not be too bad because the inflation figures slightly exaggerate the actual state of affairs. It's a well-known story. Statistics Netherlands calculates energy prices as if all people are now signing a new contract. That is not true. But when the current permanent contracts expire, everyone will still have their turn. Another extenuating circumstance is that many people have financial buffers and with that they will maintain their spending for some time. But that too is finite.

Statistics Netherlands also published figures on retail sales for August (when inflation was 'only' 13.7%) today. These turnovers were 1.7% higher than a year earlier, but inflation has yet to come down. In volume terms, sales were 6.0% lower than in August last year. It was the fourth month in a row with a negative figure. Retail sales are only a part of total consumer spending, but they do give an indication.

Source: Refinitiv Datastream

I think a recession is inevitable. What is different from previous recessions is that monetary policy cannot be expected to provide impulses to support the economy. In fact, panic had already broken out in Frankfurt and is now increasing rapidly, I imagine. Undoubtedly, the ECB will raise official interest rates considerably further. At the latest press conference, ECB President Christine Lagarde said the aim of those interest rate hikes is to dampen economic growth. Well, none of that economic growth remains this way, so the ECB is helping the trend towards recession.

The picture is not improving in Germany either. Inflation there too rose considerably in September, albeit mainly because temporary support measures (such as very cheap regional public transport and a reduction in petrol excise duties) expired in September. German business confidence as measured monthly by the Ifo Institute fell again in September. In the next picture I have depicted the 'expectation component' of that index. This is seen as a good indicator of where the German economy is heading in the short term. The picture needs no comment.

Source: Refinitiv Datastream

For the eurozone as a whole, the picture is somewhat less dramatic. The Economic Sentiment Index compiled by the European Commission, which reflects business and consumer confidence, fell from 97.3 in August to 93.7 in September, below the long-term average of around 100.

Source: Refinitiv Datastream

€200 v €23

The major problem for Europe remains the European gas price. At the time of writing, it is trading at around €200 MWh, which is thirteen times (!!!) from before the pandemic. By way of comparison, the American gas price is approximately €23 MWh! We can put together support packages until we drop, but if we don't bring the gas price down, this huge problem will remain. I occasionally read enthusiastic stories that we are currently no longer importing Russian gas. That is completely irrelevant, as far as our economy is concerned, it is about the price we pay regardless of where that gas comes from. (Sigh…). Why don't I read or hear anything about plans to bring that gas price under control? (Sigh, sigh…)

Incidentally, I do think that strong disinflationary forces are currently developing that will eventually bring inflation down. Think of the now rapidly falling freight prices, falling commodity prices (except gas), the diminishing logistical disruptions and the recession itself. But it's certainly not that far yet.

Economic divergence Europe and US

The Americans have their own challenges. Inflation is also higher there than they would like. They have more to blame than us for this, because shortly after taking office the Biden government completely destroyed the economy with an insanely large stimulus package. But inflation is now lower than in our country (which is not that difficult) and the difference in gas price is also very decisive for the difference in the economic outlook.

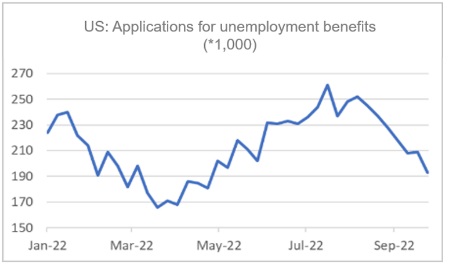

From April, it appeared that the US labour market gradually relaxed somewhat. The weekly number of applications for unemployment benefits increased slightly from April. That trend has now been reversed. As of the last part of July, the number of applications decreases again, as can be seen in the following graph.

Source: Refinitiv Datastream

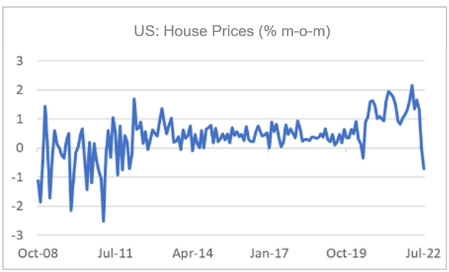

What is starting to bother the US is the rapid rise in interest rates, which is also pushing up mortgage rates. This sharp rise in interest rates is depressing house prices. The following chart shows that the year-over-year rate of increase in US home prices is currently declining rapidly. This is because house prices have stopped rising in recent months, in fact, prices fell in absolute terms in June and July. Two months is not a trend yet, it seems to be a logical consequence of the rise in interest rates. If the housing market weakens, that will also hurt economic growth in the US.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

China has a unique position

Of all countries, China has made by far the largest contributor to global economic growth over the past two decades. Unfortunately for the rest of the world, the country now faces major challenges. Covid-19 continues to affect the country economically. Lockdowns are regularly put in place to deal with corona outbreaks. The real estate sector also continues to weaken. Furthermore, it seems that it is becoming increasingly difficult for policymakers to maintain economic growth.

A positive exception

Is there no country where things are just getting better? Yes! There is one country where the economy is shrinking less this year than previously expected. In that country, unemployment fell to 3.8% in August, from 3.9% in July. Business confidence in that country has been improving for a few months now, and inflation that had previously risen is now falling. Which country is that? Russia! What the heck?

Closing

It makes me sad, very sad. Inflation of more than 17%, far above an inflation-prone country like Brazil. Why is no one asking why our inflation is so much higher, even than in comparable countries? Why is nobody doing anything about the high European gas prices? (In Belgium they manage to shut down a nuclear power plant!) Why does no one notice that we are going to hell economically while the Russian economy seems to be stabilising and recovering? Why did our central banks act so late and switch from underestimating and trivialising to panic in one fluid motion? Why are they now about to give a further push down to the already seriously weakening economy? Well, so sad. Not to mention the chaos in the UK. It is feared with great fear. And then those snipers from Napoli will also come to the Johan Cruijff Arena on Tuesday. Am I going to sit in the stands with my full mind? I should probably know better.