Google Translated from Dutch to English. Link to the original post in Dutch below.

- Dutch consumer confidence continues to fall…

- …but spending remains stable

- Analysts are becoming increasingly positive about the future, according to the ZEW survey

- Chinese growth slowdown continues and leads to interest rate cut in China

- Fed will operate cautiously and that is positive for financial markets

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 21 January 2022.

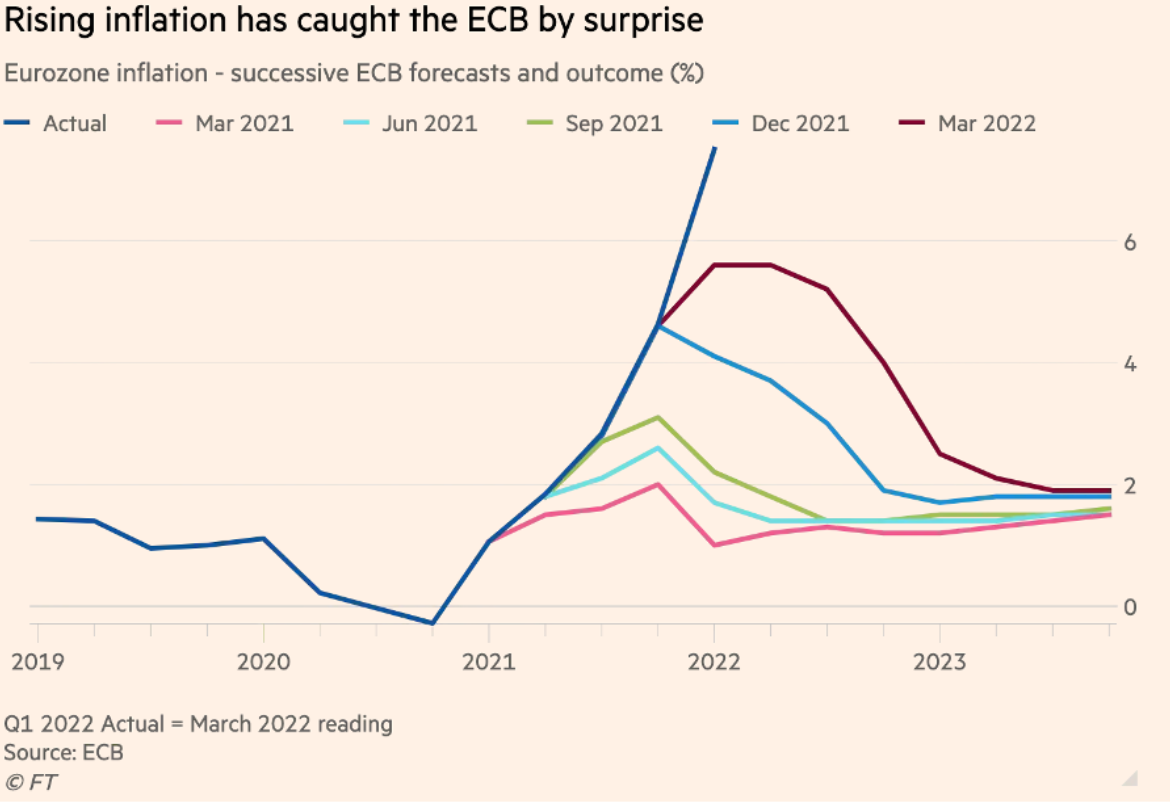

Dutch consumer confidence fell for the fourth consecutive month in January. The first chart nicely shows how low confidence is currently in a historical perspective. The willingness to buy, a sub-index, is now even lower than in April and May 2020, but still significantly higher than during the euro crisis in 2013.

The confidence of Dutch consumers is currently under the influence of strongly opposing forces. Unemployment is low and the economy is growing at a decent pace. On the other hand, confidence is suffering from the waves of corona infections, the related lockdown measures and the unrest that all this is causing. The rise in inflation is undoubtedly also having a negative impact on the mood, while the political squabbling probably does not help either.

Netherlands: Consumer Confidence (Index)

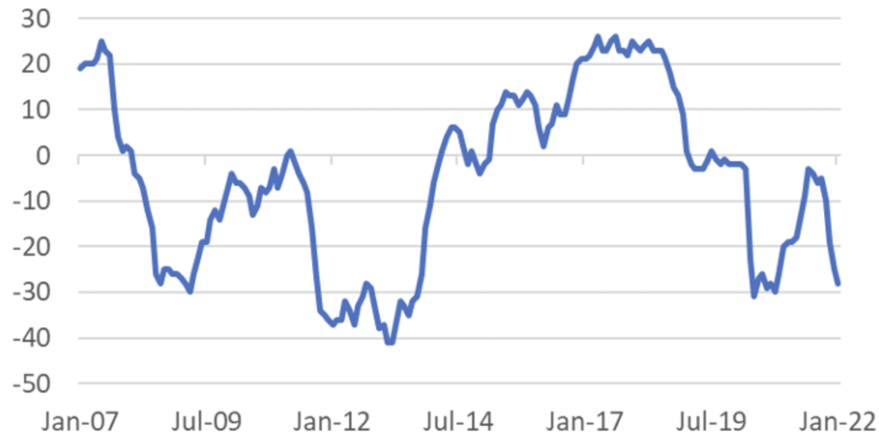

Ultimately, the economy is not about confidence, but about economic activity, which is driven by spending. Consumer spending figures are unfortunately several months behind schedule. In November, the volume of household consumer spending was 8.7% higher than one year previously. That figure is quite flattering because some of the stores were closed a year earlier and spending was 6.5% lower than in the same month in 2019. Still, the November figures look healthy. That is an interesting fact, because the 'willingness to buy' already fell sharply in November, according to CBS. It seems that there is a discrepancy between confidence and actual spending. Incidentally, spending will have fallen in December due to the increased restrictions on public life in that month.

It looks like the government will decide on further easing in the foreseeable future. Inflation is also likely to be close to its peak. It is then logical that consumer confidence will recover somewhat, although price increases will continue to affect confidence.

The following chart provides a good insight into the breakdown of consumption. During the pandemic, there has been a shift from spending on services to spending on goods. If the easing continues, consumers will also spend more on services and the pattern will normalise.

Netherlands: Consumer Consumption

(% y-o-y, 3 month moving average)

Unemployment rose slightly in December: 3.8% against 3.7% in November. Incidentally, this is a new measure in connection with the harmonisation of the system used within EU countries for measuring unemployment. On the 'old' benchmark, unemployment stood at 2.8% in December. The slight increase in December will be related to the tightened lockdown. Our unemployment rate remains low from an international perspective as well as historically low. What struck me most about these figures is that 3.4 million people in the 15-75 age group are not part of the workforce. In view of the staff shortages, you would think that it should be possible to entice some of these people to participate in the labor process after all.

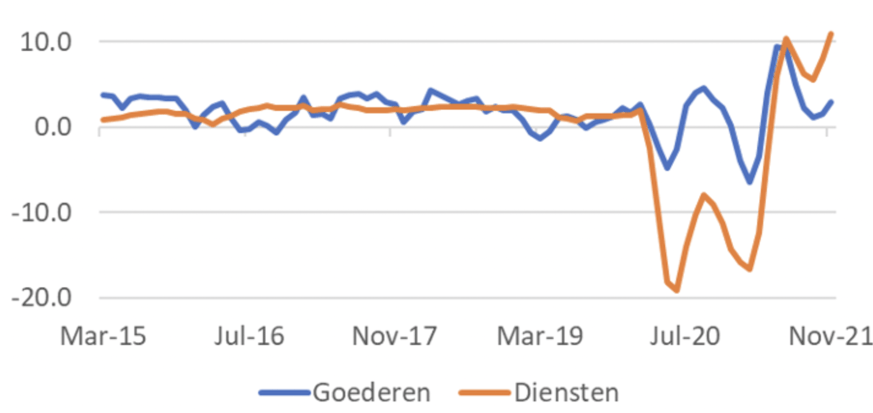

Germany shrinks in Q4

The German economy is likely to contract slightly in the fourth quarter of 2021. This can be deduced from figures that German statisticians have already produced for the year as a whole, even before the figures for the last quarter are published. In that light, the ZEW index is interesting. This index measures confidence among economists and analysts and distinguishes between how people judge the situation at the time and expectations. The following picture shows that people have been less positive about the state of affairs for several months in a row. That is consistent with the contraction that probably occurred in the fourth quarter. It is equally clear that the assessment of the future has become more positive for months. That gives citizens courage.

Germany: ZEW Index

(Expectations v Current Situation)

Chinese economy cools; policymakers give support

The Chinese economy is cooling. It seems that the problems in the real estate sector are the main driver. It is inevitable that activity in that sector will decrease and because the sector has a relatively large weight in the economy, this can be felt in the rest of the economy. The harsh lockdown measures that are put in place when the coronavirus rears its head don't help either. While GDP growth accelerated to 1.6% quarter-on-quarter in the fourth quarter (from 0.7% in the previous quarter), industrial production and consumption growth are currently unimpressive. Retail sales growth was just 1.7% yoy in December. That is very thin. Industrial production outperformed at 4.3% growth, but growth rates of slightly above 6% were normal before the pandemic. Policymakers have meanwhile cut interest rates somewhat to support the economy. As China has been the growth engine of the global economy for decades, the Chinese slowdown is making the outlook for the rest of the global economy more uncertain.

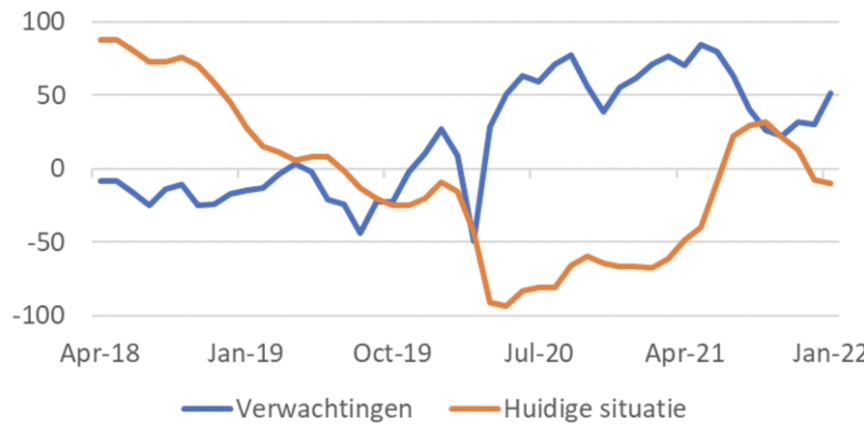

Fed will not tighten aggressively

Chinese policymakers have now also called on the US Federal Reserve not to raise interest rates in the US or as much as possible. However, it is clear that US official interest rates will be raised in the foreseeable future. A lot has been said and written about this lately. The Fed has recently seen a remarkable change of tone. Just a few months ago, it was said that higher inflation was temporary and did not require a policy response. That is why the policymakers did not foresee any, or at most, one rate hike this year. In the latest overview of such expectations by the members of the policy committee, three interest rate increases suddenly appeared as the most likely scenario for 2022. This did not leave the capital market interest untouched. In August last year, the effective yield on 10-year US government bonds was still 1.20%. It was 1.35% at the beginning of December and recently the effective yield soared above 1.80%.

In fact, the rise in capital market interest rates is not that bad given the inflation rate of 7% and given the twist that the Fed has taken. It seems to me to be a signal that the market is far from panicking about the inflation outlook.

Nevertheless, the stock market is having a hard time with it. Growth stocks in particular are taking a hit. That makes sense because low interest rates have contributed to high valuations for these types of stocks. It raises the question of whether this is an interesting 'entry point' or whether we have just started a sharp fall in the price.

I tend to think this is a good entry point rather than the beginning of the end of the bull market. The S&P 500 is already down nearly 7% from its high. A much further fall in prices will probably require either a sharp weakening of the economy or a more aggressive process of rate hikes by the Fed than is currently priced in. Of course both are possible. They probably don't look like me though. The economy has too much momentum and too few underlying problems to cool very sharply. In fact, it seems that the Omicron variant could be a blessing in that it appears to be much more contagious but also much milder than its predecessors. As a result, natural herd immunity may be built up without the need to largely shut down public life.

As for the Fed, I suspect it will be very cautious. Of course this is an uncertainty. But the turn from 'it's not that bad with inflation' to 'we have to take action' has been made, it is behind us, it is priced in. The only uncertainty is how aggressive the Fed will be. I don't think they will be very aggressive. I'll take a stab at that, though. If inflation expectations were to rise sharply, it would be a different story. Now expectations for inflation in the relatively short term have risen considerably, but that is logical because they are clearly influenced by the actual development of inflation. The expectations for longer periods have risen much less and not significantly higher than they have been in recent years.

Inflation is likely to be close to its highest level. When inflation figures fall, a very different atmosphere will emerge, which will allow the Fed to sit back a bit. I think the real problem comes when inflation doesn't fall to around 2% but stays above 3%. However, that is for later concern.

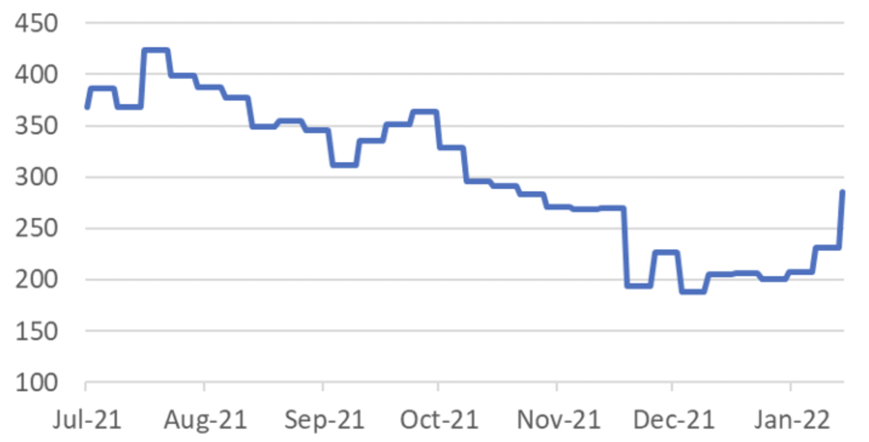

While I am not pessimistic about the economic outlook, there can always be doubts about economic growth. Take the latest unemployment benefit claims figures. Recently, they dropped to just under 200,000 a week. As the following chart shows, the numbers have increased again in recent weeks and 286,000 claims were made in the most recent week for which figures are available. It seems to me that the Fed will exercise caution in such developments.

USA: No. of unemployment benefit applications (* 1,000)

The Fed will thus want to guard against unnecessarily damaging the economy. But equally, the Fed will not want to cause financial instability. That is certainly a risk when monetary policy is tightened too quickly and/or too much. This overweight also leads to the conclusion that the Fed will not be very aggressive.

Another challenge for the Fed is that it is difficult to determine the current equilibrium value for interest rates. If you want to switch from stimulative policy to 'neutral', you need to know where that neutral interest rate is roughly. From the end of 2015, the Fed raised the key rate until 2019 in a large number of steps. When that interest rate had reached 2.5% in 2019, it turned out that the economy was struggling. The Fed was forced to cut interest rates again in a number of steps in 2019. Undoubtedly, the weakening of the economy in 2018 and 2019 was not only due to interest rates, but I suspect that they certainly played a part. This traumatic experience will still be in the memory and will lead to restraint.

If I'm right, the following picture will unfold over the course of the year. The economy is reopening as we move out of the pandemic. Inflation is falling, maybe not very fast, but it is falling. The Fed will raise interest rates, but not more aggressively than currently expected. Corporate profits continue to grow significantly. Such an environment seems positive for equity markets to me and the correction that is currently underway (and could of course last longer) in the equity markets is pushing prices towards a more interesting level for buyers.

Closing

I conclude that not only the Dutch but also other economies are being tossed back and forth by all kinds of, often opposing forces. Anyone who believes that we are going to put the pandemic behind us must be a little positive. I think there are currently four major uncertainties.

- Of course, the coronavirus is a major uncertainty. Perhaps the omicron variant is a blessing. I'm hopeful.

- Above I did not mention the geopolitical uncertainty. Should Russian troops invade Ukraine, it will send shockwaves through the financial markets that will have negative macroeconomic consequences. I'm hopeful it won't come to that.

- The Chinese economy should not weaken too much. I am hopeful that Chinese policy makers will prevent this.

- Inflation and the extent to which the US Fed will tighten monetary policy is a final uncertainty. I am hopeful that inflation will come down soon and that the Fed will take it relatively easy.