- Our GDP has now shrunk for two quarters in a row

- The CPB predicts recovery in the second half of the year…

- …I still have to see that, because…

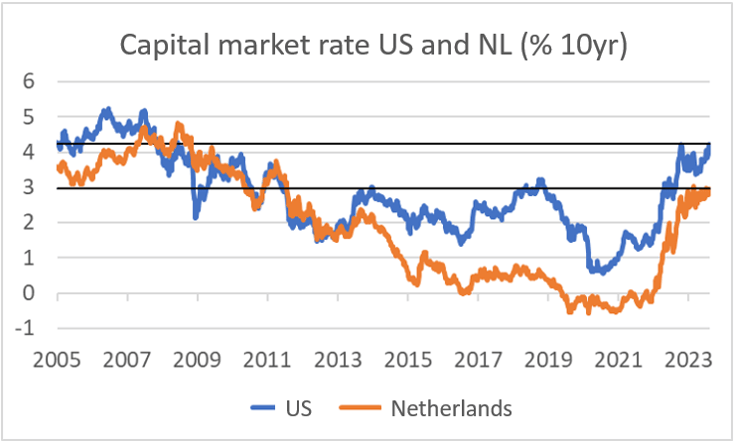

- …the capital market interest rate is rising and…

- …the prospects for world trade are unfavorable…

- …because the Chinese recovery is certainly not getting off the ground

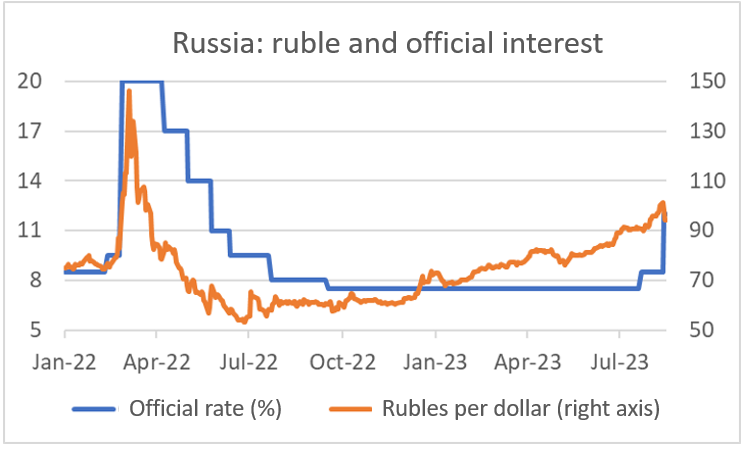

- The Russian central bank is raising interest rates sharply

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 18 August 2023.

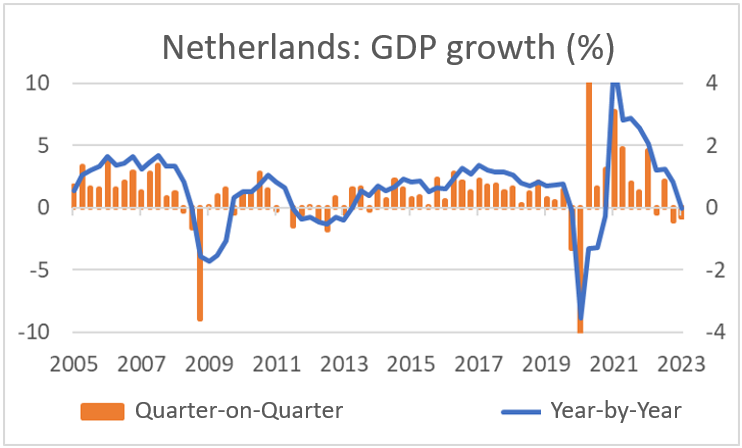

Our economy also shrank slightly in the second quarter: -0.3% quarter-on-quarter after a contraction of 0.4% in the first quarter. According to the rule of thumb that an economy that contracts for two consecutive quarters is in recession, we can say this is the case. Year-on-year there is now also a minus.

Private consumption and foreign trade in particular were the causes of the contraction. Consumption fell by as much as 1.6% and exports by 0.7% compared to the previous quarter. Investments still grew by 1.3%, but that was also weaker than the +2.7% of the first quarter.

Source: Macrobond

This is – so far – a mild recession. The labour market remains tight. Although unemployment rose slightly in July: 3.6% against 3.5% in June, this was due to more people entering the labour market. The number of jobs increased slightly.

In the draft MEV (Macro-Economic Outlook), the CPB predicts that our economy will grow by 0.7% this year. This will require the contraction in the first half of the year to turn into slight growth. Honestly, I don't see that happening yet. Wage growth is currently outpacing inflation, increasing purchasing power, but world trade remains weak and interest rates continue to rise.

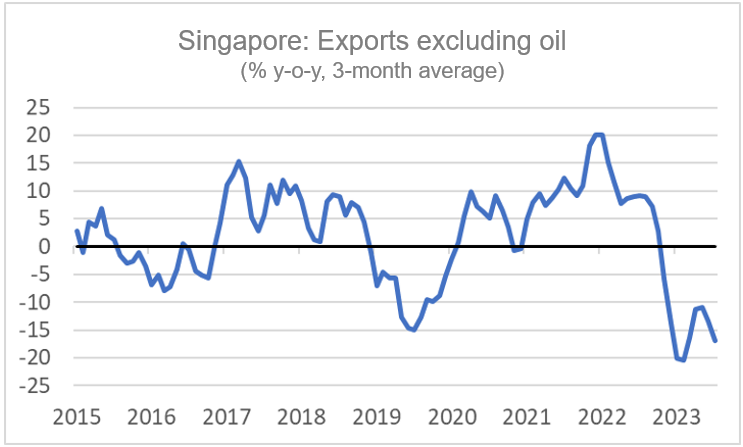

World trade is currently depressed by the lack of a strong recovery in China. In July, industrial production was 3.7% above the level of a year earlier, but that is meager for China. In June it was still 4.4%. Chinese consumers are also failing. Retail sales in July were only 2.5% higher than a year earlier. In June it was 3.1%, but rates close to 10% were common in the years before the pandemic. Unemployment rose from 5.2% in June to 5.3% in July. It is writing on the wall that China's statisticians have stopped publishing figures on youth unemployment. It had risen to 21.3% in June. In addition, some real estate companies have run into problems (again). I see more and more pessimistic analyses and comments about China.

The world economy depends on China and, of course, the countries in the region completely. The figures on Singapore's exports are therefore also significant. This is of course a relatively small economy, but very open, and sensitive to international trade and certainly to developments in China. The following picture shows that Singaporean exports are currently falling sharply. Although Singapore is far from our bed, that is not a good sign for us either.

Source: Macrobond

Orders also appear to be recovering in the US industry. The new industrial orders sub-index in the Institute for Supply Management's (ISM) monthly survey improved slightly in June to 45.6 from 42.6 in May. So that remains a low level, but, as I said, it's about the change here.

Source: Macrobond

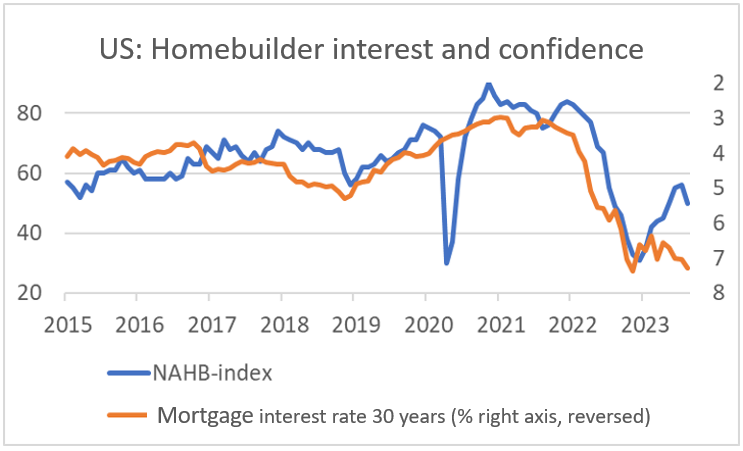

High-interest rates put downward pressure on spending. Naturally, some sectors are more interest-rate sensitive than others. The housing market in particular is interest-sensitive. In the US, the link between interest rates to the housing market is very fast and strong. The next picture shows confidence among homebuilders and mortgage market interest rates (on an inverted scale so that a fall in the line represents a rise in interest rates). Confidence had been on the rise since the beginning of the year as interest rates did not continue to rise, but in August the confidence index of the National Association of Home Builders fell again, no doubt because of the rise in mortgage rates. I must say that the American consumer is not yet discouraged. Consumption continues to increase steadily.

Source: Macrobond

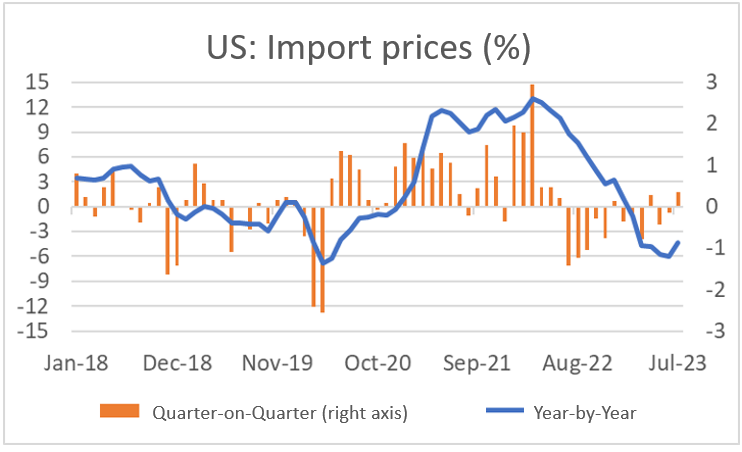

Inflation has fallen recently and I have often written that this trend will continue in the near future. I have also written before that the decline in inflation is partly due to temporary factors. It is useful to see what is in the 'pipeline'. Import prices are such an indicator. These are usually ahead of consumer prices. In July, American import prices increased by 0.4% compared to June. The next picture shows that deflation in import prices is currently decreasing. There is still a decline year on year, but the upward trend appears to have begun. This will eventually reduce the depressing effect on consumer prices. Therefore, after a decline in inflation, we should expect some increase again in the coming months.

Source: Macrobond

The Russian central bank raised the official interest rate from 8.5% to 12% this week. Less than a month ago, the interest rate had also increased: from 7.5% to 8.5%. The reason for these actions is the weakening ruble and rising inflation. Paradoxically, these are the result of the better-than-expected development of the Russian economy last year.

When war broke out, the ruble fell sharply. The central bank sharply increased interest rates and also managed to stabilise the ruble by introducing restrictions on international capital movements. In fact, it recovered strongly. Because we wanted to export much less to Russia, a large surplus emerged on the Russian trade balance. The ruble supported that. But imports are now increasing again because the Russians have found other suppliers and because of the growth in domestic demand, while production capacity is being damaged by the war. The surplus on the trade balance has more or less disappeared and with it, the support for the ruble has disappeared. It will be a hell of a job for policymakers to bring and keep the economy in calmer waters.

Source: Macrobond

Source: Macrobond

Closing

Our economy has shrunk for two quarters in a row and according to economists' rule of thumb, this means we are in a recession. Everyone calls the recession mild and the CPB predicts a recovery. Hopefully, they are right, but rising capital market interest rates and the weakness of global trade are significant headwinds. The problems in the Chinese economy appear to be greater than expected and the recovery is failing to get off the ground. I am therefore not yet convinced that we can get away with two quarters of contraction.

While it is reasonable to assume that inflation will continue to decline in the near future, we must realise that some of the factors pushing down inflation are temporary. The decline in import prices in the US appears to be over. Lower import prices can be seen as 'dis-inflation in the pipeline'. So it will disappear. After a decline in inflation over the coming months, we should therefore expect some increase thereafter. How powerful it will be is still very uncertain.

The Russian central bank has raised interest rates for the second time in a month. It is thus responding to rising inflation and the weakening of the ruble, two developments that can reinforce each other. There is a good chance that Russian interest rates will rise further. The pressure on the economy and the challenges for policymakers are increasing.