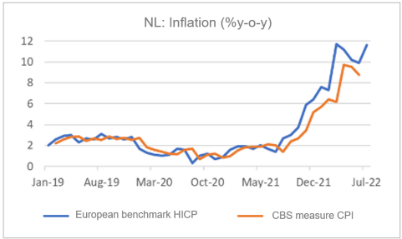

- Inflation picks up again in July…

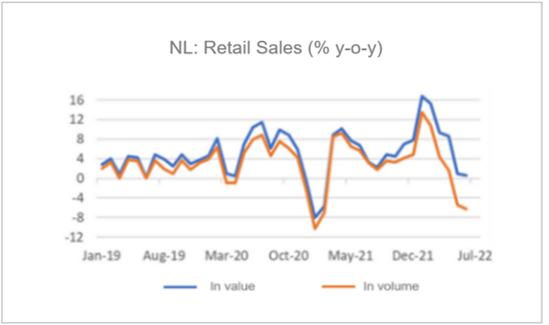

- that further erodes purchasing power

- Retail turnover already sharply down in volume

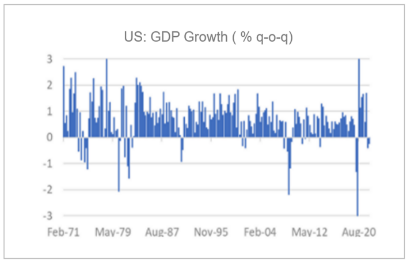

- US is also heading for a recession

- Fighting inflation is given priority over economic support

- The course of recessions is therefore uncertain

- Hopefully the labor shortage will be solved by the recession

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 29 July 2022

What exactly is a recession? As a rule of thumb, economists say that an economy is in recession when GDP (in volume) shrinks in two consecutive quarters. Unfortunately, GDP is an all-encompassing measure, which can sometimes cause significant distortions. Also, GDP figures can be revised frequently and substantially. That rule of thumb is therefore not very useful. The Americans have a committee of experts responsible for determining when there is a recession: the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER). They refer to a recession as: a. a substantial decline in economic activity; b. which manifests itself broadly in the economy; c. and lasts longer than a few months. In doing so, the committee looks at variables such as the labor market, production in industry, people's incomes, consumer spending, etc. Of course, the committee can only determine in retrospect when a recession has started and later ended.

I can only guess in real time. It is obvious that many economies are currently heading for a recession. The biggest culprit is skyrocketing inflation. This not only creates great uncertainty, which makes consumers and companies reluctant to spend. Inflation also erodes purchasing power, so that ultimately consumers cannot do much other than buy less (in volume). Add to that the uncertainty caused by the war, the ongoing logistical problems in the world and the labor shortage. The argument that we are going to end up in a recession then becomes very convincing.

Recessions hurt. People lose their jobs, companies go bankrupt, creditors lose some of their claims, house prices often fall, just like stock prices, which shrink wealth. On the other hand, recessions are also seen as a kind of cleansing. Some of the companies that go bankrupt had no raison d’être and falling house prices is annoying for people who bought at the top, but it makes houses more affordable for many others. The current labor shortage will possibly disappear because of a recession.

Governments and central banks often try to ease the pain by stimulating the economy through additional government spending and interest rate cuts. The problem with the upcoming recession is that inflation is so high that governments and central banks must prioritize controlling inflation. Stimulating activity will have to wait. However, governments must support the most vulnerable groups with specific measure.

More Inflation

I was already afraid of that. Inflation in our country rose further in July. On a European scale, inflation rose from 9.9% in June to 11.6% in July. That is a significant increase. Many details are not yet known. My fear of further inflation was based on two facts. Firstly, gas prices and thus electricity prices have risen sharply again in recent weeks. In addition, rents in our country were frozen, but could be increased slightly as of 1 July. Next week, CBS will publish the national figures with all the details.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

High inflation is beginning to have a significant impact on spending. Retail sales provide a good indication of consumer spending. In June, those turnovers were only 0.7% higher than a year earlier (0.4% when adjusted for the number of shopping days). In terms of volume, however, turnover was no less than 6.2% lower. A large part of the fixed costs of households are not part of retail turnover. I conclude that people must spend so much more on that that there is little left. In the past, the economy has been in recession when retail sales declined in volume as much as today.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

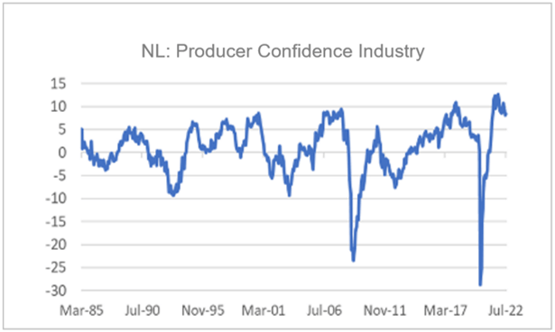

A positive exception

Dutch industrial entrepreneurs don't seem to care much about all the trouble. Business confidence measured by CBS even improved marginally in July and as the following chart shows, confidence is unprecedentedly high from a historical perspective. It should be noted, however, that the high figures are mainly based on the electrical and mechanical engineering industry. Yet…

Source: Refinitiv Datastream

Source: Refinitiv Datastream

Compare that with our eastern neighbours. The Ifo index, which measures confidence among German entrepreneurs, fell again in July. The key 'expectations component' came in at 80.3, down from 83.5 in June, like the trough of the 2008/09 recession (79.2) and not so far above the all-time low of this April series 2020 (71.9). I should add that the Ifo index also includes entrepreneurs from the service sector (as opposed to the CBS index of Dutch producer confidence) and that the methods used differ, which may lead to a comparison. Yet…

Source: Refinitiv Datastream

Source: Refinitiv Datastream

Eurozone GDP growth surprises positively

According to initial estimates, the eurozone's GDP grew by 0.7% in the second quarter, ahead of expectations. I look at those numbers with some suspicion. Such strong growth really doesn't seem in line with many other economic indicators.

Consumer confidence down everywhere

Consumer confidence in the eurozone took another blow in July and has reached a very low level. Unfortunately, that offers little perspective. Elsewhere, it is not really much better.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

The US is not in recession, not yet…

US GDP contracted again in the second quarter, according to preliminary calculations. After an annualized decline of 1.6% in the first quarter, a minus of 0.9% followed in the second quarter. You can conclude that the US has entered a recession, at least if you follow the rule of thumb that an economy that shrinks for two quarters is in recession. Fed chief Jay Powell and Treasury Secretary Janet Yellen do not follow that rule. And I don't like it either. During his press conference, Powell pointed out that some 400,000 jobs are still being created each month, spending is still growing, GDP figures are complicated and often subject to significant revisions, even years later. I wholeheartedly agree with Powell.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

What is not, however, may come. The GDP figures for the second quarter were pushed down mainly, but not solely by destocking. There were more weaknesses. Housing construction shrank 14.0% (annualized qoq). Companies invested 11.7% less in commercial buildings and 2.7% less in equipment. While consumer spending grew 1.0% (annualized qoq), it was the smallest increase since the second quarter of 2020.

Interest-rate sensitive sectors are affected by the rise in interest rates. And, as I have reported several times, the yield curve (10-year and 2-year interest rate differential) is inverted. Every recession in the past 50 years in the US has been preceded by a yield curve inversion. It seems to me that the probability of the US entering a recession is significantly more than 50%.

Powell is clear: inflation has priority, if necessary, at the expense of a recession

Fed boss Powell was asked several times at his press conference: Will the Fed accept a recession if it is necessary to bring inflation under control? He avoided that question as much as possible. But in the end, Powell said that controlling inflation is top priority. You cannot have a strong labor market in the long run without a high degree of price stability, he says. It means that the Fed will not try to boost activity with rate cuts until inflation is under control, even if a recession looms.

The Fed has raised its rate four times this year, this week, as it did in June, by 0.75 percentage points. There's more in the barrel. Powell said the June projection is still valid, implying another 1% will be added before the end of the year, spanning the three remaining policy meetings. The expectations in the market are similar. For 2023, however, market expectations and the Fed projection diverge. Market participants expect rate cuts in 2023, while the members of the Fed's policy committee expect a slight further hike in interest rates on balance. I've been looking at this sort of thing for decades. While I have a lot of respect for central bankers, I must say that market participants are more likely to be right than central bankers when expectations diverge.

Conclusion

Many economies are heading for a recession. Continued high inflation is the main culprit. This affects purchasing power and spending seems to be gradually experiencing the negative consequences. The uncertainty caused by the war, logistical disruptions and labor shortages do not help either.

Governments and central banks must give priority to controlling inflation. As a result, they have no room for the time being to crank up activity. That is an important difference from previous recessions. The current situation is therefore more unpredictable than is normally the case.

About the author

Han DE JONG is an independent economist, owner of Crystal Clear Economics and an associate of Llewelyn Consulting. Han features almost daily on Business News Radio (BNR) and is an advisor to several family offices as well as institutional investors. Han was formerly the Chief Economist of ABN AMRO Bank.