Stock markets are under great pressure. Rising interest rates and especially the planned policy of the US central bank are seen as the main cause. After all, equities are assets with high duration and are therefore sensitive to interest rates, although interest rates are, of course, not the only factor that counts.

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 16 May 2022.

Last year, Fed chief Powell argued high and low that the higher inflation would be temporary. Therefore, he and his fellow board members saw no reason for that inflation to tightening monetary policy. Meanwhile, the Fed has made a spectacular turn, and many board members can hardly move fast enough with the rate hikes.

People are realizing that there needs to be a greater balance between supply and demand in the economy. The Fed has no influence on the supply side of the economy in the short term. The Fed's contribution to the process of balancing supply and demand is that it slows demand through rate hikes. But by how much should interest rates go up?

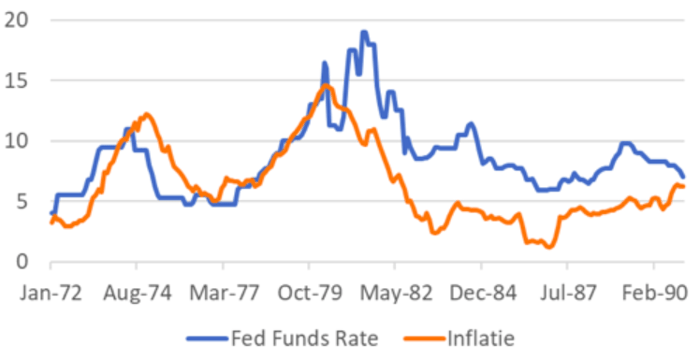

The experiences of the 1970s and 1980s are by no means reassuring for equity investors. In the 1980s, in particular, a positive real interest rate proved necessary to put the inflationary spirit back in the bottle. The US inflation rate is 8.3 percent, and the official interest rate is 0.75-1.0 percent. I don't know anyone who dares to argue that the Fed Funds Rate should increase 8 percent or even higher. This is probably due to the widespread understanding that temporary factors such as higher freight rates and delivery problems have driven up inflation in part. They will stop for a while and may even lead to a reversal of the upward trend. In a few months, base effects are also likely to weigh on inflation.

US: Official interest and inflation (%)

Investors now need to answer two crucial questions. First, how high is the inflation left after temporary factors have dissipated, and base effects have taken hold? The second question is how interest-rate-sensitive the economy is at the moment.

I suspect that US inflation will gradually fall but not fall below 4 percent on its own. That 4 percent might be a good target for central bankers. If we apply the rule that the real interest rate should be about equal to or slightly higher than inflation, then a development of the Fed Funds Rate in the direction of 4 percent is a realistic expectation.

Interest rate sensitivity

But then there is the second question, how interest-rate-sensitive is the economy? If it is highly interest-rate sensitive, a modest rate hike will quickly bring about the intended slowdown. I think the economy is more than average interest rate sensitive because of the sizeable gross debt in various parts of the economy. For that reason, I would assume that the required interest rate rise may be somewhat less than up to the 4% I just explained.

The fact that inflation expectations for the longer term have risen to a limited extent also makes it likely that a relatively small rise in interest rates will suffice. Then there is still a way for the Fed to go, but I don't think a Fed Funds Rate reaching, say, 3% will shock financial markets because it is already largely factored into the expectations of market participants.

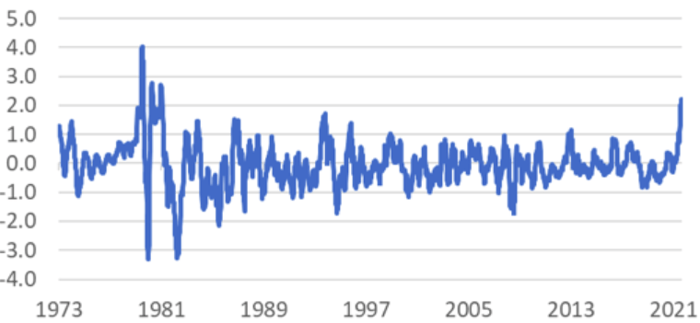

The housing market is very sensitive to interest rates, and the rise in mortgage rates can have a major impact. It has risen sharply, especially in the last five months. My previous chart shows, for every moment, how strongly mortgage rates have developed in the previous 5 months. An increase such as we have seen since the turn of the year had not occurred in the last 40 years. That cannot be without consequences.

US: 5-month change in mortgage interest rate (30 years)

Interest rates must be raised to bring inflation under control. And interest rate hikes are not good for the stock market. I think that the degree to which interest rates in the US have to go up may be better than expected.

The current high inflation will partly fall on its own, and I think the interest rate sensitivity of the economy is high. Most of the required interest rate hike has already been priced in by the market. If that reasoning is correct, then the worst for equity investors is behind us.