-

Consumers are highly pessimistic, producers are very optimistic

-

Producers can essentially pass on inflation; consumers cannot

-

Inflation drops slightly in April but broadens

-

Consumers spend money…

-

…and makes it so easy for producers to implement price increases

-

Ultimately, consumer spending growth will slow

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 29 April 2022.

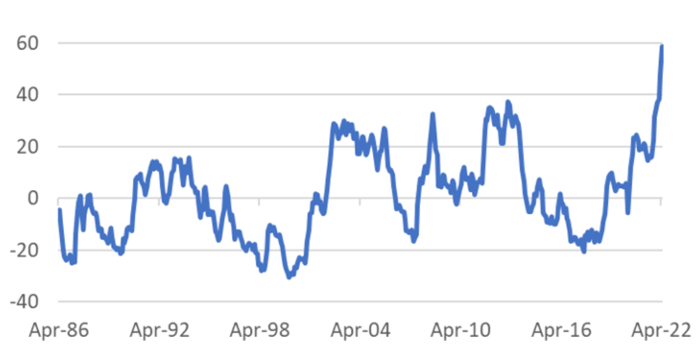

There is something very unusual going on in the Dutch economy. According to the CBS measure, which dates back to 1986, consumer confidence has never been lower than in April of this year. At the same time, confidence among entrepreneurs in the industry is very strong. The level of that CBS series was the sixth-highest monthly figure in April since the start of this series in 1985. The difference between the two series, therefore, reached a record, by a wide margin. Now you can't just subtract the values of such series from each other as I did in the picture below. The series of consumer confidence is much more volatile than that of producer confidence. But even if you take that into account, the difference between consumer pessimism in April and producer optimism this month is unparalleled.

EN: Confidence - producers minus consumers

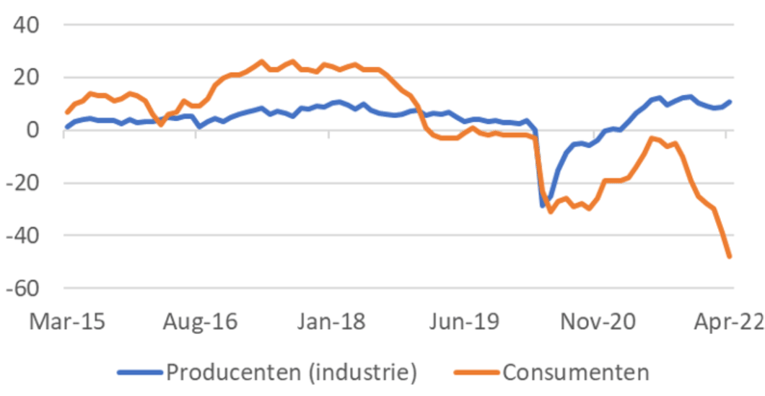

The following image shows both series over a shorter, more recent period. It is evident that consumer confidence has been under pressure for some time.

Netherlands: Confidence | Producers | Consumers

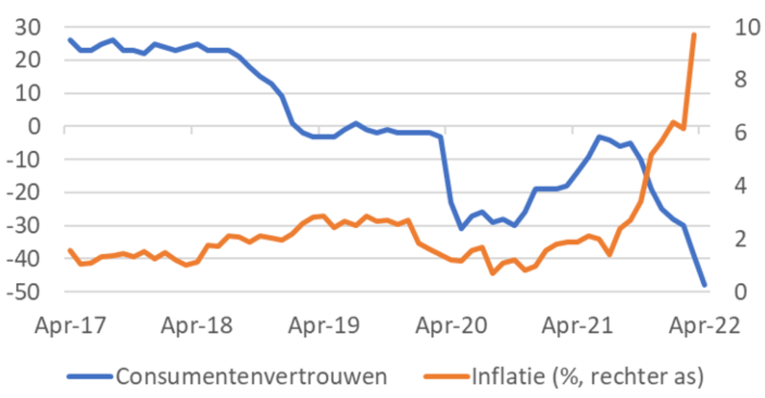

The following picture shows that consumer confidence has mainly come under pressure since inflation accelerated. That happened in the second half of last year.

EN: consumer confidence and inflation (% right axis)

The conclusion I draw is that consumers are hit hard by inflation and producers in the industry much less so. I then conclude that producers are apparently able to pass on the higher costs. Families can't do that, of course. They can set higher wage demands, but they will not be honored quickly.

From the fact that producers are apparently reasonably or well able to pass on cost increases, I conclude that we will not be able to get rid of high inflation anytime soon.

I find support for this in the most recent figures published by Statistics Netherlands on inflation in April according to the European measure, the HICP (Harmonized Index of Consumer Prices). According to that measure, inflation in the Netherlands fell from 11.7% in March to 11.2% in April. The decrease is more than entirely attributable to energy prices. Energy prices in April were still 83.0% higher than a year earlier, but that was less than the 99.6% in March, partly due to the excise tax cut from 1 April. Unfortunately, this moderating impact of energy prices on inflation in April is partly offset by an acceleration in inflation in other areas. Worryingly, the other three components for which provisional figures were published in April saw higher price increases. Foods: 7.2% in April, after 5.5% in March; Services: 3.1% in April, after 2.1% in March; and Industrials excluding energy: 4.9% in April, after 4.2% in March.

Only one conclusion can be drawn: inflation is broadening throughout the economy. We are certainly not over the high inflation yet.

A similar picture can be seen in the eurozone as a whole. According to preliminary Eurostat figures, inflation in the currency union has increased from 7.4% in March to 7.5% in April. And here, too, energy price rises slowed down slightly (38.0% versus 44.4% in March), but inflation in the other components actually rose.

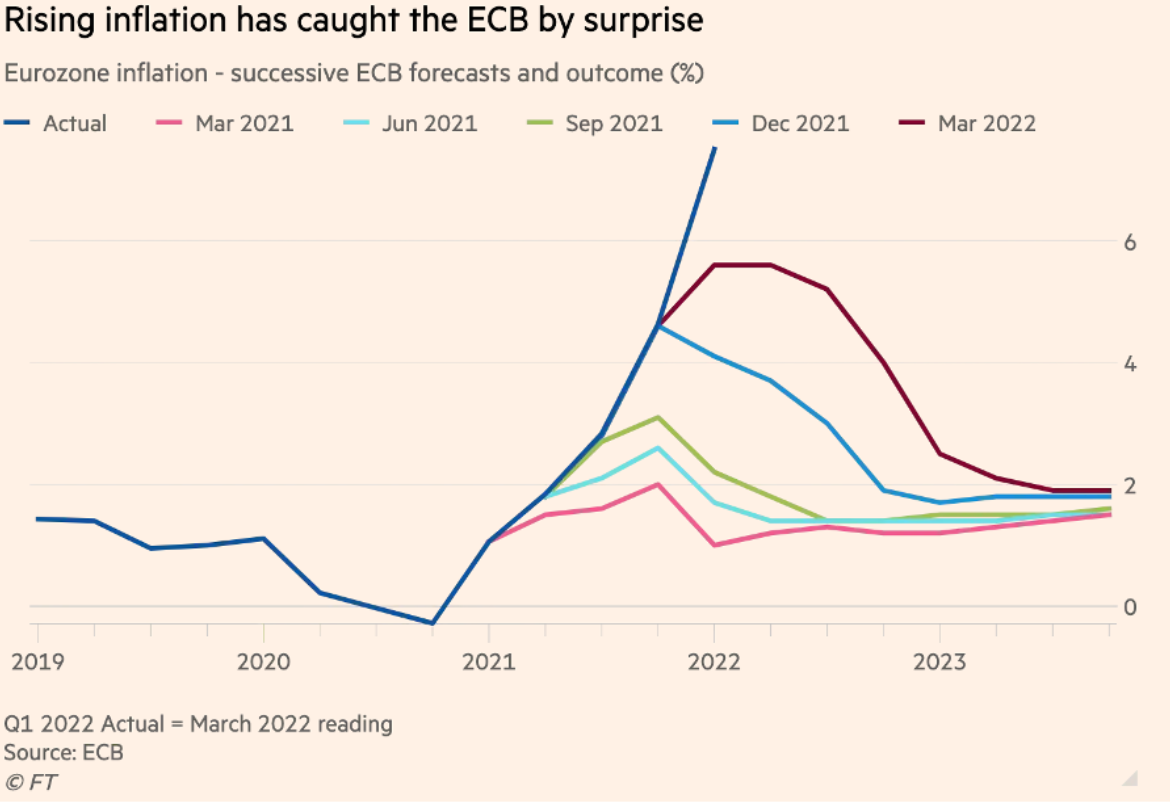

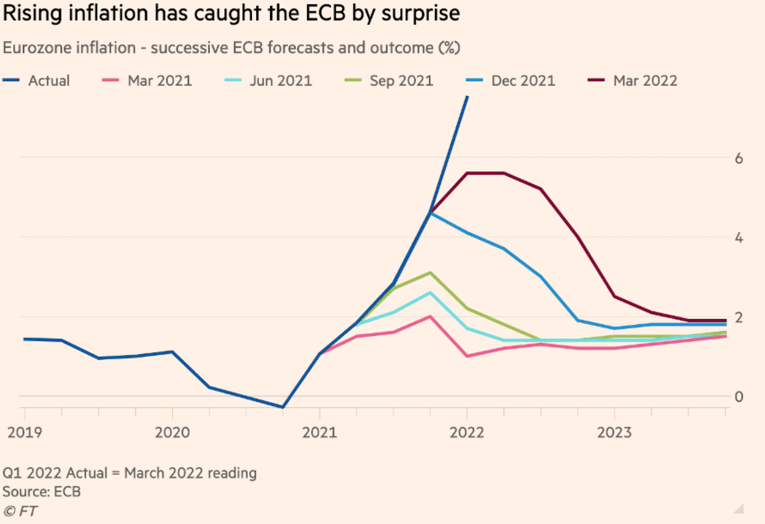

It is well known that central banks have significantly underestimated inflation in the past year. In its latest Economic Bulletin, the ECB analyses what went wrong. According to the Financial Times, that article is a mea culpa. That British business newspaper has constructed a nice graph to accompany their comments, which immediately shows how much the economists of the ECB have been wrong. Incidentally, there is quite a large degree of consistency in those mistakes. That then again…

Retail sales grow strongly

According to figures from Statistics Netherlands, retail turnover in March was 8.8% higher than in March 2021 and 3.7% in volume. These are good numbers, but the distortions caused by the lockdowns since the start of the corona crisis make it difficult to interpret the numbers. For example, retail sales in clothing increased by 53.5% in March compared to March last year. In February, that figure was still well above 100%. This is clearly a case of 'base effects'. If you try to see through that a bit by comparing the figures with those from before the pandemic, that still leaves a positive picture. In addition to basic effects, I think there is clearly still a question of 'catch-up demand', which is fueled by savings. The combination of very low consumer confidence and very high inflation suggests that consumer spending will wane over the course of the year.

Eurozone economic growth outpaces US in Q1

The eurozone economy grew by 0.2% from the previous quarter in Q1 according to preliminary figures and by 5.0% from the first quarter of last year. Details are unfortunately lacking.

In the US, on the other hand, GDP contracted in the first quarter by 0.4% from the previous quarter, or by 1.4% by the American way of calculating, the annualized figure. That US figure looks much worse than how the economy actually performed. Corporate borrowing on inventories cost about 0.2% of GDP and foreign trade took about 0.8% of GDP. Private consumption and business investment, on the other hand, grew strongly. So it's really not the case that we are really getting better...

Summarising

These are economically very uncertain times and wonderful things are happening in the economy. For nerdy economists like me, it's all fascinating. Never before has the difference between pessimism among consumers in our country and the optimism of industrial entrepreneurs been so great as in April. I think this is because consumers are depressed by the high inflation, while entrepreneurs can apparently pass on the cost increases.

Despite their pessimism, Dutch consumers spend heavily. Is this retail therapy? This growth in spending cannot continue. Inflation is too high, and income growth is too limited for that. At the same time, the consumer offers producers excellent opportunities to raise prices.

According to the latest figures, inflation in our country fell slightly in April. But that overall figure obscures the fact that the decline is mainly due to the reduction in fuel taxes. Underlying inflation is broadening in the Netherlands as well as in the eurozone as a whole. We're not done with that yet.