- Chaos just before "Prinsjesdag"

- Chaos on "Prince's Day"

- Chaos immediately after "Prinsjesdag"

- Fed will raise interest rates even further

- Russian army in trouble, economy is getting better..."

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 23 September 2022.

It was the week for me. First, the government is putting together a budget for next year that they say will contain around €17 billion (1.8% of GDP) in purchasing power support. Then, one day before Budget Day, it is also decided to set a price ceiling for the energy bill of families up to a certain consumption. Nobody knows how much that will cost, because it completely depends on the difference between the guaranteed price and the market price.

With the latter intervention, many calculations of the CPB can go into the trash, I think. However, they cannot yet start with new calculations because they do not know the details of that arrangement.

It then turns out that people with heat pumps are being 'disadvantaged'. Energy-intensive SMEs are also calling for help. And you will only be a small baker with a few staff and a tax debt from the corona time. Then you can start repaying that debt in a week, pay 10% more from 1 January to your staff who earn the minimum wage, immediately and also pay a much higher energy bill in recent months (in a bakery the oven is the all day, every day of the year). And as if that were not enough, the self-employed deduction for income tax will decrease and you will therefore pay more tax. If you have your company in a BV and you would still make some profit, the corporation tax will rise because the cabinet believes that the business community should pay. I myself am the son of a pastry chef. I'm glad my parents don't have to go through this…

Bill of millions and MEV

This week I extensively studied the Budget Memorandum and the Macro-Economic Outlook (MEV) of the CPB. I noticed two things that I would like to share.

Firstly, the CPB predicts an average inflation of 9.9% in the MEV this year and 2.6% for next year. Now I am optimistic that inflation in many countries may fall faster in the next year and a half or so than many think, but 2.6% on average in 2023 in the Netherlands, that is quite a decrease. Just think. We are currently at 12.0%. Suppose the percentage were 10.0% in January – that's easy to calculate – and then went down in a straight line. To average 2.6% next year, you should be -4.8% at the end of the year. That seems very unlikely to me. So I went looking for the 'inflation path' throughout the year that the CPB is counting on, but I couldn't find it. The rather optimistic inflation estimate is mainly based on the forward curve of gas prices. This forward curve will show a significant decline in the course of next year and a much greater decline in subsequent years. This could well be the case, but the forward curve is usually not a very accurate predictor. The CPB's inflation estimate for 2023 therefore also seems extremely uncertain to me.

That brings me to the second point I want to mention, which is purchasing power. This year we suffered a significant loss of purchasing power, but next year we will make a profit. That profit will be disappointing if inflation is higher than the 2.6% that the CPB has now calculated. But there is something else.

The CPB calculates that purchasing power for the lowest incomes will increase the most next year. According to the CPB, those entitled to benefits even increase their purchasing power by 8.5%. What I didn't know, but learned this week, is that the CPB uses the same inflation rate for everyone when calculating the purchasing power figures for each income group. Under normal circumstances, that's acceptable, I think. But not under the current circumstances.

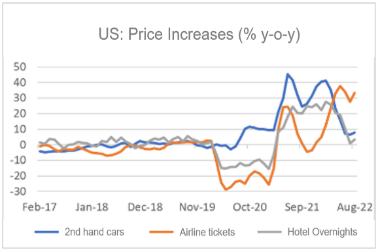

If inflation is low, there are of course differences in the price increase per product, but the differences are not so great. When inflation is high, as it is now, the differences widen. In the next picture I show this for the US (because I've been looking at this phenomenon for a while based on US figures. It's no different in the Netherlands).

Source: Refinitiv Datastream

People with low incomes, I suspect, spend a relatively large part of their income on energy, often through draughty social housing. Because energy prices are currently rising the fastest, this is affecting people with low incomes the most. But the CPB does not include this in the purchasing power charts.

If you add these two things up, you have to conclude that the relatively favourable development of the purchasing power of the lowest incomes in 2023 as calculated by the CPB may well be a much flatter representation of things. Firstly, the chance that inflation will be higher next year than the 2.6% that the CPB is now calculating is quite high in my view. Second, effective inflation for low income earners is likely to be higher than average. The price ceiling that is still being worked out will certainly help, but we do not yet know exactly what the arrangement will look like. When is it?

My conclusion on this point is that there is chaos. Despite all the activities of the CPB's accountants, we have no idea how all this will turn out.

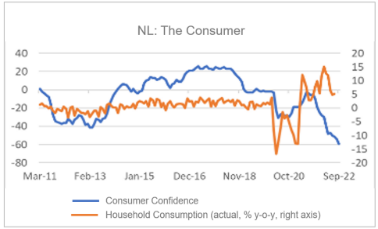

Another sad record, but spending still up to par

Meanwhile, consumer confidence fell to a new all-time low in September. I am very curious whether things will improve in October due to the measures taken by Prinsjesdag, including the price ceiling for energy. We will see. Meanwhile, total consumer spending in July was still more than 6% higher in volume than twelve months previously. That comparison was a bit flattered because there were still some restrictive corona measures in July last year. As a result, spending on services was able to grow by 12%. In fact, retail spending fell by 1.5% in volume.

Source: Refinitiv Datastream

The Fed Continues Steadily and Is Ready to Accept a Recession

The Fed has raised its official interest rate by 0.75% for the third time in a row this week. Fed boss Powell also emphasised that the US central bank will continue to shorten its balance sheet by not reinvesting all of the money from redeemed bonds. If you believe that bond buying has had a stimulating effect on the US economy, now the opposite is true. The monetary tightening is therefore even more robust than the interest rate hike suggests.

The interest rate hike was expected by the markets. Unexpected was the adjustment of the median expectation of official interest rates at the end of this year. According to the so-called 'dot plot', the median expectation by the members of the policy committee is that interest rates will rise by a further 1.25% during the next two meetings. Powell sounded determined and hawkish. He didn't say it explicitly, but the bottom line is that the Fed is willing to tolerate a recession if necessary to stem inflation. Ultimately, allowing high inflation to continue is more damaging than a temporary, short-lived recession. The housing market will have to undergo a correction, according to Powell. It already seems to be coming.

The Russian army in trouble, the Russian economy less?

This week, Putin announced a partial mobilisation. Apparently large numbers of potential soldiers are fleeing the country. I am not a military strategist but an economist and that is why I look at the economic figures. Whether they paint a true picture of the developments I don't know, but it's all I have.

While the Russian military is in trouble, the Russian economy seems to be gradually improving. Of course there will be a contraction this year, but also a stabilisation. The central bank has stabilised the ruble, albeit with the help of foreign exchange regulation, but still. When the war broke out, the central bank raised the interest rate very sharply, but it has since been lowered again and is now lower than before the war.

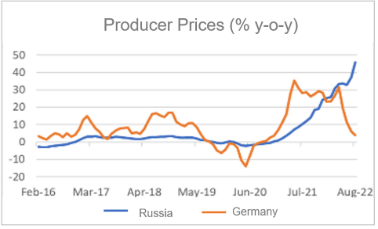

While our inflation is very high, it is falling in Russia. This week, figures on producer prices were published in Germany and Russia. Those in Germany were about 45% higher than a year earlier, while the increase in Russia has fallen sharply.

Source: Refinitiv Datastream

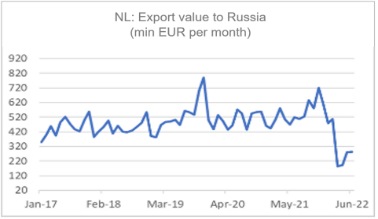

From time to time I also look at how things are going in trade with Russia. We have imposed an embargo. This has indeed led to a sharp drop in our export value to Russia.

Source: Refinitiv Datastream

Anyone who regularly watches the press conferences of the Russian central bank (I must be just about the only 'nerd' in the Netherlands who does that…) knows that they often talk about a major transition of the Russian economy. And then it is not about an energy transition, but about a large-scale transition of suppliers for the Russian industry. Now that the West has imposed an embargo, we no longer supply a lot of semi-finished products and parts that are important to the industry. So the Russians have to look for alternative suppliers. They do exist and, according to the central bank, the transition is progressing better than expected.

Having heard that, I am trying to find out which countries deliver extra to Russia. Perhaps it is still too early to get a good picture from the statistics. I would expect China to be one of the biggest beneficiaries of those transitions. They can probably handle it technically. However, the Chinese figures are very volatile and do not provide a clear picture. I find the figures on Taiwan's trade with Russia very spicy. Taiwan, of course, would like a commitment from the Americans that they will intervene if China starts to treat Taiwan militarily. You can therefore expect Taiwan to participate in the boycott of Russia. Immediately after the outbreak of the war, Taiwanese exports to Russia did indeed collapse. In the meantime, however, there has been a very remarkable recovery. At first glance, it seems that the Taiwanese are seriously undermining our boycott. Tasty friends, those Taiwanese!

Source: Refinitiv Datastream

Closing

The chaos surrounding the government budget for 2023 is phenomenal. On the day before Budget Day, it was decided to set a price ceiling for energy for a limited amount of gas and electricity. What that arrangement will look like, how much it will cost, where the money will come from and how it will affect inflation, purchasing power and economic growth is completely unclear. It is also unclear whether anything will also be done for SMEs and what it will cost.

I think the calculations of the CPB can go in the trash. I have serious doubts about those calculations anyway. The inflation estimate for 2023 seems very optimistic to me and largely leans on the forward curve of the gas price. Moreover, I think that the purchasing power charts per income group are unreliable.

The US central bank says it intends to continue raising and/or keeping interest rates high until inflation is under control. They want to accept a recession. Well, it will come then.

The Russian economy, which is in serious trouble and is shrinking this year, seems to be doing less badly than with the Russian army. But then, instead of reservists, the economy has to do with suppliers from outside the countries that have imposed sanctions. The latter are eager to supply the Russian economy while the reservists try to flee the country. You can't blame them.