- Our inflation fell sharply in November

- It may have peaked now, but gas prices are a cause for concern

- The Dutch buy less stuff

- Massive risk of recession in Europe

- Sharp weakening of Chinese economy

- US still going strong, but also weakening

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 2 December 2022.

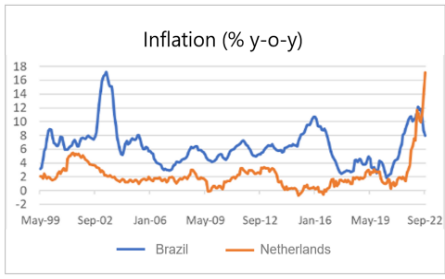

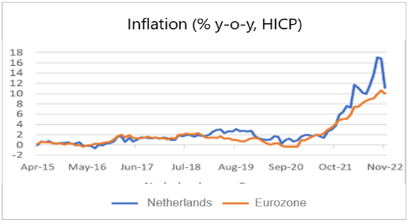

Inflation in the Netherlands fell sharply in November according to the European benchmark. After 17.1% in September and 16.8% in October, the figure was 11.2%. Our inflation is now a lot closer to the average for the eurozone.

The number was lower than expected and the fall in the rate of inflation was also greater than in the other euro countries. According to this measure, prices in our country fell by 4% from October to November.

The lion's share of this decrease can be attributed to 'energy including motor fuels'. In that category, the rate of increase fell from 99.7% (year-on-year) in October to 41.6% due to low gas and petrol prices.

Encouragingly, the rate of inflation also declined in industrial goods (excluding energy) and services. The inflation rate of food actually accelerated (12.5% in November versus 11.5% in October).

Source: Refinitiv Datastream

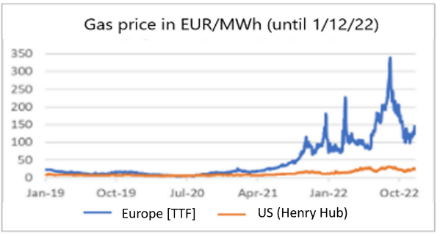

That the inflation rate has now fallen for three of the four reported categories may suggest that the peak of inflation is behind us. That could very well be, but a lot will depend on energy prices. Unfortunately, the European gas price is currently rising again. At the end of October, the European gas price briefly fell below €100/MWh but has now risen again to around €140. If this continues or worsens, inflation may rise again in December.

Source: Refinitiv Datastream

Consumers buy less stuff

Retail sales continue to grow. In October, retail turnover was 4.2% higher than a year earlier. However, that was more than entirely due to higher prices. In volume terms, the retail sector sold 5.2% less. The fact that total private consumption has grown in volume so far is mainly due to expenditure on services. But we may also see the effects of the serious loss of purchasing power in the retail sector.

Source: Refinitiv Datastream

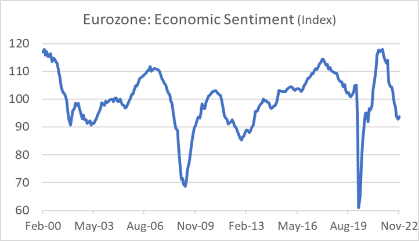

I keep thinking that we are heading, or rather that we have already entered a period of contraction, a recession. The same applies to the eurozone as a whole. One of the broadest and fastest available indicators of activity in the eurozone can be found in the European Commission's 'Economic Sentiment Index'. In November it was 93.7 for the eurozone. While that was slightly better than October's 92.7, it was well below January's 113 and also below the long-term average of 100.

Source: Refinitiv Datastream

China hit hard by corona and corona policy

Developments in the various economic blocks are currently quite different from each other. Europe is suffering from high energy prices, war, and rising interest rates. The Chinese economy is being hit by the persistence of the coronavirus in that country and their government's zero-covid policy. It is not always easy to follow exactly what is happening in the Chinese economy from a great distance, but you can list various indicators. Then a worrying picture emerges. First, business confidence has been falling for months. According to the NBS benchmark, the confidence index fell from 49.0 in October to 47.1 in November. A number below 50 basically indicates contraction. The following chart speaks for itself.

Source: Refinitiv Datastream

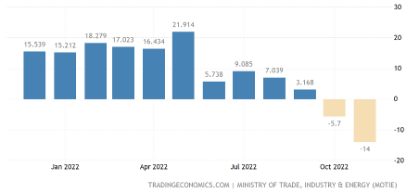

When China slows down, surrounding countries notice immediately because of their strong economic ties with the country. Korea's exports were 14.0% lower in November than a year earlier. The decrease was mainly caused by a 25% reduction in exports to China.

Korean Exports (% y-o-y)

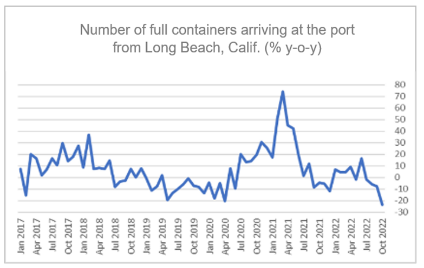

US data also point to a sharp weakening of activity in China. The next picture shows the development of the number of containers arriving at the port of Long Beach, near Los Angeles. In the year-on-year comparison, that has now fallen sharply. I don't know the figures, but you have to assume that a large proportion of those arriving containers come from China.

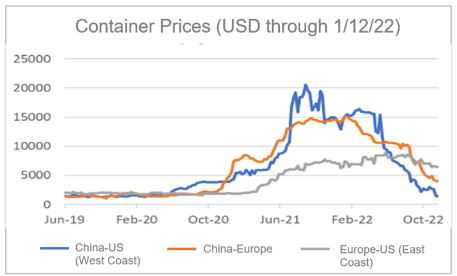

If so much fewer goods are shipped from China to the US, it must have an impact on freight rates. And that turns out to be the case. As logistical disruptions around the world pushed up freight rates, they rose nowhere more than on the China-US route. Freight rates on that route are now back at the same level as before the pandemic. That is quite remarkable because the fuel costs are actually higher. The following graph shows that freight costs on the China-Europe route have also fallen, albeit at a lesser rate than those from China to the US. Transatlantic freight costs had risen much less and are now falling much less quickly.

Source: Refinitiv Datastream

Taken together, these figures point to a very strong weakening of Chinese economic activity. This is important because China has been the most important growth engine in the world for decades. But not right now. Moreover, China has become the "workshop" of the world. The downturn in activity there could again lead to supply problems and thus perhaps give a new boost to inflation, although I don't expect that to happen in the short term.

US strongest, but not without risk

While Europe suffers from high European energy prices, war, and sharply increased interest rates and China is creaking under the scourge of the coronavirus and the government's corona policy, the US economy has the fewest problems. Of course, high inflation is also taking its toll in the US and the rise in interest rates is already having a major impact on interest-rate-sensitive sectors, such as the housing market. But the economic picture in the US is more favourable than here and in China.

Although US GDP fell slightly in the first two quarters of this year, this should not really be called a recession. In addition, third-quarter GDP growth has returned (2.9% quarter-on-quarter, annualised) and fourth-quarter growth, according to the Atlanta Federal Reserve's GDPNow (a sort of "real-time" indicator, is of GDP updated every week) is currently 2.8%.

Still, the prospects are not entirely without concern. US private consumption still grew by 1.7% (qoq, annualised) in the third quarter, but that requires households to spend an increasing share of their income. This is evident from the savings ratio, the part of the income that is saved. In October, the savings rate was only 2.3%. That is exceptionally low, although it must be said that these figures are sometimes significantly revised.

Source: Refinitiv Datastream

The manufacturing purchasing managers index also fell below 50 for the first time since May 2020. In November, this index stood at 49.0. That is by no means a disaster, but it does indicate a weakening.

Source: Refinitiv Datastream

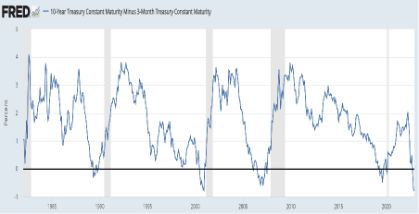

Finally, the yield curve has been 'inverted' for some time, i.e. short-term interest rates are higher than long-term interest rates. In the past, this has been a remarkably reliable signal of an approaching recession. The signal that the difference between the 3-month money market interest rate and the effective yield on 10-year government bonds is currently sending is rather firm. The difference between the two rates is shown in the graph below, where the gray-shaded areas indicate recession.

Financial markets don't care

Equity markets have not had the best year, but have recovered strongly since mid-October. Signs that interest rate hikes are coming to an end are especially helpful for the sentiment. Nevertheless, great uncertainty remains about how many central banks will raise interest rates and how capital market interest rates will respond. For the time being, the hawks within the central banks seem to be in charge and will continue to raise interest rates. I don't want to be a sourpuss, but euphoria on the stock market seems a bit premature to me given the prospect of higher policy rates and recessions.

Closing

The global economic picture is extremely unusual in that the different blocs are affected by very different factors. Europe is groaning under the insanely high gas price and the war, while the rise in interest rates is of course no support either.

In China, the zero-covid policy seems to be leading to a very strong weakening of activity, and the question is how that will affect us in the near future.

Of the three major blocs, the US economy is by far the best, but here too various indicators point to a weakening. The yield curve even points quite firmly to a recession.

In this turmoil, the central banks in the US and Europe appear to be planning to raise key rates even further in order to put the inflationary spectre back into the bottle. This does not mean that capital market interest rates will rise further.