- Inflation is falling, but mainly because of energy prices

- The European gas price has risen sharply since mid-November

- Production in the industry has been falling for months

- The decrease is particularly sharp in energy-intensive sectors

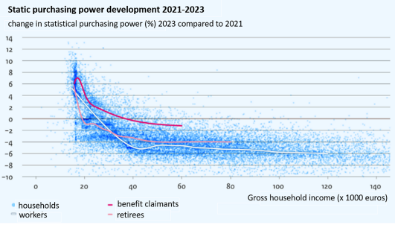

- The development of the purchasing power of workers with a modest income next year will lag far behind that of benefit recipients.

- Pensioners with a modest income are even worse off in terms of purchasing power development.

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 9 December 2022.

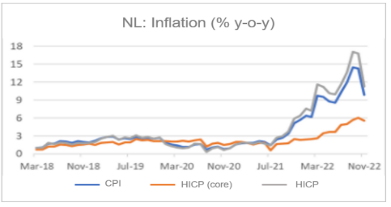

As expected, inflation in the Netherlands fell sharply in November. This was already apparent last week from the figures based on the European calculation method (HICP), this week Statistics Netherlands (CBS) confirmed that the same is apparent from its own calculation method (CPI).

By its own benchmark, inflation fell from 14.3% in October to 9.9% in November. So-called core inflation fell, but only slightly: from 6.9% to 6.8%. Judging by the European benchmark, core inflation (ie excluding food, energy, tobacco, and alcohol) had fallen from 6.0% to 5.6%.

Source: Refinitiv Datastream

The sharp fall in headline inflation was mainly caused by energy prices. According to Statistics Netherlands, they fell by more than 25% from October to November. Last year, energy prices rose sharply in November: about 20%. As a result, the year-on-year rate of increase dropped from 173% to 70%!

Unfortunately, the rate of increase in food prices continues to accelerate. With those prices rising by 2.0% in one month, the year-on-year increase was 15.4%, compared to 13.8% in October. A sad record.

Another caveat to the drop in inflation is that European gas prices have risen considerably since mid-November. The TTF price was briefly below €100/MWh in November but is now €140/MWh again.

The energy price cap will start in January and is expected to reduce inflation by around 2.5%.

Industry growth rapidly downhill

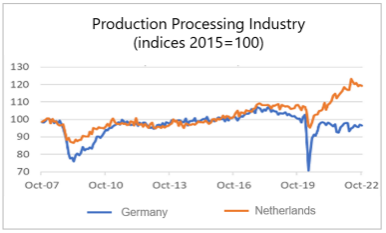

According to CBS figures, manufacturing in the Netherlands produced 3.3% more in October than one year previously. That in itself is a good number. But it was the lowest year-on-year growth since March 2021. A month earlier, the growth rate was still 5.2%. Although the production level can fluctuate considerably from month to month, it is significant that in seven of the first ten months of this year production has fallen compared to the previous month. In October, the decrease compared to September was 0.4%.

The differences between the various sectors are now very large. Machine construction is the absolute star performer. Production there was 21.2% higher than a year earlier and Statistics Netherlands also reported that the sector was struggling with chip shortages. As expected, energy-intensive sectors are at the bottom of the list. The production level in the chemical industry was 13.1% lower than a year earlier. A minus of 9.8% was recorded in the rubber and plastics sector.

The same picture can be seen in Germany. There, Destatis (the German CBS) reported that production in the industry fell by 0.1% in October compared to September. But the energy-intensive sectors are also doing poorly there. Production in those sectors fell by 3.6% in October compared to September and by almost 13% year-on-year. That is very similar to what happens in our chemical industry. In Germany, BASF has already warned that chemistry in Europe is doomed at the current, absurdly high energy prices. In the Netherlands, the sector provides employment for about 45,000 people, to which added the employment of the surrounding chains.

From divergence to convergence?

In the past I have several times pointed out the remarkable divergence between the production of the industry in the Netherlands and that in Germany in recent years. In the past, the correlation between the two was very high, but more recently the Dutch industry has been performing much better than its German counterpart.

Source: Refinitiv Datastream

The divergence of both series started when the German automotive industry was hit by 'dieselgate'. Although the Netherlands also has an 'automotive' sector, it is much smaller in our country as a percentage of the total industry.

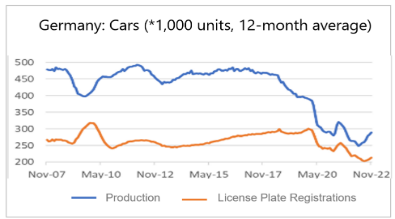

The following picture shows the production of cars and the number of registrations in Germany. Germany is traditionally a major exporter of cars. However, the graph shows that production has fallen sharply from 2018 onwards. In part, this may have been due to the fact that German car companies have moved production to other countries, but dieselgate may also have led to reduced demand for German cars.

Source: Refinitiv Datastream

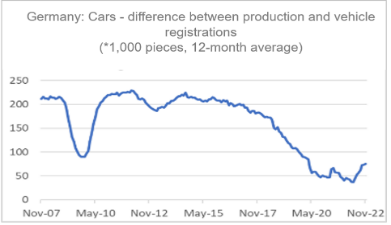

However, it seems that the bottom has passed. Production is increasing again. And that increase is faster than domestic sales. German car exports are therefore on the rise again. The next picture shows the difference between production and license plate registrations. Of course, imported cars are still in between. Yet it is significant that a tipping point seems to have been passed.

Source: Refinitiv Datastream

A remarkable difference in recent years between the performance of the Dutch industry on the one hand and the German industry on the other can also be found in mechanical engineering. Germany is traditionally very strong in mechanical engineering. Nevertheless, the growth of this sector in Germany is currently lagging far behind that in the Netherlands. Our sector produced more than 21% more in October than a year earlier. In Germany, it is a more modest 5%. It is not immediately clear to me how this difference can be explained. It may be due to a major player such as ASML.

German figures on the development of orders in the industry give cause for further concern. The next picture shows the development of orders in the German capital goods industry. While production in mechanical engineering has grown so far, new orders have fallen considerably in recent months. Compared to the peak in March of this year, there is a decrease of about 15%.

Chinese foreign trade in trouble

The international economy is weakening. I have previously pointed out that the Chinese economy has become a 'stop-go' economy due to the ongoing lockdowns. This was also reflected in the trade statistics this week. As the following picture shows, the value of China's imports and exports was lower in November than a year earlier. There are reports that the zero-covid policy is being weakened. That would be favourable for economic activity and thus for the global economy. But I would say: seeing is believing.

Source: Refinitiv Datastream

In 2023, working people will be worse off than benefit recipients

This week, the CPB presented calculations for the Dutch economy based on various scenarios for energy prices. Compared to the September estimates, two opposing factors determine the otherwise relatively limited differences in the outcomes. Inflation has risen further than expected in September and the price ceiling has now been included in the calculations. The bottom line is that the negative factor slightly outweighs the positive. So economic growth will be slightly lower and unemployment slightly higher. The price cap is expensive for the government, but the treasury is cushioned by higher gas revenues so the government deficit is estimated to be only slightly larger than in September.

Purchasing power is worse than expected in September. The CPB expresses this as the total loss of purchasing power over 2022 and 2023. In September, a loss of purchasing power in 2022 and 2023 together of around 3% was still expected. The CPB now estimates the loss at more than 4%

Two other things, in particular, struck me about the CPB publication. The first is shown in the chart below. This shows a point cloud of the change in the purchasing power of households with different circumstances and different incomes. The solid lines are averages for different groups. What struck me most now is how much better the purchasing power development of benefit recipients with low incomes is than that of working and retired people with the same incomes. It has everything to do with the increase in the minimum wage, which affects all benefits. Low-income workers are often self-employed and they are faced with a reduction in the self-employed deduction. I thought the motto was that work should pay... The increase in the minimum wage also affects the state pension, but nevertheless, pensioners with incomes of up to approximately €35,000 are the worst off in terms of the development of their purchasing power.

Source: CPB

A second striking finding is that according to the CPB, energy prices will sustainably be substantially higher than before the pandemic. This requires a structural adjustment. A price ceiling, where the treasury matches the difference between the market price and the ceiling, is not. I would say, government, do everything you can to get energy prices to a normal level. But the CPB thinks that an adjustment in wages is necessary. Since it is now clear that we are suffering a significant loss of terms of trade, wage increases do not offer a solution for the economy as a whole. Someone will have to take a welfare loss here.

Closing

Inflation fell in November, but mainly thanks to energy prices. Unfortunately, the European gas price, which strongly determines the course of our energy prices, has risen sharply since mid-November.

The growth of production in the Dutch industry is falling noticeably. The strength of mechanical engineering is still holding up the overall figures, but there has been a sharp drop in production, especially in the energy-intensive sectors. Hold your breath on what will happen in those sectors in the longer term if energy prices do not normalise. I have not yet noticed any urgency among policymakers to think about this, let alone that someone is going to do something about it.

China is reportedly going to soften its zero-covid policy. This comes not a day too soon for the business cycle. China's foreign trade has contracted sharply.

Purchasing power in our country will fall in 2022 and 2023 together more than previously predicted by the CPB. What strikes me is that the picture looks much worse for workers with very modest incomes than those entitled to benefits. Retirees are even worse off. Since many politicians talk about the idea that work should pay, you would expect them to want to address this development with some urgency. There is also no trace of such a sense of urgency.