This is my last weekly commentary of the year. That is why this text is somewhat 'different than usual'. No consideration of the business cycle with supporting charts. Instead, a series of sighs. Maybe it's just me, but I come across more and more things that make me think “how is that possible”, or “where the hell do they get that from”? There is also good news at the end!

Before I forget, I would like to thank all readers of my articles for their interest and I wish everyone a Merry Christmas and a beautiful 2023!

- China is moving away from zero-covid and going on a journey

- An Italian (!!!) European Commissioner lectures us about our budgetary policy

- I think Italy is heading for a financial crisis This will lead to a new euro crisis

- A CO2 tax is inappropriate at the current exorbitant prices

- Knot wants to cool down the economy as it is already skimming past a recession

- Knot also believes that employers should compensate for employees' energy pain

- My blood pressure is rising dangerously because of all this But there is also very good news at the last minute.

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 23 December 2022.

It is with great surprise that I see how the Chinese suddenly opened society completely after following a zero-covid policy for ages. That zero-covid policy led to very frequent and very strict lockdowns. Due to the low effectiveness of the vaccine used, it is inevitable that the number of infections and deaths will rise sharply now that society has opened up. It is a mystery to me how policymakers will deal with this. The frequent lockdowns have seriously damaged the economy. I can't imagine that an explosion of infections and deaths will work out much more favorably. In a month it will be Chinese New Year and then a few hundred million Chinese people want to travel. The virus is already looking forward to it. Could it be that the virus mutates and there are variations that our vaccines cannot cope with?

I read with great surprise how European Commissioner Gentiloni (an Italian, that is...) lectures the Netherlands because of our too-loose budget policy. According to him, the accommodative fiscal policy exacerbates inflation. In itself, he may have a point and he is not the first and certainly not the only one to express this criticism. But no one can accurately quantify the effect on inflation, so what exactly are we talking about? Our economy is also very open. A spending impulse that may result from an overly generous budget policy thus leaks to a large extent abroad.

He needs to say that

In addition, I tend to think: 'the European Commissioner needs to say that'. Last year, the NextGenerationEU program was launched, which aims to help the EU economy recover from the pandemic. It is a multi-year program and involves large sums (€800 billion or more). The European Commission's sites proudly state that this is "the largest stimulus package ever". If Gentiloni is so concerned about the economy overheating, I would say the Commission should cut that program.

I am very surprised to read that Gentiloni is calling for a new EU-wide fund to help the EU adapt to and recover from high energy prices. Following on from the NextGenerationEU programme, the European Commissioner argues that common funds should also be raised for the new program and that borrowing should be allowed. The Netherlands agreed with the size of and the borrowing for the NextGenerationEU program with a healthy dose of reluctance because it would be a one-off exercise. It's not even two years later and there's another knock on the door.

Italy is heading for a financial crisis and we are heading for a euro crisis

I think Italy is the big problem here. The country has a public debt of about 150% of its GDP. The interest on Italian government bonds has risen by approximately 3 percentage points this year. This will eventually cost the Italian government 4.5% of GDP in extra interest costs. Italy's budget deficit this year amounts to just under 6% of GDP. Significant cutbacks will be required to bring this under control. You don't have to be Einstein to foresee that major problems will arise here. I do not see how the country can avoid a financial crisis, and therefore I do not see how we can avoid a new euro crisis, although it will probably take some time. The ECB can of course come to Italy's aid and Gentiloni's plan would also help. But I think there is not enough support to spread Italy's budgetary problems over all other countries in the eurozone. I fear that ultimately not only the euro but also the EU in its current form will come under pressure.

I am very surprised to read that Gentiloni also believes that our price ceiling for gas and light reduces the incentive to save on energy. Of course, he is somewhat right. But look at the facts. My energy contract runs until the end of March 2023. I currently pay 14 cents for electricity and 77 cents for gas. Below the price ceiling, that goes to 40 cents and 1.45 euros. Well, then there really remains an incentive to save. Well, if you want to maximize the incentive to save, you have to make energy unaffordable…

With great surprise, I read the discussion among economists (and non-economists) about the introduction of a CO2 tax. The emission of CO2 causes social costs. In fact, the production and distribution of every product cause CO2 emissions. This is what economists call an “external effect.” You have to include these costs in the price with a tax to confront the users of a product with those social costs so that the consumption of the most CO2-emitting things decreases. I think this is typical ivory tower chatter. First, we already pay various taxes. I looked at my own energy bill again. Admittedly, I pay very low prices by today's standards. But two-thirds of what I pay for gas are already taxes: 'energy tax' and 'surcharge for sustainable energy and climate transition'. Will a new carbon tax fundamentally change my behaviour?

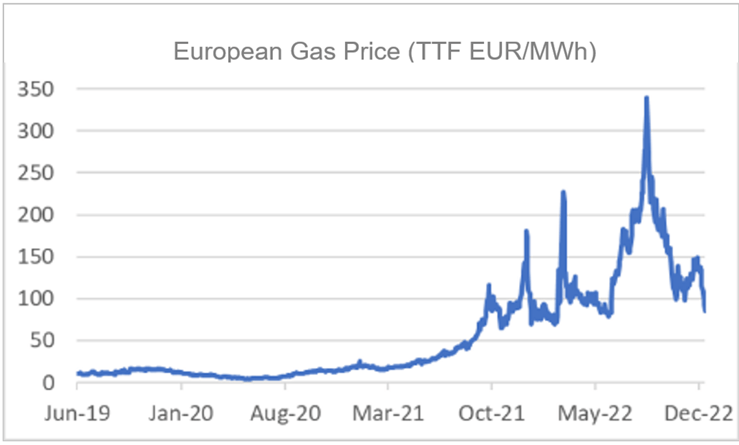

Another and actually more important objection I have to the introduction of a CO2 tax now is that energy prices have already risen insanely. The idea that you should include social costs in the price through a levy assumes that the basic price is the sum of the production, transport, and distribution costs plus a reasonable profit margin. The reality is very different. The current European gas price largely exceeds the 'cost-plus-reasonable profit'. Because the rise is spreading everywhere and inflation is at an all-time high, the suffering for families is already great. Do you really want to increase that suffering? I really don't understand it at all anymore.

Knot in the bend or Knot out of the bend?

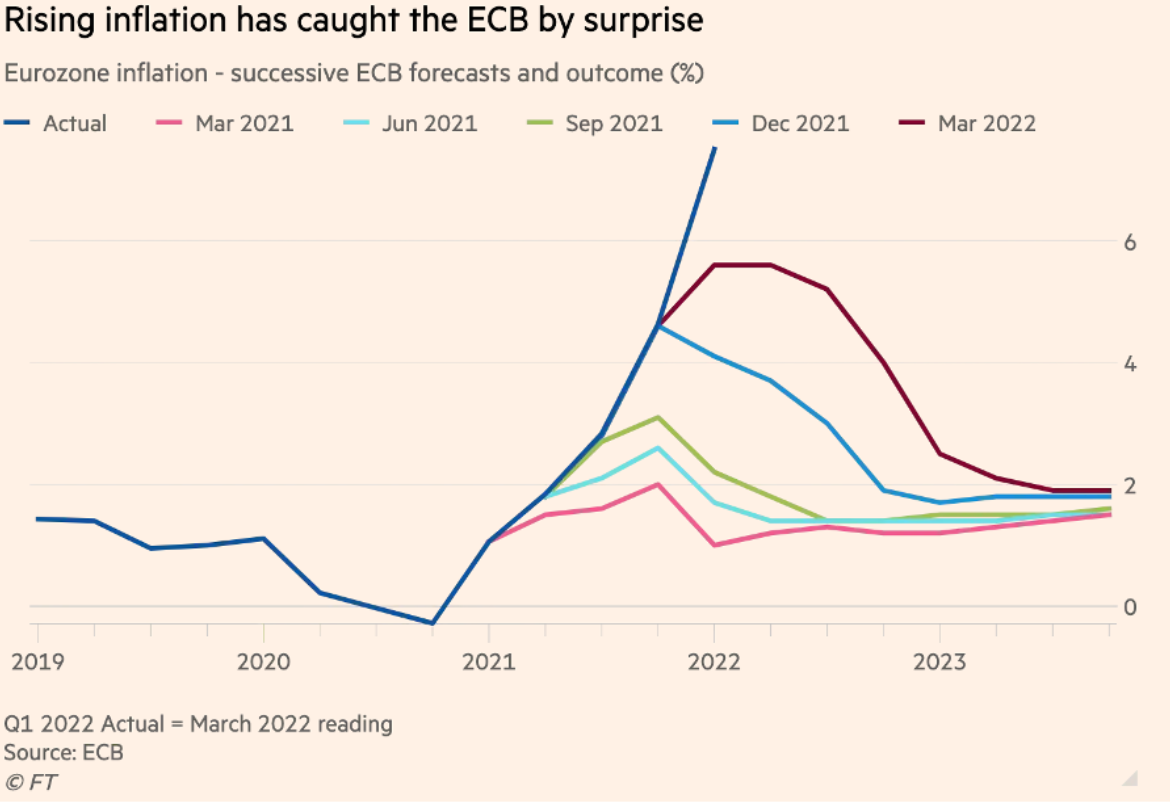

With great surprise, I read an interview with DNB boss Klaas Knot in the newspaper in which he argues that the ECB's interest rate hikes are aimed at cooling the economy in order to bring inflation under control. Well into 2022, the ECB argued that rate hikes were inappropriate because inflation stemmed from problems on the supply side of the economy. Interest rate hikes mainly affect the demand side of the economy. I checked it out. In the five quarters from the second quarter of last year to the second quarter of this year, the eurozone economy grew by an average of 1.2% per quarter, the Dutch economy even growing by an average of 1.8%. The growth has now stopped. In the third quarter, the eurozone economy grew by only 0.3% and that of the Netherlands even contracted by 0.2%. The Chief Economist of DNB said last week that our economy is skimming past a recession, and he expects a slight contraction in the third and fourth quarters of this year and in the first quarter of next year. I don't understand that. When the economy grew as crazy and inflation rose, the ECB saw no reason to curb that growth, and now that growth has disappeared, the economy suddenly has to be cooled down.

I am very surprised to read that DNB boss Knot also thinks that companies should raise wages more. That interview also states that employers should compensate for the energy pain for employees, not the government. According to Knot, companies have enough fat on their bones to do that. I fall off my chair. Such a 'sweeping statement' completely ignores the fact that the position can differ greatly per company. And to be honest, I also tend to think that the high European gas price has not been caused by the employers, but by the government's unwise energy policy over the years. Nice! For years, the government has pursued an energy policy that – admittedly, partly due to unforeseen developments, in this case, the war – has led to a disastrous rise in energy prices in Europe. Then a callous finance minister shouts that unfortunately we are all getting a little poorer and the president of the central bank thinks that employers should pay the consequences….

It's really time for me to get some rest… This is all bad for my blood pressure, very bad…

Good news

Nevertheless, I will close with good news. The European gas price is falling sharply. At the time of writing, I see €85/MWh. Of course, that's still four to five times the pre-pandemic price, but 75% lower than the August high. Hallelujah! I'll let you pull the cork out of a bottle of bubbles. Cheers!

Source: Refinitv Datastream