Google Translated from Dutch to English. Link to the original post in Dutch below.

-

The ECB will stop the asset purchase program earlier than expected…

-

...a first-rate hike is, therefore, closer than assumed

-

Rising inflation expectations, in particular seem to play a role here

-

Rising mortgage interest is being felt, both with us and elsewhere

-

Will our housing market turn abruptly?

-

Dutch consumer confidence at a new low

-

Chinese economy is under pressure due to lockdowns

-

Sanctions against Russia, for the time being, do not lead to very great economic pain in Russia perceptible in economic statistics

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 22 April 2022.

Through Vice-President De Guindos, the ECB seems to have turned around. ECB executives have consistently maintained that inflation would be temporary, that the economic situation in the eurozone is different from, say, the US, that their medium-term inflation forecast is close to or even below target, and that the tightening monetary policy should therefore not be an issue in the short term. However, it has always been said that the bond-buying program, which had already started before the end of 2019, would end in the third quarter of 2022. Market participants assumed that the purchases would continue into September. An interest rate hike could happen very late this year or sometime early next year.

In an interview with Bloomberg, De Guidos suddenly said he didn't see why the purchases couldn't be stopped in July. That's an entirely different sound. Interest rate hikes are more likely to be on the ECB's agenda, although De Guindos did not want to prejudge them.

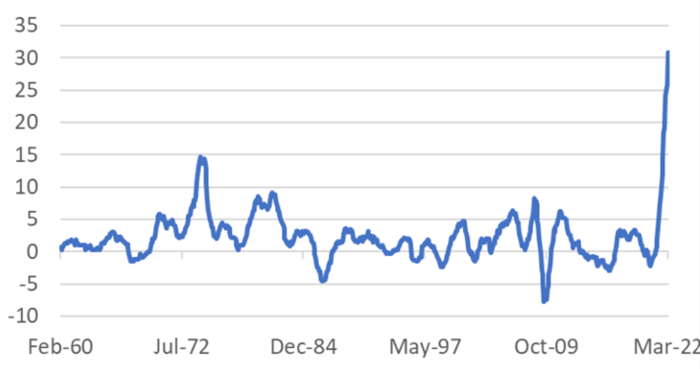

Apparently, the ECB's view on inflation has changed. That's not so crazy either. Inflation has risen much more and more persistently than has long been claimed. The war in Europe has given inflation a further boost. For example, German producer prices turned 30.9% higher in March than a year earlier. Before the recent rise in this inflation measure, the German record stood at just under 15% in the 1970s.

Germany: producer price inflation (%)

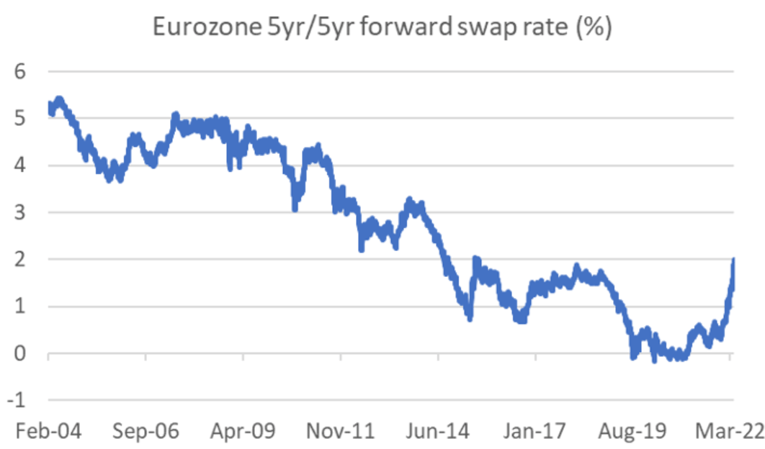

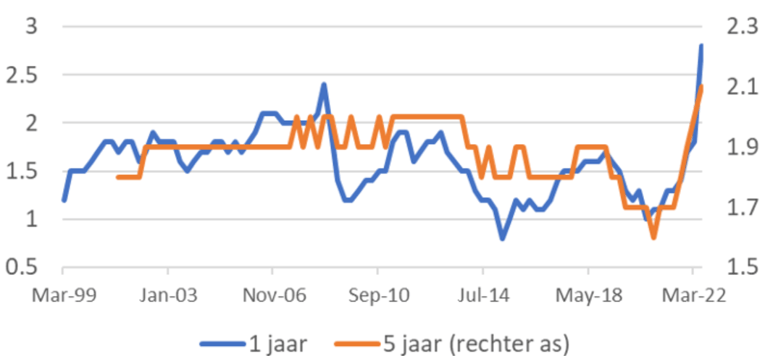

Anyway, those ECB executives knew that a month ago. What has changed further is inflation expectations. Among other things, the ECB looks at the so-called 5yr-5yr forward swap rate. This indicates the inflation expectations in the market in the longer term. Within a few months, it has increased from about 0% to 2%. In 2014, the decline in this indicator from 3% to 1% was used as an opportunity to start a bond-buying program in 2015. Now it is going the other way, even faster than then.

The ECB's quarterly survey among 'professional forecasters' also points to rapidly rising inflation expectations in the somewhat longer term. De Guidos rightly said that longer-term expectations align with the ECB's target but forgot to mention that there has been a remarkable increase here. In fact, respondents have never expected inflation to average 2.1% over the next 5 years.

We know that inflation expectations play an important role in the inflation process and it would not be very wise for the ECB to allow those expectations to rise further without trying to prevent it.

Eurozone: inflation expectations | 1 year \ 5 years (right axis)

Rising mortgage rates appear to be causing an abrupt turnaround in the housing market

I would say the ECB is finally awake; let's see how diligent they will act now. In a sense, you could say that not only is the ECB now trailing behind the facts and many other central banks, but the ECB is also trailing behind the bond market. The capital market interest rate in the Netherlands has risen from 0% to approximately 1.2% since the beginning of the year. That is quite a significant increase for such a short period. No wonder mortgage interest rates are also rising. That saves a sip on a drink. Rising mortgage rates are an effective way to cool down the housing market. A real estate agent friend told me yesterday that only three viewers showed up when he organised a viewing day for a very affordable house that he had put up for sale. This indicates an abrupt turnaround in the housing market. One of the candidates offered well above the asking price. I asked this broker why those people are still bidding above the asking price. He answered that those people did not yet realise how quickly the market was currently turning.

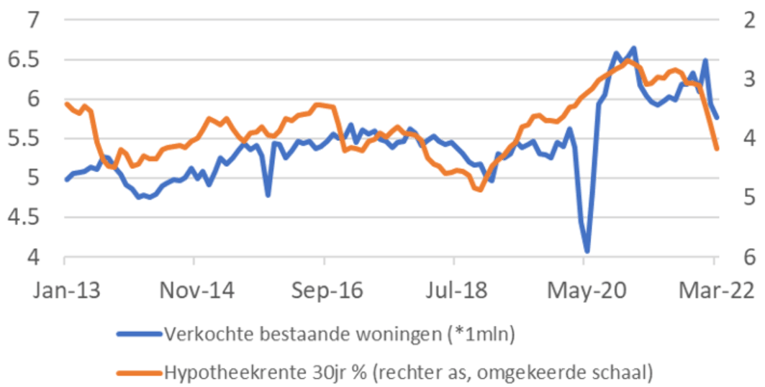

Mortgage interest rates have already risen considerably in the US. The following picture shows that the number of existing homes sold is sensitive to interest rates. In fact, you should now expect a considerable price drop, but the supply is still very limited. That will likely limit downward price pressures.

US: mortgage interest and home sales

Sold existing homes

Mortgage interest rate 30 years % (right axis inverted scale)

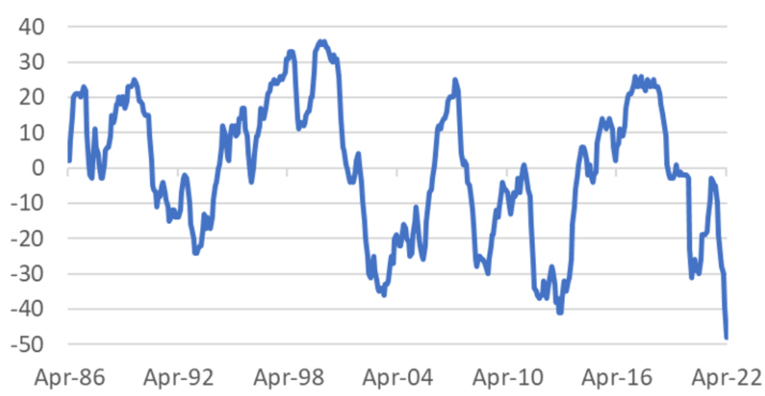

Dutch consumer confidence at a new low

The confidence of Dutch consumers is under great pressure. Statistics Netherlands has conducted a monthly survey on this since 1986. According to the CBS measure, confidence fell to a new low in April: -48, compared to -39 in March and a previous low of -41 in 2013. Consumer confidence has now been up for seven months in a row. decreased. This is in line with inflation, which actually only rose in the second half of last year in our country. Inflation has not been this high since this CBS survey began. The war in Europe has undoubtedly dealt a further blow to confidence. It is inevitable that consumer spending will take a hit. Of course, consumer confidence and especially their willingness to buy play a role in this, but the erosion in purchasing power is now reaching such proportions that many households will ultimately have little choice but to reduce spending in volume.

Netherlands: consumer confidence

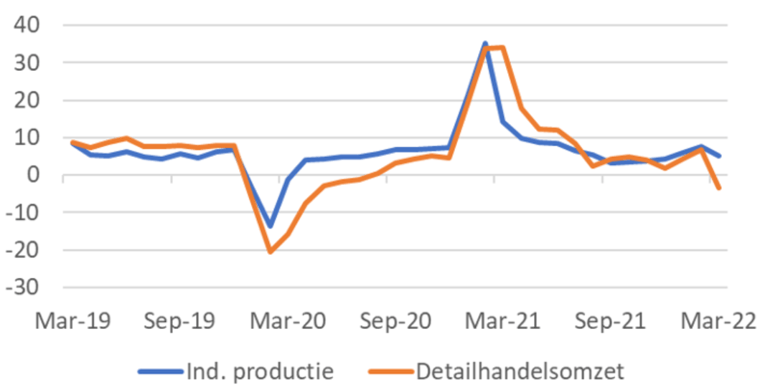

The Chinese economy is already in trouble. The new lockdowns put a significant brake on spending. In March retail sales were 3.5% lower than a year earlier. Manufacturing production was only 5% higher than a year earlier. GDP growth in the first quarter was not that bad. This was 1.3% compared to the fourth quarter when growth was still 1.5%. Still, year-on-year growth rose from 4.0% in the fourth quarter to 4.8% in the first quarter.

China: Industry production | retail sales (%)

Sanctions

Since the outbreak of the war, the West has imposed numerous sanctions on Russia. Its ultimate goal is to end the war. This must then be done by inflicting economic pain. How much pain we cause is difficult to measure. What strikes me is that the exchange rate of the ruble is roughly back to its pre-war level. Of course, this is achieved with skill and special measures, but it definitely counts as a success for Russia's central bank and it limits the chaos in an economy where the value of the currency completely falls.

Exchange rate of the ruble to the US dollar (rubles per dollar)

Inflation has risen sharply in Russia, just like it is here. Still, the early numbers don't seem to point to immediate and massive economic pain. Now that the currency has bounced back, inflation in Russia may even drop somewhat in the coming months..

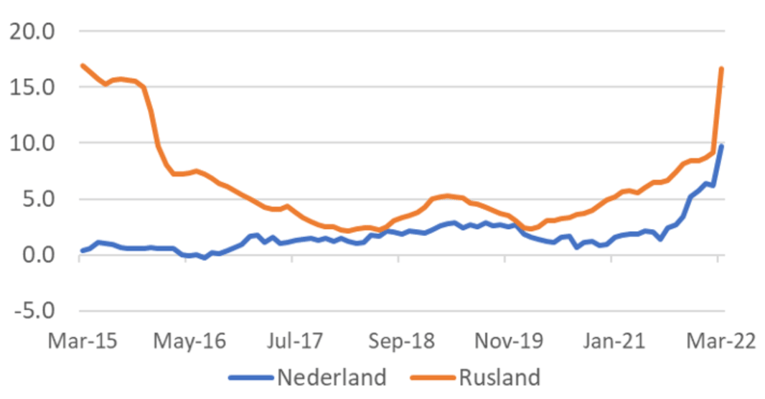

Inflation (%)

Netherlands \ Russia

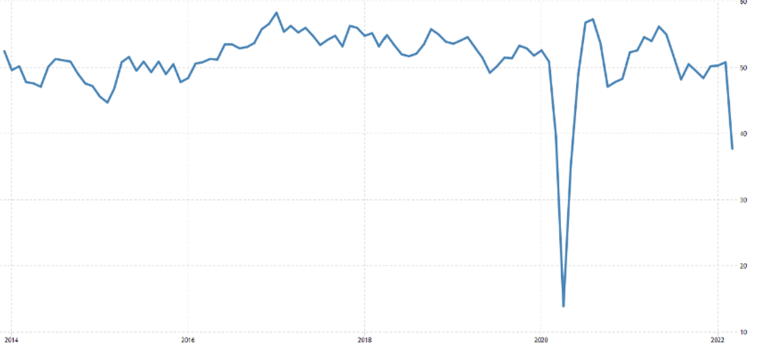

Russian business confidence as measured by IHS Markit did take a hard knock in March, though. But to really be able to speak of severe economic pain, that confidence has to go down a lot further.

Russia: Business Confidence – IHS Markit, Industry and Services Combined

Be that as it may, it doesn't look like our sanctions will move any closer to the ultimate goal. We will, of course, continue to discuss further sanctions. A boycott of Russian oil and gas is a tricky subject. When imposing sanctions, one should always consider how effective they can be and how much damage you are doing to your economy. But yeah, that's just my opinion.

Closing

It appears that rising inflation expectations will convince the ECB of the need to tighten monetary policy earlier than previously assumed. The still-on-going asset purchase program will probably end in July and a first rate hike will soon be in sight after that. The ECB apparently takes for granted that this will exacerbate the slowdown in growth that is already underway due to various factors. And rightly so, in my view, you cannot let current inflation run its course.

Capital market interest rates have already risen considerably this year. This translates into an increase in mortgage interest. Anecdotal evidence is emerging that higher mortgage rates are currently leading to an abrupt turnaround in our housing market.

Dutch consumer confidence fell to a new low in April, probably mainly driven by inflation and the war. In the first months of the year, the newfound freedom of public life was enhanced by consumers who were able to spend money again. Many people have saved extra during the pandemic, so there are buffers. Nevertheless, the combination of low consumer confidence and significant loss of purchasing power will ultimately lead to a contraction in consumption (in volume).

While we have regained our freedom, China has not. There are still lockdowns that negatively affect economic life. The logistical problems in the world will therefore worsen rather than diminish for the time being.

Various economic indicators do not yet indicate that the Western sanctions policy against Russia is causing such economic pain in Russia that the war will be ended quickly for that reason.