- My friend Hans doesn't understand why I'm talking about a recession

- Dutch industry loses momentum in

- US inflation has fallen slightly…

- …that decline will continue in the coming months…

- …but the rise in rents stands in the way of a return to 2% inflation

Google Translated from Dutch to English. Here is the link to the original article in Dutch. The article was originally published on 12 August 2022.

Earlier this week, I received a call from a good friend (his name is Hans) who informed me that he did not agree with me. He had heard me on BNR where I had said that it seems very likely to me that the economy of the eurozone and also our own country will experience a recession within a few quarters. He himself is a businessman in the field of education. If I have understood him correctly, his sector is running like a charm. Now, Hans and his sector have experienced some difficult times in the past so he knows what he is talking about when it comes to recessions.

I told him that we are not in a recession yet, that it is just a prediction for the future. After all, the most important characteristic of the period before a recession is that there is no recession yet. He objected that we now have such a strong economy that some downturn is quite possible, but that contraction of the economy as a whole still seems unlikely to him.

These are special times. Consumer confidence has reached an all-time low. Business confidence has been weakening in many countries for several months, but is still much less negative than consumer confidence. In our own country, the difference between the two (2) has never been greater (if you use Statistics Netherlands' standards). It suggests that companies are less affected by the inflation chaos than consumers. Of course, companies will again have to deal with logistical disruptions, very high transport costs, staff shortages and October is approaching, the month in which they must start paying back any tax debts incurred during the pandemic.

The skyrocketing fundamentals have eroded the purchasing power of households in recent years with extra savings and now that life is free again, there is plenty of spending despite extremely negative consumer confidence. In addition, all households are not already fixing the prices for a longer period of time due to the larger electricity bills.

Who's right?

Because this situation is so special, predictions are surrounded by more than usual uncertainty. As an economist, I have to answer the question of which of all these factors will ultimately be dominant. I will put inflation and the loss of purchasing power at the top of my list. Ultimately, a fall in the volume of consumer spending seems inevitable to me and I believe that it will cause a fall in GDP. Of course, I hope I'm wrong.

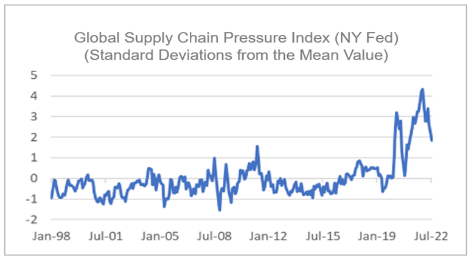

But maybe Hans is right and there is enough growth momentum to stay out of a recession. In addition, some problems on the manufacturing side of the economy appear to be easing. Logistical disruptions and very high freight rates are currently holding back the production side of the economy, but the situation is improving and that offers room for growth. The New York Federal Reserve has developed an indicator with which they try to measure the pressure on production chains, the Supply Chain Pressure Index. He has shown some relaxation in recent months.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

And container prices are also falling. According to Freightos' global indicator, renting a container cost an average of more than $6,000 this week. That is four (4) times as high as before the pandemic but a lot lower than the more than $11,000 in September last year.

Freightos Baltic Index (FBX)

Source: Freightos

Source: Freightos

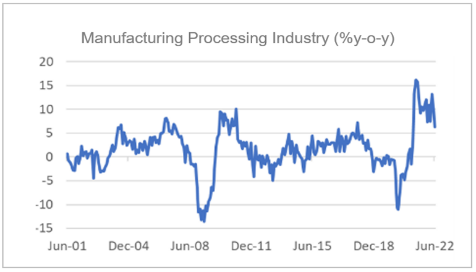

Growth in manufacturing industry weakens

The processing industry in our country has recently distinguished itself very positively from most other countries in Europe, but production growth is now also slowing down in our country. In June, the production level was still 6.2% higher than a year earlier, against 9.9% and 13.8% in May and April respectively.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

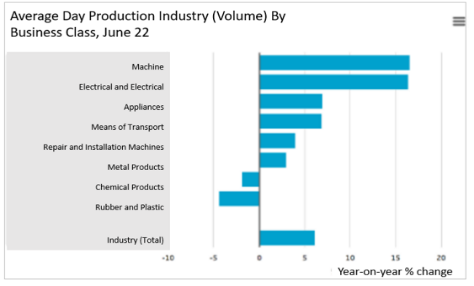

The 'Machine Construction' and the 'Electrical and Electronic Appliances' remain the fastest growing sectors. However, things have deteriorated in recent months. In five of the first six (6) months of this year, production fell slightly compared to the previous month. Caution is advised here because those monthly figures jump up and down, but still. It is positive that things seem to be improving somewhat with the transport equipment industry. That's where production picks up. After the production volume was still about 10% lower in the first months of the year than a year earlier, a +7.0% was recorded in June. Does that perhaps indicate that the chip problems in the sector are easing?

Source: CBS

Source: CBS

US inflation slows down

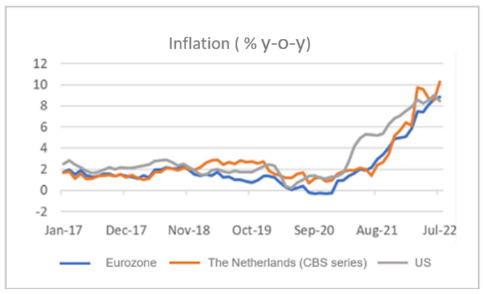

US inflation fell in July: 8.5% from 9.1% in June. As a result, inflation in the US is lower than that in the eurozone for the first time in years. In our own country, inflation rose further in July and is now significantly higher than the American one on both the European and national measures.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

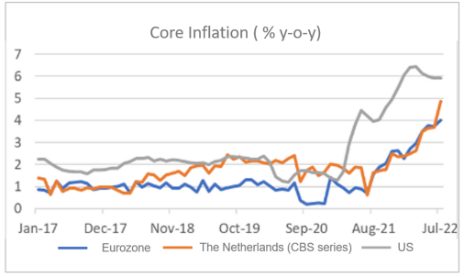

The ECB has only recently raised official interest rates, while the Fed has already started to do so in March and has since implemented 2.25 percentage point rate hikes. ECB boss Lagarde has long argued to justify the divergent approach that inflation in our country is very different from that in the US. Some banking economists call it that after her. With us, energy is the main culprit, while the US economy, unlike ours, is said to be overheated. To a certain extent, that is true. Core inflation, ie excluding food and energy, is clearly higher in the US than ours, although we have now started to catch up and core inflation in the US has been leveling off for months, as the following chart shows.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

My objection to the view of Lagarde and her supporters is that supply and demand in the economy are not in balance in our economy either. Unemployment in the eurozone has never been as low as it is now and there is a shortage of labor everywhere. You may not directly call it "overheated", but still.

An incredibly interesting experiment

There is currently, in my view, an extremely interesting experiment going on in monetary policy. Inflation is a huge problem everywhere and to a certain extent the situation in the various countries is quite comparable, although there are also differences from country to country. However, the differences in policy are remarkably large and the question is whether this is justified.

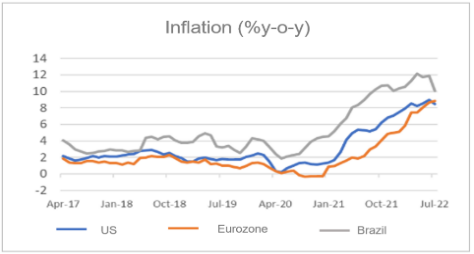

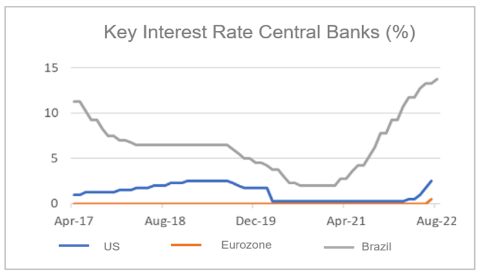

For example, consider the situation in Brazil, the US and the Eurozone. Inflation in Brazil is higher than in the US or ours; this has been the case for a long time, but the rise in inflation is running fairly parallel. The central bank of Brazil has already raised interest rates 12 times and started doing so in March 2021. We'll see how this turns out. Incidentally, I note that the European gas price (TTF) is again above EUR 200 MWh. That's not good for us.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

Source: Refinitiv Datastream

Source: Refinitiv Datastream

US inflation key for financial markets

What happens to inflation in the US is of great importance for developments in the financial markets. After all, inflation has a major impact on US interest rates and is an anchor for other markets.

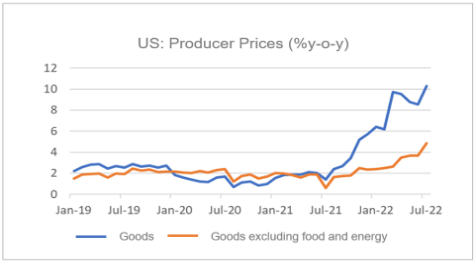

I see something positive and also something less positive. On the positive side, inflation in the US is near or perhaps just past its peak. Of course one has to keep the necessary blows in the arm. But one of the previous charts showed that core inflation has been stabilising for months. We also see some relaxation in producer prices, especially when it comes to goods as the following chart shows. Producer prices are sometimes slightly ahead of consumer prices.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

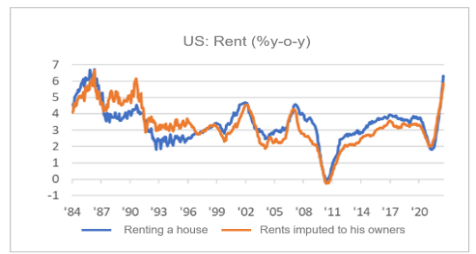

I therefore believe that US inflation will fall further in the near future. The question is, how far and how fast? Here I should note something less positive. I've written about it many times before. Rents (actual home rents and imputed rents to homeowners) make up almost a third of the US inflation basket (CPI). These rents follow house prices with some delay. Rents are now rising by about 6%, as the latest chart shows. That could go even further. If rents rise at such a rate, it will be very difficult to get inflation rates close to the Fed's 2% target anytime soon.

Source: Refinitiv Datastream

Source: Refinitiv Datastream

Closing

I think we are heading for a recession. My friend Hans thinks not. I'm an economist, say bookworm. He is a businessman with a large dose of common sense and a lot of experience with recessions, who has his feet in the clay. Our difference of opinion is indicative of how unusual the current situation is. I think the erosion of purchasing power is going to kill us. Hans thinks the economy has too much growth momentum to fall into recession within a few quarters.

US inflation is slowing. I think that will continue, but the increasingly sharp rent increases are hindering a quick return to a world of 2% inflation for the time being.